Blog

-

16 Apr 2024 The Payments Hub Explained: Alacriti's Unique Definition and How It Differs Explore how Alacriti defines a payments hub, which is becoming a strategic asset for financial institutions aiming for innovation and improved customer service.

-

09 Apr 2024 Earned Wage Access: A Use Case for Instant Payments Explore the challenges and considerations of financial institutions meeting the demand for instant payments and how Earned Wage Access (EWA) has been gaining traction.

-

02 Apr 2024 What is CFPB Section 1033 and How Will it Affect Financial Institutions? Discover the core elements of CFPB’s Section 1033 regulation and its effects on community banks and credit unions.

-

12 Mar 2024 ACH Modernization: Insights from the Experts This blog discusses the significance of modernizing ACH systems in the realm of payments, highlighting insights from the Q&A session of a webinar featuring industry experts Alex Romeo from Federal Reserve Financial Services and Paul Steinbrecher from Alacriti.

-

13 Feb 2024 The FedNow Service: Community Bank Executive Questions Answered In this blog, we tackle critical questions raised by community bank executives during a recent ICBA-hosted webinar regarding instant payments. Gain valuable insight on the FedNow service’s integration, customer impact, and fraud mitigation strategies.

-

01 Feb 2024 Decoding the FedNow Service for Community Banks This blog highlights insights and common community bank questions from the ICBA webinar, FedNow in Focus: Maximizing Real-Time Payments for Community Banks, featuring Siobhán O’Malley, National Account Program Manager at Federal Reserve Financial Services, and Mark Majeske.

-

16 Jan 2024 The Future of Real-Time Payments in Banking Explore the evolution of real-time payments, aligning with modern expectations for immediacy and efficiency. Gain insights from industry experts Jim Colassano (The Clearing House), Jim Maimone (Citizens Bank), and Mark Majeske (Alacriti).

-

16 Jan 2024 Fednow Guide for Banks and Credit Unions What is FedNow? How does it work?

-

15 Jan 2024 How the Evolution of EBPP Affects Credit Unions This blog provides insights into current opportunities, trends, and future prospects in the world of Electronic Bill Presentment and Payment (EBPP) for credit unions.

-

08 Jan 2024 Understanding the Complexities of EBPP: A Q&A Session with Stuart Bain This blog features a Q&A of NACUSO's recent webinar, "The Evolution and Opportunities of EBPP for Credit Unions.” Dive into insights on changing bill payment patterns, revenue avenues, fraud mitigation, and the impact of real-time payments.

-

03 Jan 2024 The Surge in Popularity of Real-Time Payments in SMB and Corporate Markets There’s been a recent shift in the demand for real-time payments in small and medium-sized businesses, as well as corporates. In this blog, we explore how this has been affecting the fintech industry.

-

15 Dec 2023 Payments Hub Solutions: A Guide for Financial Institutions Explore the transformative power of payment hubs for financial institutions. Streamline operations, enhance efficiency, and elevate customer experiences with centralized payment solutions.

-

30 Nov 2023 What Are Payment Rails? When a payment is initiated online or at the point of sale, payment rails transmit instructions between relevant parties. Our blog examines four U.S. payment rails—ACH, card networks, RTP® network, and FedNow® Service.

-

15 Nov 2023 Unraveling the Future of FedNow for Credit Unions Explore the evolution of real-time payments with insights from experts. Learn about FedNow® Service’s fraud mitigation tools, charges for expedited payments, and the focus on domestic transactions.

-

26 Oct 2023 Unveiling the Future of Payments: A Credit Union Perspective on Instant Payments In today's digital age, credit unions are navigating the shift towards instant payments. Industry experts and credit unions dispel myths and discuss how real-time payments position credit unions at the forefront of this evolution.

-

18 Sep 2023 Meeting Consumer Demand: Real-Time Payments Use Cases Unlock a world of convenience and security for consumers through real-time payments. Explore how financial institutions can attract and retain customers by leveraging the use cases.

-

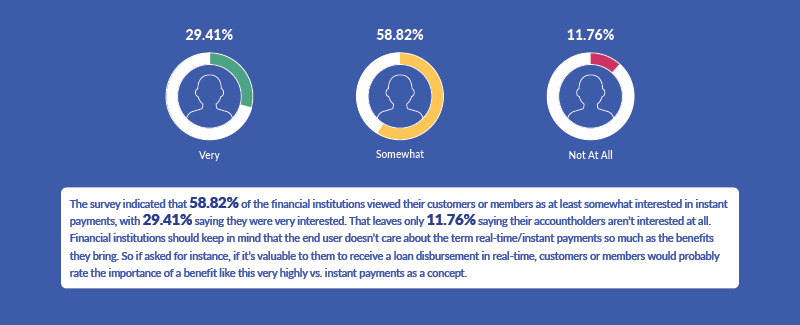

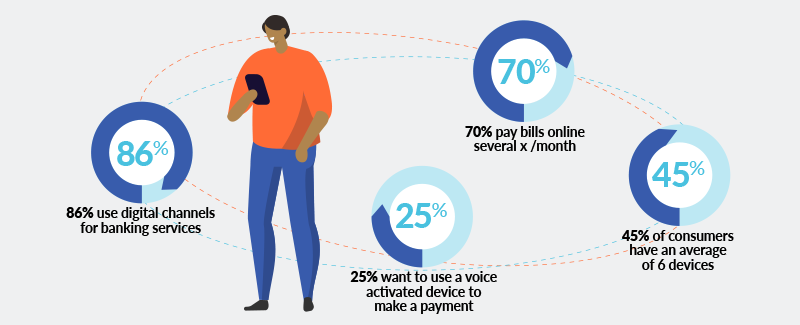

12 Sep 2023 Instant Payments: Market Survey (Infographic) Take a look at the latest result for the survey.

-

30 Aug 2023 Real-Time Payments: Practical Use Cases Driving Growth in Financial Institutions Discover the impact of real-time payments in financial institutions. Understand challenges, learn from compelling use cases, and drive growth, value, and customer retention through this innovative technology.

-

30 Aug 2023 Biller Solutions: The Difference Easy Bill Payments Make Uncover the power of Electronic Bill Presentment and Payment in revolutionizing the billing processes. This blog provides insights into EBPP integration, advantages, and how to choose the optimal solution to enhance efficiency.

-

14 Aug 2023 Business Use Cases: The Promise of Real-Time Payments Explore the transformative potential of real-time payments for financial institutions and businesses. With improved efficiency, enhanced security, and competitive advantage, see how the benefits shape the financial landscape.

-

09 Aug 2023 Elevating Digital Banking: The Power of Bill Pay in Credit Unions Discover how credit unions can elevate member satisfaction and retention by repositioning bill pay at the heart of their digital experience. Learn about strategies for enhancing visibility, offering diverse features, and using modern solutions.

-

08 Aug 2023 Demystifying the Top 5 Misconceptions about the FedNow Service Explore the FedNow Service and its potential impact on credit unions through a recent webinar debunking top misconceptions. This blog offers insights and discusses five misunderstandings to aid in financial institution decision-making.

-

31 Jul 2023 11 Things You Wanted to Ask About the FedNow Service Discover all things FedNow, the newest real-time payment system in the U.S. Explore the benefits, fees, replacing Fedwire, maximum limits, and how to connect. Read this blog to prepare for the upcoming launch.

-

18 Jul 2023 The Importance of Digital Customer Service in Banking to Businesses Digital customer service is vital for businesses in today's tech-savvy world. Discover how financial institutions can leverage online services to meet the demands of customers, improve customer retention, and increase revenue.

-

28 Jun 2023 Faster Payments: The Benefits to Businesses In today's digital age, faster payments transform financial operations. In this blog, we discuss how their positive impact on cash flow, customer satisfaction, and efficiency allow businesses to remain competitive

-

06 Jun 2023 Maximizing Bill Payments with EBPP Learn about the advantages of EBPP solutions, including convenience, billing data access, diverse payment options, and quick posting. This blog explores Orbipay EBPP, Alacriti's customizable billing and payment solution.

-

11 May 2023 How Gen Z Pays Their Bills Zoomers want a modern payment experience that is quick, easy, and convenient. In this blog, we’ll discuss their payment preferences and how businesses and financial institutions can provide a modern payment experience that meets their needs.

-

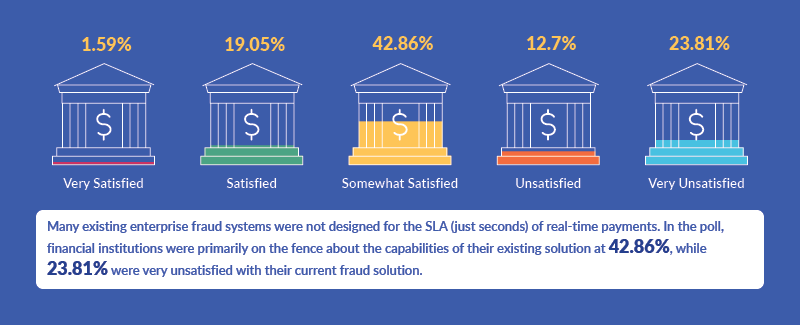

03 May 2023 Instant Payments Fraud: Market Survey (Infographic) Find out what fraud and real-time payments concerns keep financial institutions up at night.

-

27 Mar 2023 What are Embedded Payments? Embedded payments are the fuel that will make your digital transformation journey possible. This blog provides a brief overview of what embedded payments are.

-

14 Mar 2023 A Quick Run-Down on Real-Time Payments and Liquidity Management With real-time payments becoming ubiquitous, many credit unions have decided to move forward with adoption. This blog discusses the decision to use a funding agent or correspondent partner.

-

08 Mar 2023 Busting 5 Common EBPP Myths Electronic bill presentment and payments (EBPP) is a wide-reaching discipline that encompasses everything from mobile payments to debit cards. Our blog busts five common EBPP myths to give a better understanding of how it all works.

-

21 Feb 2023 Instant Payments Market Survey (Infographic) Take a look at our survey results from the American Banker webinar.

-

16 Feb 2023 5 Common Cloud Security Myths A common concern about cloud-based systems is that they are prone to security vulnerabilities. However, in reality, the cloud mitigates many security risks. Here are 5 common misconceptions about cloud security.

-

16 Feb 2023 What Are Integrated Payments? When you hear the term ‘payments modernization’, you are also most likely hearing the term ‘integrated payments.’ In this blog, we explain what integrated payments mean.

-

13 Feb 2023 What is EBPP? What does the term EBPP mean? This blog provides a high-level overview of the major components, features, and functionality of an electronic bill presentment and payments (EBPP) solution.

-

08 Feb 2023 The Rules and Regulations of Online Payments Accepting online payments means that businesses are subject to regulations from various entities. Here’s an overview of rules pertaining to Nacha, the card networks, PCI DSS, and Know Your Customer (KYC).

-

03 Feb 2023 Why is AWS a Good Choice for a Cloud Provider? With a number of cloud providers to choose from, Alacriti chose to work with AWS Cloud. Here’s why.

-

01 Feb 2023 Faster Payments Are Set to Revolutionize Modern Digital Payments When it comes to payments modernization, how does it fit into an overall seamless digital banking experience? This blog highlights the importance of ease of use and instant gratification in the user’s banking experience.

-

31 Jan 2023 3 Things to Know about Payments Modernization and Digital Banking A modern payments solution and a seamless user experience are key differentiators in allowing credit unions to remain competitive. Here are 3 things to know to provide an overall great digital banking experience.

-

25 Jan 2023 Bill Payments: Helping Small Businesses Think Big For small businesses that rely on income from bill payments, an electronic bill presentment and payment (EBPP) solution can help keep the revenue flowing. Here are five ways EBPP can help small businesses think big.

-

19 Jan 2023 Full Coverage EBPP for Auto Insurance Auto insurance premiums are among the most predictable bill payments in consumers’ lives. A forward-thinking EBPP solution can deliver a seamless experience and help prevent the negative impacts of missed auto insurance payments.

-

16 Jan 2023 What Are Digital Disbursements? Digital disbursements have emerged as a user-friendly alternative to paper checks for B2C payouts. What are digital disbursements? Our blog shares four things to know.

-

15 Dec 2022 Payment Trends During the 2022 Holiday Season There is speculation about how this year’s events will affect the traditional economic impact of this time of year. Here are the payment trends we expect for retail, e-commerce, and more.

-

14 Dec 2022 Real-Time Payments Are Ubiquitous: Is Your Business Ready to Accept Real-Time Payments? As instant payments grow, so does the risk of fraud. This blog discusses what financial institutions can do to mitigate real-time payments fraud.

-

12 Dec 2022 Skip-a-Pay for the Holidays The holiday season is upon us and retailers are anticipating an increase in sales. For certain customers, this is also the time of year when billers’ skip-a-payment options can be helpful. Read all about it in our blog.

-

25 Nov 2022 Help for the Holidays—from Chatbots The holiday season can be hectic for call centers at financial institutions but chatbots can be integral to managing the call volume. In this blog, we spoke with Jenn Markus, Glia’s Director of Technology Partnerships on this topic.

-

08 Nov 2022 "Payment Services Hub": What it Means Today Historically, payment systems were introduced one at a time as payment methods became available. Since then, they have expanded to include new real-time payment rails. This blog discusses how payment service hubs differ today.

-

02 Nov 2022 5 Cloud Migration Challenges Consulting Services Can Help With From a security, cost, and efficiency standpoint, migration to the cloud makes a lot of sense. However, it can be a complicated undertaking. Here are five challenges Alacriti Consulting can help you with.

-

26 Oct 2022 ISO 20022: Why After Almost 2 Decades it’s More Important than Ever ISO 20022 is used by payment systems in over 70 countries. In this blog, discover its benefits and learn what it means for the U.S. market.

-

19 Oct 2022 3 Reasons Why You Need to Offer Pay by Text—Now A key element in accelerating receivables is to make it as easy and convenient as possible for customers or members to pay their bills. Pay by Text can deliver a bill payment experience that’s quick, convenient, and personalized.

-

11 Oct 2022 3 Things to Know About FedNow, Now In a recent CUInsight hosted webinar, credit unions had the opportunity to ask questions regarding FedNow Service's upcoming launch in 2023. Here are 3 things that were discussed that you should know.

-

27 Sep 2022 What Are Real-Time Payments? Real-Time Payments or “RTP'' refers to payment rails (platforms or networks via which payments are made) that share a few characteristics. This blog highlights the different networks, common questions, and more.

-

13 Sep 2022 A Crash Course in Faster Payments Faster payments is an umbrella term for the various systems that support the move toward quicker, on-demand payments. This blog discusses four of the major systems that have evolved in support of faster payments.

-

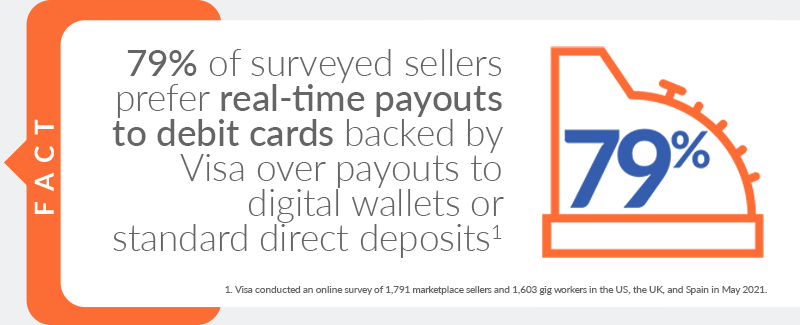

07 Sep 2022 6 Leading Use Cases for Push to Card (Infographic) Here, we look at 6 of the leading use cases for Visa Direct's card-based push payments.

-

15 Aug 2022 Perspectives on BNPL by Generation How do different generations feel about BNPL? When did it rise, and how will it adapt to older generations?

-

26 Jul 2022 Zoomers: How Much Do They Value Real-Time Payments? How does Gen Z feel about real-time payments? What are the general perks of RTP, and how has COVID shaped this generation’s feelings about it?

-

20 Jul 2022 Zoomers: Traditional Financial Institutions Vs. Neobanks How does Gen Z feel about neobanking? Neobanking matches the speed of Gen Z whereas traditional financial institutions are unable to keep up.

-

14 Jun 2022 How Do the Underbanked Pay Their Bills? Not all consumers have traditional banking relationships. When the unbanked and underbanked need to pay their bills, businesses must offer payment methods (cash, prepaid debit) and channels (kiosk, walk-in) that meet their needs.

-

08 Jun 2022 Real-Time Payments Without Borders In April 2022, EBA Clearing, SWIFT, and The Clearing House announced their plan to launch a pilot service for immediate cross-border payments. Here’s why that’s huge for payments.

-

06 Jun 2022 Accepting Online Donations: 4 Things to Know Online donations are an important part of charitable gift giving and accepting these payments might be possible with existing solutions like EBPP. Here are four things to know about accepting online donations.

-

03 Jun 2022 Alacriti Insurance Series Part II: How AI Can Help Your CX A chatbot can help insurance companies decrease the volume of calls to their call centers and also improve the policyholder experience.

-

02 Jun 2022 Alacriti Insurance Series Part I: Accelerate Payment Receivables Current events have made it more necessary than ever before for insurance companies to partner with modern fintechs.

-

01 Jun 2022 Increasing Autopay Adoption and the Remarkable Results of Repetition The Marketing Rule of Seven helps billers increase autopay adoption. This powerful rule stipulates reaching and positively impacting people at least seven times, in as many ways possible, to elicit autopay enrollment action.

-

31 May 2022 Faster Payments: Are You Ready? Bill payments have been identified as one of four use cases that could benefit the most from faster payments. Get ready to reap the rewards by offering a wide variety of new ways to pay in terms of payment channels and methods.

-

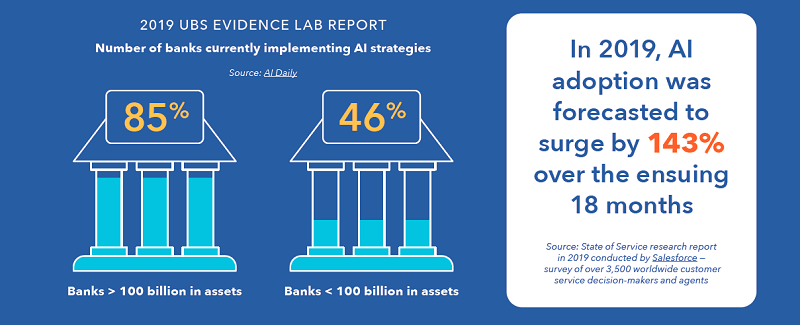

11 May 2022 AI and Customer Service by the Numbers (Infographic) Here is a look at what AI in customer service means to tomorrow’s competitive landscape.

-

05 May 2022 The Metaverse and Payments: 5 New Developments What is a metaverse? Big businesses are embracing this growing concept, which is becoming more important. This blog discusses five interesting news pieces about the metaverse as it relates to payments.

-

28 Apr 2022 What is Payments Orchestration? The words 'payments orchestration' appears to be all over the place, but what exactly does it mean? In this blog, we'll look at the journey of orchestration and how it handles a payment's whole end-to-end lifecycle.

-

28 Mar 2022 Real-Time Everything In banking and payments, innovation is on the horizon. In fact, the foundation for a real-time ecosystem is rapidly taking form.

-

24 Mar 2022 Everyday Automation: How Voice Payments Are Being Heard Our voices are becoming more powerful than ever thanks to advancements in AI, NLP, intelligent personal assistants, and smart home devices. Learn how voice commands can automate everyday tasks like making on-time bill payments.

-

22 Mar 2022 The Fastest Route to Faster Payments Success The road to faster payments doesn’t have to be a multi-year journey to the starting line. One use case, in particular, could be the fastest route to realizing the promise of faster payment’s potential disruption opportunity.

-

16 Mar 2022 Billing and Payments for Credit Unions: 7 Questions to Consider Credit Unions offer financial products with favorable terms and interest rates, including loans. Learn what credit unions should consider in an electronic bill presentment and payment solution (EBPP) for servicing these loans.

-

23 Feb 2022 Payment Services Hub Explained Depending on who you're talking to and what era of payments history you're looking at, "payments hub" might mean several things. In this blog, we'll look at what today’s payments hub has to offer and how FI’s can benefit from it.

-

08 Feb 2022 Working Together: Financial Institutions and Fintech Partners Working with a fintech partner can help financial institutions deliver new solutions without building them in-house. Learn how fintech partners and financial institutions can work together to develop solutions more efficiently.

-

01 Feb 2022 How Credit Unions Can Turn Indirect One-and-Done Members Into Direct Members Credit unions with extensive and innovative EBPP capabilities have a major opportunity to grow member relationships. Converting indirect, one-and-done members into long-term, direct members.

-

28 Jan 2022 Offering More Payment Channels Improves the Customer Experience Offering convenience and flexibility around the payment channels your customers use enhances their experience, which leads to increased loyalty and retention, plus increases the likelihood you’ll get paid.

-

19 Jan 2022 5 Benefits of Card Account Updater for Bill Payments Due to lost and stolen cards, expiration date changes, and mass reissuance, payment card information changes often. A credit card updater can assist prevent missed bill payments due to outdated credit card and debit card data.

-

17 Jan 2022 The Hitchhiker’s Guide to EBPP (Infographic) Consumers always appreciate a convenient way to pay their bills. An electronic bill presentment and payment (EBPP) solution can get your business on the right path. Read our hitchhiker’s guide and download the infographic.

-

12 Jan 2022 Paper or Electronic Billing: What’s Your Preference? While businesses may benefit from eliminating paper bills, some customers still depend on them. By having the right incentives, your organization can support a permanent move toward electronic bill presentment and payments (EBPP).

-

10 Jan 2022 Payments and the Internet of Things (IoT) Consumers expect payments to work seamlessly with their connected devices as the Internet of Things (IoT) has evolved rapidly. In our blog, you'll find examples of the IoT in action, as well as what it implies for payments.

-

07 Jan 2022 Educating Consumers on Real-Time Payments Fraud Risks When it comes to payments, fraud is always a major concern. The most effective preventative tool is consumer education. In this blog, we'll discuss how financial institutions should educate their consumers about fraud risks.

-

13 Dec 2021 2021 Year in Review: Real-Time Payments, Crypto and BNPL Throughout 2021, our blog strived to keep clients updated on the latest industry developments and offer our views on future trends in billing and payments. As we close another unconventional year, we’ll revisit the developments we touched on earlier in the year.

-

09 Dec 2021 Looking Back at AFP 2021 Alacriti had the opportunity to attend the Association for Financial Professionals (AFP) conference in Washington D.C. In this blog, we highlight a few takeaways from the event.

-

06 Dec 2021 How to Choose an EBPP Solution: Three Factors to Consider The bill payment process can impact customer satisfaction, so businesses need an electronic bill presentment and payment (EBPP) solution that delivers a great experience. Read three important factors to consider in our blog.

-

02 Dec 2021 A Look at P2P Payments Person-to-person (P2P) payments are becoming more popular as consumers switch from physical payment methods like cash and cards to digital alternatives. Read about two of the biggest P2P solutions, Venmo and Zelle, in our blog.

-

30 Nov 2021 5 Request for Pay (RfP) Use Cases for Billers Billers and bill payees benefit from Request for Pay (RfP), a financial messaging scheme that allows billers to initiate real-time payments from bill payees with a single click. In this blog, we go over five use cases for billers.

-

16 Nov 2021 Looking Back at Money20/20 Alacriti had the pleasure of attending Money20/20, the world's greatest FinTech event. Its interactive experience emphasized the current industry's biggest trends. We review those trends in this blog.

-

10 Nov 2021 Faster Payments Use Cases – What Does the Future of B2B Payments Look Like? The market is quickly moving forward with their real-time payment projects. What does this mean for the future of financial institutions? Discover the answer to this question and more in this blog.

-

04 Nov 2021 Zoomers on Campus: Where I Choose to Bank There are various factors that appeal to Zoomers, from newly entering college to determining where they should bank. In this blog we discuss Zoomers and their on-campus experiences.

-

29 Oct 2021 Top RfP Test Cases, Use Cases, and Case Studies We're Watching Request for Pay (RfP) is benefiting bill payers and billers by making real-time payments easier and more efficient. It's transforming the way we pay our bills. In this blog, we explore different RfP test cases in today’s market.

-

27 Oct 2021 Zoomer Financial Habits: Loans We discuss the statistics and significance of the many upcoming loans and financial services needs for the Zoomer generation in this blog.

-

25 Oct 2021 Mobile Payments: What Will It Take to Convince Consumers? Mobile payments are becoming more commonplace, but US adoption continues to be slow. What will it take to convince consumers? Our blog discusses how accessibility, merchant acceptance, and disruption can help shift behavior.

-

18 Oct 2021 P2P Money Movement - The Retrospective You Didn’t Know You Needed Over the last fifteen years, person-to-person money movement has been the most popular mobile payments trend, and it has continually evolved since its inception. In this blog, we'll look back at where we've been and where we're heading.

-

14 Oct 2021 Buy Now, Pay Later - Good, Bad, or Somewhere in the Middle? The Buy Now, Pay Later space is really on fire, possibly causing consumers to overspend on things they don’t need or can’t afford. This blog discusses what it means for your financial institution’s payment strategy.

-

12 Oct 2021 Zoomer Financial Habits: Bill Pay When it comes to bill pay, Zoomers value a variety of factors including speed and efficiency, but what else? Convenience and awareness are other key considerations. We discuss why in this blog.

-

05 Oct 2021 Paperless Billing: Why Make the Switch? Paper statements provide many benefits, but electronic billing can deliver those benefits and more. Here are four reasons why businesses should continue encouraging their customers toward electronic bill presentment.

-

29 Sep 2021 Ways Financial Institutions Can Attract Zoomers Now that you know more about Zoomers, what are the best ways for financial institutions to appeal to this group? Our recommendations are listed here.

-

23 Sep 2021 Payments Transformation - The Journey from Engines, to Hubs, to Platforms From monolithic engines to payment platforms, payments transformation has been occurring more rapidly. In this blog, we’ll look at how advanced payment methods came to be.

-

20 Sep 2021 4 Ways Chatbots Are Revolutionizing Electronic Bill Payments Chatbots are revolutionizing the entire customer journey, right down to bill payments. Our blog highlights four ways that businesses can benefit from implementing chatbots for electronic bill payments.

-

16 Sep 2021 Why Should Businesses Offer Flexible Payment Options? Payments are a crucial component of the customer experience but can sometimes be an afterthought. Flexible payment options can help businesses get paid faster, reduce bad debt, and adapt quickly to changing customer expectations.

-

09 Sep 2021 4 Ways to Reduce Friction in Bill Payments (Infographic) Consumers expect seamless bill payment experience.

-

08 Sep 2021 Payments Modernization - What to Look for in a Fedwire Solution? The U.S. is starting to adopt faster and real-time payments en masse, pressuring financial institutions to rethink their payments strategies. This leads to the question, what should you look for in a new payments platform?

-

01 Sep 2021 EBPP for Commercial Clients—How Banks Can Defend Their Turf Treasury services is a complex labyrinth of needs that goes beyond having good rates and available credit. It gets increasingly complicated by the introduction of FinTech players. What can banks do to defend their turf?

-

24 Aug 2021 Zoomers: Banks Vs. Credit Unions In our last blog, you learned about the Zoomer generation. Now, to be more specific, how are Zoomers interacting with their banks and credit unions? Here is what you need to know.

-

20 Aug 2021 Request for Pay (RfP)—Exploring the New Frontier of Bill Payments The promise of real-time payments go hand-in-hand with RfP. In this blog we discuss the opportunity that RfP presents.

-

18 Aug 2021 Will Faster Payments Cannibalize Your Fedwire Revenue? The potential for Fedwire revenue being at risk is something that many financial institutions will have to grapple with as clients start to embrace them—both at a business level and for consumer money movement expectations.

-

16 Aug 2021 Zoomer Generation’s Core Qualities and Values FI's face the challenge of making their existing customers happy while attracting younger customers. The first step is to understand the demographic you’re targeting. In this blog, we explore the qualities of the Zoomer generation.

-

10 Aug 2021 3 Applications of Machine Learning in Financial Services Advances in machine learning have game-changing implications for financial services. Learn how ML is transforming customer service, personal finance, and fraud and risk management in our blog.

-

04 Aug 2021 Improving Loan Portfolio Performance Discover three ways to improve your loan portfolio performance with consumer experience top-of-mind.

-

29 Jul 2021 Bill Payments on Mobile Devices: A 5-Step Approach A holistic, mobile-based bill payments strategy includes components like optimized websites, Guest Pay, text-based bill payments, messaging apps, and biller apps. Learn how an EBPP solution can help.

-

27 Jul 2021 Faster Payments: Full Speed Ahead Faster payments bring speed and efficiency to money movement around the world. Our blog defines faster payments, gives an overview of global and domestic systems, and provides use cases for B2B, B2C, and C2B transactions.

-

21 Jul 2021 How to Convert Customers to Paperless Billing Paper bills aren’t dead yet. How can your organization convince customers to adopt electronic billing and payments once and for all? Our blog shares six techniques to consider.

-

14 Jul 2021 Back to Basics: ACH for Bill Payments ACH is a popular funding source for electronic bill payments. This blog outlines the basics of how ACH works and explores why customers use it so frequently for bill payments.

-

09 Jul 2021 Report: Modernizing Payments Infrastructure in the Era of Real-Time Payments We highlight some of the key points from our Payments Infrastructure Outlook: Real-Time Payments Take the Lead report with Mercator Advisory Group.

-

08 Jul 2021 Ditching Paper Checks for Digital Disbursements: 5 Use Cases Paper checks are still a go-to for personal and professional debts, but they have their flaws. Here are five use cases where Digital Disbursements can eliminate paper checks for B2C payouts.

-

07 Jul 2021 Best Practices to Prevent Payment Fraud As payments get faster and more rails become available, fraud is a reasonable concern. Here’s how to avoid it.

-

29 Jun 2021 Biometrics in Payments—Dropping our Collective Masks More businesses are incorporating biometric authentication into their user experiences, including payments. Here are the top five we’re keeping an eye on.

-

28 Jun 2021 New Players, New Games The best way to stay ahead is to prioritize your digital transformation. Offering ease-of-use and speed to compete with new competition is absolutely necessary and is a natural complement to the security already provided.

-

24 Jun 2021 Digital Transformation - Your Guidebook Has Arrived Everyone's digital transformation journey is different. This guidebook discusses three phases that may make it more manageable and focused to help bring customers and members better experiences faster.

-

15 Jun 2021 Fintech Disruption: Creating Opportunities for Financial Institutions Fintech can help financial institutions deliver better customer experiences. This blog examines opportunities that fintech can help unlock in faster payments, conversational commerce, and data and analytics.

-

07 Jun 2021 Flourish or Flop: How to Follow Through on Your Payments Transformation It's estimated that 7 in 10 digital transformation schemes ultimately fail. What this often comes down to is an assumption that employees will effortlessly adapt to the new normal.

-

02 Jun 2021 Preparing for Payment System Outages Payment system outages are inevitable. But what can be done to prevent outages and their impact?

-

25 May 2021 The SWIFT Approach to Payments Security SWIFT’s Customer Security Programme (CSP) is designed to help protect the security of the financial system and the counterparties within it. Learn more about SWIFT, its CSP, and what it means for payments in our blog.

-

17 May 2021 Payments Modernization: An Account Holder View Having a unified, consistent experience is the key to the future success of your institution. But what does that mean from the perspective of your account holders?

-

11 May 2021 Conversational AI for the Customer Experience Experts predict the proliferation of artificial intelligence will be more impactful than the Internet. Learn how artificial intelligence can help your business streamline operations and deliver a better customer experience.

-

06 May 2021 Comparing U.S. Faster Payment Channels (Infographic) Discover which faster payment channel is best for your financial institution

-

22 Apr 2021 Chatbots Gone Rogue: How Weak Chatbot Security Enables Bad Actors Chatbots have become a standard practice in customer service. Learn from these past chatbot security flaws and discover how to maximize your investment in AI while minimizing data privacy risks in this blog.

-

14 Apr 2021 Faster Tax Refunds Using real-time payment rails could result in tax refunds finding their way from the IRS to your bank account in just a few seconds.

-

09 Apr 2021 5 Common Misconceptions FIs Have About Real-Time Payments There are common misconceptions about real-time payments that may be contributing to its slow adoption in the U.S. We put them to rest in this blog.

-

07 Apr 2021 When Compliance Leads to Innovation Annual compliance reviews and reports often lead organizations to make changes to their systems or processes. But how many are taking a step back to think about how they could leverage them to think bigger?

-

05 Apr 2021 What Faster Payments Can Do for Your Industry Whether it’s a financial institution, merchant, government entity, or individual, there are use cases for faster payments that touch all of us. Alacriti’s Payment Practice Lead, Mark Ranta, discusses more in this blog.

-

30 Mar 2021 Open Banking: Discover Ways to Improve Customer Journeys and Experiences (Infographic) Explore how open banking improves customer journeys and experiences

-

29 Mar 2021 Bill Pay the Mobile Way Customers’ expectations for seamless user experiences on their mobile devices are only getting higher. Can your electronic billing and payments solution keep up? Here are four ways to support bill payments via mobile technology.

-

25 Mar 2021 Real-Time Payments and the Non-24x7 Banking Core 24/7/365 access to services is an often noted benefit of the digital era. Organizations that thrive in an always-online digital environment have gained a significant edge in the past year.

-

15 Mar 2021 5 Ways Chatbots Are Redefining Customer Service With some 300,000 chatbots on Facebook Messenger, how are businesses using them to deliver better customer service? Here are five ways chatbots are being leveraged for positive brand interactions, including bill payments.

-

12 Mar 2021 What is Payments-as-a-Service? You’ve probably heard of SaaS (Software-as-a-Service) but what about PaaS (Payments-as-a-Service)? We define PaaS and outline its key functions and features in this blog.

-

10 Mar 2021 A Primer on PCI DSS Accepting digital payments opens the possibility for cybercriminals to steal and misuse customer data. A solid defense requires a multi-faceted approach including PCI DSS. Here are some questions and answers to help get started.

-

09 Mar 2021 U.S. Faster Payments - What We Can Learn from the Rest of the World There are 56 real-time payment schemes currently operating internationally. In this blog we’ll hone in on three of the most interesting locations: Japan, India, and Brazil.

-

01 Mar 2021 Financial Institutions Are Investing in Chatbots Financial Institutions are deploying chatbots because they can improve the digital experience and help reduce costs. In this blog, we make the case for why Financial Institutions should consider investing in chatbots.

-

24 Feb 2021 Microservices and API Architecture: Lesson 3 Microservices are the key to digital acceleration and the flexibility to keep pace with the industry. In part three of this blog series, we discuss the benefits of using them.

-

22 Feb 2021 Why RTP, Why Now? Everyone acknowledges the potential of real-time payments, but it’s still relatively new. So why use RTP?

-

16 Feb 2021 Poky Stimulus Checks—An Argument for Payment Modernization The U.S. has a disbursements problem characterized by a reliance on physical payment media, vague or siloed payments data, and a lack of multichannel support. In this blog, we discuss how to solve this problem.

-

12 Feb 2021 Microservices and API Architecture: Lesson 2 There are two different API prefixes we see regularly, RESTful and Open. In this blog, we discuss those two prefixes and reveal what they mean to your overall API strategy in part two of this three-part series.

-

10 Feb 2021 Picking Up Speed: FedNowSM Service to Launch in 2023 The Federal Reserve announced they are on track for a 2023 launch of their FedNowSM Service. We discuss what this means for faster payments in this blog.

-

08 Feb 2021 Microservices and API Architecture: Lesson 1 There can be some confusion associated with the subject of API strategy. We break down the topic in part one of this three-part blog series.

-

04 Feb 2021 Nacha Rule Extensions Nacha has provided some leeway for compliance to their rules that were supposed to become effective in 2021. So, what does this mean for your organization?

-

01 Feb 2021 How CUs Can Win with EBPP and Online Banking Integration Implementing new technologies does not need to be difficult when you have seamless integration with your OLB system. We explain the benefits of integration between your EBPP solution and OLB systems in this blog.

-

01 Dec 2020 Faster Payments: What it Means for Credit Unions (Webinar Recap) The need for convenient and fast online payments has never been greater. For credit unions, this means getting ahead of the curve. Despite the growing demand, the burning question remains: Where do we start?

-

16 Nov 2020 Nacha’s New 8 Amendments Another sign that 2021 will be the year of faster payments.

-

13 Oct 2020 Alacriti Insurance Series Part III: How Digital Disbursements Extend a Lifeline While Controlling Costs Insurance companies looking to deliver fast and efficient payouts to policyholders should consider digital disbursements. This blog makes the case for why.

-

22 Sep 2020 Shortening the Distance Between You and Your Customers Customer-centricity is a key tenet to any digital transformation project. But what does that actually mean? For us, it means meeting your customer, where and when they want to be met, with how they want to pay.

-

09 Sep 2020 The Importance of System Integration to Drive Core Banking Transformation What do the words "fully integrated" mean from an Electronic Bill Presentment and Payment (EBPP) perspective? Here's a list of seven questions and answers to help you get started.

-

03 Sep 2020 Transparency While Being Invisible With new real-time payments emerging, the demand customers have to know where their money is still holds true.

-

28 Aug 2020 How is COVID-19 Accelerating Digital Adoption In Payments? Part ll COVID-19 is driving a mass movement towards new technologies and a demand for more innovation.

-

13 Aug 2020 Mobile Payments: What Are the Benefits? Mobile payments via digital wallets are more commonplace than ever. What are some of the perks of mobile payments? Our blog shares four benefits for businesses and consumers.

-

14 Jul 2020 Prepare for Your SWIFT CSP Assessment Now SWIFT users must complete a KYC Security Attestation application and submit self-assessment data before December 31, 2020, to confirm their organization’s level of compliance with SWIFT Customer Security Programme (CSP) requirements.

-

02 Jul 2020 How is COVID-19 Accelerating Digital Adoption in Payments? COVID-19 is changing how consumers pay for things, which is one area where some of the lasting impacts may be felt permanently.

-

19 Jun 2020 Payment Trends from the Stamford FinTech MeetUp On June 11th, Alacriti’s Payment Practice Lead, Mark Ranta, along with other industry experts came together to discuss the biggest topics moving the payments industry from AI to Faster Payments. Read Mark’s recap.

-

18 Jun 2020 Rule Changes and the Opportunity for Innovation (Webinar Recap) Alacriti hosted a webinar with Nacha that explored the upcoming rule changes for WEB Debits and what that means for payment workflows from a billing and payments standpoint. Here's our recap.

-

15 Apr 2020 Billers: Seven Tips to Lessen COVID-19’s Impact The negative effects of COVID-19 on the global economy cannot be understated. However, there are small things that we can do to lessen the impact, and more importantly, make life easier for the people who support our businesses.

-

27 Mar 2020 The Value of AWS Well-Architected Framework Reviews AWS Well-Architected Framework reviews help businesses create and maintain resilient and efficient computing infrastructure through operational excellence, security, reliability, performance efficiency, and cost optimization.

-

04 Mar 2020 Hyper-Customization: What Does it Mean for EBPP? Hyper-customization is the next wave of EBPP customer engagement. Your business can capitalize with a wide range of acceptance options and channels, account updater services, and personalized data infused into the payments process.

-

20 Feb 2020 Benefits of Cloud Computing with AWS Amazon Web Services (AWS) helps businesses thrive by freeing up financial and IT resources, increasing speed and agility, and reducing business risk. With AWS, organizations are better equipped to address market needs and demands.

-

30 Jan 2020 A Look Back at 2019 and What's Ahead: Orbipay EBPP Alacriti hosted a webinar reviewing 2019 enhancements made to its flagship electronic bill presentment and payment solution Orbipay EBPP. An overview of the offering’s 2020 roadmap was also provided.

-

13 Jan 2020 Adopting a Loan Payments Solution: Lessons Learned from Tech CU (Webinar Recap) Making loan payments easier for members is key for every credit union. Alacriti co-hosted a webinar with WesPay and Tech CU to discuss the benefits of implementing Orbipay EBPP to better their member experience.

-

08 Jan 2020 Six Payments Trends to Watch in 2020 Six payments trends to watch in 2020 include unbridled industry change, cloud computing, unified commerce, frictionless data-rich payment experiences, real-time payments and increasing data security and privacy regulation.

-

18 Dec 2019 2019 Year in Review: Faster Payments, Digital Disbursements, and CAU In 2019, we reported on significant developments in the billing and payments ecosystem in areas including faster payments, digital disbursements, and card account updater. Here’s a look back at key themes we explored in our blog.

-

04 Dec 2019 The 6 Critical Components of Effective Healthcare Billing Patient payments are a critical revenue source for healthcare providers. Our blog outlines six critical components of effective healthcare billing and how they can facilitate patient payments.

-

21 Nov 2019 3 Payments Stories That Caught Our Eye Alacriti keeps a close eye on news impacting the electronic billing and payments ecosystem. Here’s a summary of recent headlines related to holiday spending predictions, big tech in financial services, and Apple Pay usage.

-

11 Nov 2019 The Road to Same Day ACH NACHA’s Same Day ACH is up, running, and expanding. Our blog recaps the road to Same Day ACH, including benefits for consumers and businesses, and what’s to come.

-

06 Nov 2019 What We Learned at AFP 2019 Alacriti attended sessions at AFP 2019 dedicated to the latest in payments. Our blog shares lessons learned about paper checks, refunds, and why it’s more important than ever to embrace payments innovation.

-

24 Oct 2019 What’s Driving Consumer Adoption of Digital Payments? Digital payments provide benefits including enhanced security, speed, and convenience. Our blog investigates key reasons why today’s consumers are adopting digital payments as an alternative to traditional methods like cash.

-

23 Oct 2019 How to Streamline Auto Finance Payments in 4 Easy Steps On-time car payments can be as crucial to people’s well-being as paying their mortgage and utility bills. Here are four ways a forward-thinking EBPP solution can help auto finance customers stay current on their auto loans.

-

02 Oct 2019 A Better Member Journey Is Just a Chat(bot) Away (Webinar Recap) Chatbots are a hot topic for organizations across all industries, including credit unions. Alacriti co-hosted a webinar with NACUSO to discuss the benefits of chatbots for credit unions. Read key takeaways in our blog.

-

27 Jun 2019 P&C Insurance: Consumer Bill Payment Preferences & What’s Ahead (Webinar Recap) What’s ahead for the Property and Casualty Insurance sector? Alacriti hosted a webinar that explored bill payment preferences, blockchain, cloud computing, and digital disbursements. Read our recap.

-

15 May 2019 5 Takeaways from NACHA PAYMENTS 2019 Alacriti was honored to attend and speak at NACHA PAYMENTS 2019. Here are five takeaways we learned at the conference related to artificial intelligence (AI), payments fraud, chatbots, paper checks, and biometrics.

-

18 Apr 2019 4 Takeaways from CS Week 2019 At CS Week 2019, Alacriti attended sessions dedicated to the latest customer service trends in utilities. Here are four themes we heard related to artificial intelligence, emerging payment channels, and self-service technology.

-

08 Apr 2019 The Building Blocks of Production Support: ITIL and COBIT Alacriti’s Production Support capability is guided by two approaches, ITIL and COBIT, that help set appropriate client expectations while allowing us to deliver the best service possible. Our blog details these approaches.

-

08 Mar 2019 Consumer Bill Payment Trends in 2018: 5 Takeaways Alacriti has a unique view into consumers’ bill payment habits thanks to our electronic bill presentment and payment solution, Orbipay EBPP. Here are five takeaways from an analysis of our 2018 transaction data.

-

07 Mar 2019 Webinar Recap: Why businesses need to embrace Digital Disbursements. Now. There are significant benefits to be gained by businesses that transition away from paper checks and toward Digital Disbursements for B2C payouts. Our webinar recording makes the case for making the switch.

-

19 Feb 2019 3 Takeaways from HIMSS19 Alacriti attended the 2019 HIMSS Global Conference & Exhibition and sat in on educational sessions dedicated to the latest topics in health information and technology. Our blog shares three takeaways learned at HIMSS19.

-

14 Feb 2019 A Payments Experience Your Customers Will Love It’s Valentine’s Day and love is in the air. Your organization’s bill payments experience should show your customers a little love, too. How can it do that? Here are three tips to help get you started.

-

05 Feb 2019 2018 Year in Review: Orbipay EBPP This blog reviews five key accomplishments, improvements, and upgrades related to Alacriti’s electronic bill presentment and payment (EBPP) solution, Orbipay EBPP, in 2018.

-

29 Jan 2019 What’s ahead for EBPP in 2019? Alacriti’s electronic bill presentment and payments (EBPP) experts reflect on key industry developments in 2018 and share their thoughts on what the future might hold for EBPP in 2019.

-

16 Jan 2019 3 EBPP Resolutions for 2019 How can your business resolve to make bill payments simpler and smarter in 2019? Here are three electronic bill presentment and payments (EBPP) resolutions to consider.

-

27 Nov 2018 AI Steers Auto Finance in a New Direction, and Other Ideas from the Auto Finance Summit Last month, Alacriti attended the 18th annual Auto Finance Summit in Las Vegas, Nevada. Professionals from across the auto finance world convened for three days of engaging presentations and idea exchanges about all things auto finance. Here’s what we learned.

-

09 Nov 2018 5 Things We Learned at AFP 2018 Alacriti attended and exhibited at AFP’s 2018 conference in Chicago. Here are five things we learned during the payments-related presentations that were delivered at the event.

-

25 Oct 2018 Bill Payments in 2017: Most Popular Ways (and Days) to Pay Part 3 of our series explores the payment channels (Web Portal, Guest Payments, Agent, IVR) that Orbipay EBPP users chose most often in 2017. It also shares the days of the week that users were most likely to make bill payments.

-

18 Oct 2018 Bill Payments in 2017: 6 Trends in Payment Options Orbipay EBPP’s 2017 transaction data reveals new insight into consumers’ bill payments behavior. Part 2 of our three-part series shares six trends related to payment options including One Time, AutoPay, and Recurring payments.

-

11 Oct 2018 Bill Payments in 2017: 7 Insights About Payment Methods We analyzed Orbipay EBPP’s 2017 transaction data to better understand consumers’ bill payments behavior. Part 1 of our three-part series shares observations related to payment methods including ACH, credit cards, and debit cards.

-

26 Sep 2018 Forget the Login with One-time Bill Payments Consumers are managing more online accounts than ever before. One-time guest payments can simplify the bill payment process by giving customers an easy way to make online payments without needing to create user accounts.

-

17 Sep 2018 7 Benefits of Kiosk Payments Electronic bill payments are quick and convenient, but what about customers who want or need to pay their bills in person? Here are seven benefits that self-service payment kiosks can deliver as part of an overall EBPP solution.

-

27 Aug 2018 3 Tips for Painless Health Insurance Payments An EBPP solution can streamline health insurance premium payments by simplifying binder payments, offering diverse payment options, and sending members timely alerts and notifications.

-

21 Aug 2018 The Case for Flexible Mortgage Payments It’s critical for customers to pay their mortgages on time. An EBPP solution can encourage timely payments by offering proactive account communications, customer-friendly payment channels, and flexible payment schedules.

-

06 Aug 2018 EBPP Glossary: 11 Terms to Know The first step toward a deeper comprehension of electronic bill presentment and payments (EBPP) is a better understanding of the terminology associated with it. Here’s a shortlist of 11 commonly used terms to help get started.

-

18 Jun 2018 EBPP, From Checks to Voice Payments Every channel is an important part of a complete billing and payments solution. The best approach is to offer a comprehensive bill payment experience that makes things easy for customers no matter how they choose to pay.

-

15 Jun 2018 Southeast Credit Union Conference & Expo (SCUCE) Recap Alacriti was honored to attend and exhibit at the 2018 Southeast Credit Union Conference & Expo (SCUCE). Here’s our recap of the conference.

-

12 Jun 2018 5 Steps for Simplifying Utility Payments Utility customers are looking for a bill payment experience that’s on par with other retailers and service providers. Here are five ways that the right EBPP solution can help simplify billing and streamline payments for utilities.

-

15 May 2018 CS Week 2018 Recap Alacriti was honored to exhibit and speak at CS Week 2018. Here’s what we learned at our session on how utility companies can leverage artificial intelligence (AI) and chatbot technology for bill payments and customer service.

-

14 May 2018 AI Agents that Learn with Experience Businesses of all kinds are utilizing AI to improve the customer experience. While a pre-trained AI agent does a decent job at understanding and performing actions based on user inputs, it’s better to have an AI agent that continues to learn and understand its users better over time. Our new blog discusses the first of three aspects in which a bot can “learn” to do better.

-

09 May 2018 NACHA PAYMENTS 2018 Recap Alacriti recently participated in NACHA’s PAYMENTS 2018 conference. Here’s a summary of our sessions dedicated to artificial intelligence (AI), blockchain, and chatbot technology.

Schedule A Personalized Demo

Schedule a Free Consultation