Orbipay Instant Payments

Modern instant payments infrastructure for financial institutions.

See DemoGain access to TCH’s RTP® network, FedNow® Service, and Visa Direct payment rails and deliver modern money movement experiences to your customers.

Customers today expect financial institutions to deliver the same kind of experiences and services they routinely receive from companies on the leading edge of digital innovation. The pandemic has hastened the evolution of customer expectations, and FIs need to rapidly deliver new digital experiences, or face loss of customers to competitors.

Key Features

Real-Time Payments

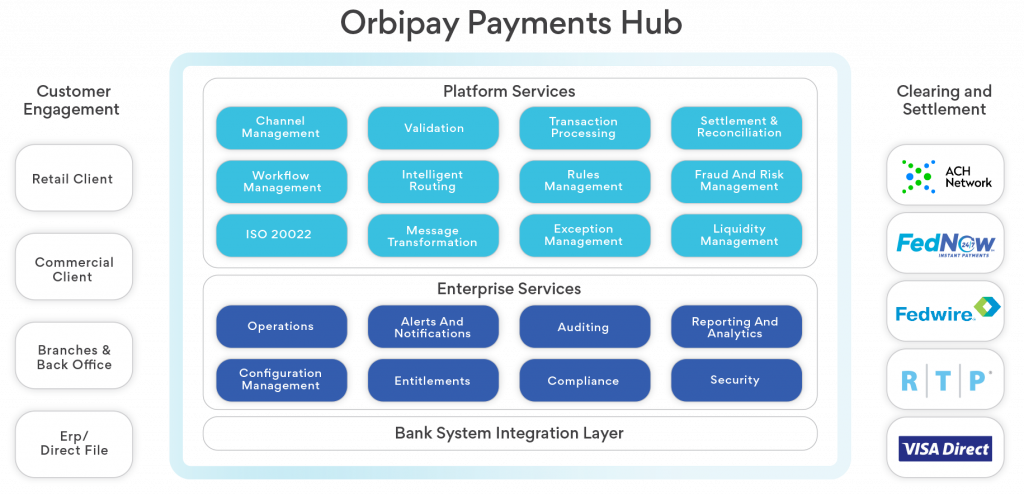

Access real-time payments via TCH's RTP® network, FedNow® Service, or Visa Direct and deliver innovative money movement experiences to your customers.Cloud-Native, Built for Scale

Built on leading cloud services including Amazon Web Services, Orbipay Instant Payments provides you with security and scalability that’s always available. Our cloud-native architecture is built for speed, responsiveness, and reliability and provides you with a strong foundation for innovation.Open APIs, Microservices-Based Architecture

Orbipay's Open APIs and microservices based architecture allow you to fine tune your payment services to meet ever changing customer needs and regulatory requirements. Learn moreIntegrated Fraud and Risk Management

Real-time fraud monitoring and detection including transaction screening against OFAC lists, negative / bad accounts, transaction limits, velocity rules, etc., enables you to manage risk and maintain regulatory compliance.Intelligent Payment Routing

Provides you with flexible options tailored to your needs and payment scenarios.Ease of Integration

Orbipay's flexible framework delivers simple and fast integration with core banking, digital banking, fraud and risk management and other internal systems.ISO 20022 Native Services

Employs data and message models based on ISO 20022 standards helping you drive payments modernization and innovation, greater levels of automation and global messaging consistency.Built-In Security

Built-in advanced security features to ensure data and privacy protection.Reporting and Analytics

Comprehensive, in-depth reporting and analytics for unparalleled insight into payment operations.Benefits

Unified Payment Processing and Settlement

Consolidate payment processing, orchestration, and settlement for all payment types through a single system. Centralized processing helps to lower processing costs and improve operational efficiencies.Fast Time to Market

Deliver on customer expectations for convenient real-time payment experiences. Gain access to the TCH's RTP® network, FedNow® Service, and Visa Direct payment rails with pricing models that scale with you, eliminating the need for large upfront investments.Future-Proof Your Payments Infrastructure

Drive payments modernization and data-driven innovation powered by ISO 20022-based messaging standards that supports seamless interoperability between payment schemes, including TCH's RTP® network and FedNow® Service.Agile Cloud-based Platform

Built from the ground up, and optimized for cloud scale and performance. Open APIs and microservices based architecture provides limitless possibilities to create differentiated faster payments products and experiences.Related Resources

-

11 Jan 2023 Articles & Trend Reports Aite Matrix: Payment Hub Vendors Alacriti is featured in Aite-Novarica's report.

-

24 Jan 2023 News Payments in 2023: What You Need to Know 2023 will be an important year for payments. Take a look at what’s to come.

-

05 Dec 2022 Articles & Trend Reports Building Blocks for Success in US Real-Time Payments The US has a fantastic opportunity to learn from the success of others, and take a shortcut to success.

Schedule A Personalized Demo

Schedule a Free Consultation