Orbipay Payments Hub

Modernize and Orchestrate All Your Payments—From a Single Hub

Orbipay Payments Hub provides banks and credit unions with a future-ready, cloud-native platform that simplifies payments orchestration across all rails—RTP®, FedNow®, Fedwire, ACH, Visa Direct, and Zelle®.

Problem

A Growing Need for Change

Disconnected payment systems create inefficiencies, increase risk, and make it harder to support newer channels like FedNow and RTP. Common pain points include:

Legacy infrastructure that hinders scalability

Manual workflows that reduce speed and efficiency

Disjointed user experiences that impact satisfaction

Escalating operational costs

Solution

Simplify Ops, Amplify Growth: Modern Payments Hub for Banks & Credit Unions

Orbipay Payments Hub provides a unified, cloud-native platform that integrates seamlessly with existing systems and supports all major payment rails, enabling faster deployment, secure operations, and scalability.

Unified Payments, Smart Orchestration.

Instant Impact.

Automate and simplify payments through initiation and settlement in one centralized ISO 20022-based payment processing engine— across all payment rails. Orbipay Payments Hub delivers end-to-end payment orchestration and processing for all payment rails on a secure, unified, future-proof platform

Payments Center

Submit and manage payments on behalf of the FI Customers across channels:

- Call Center

- Branch and

- Teller operations

Payments Manager

Initiate institutional payments to:

- Other FI's

- Vendors

- Business Partners

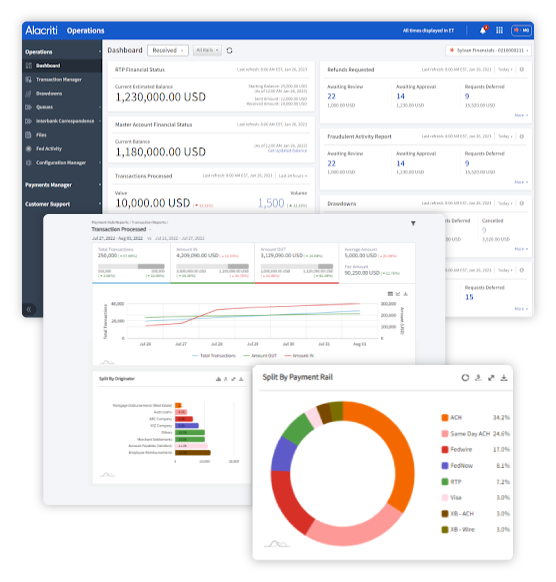

Payments Operations

End-to-End support for payment operations:

- Real-Time Visibility

- Exceptions Management

- Settlement Positions

Payments Reporting

In-depth reporting provides unparalleled insights into:

- Transaction Activity

- Fund Sources Destinations

- Trends & Analytics

Right Rail, Right Use Case—Centralized

From real-time to batch, Orbipay Payments Hub supports both Send and Receive for today’s most critical rails:

Powerful Integrations, Proven Partners

Alacriti is proud to partner with the world’s most innovative technology companies, collaborating with industry leaders to deliver cutting-edge payments modernization solutions.

Value

Why Orbipay Payments Hub?

Built to power innovation, scale, and agility in payments

Orbipay Payments Hub delivers a unified, ISO 20022-native infrastructure for fast and flexible payments. Designed with microservices and open APIs, it integrates seamlessly with your existing systems, empowering your institution to:

- Launch new payment services faster

- Reduce operational complexity and costs

- Meet evolving regulatory and customer expectations

Key Capabilities

End-to-End Orchestration on One Secure Platform

Orbipay Payments Hub delivers a unified, ISO 20022-native infrastructure for fast and flexible payments. Designed with microservices and open APIs, it integrates seamlessly with your existing systems, empowering your institution to:

Unified Platform

Centralize all payment types and rails in one interface

Business Rules Engine

Apply configurable logic and compliance checks

Liquidity Management

Maintain balances and meet funding thresholds

Intelligent Routing

Optimize how and when payments are sent

Exception Handling

Resolve errors with built-in exception workflows

Reporting & Analytics

Gain visibility across all payment activity

Key Benefits

The Business Case for Modernizing Payments

Reduce costs

Increase Compliance

Faster Time-to-Market

Lower Total Cost of Ownership

Stronger Compliance and Risk Mitigation

Cloud-Native Agility

Customer Perspectives

We Help Customers Achieve Superior Business Outcomes

Launched Instant Payments and processed $15.5 MM in 3 months

Customer

Royal Credit Union

Industry

Credit Union

Veridian Credit Union Among the First To Connect to the FedNow® Service

Customer

Veridian Credit Union

Industry

Credit Union

Real-Time Results: 2,300+ Transactions and $5M Moved in Two Months at ABNB

Customer

ABNB Credit Union

Industry

Credit Union

Frequently Asked Questions

What is a payments hub?

A payments hub is a centralized platform that streamlines payment processing across multiple rails—ACH, wires, instant payments (like RTP® and FedNow®), and more—within a single, unified interface. Explore Alacriti’s unique definition of a payments hub.

Unlike legacy systems that handle each rail separately, a modern payments hub like Alacriti’s Orbipay Payments Hub enables seamless orchestration, real-time interactions, rule-based automation, and rich reporting—all in one place.

How do payments hubs work?

Payments hubs act as the infrastructure that connects financial institutions to various payment networks. They generate and route payment messages, ensure compliance, apply business rules (e.g., fraud checks), and convert messages between different standards like ISO 20022. By offering a single point of control and integration, they modernize and simplify payment operations.

What are payments hubs used for?

Financial institutions use payments hubs to:

- Manage all payment types from a single system

- Ensure compliance with regulatory and network rules

- Improve operational efficiency through automation

- Reduce risk with centralized fraud and exception handling

- Enable instant payment capabilities like the RTP network and FedNow Service

Are payments hubs safe?

Yes. Payments hubs enhance security by consolidating payment controls and integrating compliance checks and fraud detection. They support secure formats like ISO 20022 and offer comprehensive visibility into payment activity, helping institutions quickly spot anomalies and maintain regulatory standards.

Let’s Talk About Your Payments Strategy

See how Orbipay Payments Hub can simplify operations, accelerate innovation, and future-proof your payments ecosystem.