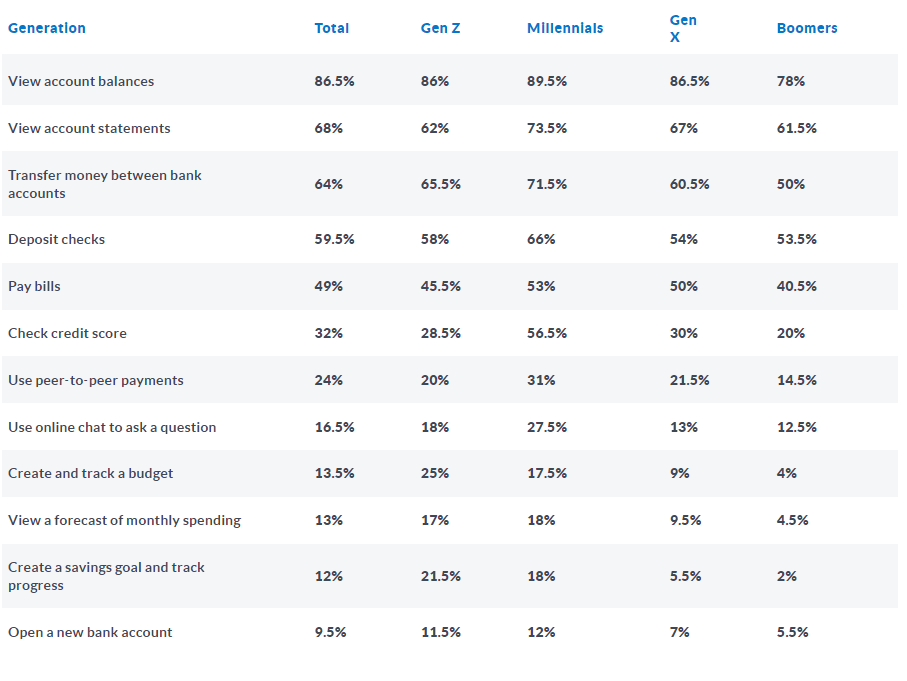

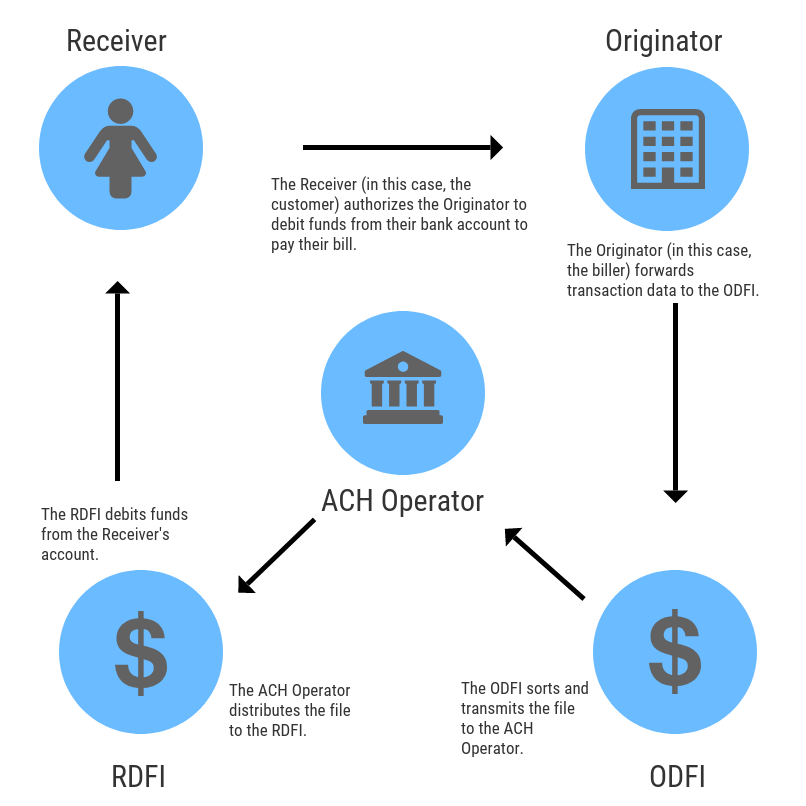

Payments modernization strategies can be tricky. On the one hand, many organizations, from large multinational banks to smaller local credit unions, have well-established payment operations to support existing volume and products today. On the other hand, the U.S. is starting to adopt faster and real-time payments en masse, opening up a slew of questions on how to support the new use cases and growing demand from their client bases—within the confines of those well-established payments operations. This conundrum puts pressure on financial institutions, 9,500+ in all, to rethink their payments strategies, and look to modernization. However, there is still a need to support the existing payment needs for heritage payment types including ACH and Fedwire. Which leads us to our question of the day, what should you look for in a new payments platform?

Fedwire isn’t a new payment type in the U.S. In fact, it’s far from it. I have mentioned in prior blogs that it is the “OG” when it comes to real-time payments in the U.S. since it is and has been our Real-Time Gross Settlement system since well before my time. The system itself pre-dates the Titanic and has moved along a digital journey through most of the 20th century, with upgrades coming as technology advanced from telephonic to internet-based. In today’s market, the solutions that support Fedwire, for the most part, rolled off the production line more than 25 years ago and have been cranking away ever since. As the years have rolled on, the Fedwire process itself hasn’t changed that much. The window still opens in the morning and closes at night, much like it did when bankers would bring their instructions down to the Federal Bank of New York in the early 1900s to settle their accounts and enter their transactions. Overnight the systems on both ends run through their batch-based processing cycles, and they’re up and running again (so long as it is a Monday-Friday and non-holiday).

Today’s market needs have started to stress these older systems, beginning with the rollout of digital banking options in the late 1990s and early 2000s and growing exponentially in the last ten years or so. As technology advances, we are at an interesting inflection point for Fedwire solutions for the masses (smaller regional banks and credit unions).

From my perspective, new solution searches should focus on the cloud. For starters, it gives banks and credit unions a much lower point of entry in terms of having a Fedwire solution (beyond just a fed terminal in the bank to manually key in payments). Additionally, it allows everyone to stay up to date on third-party upgrades and security updates from a tech behemoth (whether that’s Google, Microsoft, or Amazon). All of whom have deeper pockets than any individual entity or hosting facility would have. Also, the geolocation issues that arise from physical data centers are more or less neutralized with cloud-based computing.

But the cloud by itself isn’t enough. The next big thing is making sure the product/solution is built for and on the cloud. Taking a big monolithic application and deploying it on AWS or Azure brings the same problems that exist on-prem and in data centers. It is costly to maintain, at least way more costly than a solution built with the tools from the cloud provider, so look for what tools the product uses and what technology it is taking advantage of. For the record, Alacriti is Amazon WAR (Well-Architected Review) certified.

The final thing is to dig into the engine process itself. Ask, what is the solution’s native standard? For many older applications and Fedwire itself today, the messaging standard of the solution is proprietary. The Federal Reserve announced in 2018 that they would be moving the Fedwire system to the ISO 20022 standard, which is also leveraged in its FedNow network. While the solution today uses a proprietary based messaging protocol, the future of Fedwire is ISO-based, so look to solutions that are also handling the message natively.

Due to the aforementioned reasons, Alacriti’s payment solutions are both cloud-native and ISO 20022 based. Alacriti’s Cosmos Payment Services supports real-time payments on the RTP network, ACH, and Fedwire payments, giving institutions a future-proof platform for payments innovation.

More on Fedwire in Will Faster Cannibalize Your Fedwire Revenue?

Today’s legacy and siloed banking technology infrastructure limit financial institutions’ ability to rapidly innovate. It’s time to look at money movement in a new way. Alacriti’s Orbipay Unified Money Movement Services does just that. Whether it’s real-time payments, digital disbursements, or bill pay, our cloud-based platform enables banks and credit unions to quickly and seamlessly deliver modern digital payments and money movement experiences. To speak to an Alacriti payments expert, please call us at (908) 791-2916 or email info@alacriti.com.