Since TCH’s launch of its RTP® network in 2017, the first new payments network in 40 years, adoption has been steady, but slower than it should be for a variety of reasons, including uncertainties about profitability and a reactive stance to consumer demand, as well as a lack of imagination about all the ways real-time payments could act as a foundation for new products.

Real-time payments offer numerous benefits for consumers, including speed, convenience, and security. Consumer demand exists and the benefits are undeniable, so the field remains wide open for innovative opportunities to leverage—and monetize—real-time payments. How exactly then can financial institutions best leverage real-time payments to add speed, convenience, safety, and value for consumers—and increase revenue?

Drawing out consumer demand for real-time payments

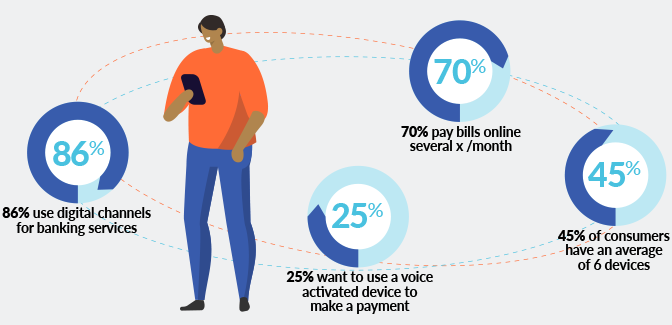

Consumers have had a taste of faster/instant payments and they like it— 41% are even willing to pay for the added speed and convenience in some cases, for example, paying a fee to transfer money from their P2P app instantly as opposed to waiting 2-3 days for an ACH transfer to their bank account.

The problem is, while the benefits are tangible and easy for them to see, consumers aren’t going to proactively knock on their financial institution’s door and demand “real-time payments” because they don’t know or care how faster payments happen. It’s up to financial services providers to lead with innovation based on consumer demand and expectations. After all, if you don’t do it, a disruptor will step in for you.

A solid example of this can be found in cross-border payments. Many financial institutions still only offer wire transfers to send money internationally. And many financial institutions will say there is little demand for wire transfers these days, especially low dollar amount transfers. However, people in the U.S. send $74.6 billion to individuals in low- and middle-income countries a year. Fees average 6% a transaction. For example, sending $1,000 to a family member could cost $60. However with some alternative services available, sending money internationally is quick, cheap, and easy. For example, to send money to send $50 to someone in Mexico with WorldRemit (most transfers are instant or near instant), it would just cost $1.99. The truth is, demand is there, but traditional financial institutions aren’t meeting it, so consumers have had to seek fulfillment from disruptors. This is business financial institutions could easily recapture using real-time payment rails.

Benefits for consumers, opportunities for banks and credit unions

Speed

One of the biggest benefits of real-time payments is speed. When a real-time payment is sent, the funds are transferred instantly. This is in contrast to traditional payment methods, such as ACH transfers, which can take several days to clear.

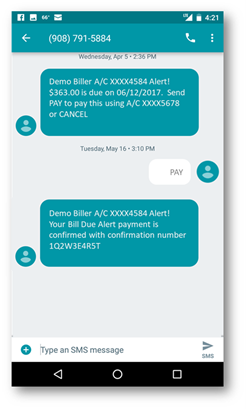

Financial institutions can satisfy this need for speed using real-time payments rails as the bedrock for innovative products and services, like instant P2P payments, upselling instant transfers from app balances to consumers’ bank accounts, instant (or earlier) payroll, and expedited bill pay.

Convenience

Another benefit of real-time payments is convenience. The 24/7/365 nature of real-time payments means bankers’ hours are a thing of the past. Consumer access to the network via integration with existing banking channels means consumers can send and receive money—or pay for goods and services—anytime, anywhere.

Security

Real-time payments also offer enhanced security. Funds are transferred using a secure network with no float time, which helps to reduce the likelihood that fraudsters will have time to attempt to divert and intercept payments. This can be especially helpful for securing large transactions, such as mortgage escrow funds.

Orbipay Instant Payments brings the future to financial institutions

The use of real-time payments will eventually grow rapidly. As more and more businesses and consumers adopt real-time payments, we can expect to see even more innovative use cases emerge.

Alacriti’s Orbipay Instant Payments brings a modern payments infrastructure to financial institutions. The platform provides access to TCH’s RTP® network, FedNow® Service, and Visa Direct payment rails empowering you to deliver modern money movement experiences to your customers or members.

The real-time payments gateway is cloud-native and built for scale, and its open APIs and microservices-based architecture mean the sky is the limit for building innovative solutions that can be integrated with your existing systems (Alacriti has pre-built integrations with many core banking solutions and digital banking systems). The platform also offers a host of built-in features for safety, security, speed, convenience, and ease of use to ensure seamless integration of real-time payments into your existing infrastructure and workflows.

Discover more about real-time payment use cases in our article: “The Sky’s the Limit: How Financial Institutions, Businesses, and Consumers Benefit.”

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.