What are bankers thinking about when it comes to instant payments? Take a look at this infographic containing stats from a recent survey to find out:

What are bankers thinking about when it comes to instant payments? Take a look at this infographic containing stats from a recent survey to find out:

*Originally submitted by Mercator Advisory Group

Faster Payments Are Set to Revolutionize Modern Digital Payments

Faster payments and the user experience are the differentiators that will enable banks and credit unions to remain relevant and competitive.

We’ve seen this gradual shift during the past decade as modern payments have undergone a significant transformation based on consumer expectations. And in the past few years, in particular, the shift has accelerated as the pandemic changed the way many are paying for goods and services.

To put it simply, consumers want convenience — and that’s what’s driving this surge in digital payments. “Most people are looking for the iPhone experience,” said Jeff Bucher, Senior Product Manager at Alkami. “On your iPhone, you can click on the app and you can get things right away. You can order food immediately and have it delivered quickly.”

“Banking is important and using banking in the same manner that you use other apps and other interfaces is what people expect,” he added. “At this point, people want digital banking at their fingertips. They want to be able to have a streamlined interface, and they expect robust capabilities — to pay their bills online, pay their friends and family, and pay their loans online as well.”

The growth of faster payments is starting to be reflected in new use cases, according to Mark Majeske, SVP of Faster Payments at Alacriti, especially when looking at real-time payments, which has been available in the U.S. for five years.

“2023 is going to be the year of use cases,” said Majeske. “How do you drive usage of these systems, at the end of the day, adoption of these RTP [real-time payment] rails and FedNow—that’s coming up—really depends on us, with consumers and businesses using it. In the next couple of years, we’re going to see a huge emphasis on user expectations.

Key Differences Between the RTP® Network and the FedNowSM Service

The FedNow Service is poised to go live next year, and it shares considerable similarities with The Clearing House’s RTP network, which launched in the U.S. five years ago.

“Both the RTP network and the FedNow Service are instant, real-time payments, and they’re final,” said Bucher. “This is key to understand — that once you send the payment, it’s done. The only way to get the money back is to request that the money is sent back.”

“It’s a push-only method,” he said. “They’re not batches like ACH [Automated Clearing House] — both use ISO 20022 messaging to communicate, and this is key because ISO 20022 is a messaging method that’s being adopted around the world [and] is becoming more of a standard ever year.”

According to Bucher, both the RTP network and the FedNow Service are similar to wires, but they can replace wires in a lot of different ways because they’re faster, cheaper, and easier. “Some differences between the two are that you have to be on one network or the other,” he said. “They’re not ubiquitous, they don’t crossover, so you can’t send something on the FedNow Service and it will show up on the RTP network. You’re either on the RTP network or you’re on the FedNow Service.”

Another significant difference is that the maximum transaction limits are different. The RTP network has a maximum transaction limit of $1 million, and the FedNow Service $500,000.

Significant Use Cases for Faster Payments

One important use case around faster payments is account-to-account (A2A) money transfers. “We are partnering with Alacriti to offer A2A within our native environment,” said Bucher. “I think it’s something that makes a whole lot of sense. If you want to send money to an external account, say you’re at one credit union and you want to send it to a bank…you want to be able to send it immediately where you [can] press the button and it shows up in your account.”

“It’s a great use case, and it’s very needed and very desired among financial institutions and their users,” he added.

There are also many use cases within the business-to-business (B2B) space that are leveraging real-time payments—to pay for invoices, request payments, and even request payments back on invoices.

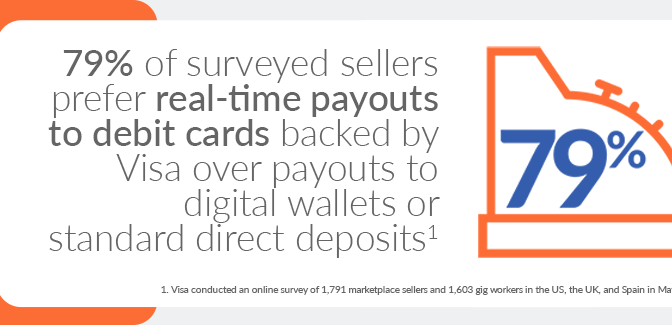

For business to personal transactions, a growing number of companies have gig workers who need to be paid daily, so it makes sense to use the FedNow Service and the RTP network for payroll. In addition, insurance payments can also be paid out quickly after a disaster to help people receive funds for housing, food, and clothing.

“Payroll’s another use case,” said Bucher. “There’s a lot of companies that have gig workers or temp workers and you need to pay them on a daily basis—and it makes a whole lot of sense to use real-time payments for that. It could be cheaper and easier than ACH in some instances.”

According to Majeske, real estate and automotive are other industries benefiting from RTP. “Some of the high-level transactions I’m starting to see is basically a car purchase. Let’s say you’re at the car dealership and you go to your mobile phone and sign up or apply for a loan,” he said. “The loan is turned around very quickly and at the end of the day, you’ve got the funds going to the dealership and you’re walking out with a set of keys.”

A Partnership That Works

In order for faster payments to work and for the consumer to take advantage of their offerings, they must be simple to use and fast. Ensuring that the front end of operations also has a user-friendly interface is crucial.

“Alkami takes care of all the back end,” said Bucher. “Alacriti has an engine that chooses the rail on the backside, whether the FedNow Service or RTP network, and we handle the interface to ensure they know we are executing their transactions and they can input what they need.”

“We picked Alacriti to partner with based on the fact that they were further along than a lot of the other potential partners that we talked to,” he added. “They really had an inside track on RTP and they were also in the pilot for the FedNow Service. Now they have strengths where we need them in payments, in particular, and they have a great track record of working with credit unions and banks.”

“It’s a win because at the end of the day, to be successful in faster payments you need the expertise on the payments side,” said Majeske. “Oftentimes, even more importantly, is that you [get] the user experience right, because without that, customers won’t easily use it or adopt it.”

*Originally submitted by Mercator Advisory Group

As instant payments grow worldwide, so do the opportunities for fraudsters to strike. In a recent webinar with Alacriti, Mark Majeske, Senior Vice President of Faster Payments at Alacriti, and Brian Riley, Co-Head of Payments Research at Mercator Advisory Group, discussed what financial institutions and other organizations can do to mitigate fraud amid the widespread adoption of real-time payments.

Faster Payments = Faster Clearance

Faster payments have been a mainstay in Europe for roughly a decade, and their adoption is rising in the U.S.

“Faster payments is an emerging trend in the U.S.,” said Riley. “The clearance will speed up in a short period of time — from a difficult three-day period to minutes in most cases. One of the challenges is that you still have the same requirements to manage fraud, but now it’s in a shorter period of time. And that’s significant.”

“When we look at payment growth through the next decade, we see real-time payments hitting close to $5 trillion by 2023,” he added.

Regardless of the narrow margin of time given to catch fraud, businesses must still grapple with the four common types of fraud, including synthetic fraud, account takeover, unauthorized use, and authorized use. Sifting through the various distinctions of each category of fraud and knowing their risk is critical, as is getting familiar with all aspects of these risks and compiling them together to form an effective strategy.

Nimbleness Is Key in Detecting Fraud

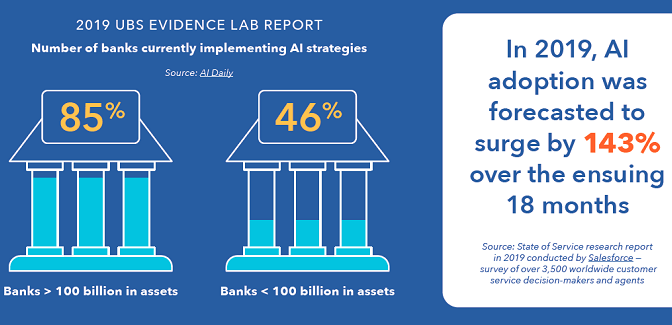

The modus operandi of fraudsters involves finding an entryway into a system until the user makes a change, at which point, the fraudster course-corrects and figures out what the change was. Artificial intelligence (AI) and machine learning (ML) can easily pick up on these changes.

“What AI and machine learning does is identify deltas or changes in patterns far better than humans can,” said Majeske. “It’s noticing that the fraudsters are doing something different. It enables you to identify that sooner and adjust the tolerance levels of your fraud system to accommodate.”

“Nimbleness is essential when you are dealing with fraud,” added Riley. “In contrast to operational risk, or credit risk, where there is predictable behavior with the customer. Fraud works through the weakest channel. Having a high-impact way that can cross all channels and filter way beyond what a human operator can do is key to getting through the fraud management process.”

Customer Involvement Is Key

One of the most critical and strategic players in fighting fraud is the customer. And, financial institutions have an obligation to communicate that to their customers.

“It’s extremely important that FIs constantly send information and education out to their customers because they are the front line,” said Majeske. “Encourage your customers to look at their transactions. What fraudsters will often do is place a small-dollar-amount transaction just to test to see if you’re watching. They look at when you are paid and when you have the most money in your account.”

This emphasizes a key point that although financial institutions can throw money at countless fraud prevention tools, it’s not a fool-proof solution. Customers must be introduced as key players in the fraud prevention process.

“Customer involvement is important,” said Riley. “Although they are protected, they are subjected to inconvenience. Calibrating the fraud management system is essential to protect against false positives and false negatives that can cloud the situation. Having the customer involved whether it’s sending messages, notifying them of the transaction, or doing routine reviews of their accounts is important.”

Critical Data Points for Fraud Prevention

For many financial institutions, there’s a temptation to gather as much data as possible and then figure out what’s needed. And that’s not necessarily the best approach. Rather, FIs should take the data they currently have and align them with their current model to determine the best strategy.

“Don’t collect data that you don’t need,” said Majeske. “We are looking at transaction-based data — AML [anti-money laundering] controls, channel limits, transaction limits, and individual practices. We also add an analysis on the individual. We’re looking at how many times they change their email address. Do they have a history in another financial institution that might be negative? We combine all that into one rating.”

Current Tactics Banks Have to Prevent Fraud

When it comes to faster payments, it’s critical to first look at your current fraud system. Ensure that it’s competent and has the capability to handle transactions 24/7. Adding additional layers of protection to the current fraud protection tools is also a good practice.

With real-time payments becoming more ubiquitous, financial institutions must look at their current infrastructure and ensure that they are ready to accept real-time payments. Some organizations are only built to handle wire and automated clearing house (ACH) payments. If that’s the case, an upgrade will be required.

“Preventing the problem before it starts is really the way to go,” said Riley, “I agree on having different layers because you are dealing with so many different angles for crime to be committed.”

Addressing Fraud in Real-Time

The fact that real-time payments are happening around the clock, including holidays, changes everything. Whereas wire and ACH payments provide a margin of time to address fraud before they post, this option is gone with real-time payments. With real-time payments, you have seconds to milliseconds to address fraud.

“It’s about capturing the right data, creating a good model, and doing so proactively before the transaction is sent to the network,” said Majeske. “We take this information while the customer is still in session.”

This is why key information is requested from customers up front, as it informs the bank before they make a decision.

“Having an orchestrated fraud strategy that addresses much of the process with artificial intelligence is the most effective way to go,” said Riley.

Alacriti offers a payments as a service model (PaaS). It’s cloud-based and can easily integrate with many banking cores. It also has an open application programming interface (API), is ISO 20022 native, and includes smart routing.

The benefits to adopting this solution are that it grants both banks and credit unions access to all currently available payment rails. They include ACH, the FedNowSM Service, and The Clearing House real-time payments (TCH RTP®) network. Alacriti offers protection on all the available rails.

Banks and other financial institutions really need to look carefully at their current enterprise fraud system to determine whether they need to make significant updates to truly accommodate real-time payments.

To learn more about real-time payments fraud prevention, watch the full webinar, Fraud Prevention in a World of Instant Payments, featuring Mercator and Alacriti.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNowSM Service, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.

The holidays bring on a flurry of activity for most businesses every year. Even with the potential of a recession looming over us, there seems to be little to no signs of it slowing down at the year’s end. Both online and retail sales are expected to grow substantially during the 2022 holiday season. During the months of November through December, holiday sales are expected to reach $1.45 to $1.47 trillion. Compared to 2021, e-commerce sales alone are expected to rise from 12.8% to 14.3% year over year.

For call centers at financial institutions, this season can get hectic. Accountholders call in for their balances, some to enquire about an overdraft and perhaps to dispute NSF fees. Also, unconventional spending may trigger fraud alerts, which increases call volume even further. Friendly fraud, in which a consumer demands a reversal of a charge they actually made (because they didn’t recognize it) triggers even more phone calls—39% of consumers have admitted taking part due to forgetting about the purchase or it being made by a family member. Of course, this increase in inquiries is all during a time of the year when many employees ask for personal time off to celebrate.

Today, many organizations use chatbots to free up customer service agents, allowing them to have more time to deliver personalized and focused support for customers with more complex issues. A recent report found that 58% of customers now opt to use chatbots for customer service. This can also apply to banking. Call centers can be relieved and provide better service when there’s a chatbot to answer standard inquiries.

We spoke with Jenn Markus, Glia’s Director of Technology Partnerships, for her take on how chatbots can help financial institutions run smoothly during the holidays.

It’s hard to get customer service right when you’re extremely busy. Do you have an example of a financial institution that you think really got it right?

There are so many examples of financial institutions doing things right, it’s hard to choose! Without calling out a specific financial institution, I would say that the most successful service organizations have common traits: they are proactively meeting customers where they are in their journey and they are balancing automation with personalized experiences.

At its core, Digital Customer Service (DCS) is all about providing a positive customer experience, based on each customer’s unique needs. Successful FIs are meeting customers in the digital channel of their choice—chat, voice, or video—but they are also offering a seamless transition between channels for live support as appropriate. Specialized AI-enabled chatbots can handle more straightforward inquiries, like reporting account balances or routing numbers, but can also transfer the complete interaction to Customer Service Representatives (CSR) for more complex questions. The result is a win-win situation: customers are able to navigate rapidly through your digital properties while CSRs are freed-up to handle more complex issues.

Considering 32% of all customers will stop doing business with a brand they loved after just one negative experience, what’s a good way for a financial institution to keep the inconvenience and frustration of card denials down, without compromising the integrity of fraud prevention?

While suspected fraudulent activity accounts for a fair share of transaction denials, there are a number of other reasons a card can be declined at the point-of-sale or during an online transaction. Throughout the transaction authorization process, there are various checks and validations occuring behind the scenes by the payment processor. Each one of these validation points present an opportunity for a transaction to be denied. In most cases, the only piece of information the cardholder will receive is a notification that their transaction has been denied and perhaps a denial code, which means nothing to them. Receiving a denial in public can be an embarrassing experience, just imagine a first date or perhaps hosting a business dinner. Additionally, the cardholder is in the dark about why their card was declined and needs to follow a multi-step process to resolve the issue.

As you mentioned in your question, according to a PWC survey, 32% of all customers will stop doing business with a brand they loved after just one negative experience, and 59% will walk away after several bad experiences. This presents high stakes for a financial institution trying to not only retain the existing cardholder accounts, but also acquire new ones and grow transaction volume.

It’s not all doom and gloom, though! While card denials are somewhat inevitable, there are solutions available to financial institutions to improve the cardholder experience. Financial institutions that offer Digital Customer Service (DCS) options for cardholders to seamlessly connect are seeing improved customer satisfaction results. Enabling cardholders to connect in the channel of their choice and where they are—OnScreen —can help resolve any issues quickly.

For those who aren’t tech savvy, what’s the best way to make digital customer service something they can actually appreciate?

Glia’s Digital Customer Service platform is well-suited for users of all technical levels. Customer Service Reps (CSRs) have a single view into the customer’s journey, providing context to the customers’ experience to and through the point of contact. CoBrowsing, or Collaborative Browsing, enables CSRs to guide customers through friction points. Reps can use DCS to demonstrate rather than tell customers how to navigate digital properties and resolve issues. Customers don’t have to download any apps and can choose the communication mode—voice, video, chat— that they are most comfortable with.

Where do you think a chatbot would be of greatest service in banking during the holidays?

During the holidays, there seems to be an increased sense of stress and pressure for customers and members. As they rush to finish holiday shopping or year-end tasks, more time-sensitive questions come up. With virtual assistants, your customers will receive a faster, more consistent support experience and your representatives will be able to easily handle multiple engagements without a decrease in quality. As I mentioned previously, chatbots can be deployed to handle routine inquiries, freeing up your CSRs to tackle more detailed interactions. As a result, there are less wait times, faster and more consistent service.

We’ve all talked to a chatbot who couldn’t answer our questions and then had to explain the issue again to a live rep or call in. What’s the best way to prevent that friction in the chatbot experience?

Digital Customer Service (DCS) offers a seamless experience for both customers and operators. Glia’s operator interface displays the customers’ interaction as well as where they are on your digital properties so that the CSR can jump straight into the interaction with full context and doesn’t need to ask “How may I help you?” Further, Glia’s platform allows operators to utilize the channel that is most appropriate for the engagement, so they can seamlessly move between chat, video or voice as well as assist with screen sharing and CoBrowsing to efficiently service customers.

From an end-user perspective, what do you think are the greatest benefits to banking with an institution that offers a chatbot?

The first benefit is meeting the customer where they are—OnScreen. Chatbots are a great entrypoint to understand what a customer needs and provide answers for simple tasks, such as a balance inquiry.

Being able to quickly speak with a live rep from within the chatbot by simply pushing a button is a tremendous convenience and also keeps the digital connection. Plus, reps benefit from seeing the full context when they get connected to the customer. Chatbots that just offer a phone number to speak to a live agent disrupt that digital connection, causing a friction point where many will simply abandon the call.

The immediacy without having to navigate the dreaded phone tree is yet another benefit, leading to a positive experience. Chatbots free up agents, to the benefit of even those who call in and DON’T use the chatbot. The call center isn’t as overwhelmed and callers are able to speak with someone fairly quickly.

This year, holiday forecasts predict a 6-8% increase in year-over-year spending in November and December. Banks and credit unions can drive spending around two months before the holidays by marketing relevant products and promoting cards so they’re top of mind/wallet. For example, increasing credit lines. And then after the holidays, offer balance transfers or convenience checks to prevent competitors from stealing away cardholders with similar offers. How could a chatbot assist?

First, simply helping to keep CSRs available, and wait times down helps a great deal during busy seasons. Financial institutions might consider deploying microbots that are able to handle specific requests common during the holidays, such as credit card spending limits. In fact, financial institutions should regularly evaluate their chatbot strategy based on seasonal usage data. Lastly, give the chatbots some character. Everyone appreciates a season’s greetings and a friendly ho ho ho in December!

Read more about chatbots in 4 Ways Chatbots Are Revolutionizing Electronic Bill Payments.

Updated from a blog originally published November 11, 2021.

Alacriti and Glia have partnered to assist financial institutions in providing their members with best in class digital-first service. Glia’s Digital Member Service Platform combines all communications into one unified digital experience. With the partnership, members have access to Ella, Alacriti’s AI chatbot that’s fine tuned to answer bill pay questions and is fully integrated within Glia’s Digital Member Service platform. For more information about Digital Member Service powered by Alacriti and Glia, please please call us at (908) 791-2916 or email info@alacriti.com.

*Originally published on CUInsight.com

“Payment services hub” or “payment hubs” used to mean a consolidation of systems supporting Fedwire and ACH processing, which helped large financial institutions bring together their Commercial and Retail payment operations. Payment systems were historically introduced one at a time as new payment methods became available, giving rise to silos by workstream for operations such as product management, customer service, compliance, etc. for each payment type. An example of this is check processing, which began in the 1950’s.

Today, “payment hub” has expanded to include new real-time payment rails such as TCH RTP® network, the FedNowSM Service, and reverse debit networks such as Visa Direct and MasterCard Send. Celent refers to payment hubs as ‘where a single solution can process all payments on a single platform’.

Here is how the payments services hubs of today are different:

Today, payment hubs are being used around the world at hundreds of banks, and most of the top 30 U.S. banks have at least one payment hub. They are a key component of payment modernization, and widen the gap between bank and credit union capabilities.

Learn more about payments hubs in Payment Services Hub Explained.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNowSM Service, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.

Previously the Federal Reserve’s real-time payment rail, the FedNowSM Service, was said to launch in 2023, with no further details. However, the launch window is now more defined. The Fed has recently announced that the FedNow Service will launch in May-July 2023. Currently, over 120 organizations are participating in the FedNow Pilot program, which entered technical testing in September.

In a CUInsight hosted webinar, credit unions had the opportunity to ask questions directly to Joni Hopkins, Vice President, Product and Relationship Management Group at Federal Reserve Financial Services, and Mark Majeske, SVP Faster Payments at Alacriti.

Here were 3 interesting things shared in the webinar:

How to Connect:

An important part of the plan is how to connect.

A credit union can connect through one of the following:

FedLine Direct®, FedLine Command®, and FedLine Advantage® are all direct means of connection. However, FedLine Web® users will need to switch to one of the three aforementioned solutions for FedNow Service connection.

Types of service providers included hosted gateways, bankers’ banks, corporate credit unions, and core processors. Whether using Alacriti, a core processor, or a corporate credit union (if preferred), credit unions can have more control by managing their profile directly through the Federal Reserve (through a FedLine Advantage or above connection). Because of the FedNow Service’s flexibility, credit unions can even connect with multiple partners, e.g., a core processor and online banking service.

The Impact of Real-Time Payments on Operations:

When considering the impact that real-time processing will have on operations, there are further questions to think about. How will real-time processing be managed? Which upstream and downstream applications need to operate on a 24x7x365 basis? What contingency arrangements are needed to mitigate service disruptions?

Hopkins shared that the impact on operations is a significant concern for many credit unions. “When I’m talking to credit unions, a lot of times people get a little nervous when they think about real-time processing. Does 24x7x365 mean that I have to have someone sitting at the credit union 24 hours a day, 7 days a week, 365 days a year? The answer is no. When we’re your service providers, you will understand more about how you can offer 24x7x365 and have real-time processing without someone physically having to be in the bank. Understand that this is different, but your partners are going to walk you through it.”

Limits and Anticipated Pricing:

Hopkins shared a sneak preview of anticipated pricing. However, she encouraged attendees to review their next pricing announcement for official pricing, which will likely be at the end of 2022. Overall, it won’t be a lot more than what financial institutions are paying today for legacy services, such as checks and ACH. It is likely to be a $25 monthly fee per routing number that’s enrolled in the Fed. The prices anticipated are a fee of $0.045 per credit transfer to be paid by its sender, including returns, and a $.01 Request for Payment fee.

The transfer value limit for the FedNow Service is $500,000, and the default value limit is $100,000, which can be intimidating for some. However, the Fed allows financial institutions to set their own risk tolerance. For instance, a credit union can choose to set it lower for certain payment types. The reason it goes up to $500,000 is due to use case scenarios such as possibly having real-estate closures over the weekend.

To get an update from the Federal Reserve and learn the answers to commonly asked questions, watch the full webinar, FedNow Service 2023: Your Questions Answered, featuring the Federal Reserve and Alacriti.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNowSM Service, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.

As the payments landscape evolves, it’s important to understand your customer/member needs when evaluating payment rail choices and settlement speed. However, one rail is not going to fulfill all the needs of all accountholders. Therefore, multiple payment rails are needed. One of these rails is Visa Direct, which offers both domestic

and cross-border payments, and global ubiquity. Here, we look at 6 of the leading use cases for card-based push payments.

*Originally published on CUInsight.com

In April 2022, EBA Clearing, SWIFT, and The Clearing House announced their plan to launch a pilot service for immediate cross-border payments with the support of banks from both sides of the Atlantic. Twenty-four financial institutions are contributing, and the pilot service will launch at the end of this year. Initially, the service will begin with the U.S. dollar and Euro, and the intention is to expand to other currency channels and payment systems. Here’s why this is an important development:

Connects the U.S. and Europe in the immediate future

Although the global card networks have been offering fast cross-border payments for years, this announcement is important because it provides a means for the U.S. real-time payment rails to connect with Europe (real-time cross-border products have already appeared in Asia and in the Nordics). Russ Waterhouse, the executive vice president of product development and strategy for The Clearing House, stated to American Banker, “As much as we see use cases developing from real-time pay in the U.S. and Europe in their own countries, you’ll see the same kind of innovation in cross-border payments.”

Avoiding the lag and friction

Sometimes international transactions can take longer—sometimes multiple days— due to local liquidity and risk management requirements. Currently, there are intermediary banks that act as hubs, meaning one payment could go through several banks. This also adds to the time it takes for a payment to clear. Manual processes still prevail, and there is a lack of interoperability between platforms. With cross-border real-time payments, parties will know immediately if a transaction has settled, removing the risk of being unsure of settlement.

The potential of a global network

There are already four dozen countries with a real-time payment system. With economies becoming increasingly interdependent globally, there is more need for cross-border real-time payments. This could democratize entries into markets by reducing barriers to entry and promote financial inclusion.

There isn’t just one rail or channel that’s ideal to deliver faster payments. Card networks such as Visa can push instant payments to debit cards where existing rails can’t reach. Conversely, having an A2A option in real-time can reduce friction for consumers and businesses that make payments between countries where card penetration differs. It’s important to partner with a fintech that can provide connectivity to all the major rails, so the financial institution is completely covered no matter where or how fast the payment needs to arrive.

In other news, the Metaverse is becoming very important in the financial services industry. Read more in The Metaverse and Payments: 5 New Developments.

Alacriti’s centralized payment platform, Cosmos, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH RTP® network, Visa Direct, and the FedNowSM Service, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.

Artificial intelligence (AI) was already on a meteoric rise in the transformation of customer service as we

know it. The current environment can be expected to accelerate that trend even further. Here is a look at what AI in customer service means to tomorrow’s competitive landscape.

*Originally published on CUInsight.com

In 2009, Bruce Willis starred in a movie called Surrogates, featuring a futuristic world where humans interacted through surrogate robots. At the time, the thought of living a life by proxy seemed otherworldly. However, if you’ve noticed the accelerating number of headlines about the concept of a virtual second life is being embraced by major corporations.

So what is the metaverse? According to the NY Times, the metaverse is the convergence of virtual reality and a digital second life where virtual reality serves as a computing platform for living a second life online. In short, you and your avatar interact with others in a digital, virtual reality environment. This is seen as a step into ‘ambient computing’, which according to Digital Trends is “an environment of smart devices, data, A.I. decisions, and human activity that enables computer actions alongside everyday life, without the need for direct human commands or intervention”. This is not a foreign concept for gamers, as social elements of the metaverse are already there in games like Fortnite. For the rest of us, the metaverse is still very important to understand as it’s now attracting big business.

Here are five news stories that we find interesting about the metaverse as it relates to payments:

As the year progresses, we expect to see many more stories like this. The growing popularity of the metaverse demonstrates the importance of having a modern payments platform that allows your financial institution to quickly innovate in response to the industry trends.

To learn more about what to expect this year, read the article, Payments in 2022: What You Need to Know.

Today’s legacy and siloed banking technology infrastructure limit financial institutions’ ability to rapidly innovate. It’s time to look at money movement in a new way. Alacriti’s Orbipay Unified Money Movement Services does just that. Whether it’s real-time payments, digital disbursements, or bill pay, our cloud-based platform enables banks and credit unions to quickly and seamlessly deliver modern digital payments and money movement experiences. To speak to an Alacriti payments expert, please call us at (908) 791-2916 or email info@alacriti.com.

*Originally published on CUInsight.com

The term ‘payments orchestration’ seems to be everywhere, but what is it? As defined by PaymentsJournal, payments orchestration is:

A Payments Orchestration layer manages and unifies payments from diverse gateways, payment methods, 3rd party services, and platforms in order to minimize costs, optimize customer experience, and decrease time to market. The Orchestration layer acts as a hub for traditionally more commercial facing or wholesale applications although it can and does also consolidate merchant facing applications.

The term orchestration is really talking about automation—how your system can help automate payments from initiation all the way through clearing and settlement. There’s a lot that happens from Point A to Point B on that journey, including:

In sum, orchestration handles the full end-to-end lifecycle of a payment. It leverages API services from external systems that need to be invoked and should be configurable for each financial institution. APIs make it possible for payments capabilities to be added quickly and cost-effectively. This flexibility can facilitate key payment functions such as intelligent routing. From an end-user standpoint, the payment process is simplified as payments orchestration removes much of the friction consumers face. Ultimately, payments orchestration automates as much as possible.

The payment engine is where payments orchestration happens. The Alacriti payment engine, Cosmos, is the underpinning system of record for payments. Cosmos is the backend connectivity for banks and credit unions to connect to various networks, including The Clearing House’s RTP® network, the FedNowSM Service when it’s live, Visa Direct, and heritage platforms such as Fedwire and ACH. Its cloud-native structure makes it both affordable and scalable.

Learn about another common payments term, ‘payments services hub’, in the blog Payments Services Hub Explained.

Alacriti’s centralized payment platform, Cosmos, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments, and control their evolution with ACH, Wire, TCH RTP® network, Visa Direct, and the FedNowSM Service, all on one, cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.

Our voices are becoming more powerful than ever. Thanks to advancements in artificial intelligence (AI), natural language processing (NLP), and smart home devices, our voices can control everything from turning up our thermostats to selecting our favorite television shows.

It wasn’t so long ago that intelligent personal assistants that respond to voice commands were considered cutting edge, but they’re also becoming more commonplace in our daily lives, especially in the aftermath of the global pandemic when adoption swung abruptly upwards with Juniper Research projecting there will be 8.4 billion devices in use by 2024.

The pandemic has given voice assistant technology another level of importance and has opened new avenues for its use. For example, Mayo Clinic used Amazon Alexa to assess symptoms and access information on COVID-19. Amazon has imparted the ability to answer tens of thousands of questions related to the virus. Alexa’s Mayo Clinic First-Aid skill offers self-guidance.

As the technology that powers intelligent personal assistants continues to be refined, there are new applications for it created daily. Here are three innovative uses of voice commands via smart home devices that help automate everyday tasks.

1. Voice shopping

With the uptick in popularity of shopping from home, voice shopping using a smart speaker has proven to be a huge convenience. Amazon built a voice shopping experience that makes reordering and buying new products via Alexa easier than ever. Using a simple command like, “Alexa, order paper towels”, gives shoppers the ability to either reorder items from their order history or have Alexa find new items to buy. The final price is always provided before order confirmation. And if the user doesn’t have an Alexa home device, they can access voice shopping via the Amazon mobile app.

Google offers a similar experience through Google Express in which Google Assistant responds to voice commands via Google Home devices. There is free shipping for orders above the store minimum, and Walmart and Target both offer products via the service, meaning there is a large assortment of products to choose from. As with Alexa, a Google Home device is activated using a voice command like, “OK Google, order paper towels”, and different options are given along with their total prices including tax. Once a product is confirmed by the user, the order is placed. Voice Match enables users to secure Google Assistance purchases. Using your voice has the potential to be more seamless than responding to a fingerprint or face unlock prompt.

2. Voice donations

Amazon has enabled Alexa to users make charitable donations using voice commands via Amazon Pay. Users can either direct a donation to a specific charity that’s on the platform or say, “Alexa, make a donation,” and Alexa can suggest a charity. Almost 400 nonprofit organizations have registered to accept donations via Alexa, (the list of charities is available here) and it continues to grow, making supporting charitable organizations easier than ever.

3. Voice bill payments

While voice commands can facilitate common tasks around your home, they can also facilitate the transactions that keep your home running (think mortgage, utilities, insurance, and auto finance payments). Intelligent personal assistants like Amazon Alexa and Google Assistant can also facilitate bill payment tasks like inquiring about account balances, checking due dates, and making voice-activated payments. By automating these important transactions, intelligent personal assistants can help users keep their finances on track and facilitate on-time bill payments.

The Bottom Line: Voice technology is facilitating everyday tasks like never before. One day medical robots may be able to take over for nurses and doctors with some tasks initiated via voice interaction. For now, in addition to checking the weather, playing music, and setting reminders, it can also automate transactions that keep households running smoothly – like making on-time bill payments.

Updated from a blog originally published May 28, 2020

Read about how the IoT affects payments in the blog, Payments and the Internet of Things (IoT).

Alacriti created Ella, an AI-powered chatbot that facilitates seamless, personalized, and context-aware interactions between you and your customers through messaging apps, intelligent personal assistants, and directly on your website. To find out how Ella can transform how you engage with your customers, contact us at (908) 791-2916 or info@alacriti.com.

Credit unions have come a long way in terms of the scope of their reach and the sophistication of their product portfolios, specifically in lending. In addition to direct lending, credit unions may also offer indirect loans through businesses in their community, such as auto dealerships where consumers can receive financing at the point of sale. Many credit unions are also opting to grow their commercial loan business, which has been an area ripe for opportunity within recent years.

Servicing these loans means that credit unions need to present bills and collect payments from their members. Credit unions may have an advantage in offering members the intimacy of a limited number of branch locations where employees know their members’ names and can assist with account inquiries and payments. On the flip side, their for-profit counterparts often have a greater amount of digitization more and more consumers are looking for. Modern digital banking solutions that streamline loan-related billing and payments is not a convenience that credit union members want to go without.

So, what should credit unions be looking for in their electronic bill presentment and payment (EBPP) solution? Here are seven questions credit unions should ask.

1. How can I let my members know that a bill is ready for payment?

Make sure your EBPP solution has options for letting your members know that a bill is ready to pay. Bill-ready alerts and notifications may include paper bills, email, and SMS-based text messages. Give your members the option to combine these notifications in a manner that makes them most likely to pay their bills on time.

2. Can I offer my members different billing options for recurring charges like monthly loan payments?

Your members might be looking for more than a one-time bill payment option. Offering AutoPay can help them manage their finances and ensure that they never miss a payment. It can also help your credit union maintain a steady, predictable stream of payments.

In addition, recurring payments give members the flexibility to align payments with their personal financial situations. For example, they can make payments bi-monthly to coincide with paydays or set payment limits for additional financial protection. Recurring payments don’t need to be “one size fits all”—they can be customized to meet each member’s unique needs.

3. What options can I provide my members for payment methods? Can our credit union accept payments from other bank accounts?

An EBPP solution should easily support and accept an array of payment methods, including debit cards, credit cards, and ACH payments made from both in-house accounts and external accounts. Another increasingly popular method is pay-by-text. Members do not have to sign in to send your credit union a payment. This added convenience can accelerate cash flow and, of course, adds to the member experience. Another feature to ask about is integration with artificial intelligence (AI). For instance, members should be able to ask Amazon’s Alexa to make a payment for them.

4. Some of our members like to pay in-person, some like to call us, and others are looking to do everything from their mobile devices. How do we support payments across all these different channels?

Your EBPP solution should account for a wide variety of payment channels, from IVR and walk-ins to mobile payments. The technology can streamline acceptance across all these channels and record the data in a single solution for a top-down view into your entire payments program.

In addition, it should be able to consolidate all receivables across your credit union—not just a specific portfolio. For example, each retail lending division within the credit union could have a separate payment strategy within the same EBPP solution to drive efficiency and create transparency across the entire organization.

5. Servicing our members is our top priority. What should we be looking for in an EBPP solution so our member experience is top-notch?

By having all your payments recorded in one solution, you can improve operational efficiency for your member-facing teams. They should be able to easily pull billing and payments reports from your EBPP solution to answer questions and resolve issues on behalf of your members.

6. We have so many considerations to think about when it comes to the security of our financial data and the regulations that our credit union is subject to. Do we need to worry about compliance for our payments too?

PCI DSS compliance is a must when you’re accepting electronic payments. Your EBPP solution provider should be able to handle PCI DSS compliance on your behalf by ensuring that you’re never directly exposed to sensitive payment data. This will keep your credit union out of scope for PCI DSS compliance, meaning your EBPP solution provider worries about it—not you.

7. What aren’t we thinking about when it comes to billing and payments?

Payments are continuously evolving. Credit unions should be focused on serving the needs of their members, not trying to keep up with the latest payment trends. Choose an EBPP provider that will do this on your behalf and implement their technology seamlessly, so you can offer the best, most contemporary experience to your members.

The Bottom Line: Credit union members are looking for the same modern billing and payment solutions that larger, for-profit banks offer. Partnering with the right EBPP solution provider can accelerate cash flow while providing members with better choices and more streamlined experiences.

Updated from a blog originally published July 20, 2020

What should credit unions look for in a payments fintech partner overall? Find out in Checklist: What Credit Unions Should Look for in a Payments Fintech Partner. How Alacriti Scores.

*Originally published on CUInsight.com

“Payment services hub” can mean different things depending on who you are talking to and what time period you’re looking at in payments industry history. The term first appeared in the analyst community to describe the consolidation of systems supporting Fedwire and ACH processing, helping large financial institutions bring together their commercial payment operations. This complex consolidation was feasible because both systems operated in similar windows (the time in which the network can accept and process a payment), allowing banks to align cut-off times and run their large overnight batch processing operations, reconcile their internal core systems—and be ready to do it all over again when the window opened the next business day.

Today, “payment services hub” represents an even broader concept, combining not just heritage payment types like ACH and wires, but also supporting the new real-time payment rails including TCH’s RTP® network, the reverse debit networks Visa Direct and MasterCard Send, as well as forthcoming networks like FedNow. A payment services hub is a single centralized platform to connect the financial institution to multiple rails and centralize payment management and operations. These new platforms, like everything else in this new era of payments, are cloud-based, enabling them to rapidly scale as unknown volumes turn into tomorrow’s revenue streams.

The new real-time and faster payment networks are all built on the modern ISO 20022 standard, making the transition from the traditional payment services “hub” space to the modern platform discussion even more imperative. The new payment ecosystem also means financial institutions have more choice when it comes to participating in new rails or networks. Choice doesn’t necessarily mean one rail is better than the other or that the FI won’t be able to support a specific use case if the FI chooses one option over another; however, it is critical that choosing to offer one rail over another doesn’t lead to a dead end if a year, three years, or ten years down the road there’s a need need to pivot. Having flexible rail options creates opportunities, including smart routing capabilities, that can’t be ignored. The result—smarter, faster payments.

New options present a challenge for financial institutions—how to offer various payment products without confusing the end-user? An end-to-end payments platform simplifies both the front end and the back end, which creates cost savings and opens up revenue opportunities. For instance, a bank may have to pay more to make an immediate payment but can charge their customer for the expedited payment. Smart routing can also imply ‘least-cost routing’ made popular with debit transactions. However, smart routing goes beyond choosing the cheapest rail to ride, balancing time, dollar value, and consumer and FI preferences.

Modern payment services hubs, or as we refer to them “flexible payments platforms”, are important for the future success of financial institutions. They deliver future proofing so functions and features, as well as new rail connectivity for processing, can be added without full rip and replacement of point solutions. As a result, financial institutions can reduce transaction costs, and more importantly be set up to stay ahead in innovation.

Alacriti’s centralized payment platform, Cosmos, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments, and control their evolution with ACH, Wire, TCH RTP, and FedNow, all on one, cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.

The Clearing House (TCH) launched the RTP® network in 2017—the first new payment rail in the U.S. in over forty years. Fraud is always a top-of-mind business concern with payments. However, the new payment rails themselves, such as RTP, are the most secure the country has seen. This will also be true for the upcoming real-time payments network from the Federal Reserve, the FedNowSM Service when it goes live in 2023. Since real-time payments are based on a credit push model, funds just can’t be pulled out of an account from an external party. The sender has to initiate the payment directly from their account, a design element of the networks meant to thwart various fraud schemes that benefit from a debit model. There are a ton of fraud prevention tools available and practices that are already in place. However, consumer education remains the most important prevention tool available. Here’s what financial institutions should educate their account holders on to fight fraud.

Funds are irrevocable

With many legacy payment types, a consumer can recall a payment made in error before it’s cleared and settled, and in some cases up to 70 days after it has. Real-time payments happen in, well, real-time. So the payer cannot cancel the transaction and the funds are available for the payee to use or withdraw immediately. As with other payment types, but even more imperative in this case, consumers should therefore only initiate real-time payments to trusted recipients and triple-check that they have the correct information.

Financial institutions don’t ask for login information out of the blue

It can’t be emphasized enough. Consumers need to know that their financial institution will never ask for online banking credentials through an outside channel, whether it be by phone, email, or text. Both consumers and businesses should know the signs of fraud, such as spelling errors, suspicious sender email addresses, and ‘urgent’ requests. Keep yourself aware of account activity at all times by taking advantage of account alerts. And, of course, login information should be secure and hard to guess.

Business Email Compromise (BEC)

CEO fraud and authentication fraud are top threats to real-time payments. Layered fraud approaches including matrix-based approvals, biometric-based credentials, and the use of tokens for releasing payments can help, and so can employee vigilance. Employees should automatically verify the source of a request for payment from suppliers and billers. Using templates for payments or approval matrix will keep fraud to a minimum.

Read Best Practices to Prevent Payment Fraud for more on fraud.

Alacriti’s Cosmos for RTP® enables financial institutions and organizations to quickly and seamlessly connect to The Clearing House’s RTP® network without the burden of significant infrastructure overhauls or capital investments. To speak with an Alacriti real-time payments expert about RfP, please contact us at (908) 791-2916 or info@alacriti.com.

Request for Pay (RfP) is a functionality offered by TCH’s RTP® Network that allows a company or individual to send a “request” to be paid for a good/service. The receiver needs only to click a button to accept, and the payment is sent in real-time at that moment or at a scheduled date. Bill payers don’t have to worry about keeping track of various bill pay systems, and billers accelerate their receivables and benefit from a good funds model, meaning no failed payments due to NSF or incorrect account information. RfP is said to have the potential to revolutionize bill pay as we know it. There are some exciting RfP test cases already in market today, here are a few of the ones that we’re watching right now:

BNY Mellon

In May 2021, BNY Mellon was the first bank to offer RfP to corporate clients (white-labeled as Real-Time E-Bills and Payments). They were also the originator of the first ever TCH RTP transaction in 2017. According to BNY Mellon, key advantages of RfP for billers include higher straight-through processing levels, faster collections, simplified reconciliation, increased transparency, and lower costs. For the bill payers, they benefit from better convenience, transparency, and control of their cash flow. It’s expected that this solution will be particularly appealing to businesses where there is very high volume, and a need to quickly collect payments e.g., utilities, credit card companies, cable, internet, and cell-phone providers.

In September, wireless carrier Verizon collaborated with BNY Mellon and Citigroup to expedite delivery and processing for their bills. In this partnership, BNY Mellon is the billing bank, Verizon is the biller, and Citi is the consumer’s bank. They are emphasizing to customers that this service is a way to avoid overdrafts. This is a convenient alternative for customers who have weekly budgets or irregular income streams, making automatic bill payments unfeasible.

Chase Bank

In August 2021, Chase Bank announced that they are launching a B2B payment option using RfP, which will enable immediate wholesale payments between companies and certain consumer to business transactions (e.g., buying a car). For the buying a car example, consumers who aren’t taking out a loan can make a real-time digital payment instead of cash, cashier’s check or wire transfer. For corporates, this will be helpful because with better transparency, corporates will know when they were paid in real-time so they can ship a product or provide a service. For example, a gas distribution company can get paid on the spot after replenishing gas tanks instead of waiting for ten days because of the paper invoicing involved. In particular, smaller firms that are burdened by paper billing, ACH and wire fees will benefit. Approximately 42% of B2B payments are still done using paper checks. The full scale launch will include other The Clearing House RTP Network participant banks, and eventually B2C and B2B use cases.

U.S. Bank

To provide new efficiencies, U.S. Bank allows billers to use RfP through portal, batch, and API-drive origination experiences. A payment related message is sent by the biller to customers through their bank, and the biller’s customer approves the payment. The biller then receives a status notification: payment, scheduled payment, or rejection. Richard Erario, executive vice president and head of global treasury management for U.S. Bank said, “Right now, we’re among a handful of financial institutions that have enabled RfP for billers, but we expect that number to grow considerably in 2022. Adoption by more financial institutions is critical to RfP’s success.”

Learn more about RfP in Request for Pay (RfP)–Exploring the New Frontier of Bill Payments.

Alacriti’s Cosmos for RTP® enables financial institutions and organizations to quickly and seamlessly connect to The Clearing House’s RTP® network without the burden of significant infrastructure overhauls or capital investments. To speak with an Alacriti real-time payments expert about RfP, please contact us at (908) 791-2916 or info@alacriti.com.

*Originally published on CUInsight.com

Financial institutions are continually tasked by their boards with optimizing the performance of their loan portfolio. Today’s low-interest rate environment is continuing to drive both interest and volume at many financial institution loan portfolios, making improving loan portfolio optimization more important than ever.

According to Celent, here are three ways to improve your loan portfolio performance with consumer experience top-of-mind:

Recent research from Celent showed that U.S. banks and credit unions reported a 41% ¹ increase in real-time payments during the pandemic. With consumers from 2,000 financial institutions in the U.S. already using Zelle, it’s clear that demand for real-time payments is already here. Offering real-time payment products could particularly be the key for your customers or members who seem like consumer account holders on paper, but are actually small business owner members. By offering real-time payment options, such as real-time disbursements, or Any2Any account transfers, you are giving them more control over their money movement needs any time of day, which brings us to the next point.

Traditionally, late payers were penalized with large fees for missing their payment due dates, sometimes through simple faults in the clearing and settlement offerings in the bill payment ecosystem (we are looking at you ACH). Consumers now have an alternative for expedited payments, giving them the full procrastination window of the due date, not just the 2-3 days in advance an ACH payment requires, or a full week for a check to be cut and sent. Coupled with an ability to diarize (request on a future date) payments, account holders should never be caught by surprise by having to pay a late payment fee again. For financial institutions, real-time has many advantages—better margins, better insights, and of course, receipt of funds faster (and in the case of TCH’s RTP irrevocable). Also, flexible channels and payment options such as pay by text or pay by AI assistant make it easier, and therefore more likely for your payees to pay their loans on time.

Request For Payment (RfP), a message capability that has entered the market with push-based real-time payments (e.g. Zelle, RTP, and soon to be FedNow), adds additional functionality to real-time payments beyond the payment itself. Real-time isn’t just about speed, it’s also a data-rich messaging system that supports “chatter-based” payments. Using RfP to open up a conversation with your customer or member, whose payment account resides at another institution, allows them to have better control over their finances by either choosing when they want to pay or and directly from the source of the payment itself. That flexibility could greatly improve collection rates while offering a higher level of security in the payment workflow as the payment messages are not going over a channel like SMS or email. Instead, they go directly through the payment channel to another financial institution, to be viewed by the account holder in a secure location. In addition, because RfPs are tied directly to the transaction itself, it saves financial institutions on reconciling invoices and lowering the number of checks and processing costs associated with manual processing.

¹ Celent “State of the Payments Nation Survey”, May 2022

Today’s legacy and siloed banking technology infrastructure limit financial institutions’ ability to rapidly innovate. It’s time to look at money movement in a new way. Alacriti’s Orbipay Unified Money Movement Services does just that. Whether it’s real-time payments, digital disbursements, or bill pay, our cloud-based platform enables banks and credit unions to quickly and seamlessly deliver modern digital payments and money movement experiences. To speak to an Alacriti payments expert, please call us at (908) 791-2916 or email info@alacriti.com.

*Originally submitted by Mercator Advisory Group

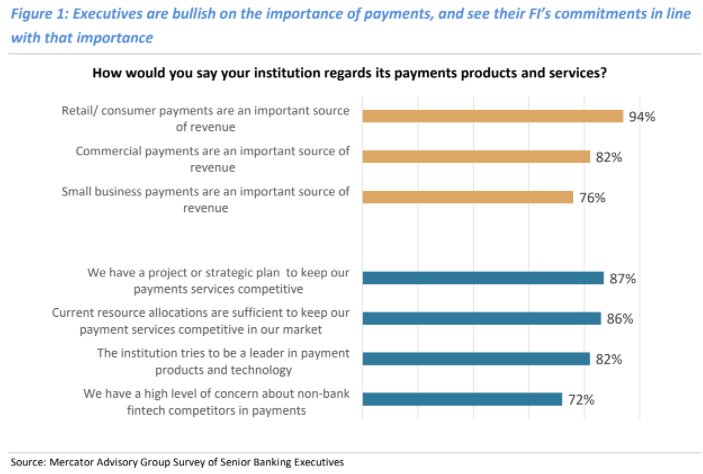

Payment products are the connective tissue of financial institutions, serving as a major source of core revenue. But what are the business and technology priorities and market dynamics that drive this array of payment services? To answer that question and more, Alacriti sponsored a Mercator Advisory Report titled Payments Infrastructure Outlook: Real-Time Payments Take the Lead.

For the report, Mercator Advisory Group surveyed 100 senior-level bankers using an online executive questionnaire designed in collaboration with Alacriti; 19% of respondents represented community banks or credit unions. The report provided insight into the opinions toward payments modernization held by senior leadership at banks and credit unions.

Some of the key points are highlighted below.

FIs recognize payments as a valuable revenue stream

Most executives surveyed for the report agree that consumer, small business, and commercial payments are important revenue streams for their businesses. Most also agree that their FI is working to be a leader in payments products and technology. A breakdown of the data around how executives view their institution’s payments products and services can be seen in the chart below:

The pandemic environment for the past year has been particularly favorable to payments modernization, with 79% of surveyed executives indicating that payments technology modernization efforts have been boosted by the pandemic. Additionally, the advent of real-time and faster payments is similarly turning up the urgency of infrastructure modernization.

This urgency corresponds with rising consumer expectations for new services, which will translate into new revenue streams for financial institutions. For example, most executives (87%) agree that real-time payments will drive new revenue streams and that they are already receiving client requests for this service.

But how are these modernization efforts being accomplished?

The role of the cloud in IT strategy modernization

As financial institutions update payments processes, rapidly evolving business products and business lines add complexity to IT infrastructure. Even as executives are acknowledging the importance of payments modernization, payment operation simplification is a dominant approach at 66% of financial institutions.

Cloud-based infrastructure is the overwhelming preference for achieving this simplification due to advantages including a superior end-user experience, quicker speed to market, pay-as-we-go, and implement-as-we-go possibilities. Overall, 90% of executives agreed or strongly agreed that cloud-based infrastructure is their current preference for payments IT infrastructure; 91% agreed that cloud-based infrastructure is their current preference for overall IT infrastructure.

Even so, previous sunk costs in proprietary and licensed IT can reduce interest in cloud implementation. Ultimately, cloud implementation will mainly lie in the hands of outsourcing partners.

Meeting the real-time need for real-time payments

Moving forward, real-time payments will be fundamental in payments technology modernization efforts. When asked about the future of real-time payments at their institution, the top two major use cases for real-time payments listed by executives are immediate payroll payment or gig economy payments (73%) and account-to-account transfers (71%).

As for how they anticipate real-time payments solutions to integrate at their institutions, executives overwhelmingly anticipate doing so through core providers and other third-party providers, building upon the key role of outsourcers in payments modernization. Ultimately, real-time payments are on the horizon and are a compelling reason for financial institutions to modernize their infrastructure now.

The takeaway

The Mercator Advisory Group report sponsored by Alacriti digs significantly deeper into the trends and strategic implications regarding payments modernization, including:

Interested in learning more? Click here and fill out the form to access the Mercator Advisory Group research brief sponsored by Alacriti, Payments Infrastructure Outlook: Real-Time Payments Take the Lead.

*Originally published on CUInsight.com

It’s hard for paranoia not to set in when you see organizations as important as Colonial Pipeline, the U.S.’s largest refined products pipeline, held for ransom for $4.4m from cyber attackers. The CEO, Joseph Blount, made the difficult decision to pay the ransom because they didn’t know the extent of the intrusion by hackers and how long it would take to restore operations. An FBI-led operation led to the recovery of $2.3m in Bitcoins paid to the hackers, but the situation highlighted extreme vulnerabilities.

No industry is immune. Since March 2020, identity thieves have taken nearly $1b in unemployment payments from The Texas Workforce Commission.

Consumers are also anxious about fraud. Sixty-five percent of 2,000 consumers surveyed stated that they are more concerned about fraud than before COVID-19 hit, and a quarter admitted to being victims of fraud within the last 12 months (a 25% increase over the prior year).

To add to an already challenging environment, attacks are becoming more sophisticated and are harder for common security tools to detect. For instance, mimicking human behavior to thwart traditional bot detection tools by running scripts that show common browser and application behavior. Techniques include spoof locations and slowing down attacks so they better resemble human interaction. In the first half of 2020, 96% of FI attacks were considered “sophisticated”.

As payments get faster and more rails become available, fraud is a reasonable concern. It can be expected for bad actors to try to take advantage of new systems, so fraud prevention efforts will always be essential. According to Gareth Lodge from Celent, here are some best practices to avoid fraud:

Speed is of the essence

The TCH rules place obligations on the sending bank to be sure that what is being sent is legitimate and that the receiving party is as well. In short, the receiving bank should be able to trust that the funds are good. Given the almost zero downtime that is allowed, that means FI fraud systems need to operate in a 24/7 single message way as well, and at speed—the total end-to-end time is from time of sending of the transaction to receiving, giving the bank very little time to do those checks.

Good practice makes a difference

Lessons from other countries around the world show that when setting up a new payee, banks should validate with the account holder that it is them. Some countries have suffered “man-in-the-browser” attacks that meant a fraudster could access the account details, set themselves as the recipient, and clear the account. By validating account details via text message, it helps ensure that it really was the account holder setting it up!

It’s a new rail

It’s not a card or a wire or an ACH, so don’t be tempted to use models developed for those rails! Instead, focus on building those patterns from scratch—artificial intelligence and machine learning are great tools for doing this. With low volumes at first, it also ensures that every data point adds to the model—again, too often, we have seen banks update their fraud models monthly or even quarterly! Bad actors could easily have emptied accounts in minutes before anyone has ever noticed using that approach!

It’s new

Customer awareness and education are key. Getting them to understand what is normal and what isn’t makes a difference. It also drives uptake. If it goes wrong (in their eyes!) the first few times, then they won’t adopt it. If you position and productize it correctly though….

Payment system outages are another huge interruption, read Preparing for Payment System Outages.

Today’s legacy and siloed banking technology infrastructure limit financial institutions’ ability to rapidly innovate. It’s time to look at money movement in a new way. Alacriti’s Orbipay Unified Money Movement Services does just that. Whether it’s real-time payments, digital disbursements, or bill pay, our cloud-based platform enables banks and credit unions to quickly and seamlessly deliver modern digital payments and money movement experiences. To speak to an Alacriti payments expert, please call us at (908) 791-2916 or email info@alacriti.com.

Of late, payment system outages have been making the news. For instance, customers at businesses across the U.S. such as McDonald’s, Ikea, and Popeyes were unable to pay using their credit cards in February 2021. Their payments processor had a service interruption due to an internet service provider outage. Multiple businesses were forced to only accept cash, and Chick-fil-A ended up giving out meals for free. Problems began at 11:00 am ET and were resolved by 8:00 pm ET.

Also in February 2021, the Federal Reserve Interbank Payment system was unavailable for a few hours. The incident was attributed to an operational error in the automated data center maintenance process. The error caused a four hour shut down of all the Fed’s financial services, meaning the electronic systems used by banks, government agencies, and businesses could not move money.

In March 2021, Wells Fargo experienced an outage on the same day stimulus checks were to be deposited. This was attributed partly to high volumes of users attempting to check their accounts. Users tried to log in to check their balance and couldn’t access their accounts. Customers began complaining that their stimulus money wasn’t immediately available.

Payment system outages are inevitable. Technology is not infallible, and we have to be prepared to minimize the number of incidents and the degree of impact that a service interruption can cause. Payment systems have their own unique challenges.

For one thing, banks and credit unions continue to use legacy payment systems, which can be 20 to 30 years old, or in some cases, even older. These systems are not ideal for a 24x7x365 operating model, which is increasingly necessary as real-time payments soar in popularity, and consumer expectations include 24/7 instant gratification. Existing legacy payment processing systems are simply not built to run continuously, as they were designed for batch-based processes. More payments outside of normal operating hours present mean more pressure to change your system.

For another, the record growth in electronic payments is an additional strain. The pandemic accelerated the growth, with the ACH network seeing 26.8 billion payments in 2020, which is an increase of 8.2% over 2019. The value of those payments, $61.9 trillion, was up by 10.8%. Several core ACH payment categories grew by more than 10%—direct deposit, digital consumer payments, P2P, and B2B.

So what can be done? One of the things that we can do as an industry is put ourselves in a better position should something go wrong. Payments modernization is necessary to help avert preventable outages and impact. Modernizing payment systems means a number of different changes:

More on payments modernization in the webinar: Payments Modernization Game Plan: Moving Forward with Existing Infrastructure.

Today’s legacy and siloed banking technology infrastructure limit financial institutions’ ability to rapidly innovate. It’s time to look at money movement in a new way. Alacriti’s Orbipay Unified Money Movement Services does just that. Whether it’s real-time payments, digital disbursements, or bill pay, our cloud-based platform enables banks and credit unions to quickly and seamlessly deliver modern digital payments and money movement experiences. To speak to an Alacriti payments expert, please call us at (908) 791-2916 or email info@alacriti.com.

Schedule A Personalized Demo

Schedule a Free Consultation