Sometimes the most basic concepts are the hardest to articulate. Oftentimes at industry events and webinars, we hear a lot of the same buzzwords, whether it’s digital transformation, blockchain, or AI to name a few. But what’s often missing is the speaker’s point of view on what those buzzwords mean to them, or how they define them. There are so many sides to these trends, that putting your talk track into context is important for the listener. So today, I will dig a little bit deeper into customer-centricity, and what we mean when we talk about it from a bill presentment and payment standpoint.

We’ve talked about the connected consumer and their changing expectations in past posts (Ex. 1, Ex. 2 and Ex. 3). I think the most basic piece to understand about consumer expectations today is that the connected consumer already has experience with the Internet of Things (even if they don’t realize they have). With the ubiquity of connected apps in homes like those on smart TVs, and with voice-based applications like Apple’s Siri, Google’s Assistant, or Amazon’s Alexa, this trend is no longer isolated to tech-forward consumers, but a full mass adoption trend. The connected consumer is expecting a personalized experience that is anywhere they are, when they want it, and perfect for the time, place, and device they are using.

When we talk about customer-centricity this is really what we are talking about. Not just enhancing the existing experiences you have available today, but also:

- Thinking beyond the screen that we’ve been building on for the past 20+ years.

- Leveraging newly emerging technologies like AI that can adapt to make each user’s experience unique.

- Building out a chatbot strategy to help meet your clients over voice-based apps anywhere from their cars to their couches

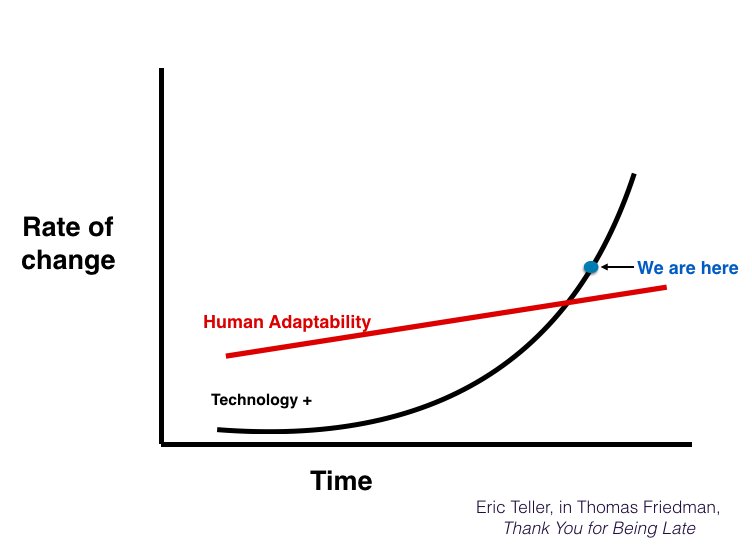

As we’ve said before, don’t be hesitant to embrace new technologies. As new technologies become available, the best thing to do is roll up your sleeves and jump in. Your client-centric digital transformation strategy will depend on it to keep pace with your clients’ always evolving and changing expectations.