Real-time payments (RTP) have experienced exceptional growth in recent years. The RTP market size was valued at 17.57 billion in 2022 and is expected to grow at a

compound annual growth rate (CAGR) of 35.5% from 2023 to 2030. As businesses and consumers increasingly adopt this digital payment method, it is crucial to

understand the return on investment (ROI) associated with real-time payments. While quantifying the monetary ROI of RTP can be challenging, industry experts

emphasize the value of competitive advantage, innovation, and meeting customer demands. This article explores the ROI of real-time payments and unveils the growth

potential it offers.

Cost Comparison: Real-Time Payments vs. Traditional Methods

Contrary to popular belief, real-time payments do not cost more for businesses

and consumers when compared to non-instant electronic payments. A 2019 report indicates that the average cost of real-time payments amounts to approximately

$1.95 for 10 transactions per capita. In comparison, traditional check-based

transactions incur a cost of around $2.79 for the same number of transactions. This

data demonstrates the cost-effectiveness of real-time payments, positioning them as

a favorable option for businesses and consumers alike.

Decrease in Net Payment System Costs

Implementing real-time payments can lead to a decrease in net payment system

costs over five-years. By replacing outdated payment methods with instant

electronic payments, businesses can streamline their payment processes, reduce

manual intervention, and eliminate the inefficiencies that stem from waiting periods.

Consequently, this not only reduces costs (for example, staff time to check on

whether a payment has been posted, the cost of waiting for supply until funds have

transferred, etc.) but also frees up valuable resources that can be allocated to more

strategic initiatives.

According to Deloitte’s “Economic Impact of Instant Payments” report, real-time

payments have the potential to deliver significant cost savings in net payment

system costs. The report emphasizes that the adoption of RTP can lead to substantial

reductions in costs by further displacing expensive check usage, particularly in

high-income countries. However, it also notes that in developing nations with low

check usage but significant cash transactions, there may initially be a net increase

in payment system costs. The analysis highlights the influence of factors such as

the cost of payment instruments, population size, and economies of scale on the

cost savings achieved through RTP. As countries transition away from cash and RTP

increasingly replaces cash transactions, the report suggests that the savings in net

payment system costs related to cash will rise progressively over time.

Driving Revenue Growth Through Real-Time

Payments

Real-time payments present businesses with opportunities to generate new revenue

streams and enhance existing ones. Here are a few ways in which RTP contributes to

revenue growth:

- Automated End-to-End Solutions: Real-time payments enable businesses

to offer automated, end-to-end solutions triggered by different touchpoints.

For example, loans can be delivered in seconds, offering a faster and more

cost-effective alternative to traditional lending methods. This not only attracts

customers, but also opens up revenue streams associated with smallervalue loans.

Example: Financial institutions can use geolocation to send a text message

to customers at dealerships saying, “Are you car shopping? Click here for an

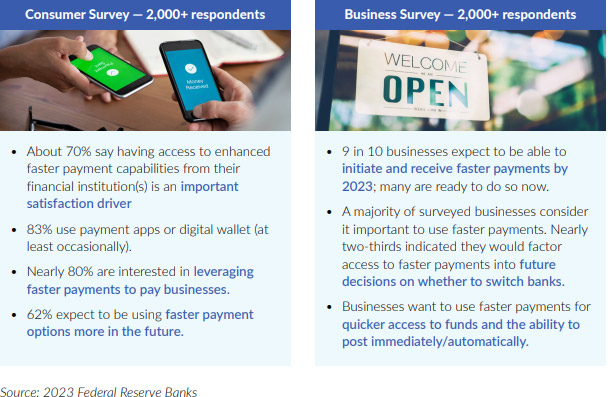

instant quote.” - Improved Client Experience: Real-time payments enhance the overall client

experience, leading to higher customer retention rates. In a recent Federal

Reserve Consumer Survey, 70% of respondents stated that having access to

enhanced faster payment capabilities is an important satisfaction driver.The

ability to provide instant, seamless transactions builds trust and satisfaction

among customers, increasing the likelihood of repeat business and referrals.

Example: The competitive advantage is often for financial institutions that can

decision and deliver funds quickly. Financial institutions can charge for turn-key

loan applications and execution. - Real-Time Data and Cash Forecasting: Real-time payments provide businesses

with access to real-time data, allowing for better cash forecasting and financial

decision-making. This valuable information enables businesses to identify

opportunities, optimize cash flow, and make strategic investments, leading to

improved revenue streams.

The subset of use cases for B2B payments is massive as they are traditionally

fee-based. Financial institutions can set a price point per transaction or bundle

transactions into a tiered service model. - Enhanced Process Efficiency: The automation of processes facilitated by realtime payments results in better end-to-end margins. By streamlining operations

and reducing manual intervention, businesses can increase efficiency, reduce

costs, and improve overall revenue.

Example: For high-value payments, Request for Payment (RfP) enables billers to

send a one-off bill or invoice that can help accelerate their accounts receivable

cycle. The message is delivered securely through the RTP network. The convenience

fees for this are another potential revenue stream.

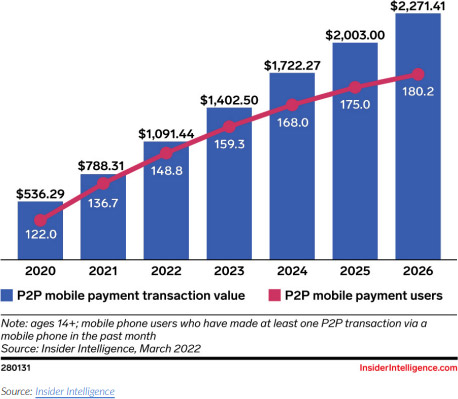

Real-Time P2P Payments Are Expected to Grow

It’s quite evident that there is a demand for faster payments. There are Zelle users

coming from virtually every financial institution in the U.S., even if the institution

does not offer it. In 2022, transactions through the Zelle network grew 26% yearover-year, totaling 629 billion, and the total transaction value increased by 28% yearover-year. In addition, P2P payments overall have been growing and are projected

to grow even more in the coming years, making real-time an even more important

feature to offer.

US Mobile Peer-to-Peer (P2P) Payment Transaction Value and Users

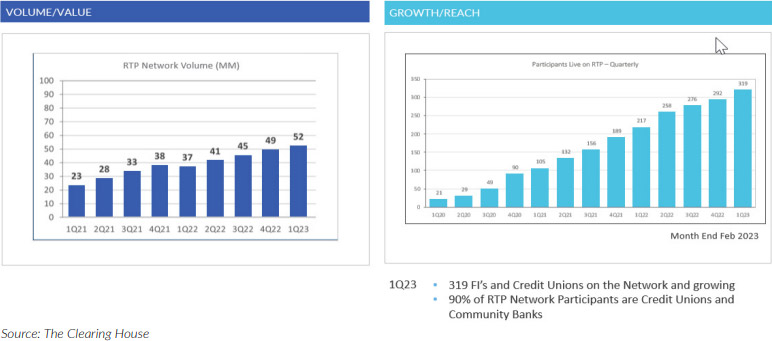

In addition, The Clearing House (TCH) has metrics that demonstrate that instant

payments are growing significantly.

RTP® network Continues To Grow in Volume and Reach

The Federal Reserve has also presented survey information that indicates demand for

real-time payments, making a clear case for the importance of real-time payments for

accountholder retention.

In Conclusion

While quantifying the exact monetary ROI of real-time payments may be challenging,

the growth potential and benefits they offer cannot be ignored. Real-time payments

provide cost-effective alternatives to traditional payment methods, and they also

drive competitive advantage, foster innovation, and meet evolving customer demands.

Businesses that embrace real-time payments can unlock new revenue streams,

improve client experience, and streamline their operations, leading to enhanced

profitability and long-term growth. As the adoption of real-time payments continues

to surge, organizations must recognize the importance of this transformative

payment method and capitalize on the multitude of benefits it brings.

Alacriti’s centralized payments hub provides innovation opportunities and the ability for

customers to make smart routing decisions at the financial institution to meet their individual

needs. Financial institutions can unify payment processing all in one cloud-based platform—

ACH, the Fedwire Funds Service, TCH RTP® network, Visa Direct, and soon, the FedNowSM

Service. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com