One Unified Platform for Every Money Movement

Streamline operations and drive efficiency with a unified solution for all money movement. Our future-proof solution consolidates loan payments, payouts, and transfers into one intuitive API-enabled layer, allowing you to serve both consumers and businesses while reducing operating costs and call center volume.

Challenges

The High Cost of Disconnected Systems

Today’s consumers and businesses expect money movement to be instant and intuitive. However, complex legacy infrastructures make it extremely challenging and costly for financial institutions to evolve. Common pain points include:

Rigid legacy systems that hinder scalability and compliance

Manual workflows that increase operating costs and call center volume

Disjointed user experiences that impact customer satisfaction and retention

Payment silos that obscure visibility into cash flow, liquidity, and performance

Solution

Unify Experiences, Accelerate Growth

Orbipay Unified Money Movement provides a suite of cloud-native applications that integrate seamlessly with your existing digital banking platforms and core systems. Our solution delivers instant, frictionless journeys for consumers, SMBs, and commercial clients while ensuring a single source of truth for your operations team.

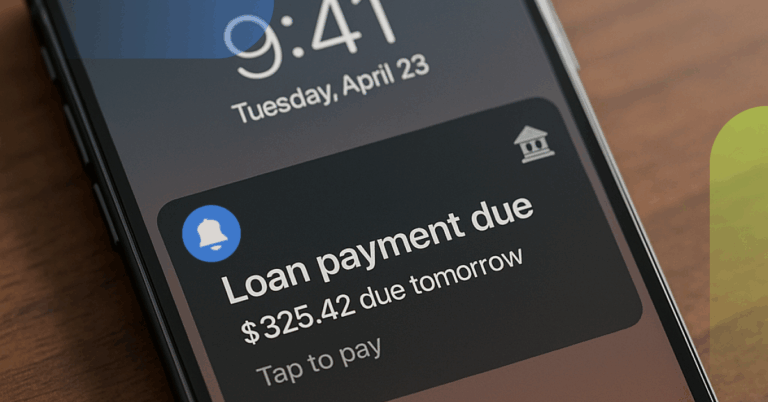

Loan Payments

Orbipay Loan Payments enables banks and credit unions to meet borrowers wherever they are—on the web, mobile, or phone—turning a standard transaction into a frictionless, self-service experience. By offering tools that fit into their daily digital lives, you empower them to stay on track.

On One Configurable Platform for Your Brand:

- Lower Servicing Costs

- Accelerate Cash Flow

- Improve Operational Efficiency

Electronic Bill Presentment & Payment (EBPP)

Deliver e-bills seamlessly and accept bill or loan payments from users with easy access to the payment channels, payment methods, and payment options they demand.

- Accelerate receivables

- Reduce operating costs

- Improve customer satisfaction and retention

Payment Channels

- Mobile

- Web

- IVR

- Agent

- Walk-In

- FB Messenger

Payment Methods

- ACH

- Credit (where

permitted) - Debit

- Cash

- Check

- Apple Pay/Google

Payment Options

- One-Time

- Recurring

- AutoPay

Orbipay EBPP is a fully configurable, bespoke billing and payment solution that’s tailored to your business and needs. More options, better payment experiences.

P2P With Zelle®

By deploying Zelle® through Alacriti’s solution you can launch Zelle® quickly with a pre-certified UI and API, built-in real-time fraud checks, and full integration with your core and digital banking platforms.

Unified directory services, and automated compliance reporting keep the experience seamless, secure, and entirely within your brand.

- Payments by email, U.S. mobile number, or Zelle® tag with no extra apps

- Core and digital banking integration with ACH settlement

- Seamless fraud and compliance protection built in with Alacriti

Supports:

- Digital Engagement

- Customer Loyalty

- Competitive Positioning

- Increased Revenue Potential

- Fast Deployment Without Core Change

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes.

Transfers A2A

Enable consumers and businesses to move money instantly and securely between their bank accounts, regardless of what financial institution holds them.

Generate revenue through transaction fees

Enhance operational efficiency by reducing manual processes

Create convenient and seamless customer experiences that drive retention and satisfaction

Access to Faster Payment Rails:

- TCH’s RTP® network

- FedNow Service

- Visa Direct

Payouts

Initiate digital disbursements to payees directly, delivering a secure, streamlined payout process that puts the customer first.

Payment Scenarios

Straight-Through, One-Off, and Recurring Disbursements

Payee Portal

Payees can enroll, provide bank account information, and access payout history

Payer Portal

Customer-facing staff can access payees’ profiles, payout history, and upcoming payouts

Reporting

Quickly access reports related to payees’ historic and upcoming payouts

Alerts and Notifications

Payout-related alerts and notifications via email and/or SMS

Improve customer experience and satisfaction

Improve operational efficiency

Reduce time and costs associated with paper checks

Requests for Pay (RfP)

Send digital payment requests to your customers, allowing them to review and respond with options for payment approval, modification, rejection, or delay, all in real time.

Businesses use for RfP

- Bill pay

- Wallet funding

- E-commerce

- Person-to-person (P2P) payments

- Point-of-sale payments

- Point-of-sale payments

With the two-step payment validation process, you have guaranteed good funding.

Increased payment flexibility and control for customers

Improved efficiency in the payment process

Enhanced transparency in transaction details

Value

Why Unified Money Movement?

Built to deliver seamless, innovative payment experiences across every segment

Orbipay Unified Money Movement is a cloud-native, SOC2-compliant suite that modernizes how customers move money. It integrates with your digital banking platform or runs standalone, helping your institution launch faster and scale confidently:

- Speedy deployment for instant account funding, loan payments, and transfers

- Deliver frictionless experiences across consumer, SMB, and commercial segments

- Gain a single source of truth for visibility into cash flow and liquidity

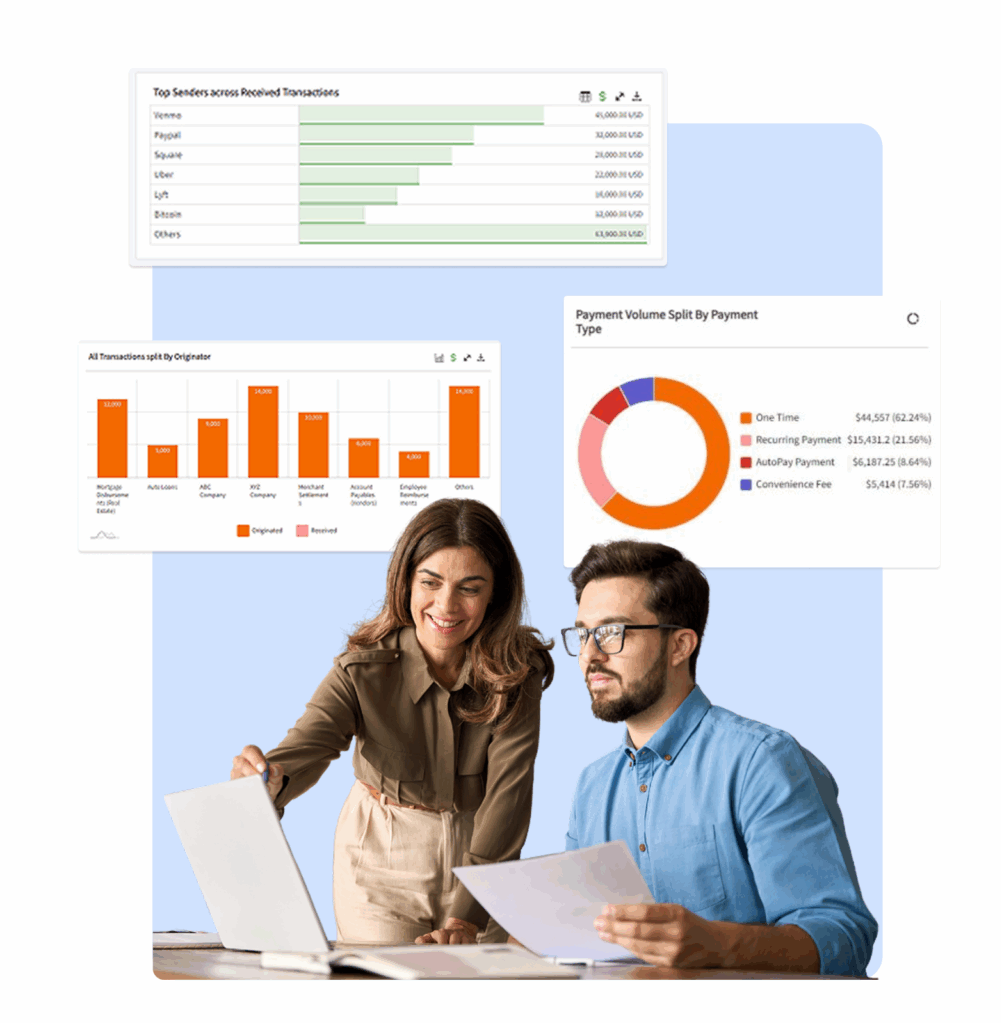

Key Capabilities

Empower Your Organization With a Unified, Data-Driven Suite

Unified Source of Truth

Break down silos for total visibility into liquidity, cash flow, and rail performance

360° Money Movement Center

Empower staff to view history, manage profiles, and schedule payments via a dedicated care portal

Centralized Reporting

Drive decisions with a consolidated view of customer behavior and transaction data across all channels

Cloud-Native Agility

Scale effortlessly with a microservices architecture that integrates seamlessly via open APIs

Omnichannel Orchestration

Deliver consistent, frictionless experiences across mobile, web, IVR, and agent channels

Business Impact

The Business Case for Modernizing Payments

Reduce costs

Increase Compliance

Faster Time-to-Market

Increase Deposits & Loyalty

Enhance Operational Efficiency

Future-Proof Infrastructure

Customer Perspectives

We Help Customers Achieve Superior Business Outcomes

Decreased Loan Payment Operating Costs by 25%

Customer

IH Mississippi Valley Credit Union

Industry

Credit Union

Frequently Asked Questions

What is Unified Money Movement?

Unified Money Movement is a comprehensive suite of cloud-based applications that centralizes and modernizes the digital payment experience for your accountholders. Unlike fragmented legacy systems that create inconsistent user journeys, a unified solution ensures that whether a customer is paying a loan, transferring funds to another FI, or sending money to a friend, the experience is intuitive, seamless, and consistent.

How does Unified Money Movement work?

It operates as an agile application layer that connects directly to your existing systems. Using pre-built connectors and open APIs, it seamlessly integrates with your digital banking, risk, and core platforms. This allows you to deliver a full spectrum of modern money movement services without requiring a massive overhaul of your current infrastructure or expensive upfront investments.

What are Alacriti’s Unified Money Movement solutions used for?

Financial institutions use these solutions to provide a frictionless, centralized payment experience across all channels. Key capabilities include:

- Loan Payments and Bill Pay: Accepting payments across multiple channels (mobile, web, text, IVR) using methods like ACH, debit, or digital wallets.

- A2A and P2P Transfers: Enabling accountholders to move money effortlessly between different financial institutions or send funds to friends securely.

- Digital Disbursements: Sending quick digital payouts (like insurance claims) using just a mobile number or email address.

- New Account Funding: Providing convenient, instant funding options to reduce account application abandonment rates.

- Customer Care: Empowering customer service staff to view transaction history, access profiles, and manage payments on behalf of users.

Does Unified Money Movement improve operational efficiency?

Yes. By breaking down traditional payment silos, it creates a single source of truth for your institution. This unified approach provides centralized data warehousing and reporting, giving your staff unparalleled visibility into customer behavior, cash flow, and payment rail performance. This consolidated view across all channels empowers your team to make faster, data-driven business decisions and offer customized recommendations to accountholders.

Let’s Talk About Your Money Movement Strategy

See how Orbipay Unified Money Movement can simplify integration, accelerate digital innovation, and deliver the frictionless payment experiences your accountholders demand.