What Is ACH?

Automated Clearing House (ACH) is a U.S.-based electronic payments system used by banks, credit unions, and businesses for money movement between accounts. Along with direct deposits and recurring bill payments, it also supports payroll and bank-to-bank transfers. Rather than being transferred instantly, transactions are grouped and move at an interval pace.

Governed by Nacha, there are two types of ACH transactions: the originating depository financial institution (ODFI), which is the sender’s bank, and the receiving depository financial institution (RDFI), which is the recipient’s bank.

What is Zelle®?

Zelle® is a digital payment service that is integrated into numerous banks’ and credit unions’ mobile apps across the U.S. It enables consumers and businesses to send digital payments to people and businesses they know and trust. Zelle® operates within the banking ecosystem, and users can send money using their email address or U.S. mobile number.

Zelle® and ACH: Key Differences

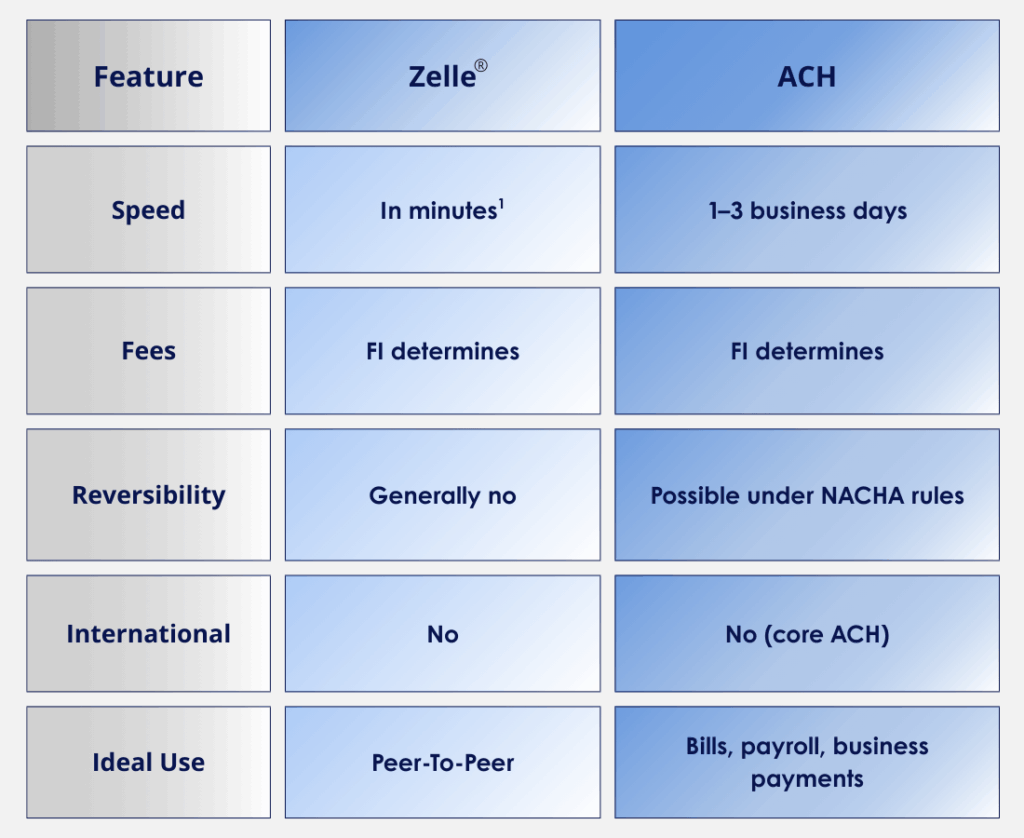

To help you quickly evaluate each method, the table below breaks down how Zelle® and ACH compare in terms of speed, cost, security, and practical use cases. Use it as a snapshot before diving deeper into the details:

Use Cases

ACH is usually used for things like utilities, mortgages, rent, insurance, and subscription services, making it a great and reliable platform for payments that are predictable and recurring.

Zelle®, on the other hand, is “family friendly,” meaning it’s popular for peer-to-peer payments. Some examples would be splitting the cost of dinner bills, making a quick payment to a pop-up vendor, or even splitting rent. While Zelle® may support repeat or scheduled payments at some financial institutions, these capabilities are typically limited to bank-enabled features for enrolled users and are intended for informal P2P use cases between known contacts instead of high-frequency or commercial payment scenarios.

Fraud and Security Considerations

Like other real-time payment experiences, Zelle® is designed for speed and convenience, which means payments are intended to be sent only to people the sender knows and trusts. Because transactions are processed quickly and are generally not reversible, Zelle® emphasizes that it should be used for payments between established contacts—such as friends, family members, or known businesses—rather than for purchases or transfers to unfamiliar recipients.

ACH presents a different risk profile. Unauthorized debits or account takeovers can occur if credentials are compromised, but Nacha rules provide defined time frames and processes for identifying, disputing, and resolving unauthorized transactions, offering a structured path for recovery when issues arise. ACH also offers more formal controls and oversight for recurring payments, including clearer cancellation and dispute processes.

Across all payment rails, safe usage depends on informed behavior and proactive monitoring. Best practices include carefully confirming recipient details before sending funds, using Zelle® exclusively with trusted contacts, reviewing account activity regularly, and enabling alerts for transfers or balance changes to help detect issues early. For recurring payments, users should also review active schedules periodically to ensure accuracy.

Choosing the Right Payment Method

Selecting the right payment method depends on the specific use case. Zelle® is well-suited for quick payments between trusted contacts, while ACH excels at scheduled billings, B2B transfers, and recurring payments.

When deciding which method to use, consider the nature of your transaction—personal or business, instant or scheduled—and how significant reversibility or dispute protections are for the transaction. The right payment method ultimately depends on balancing speed, cost, security, and geographic needs. ACH is better suited for consistent and predictable recurring payments, while Zelle® is designed for fast and easy P2P payments and is typically used for one-time or occasional payments between people who know and trust each other.

Relevant Factors For Transactions:

- Do funds need to be delivered quickly?

- How important are dispute resolution and recovery options?

- Are there transaction limits and controls imposed by the financial institutions?

- Is the payment being sent to a business or an individual?

- Are there differences in how recurring payments are scheduled or managed between Zelle® and ACH within the financial institution?

To delve deeper into ACH or Zelle®, visit Alacriti’s ACH FAQs and Zelle® FAQs pages.

1Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with TCH’s RTP® network, the FedNow® Service, Zelle®, Fedwire, ACH, and Visa Direct, all on one cloud-based platform. Alacriti’s Orbipay Loan Payments is a customizable electronic billing and payments solution for businesses and financial institutions of all sizes. Orbipay Loan Payments offers convenient and flexible choices that include all the payment channels, payment methods, and payment options expected from a modern digital bill pay experience. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.