The way U.S. consumers pay their health insurance premiums is undergoing a major transformation. Driven by rising healthcare costs, evolving consumer expectations, and the acceleration of digital technology, the payments ecosystem around premiums is becoming more complex—and more critical to get right. In this context, even small changes in billing and payments can have a significant impact on the bottom line.

Rising insurance premiums are putting increasing financial pressure on members. According to KFF’s 25th Employer Health Benefits Survey, in 2023, the average annual premium for employer-sponsored family health insurance rose by 7% to $23,968, outpacing both wage growth and overall inflation. As coverage costs climb, the burden on policyholders grows—leading to a heightened expectation for flexible, user-friendly premium payment options that make managing these higher costs easier and more predictable.

Quick Links

Bigger Payments, More Flexibility

The rise in average payment size suggests that members are consolidating payments—paying for multiple premiums at once, catching up on missed payments, or bundling different policy types into a single transaction. This shift is happening against a broader backdrop of rising insurance costs across sectors, prompting consumers to demand more flexible ways to manage their payments. According to J.D. Power’s 2023 research, customer satisfaction is increasingly tied to the availability of flexible payment options such as installments, autopay, and self-service channels. Deloitte’s 2024 Insurance Outlook further supports that higher premiums are driving greater demand for personalized payment experiences, including splitting payments across multiple methods or scheduling partial payments. For billing teams, this presents an opportunity to reduce transaction overhead while streamlining reconciliation processes. It also calls for modernized systems that can seamlessly handle high-value, complex transactions without error, delay, or manual intervention.

What’s Driving Higher Payment Amounts?

Bundled or backlogged payments:

Patients catching up on premiums or consolidating charges in a single payment

Increased use of high-deductible plans:

Leading to larger member-responsible amounts.

More payment flexibility:

With broader options like digital wallets, P2P apps, and virtual cards, members feel more empowered to make larger payments confidently and on time.

The increase in average payment values is also occurring against a backdrop of rising healthcare expenditures—expected to grow by an average of 5.6% through 2032, according to CMS. Providers, already grappling with tight margins, staffing shortages, and the fallout of large-scale cybersecurity incidents, are now under greater pressure to tighten revenue operations. As payment integrity becomes more critical, insurers and providers are shifting their focus toward prepay strategies and digital-first billing systems that reduce errorprone processes and support high-value, compliant payments before funds ever leave the system. Platforms like Orbipay EBPP not only support flexible member payments but also align with broader goals of cost containment, operational efficiency, and revenue visibility— capabilities that are becoming essential rather than optional.

Higher-value payments are also a sign of increased trust in digital billing systems. Members are more likely to make large payments when the experience feels secure, transparent, and easy to navigate. Providing real-time access to account balances, payment history, and receipts helps reduce billing disputes and supports stronger member relationships.

Strategic Implications for Billing Teams

As average payment values rise, premium billing teams should consider the following:

- Optimize for high-value digital payments: Ensure your system can support larger transactions and process them efficiently

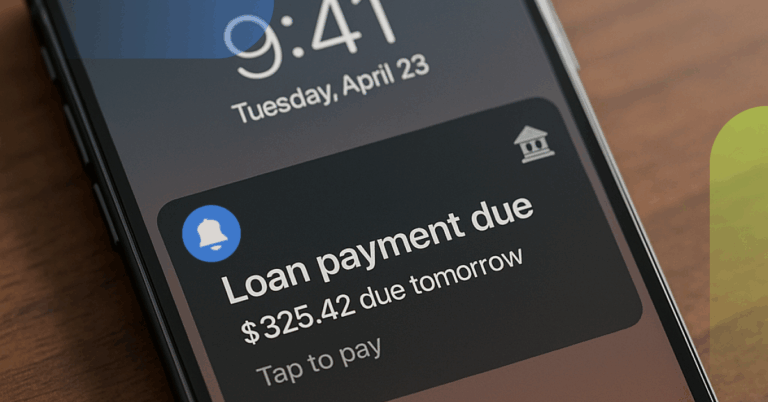

- Re-evaluate late payment strategies: With higher average amounts, late or missed payments could represent greater financial risk. Automated notifications and reminders can mitigate this.

- Focus on payment clarity: Members paying larger amounts need clear billing statements, flexible plan options, and seamless digital experiences.

Healthcare Provider Payments Trends

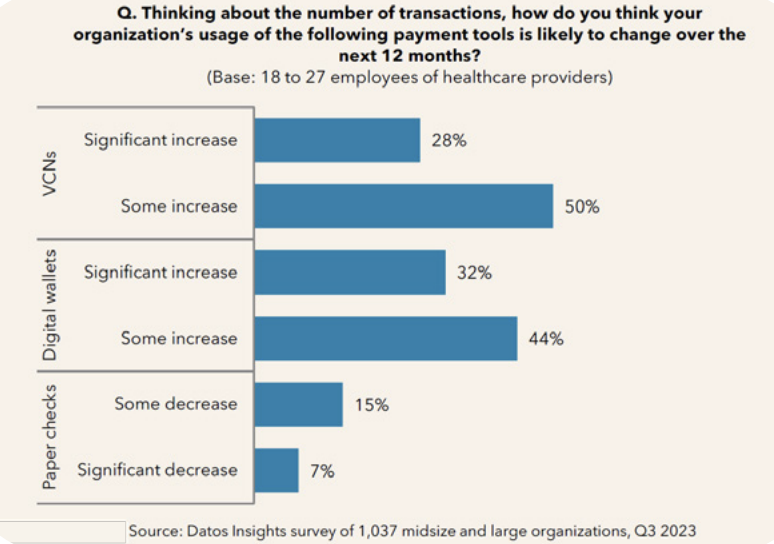

The healthcare industry is, of course, not exempt from the progress of digital transformation. Providers expect to increase both digital wallet and virtual card use, according to a Datos Insights survey. As fintech continues to expand in healthcare payments, these methods are expected to become more readily available to downstream payment partners.

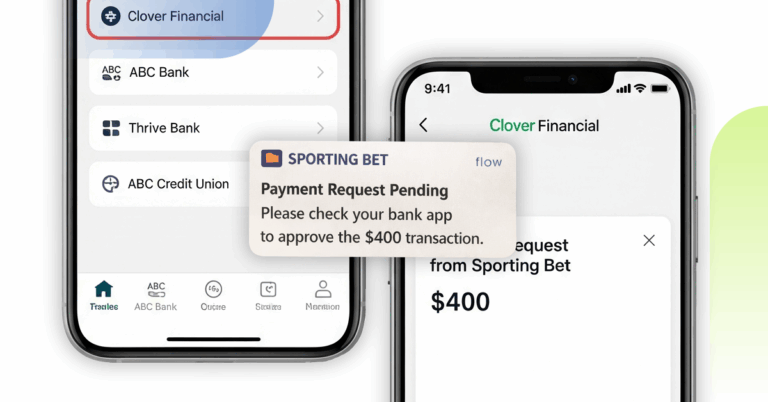

With millennials and Gen Z becoming the largest segment of insured patients, expectations around convenience and control are reshaping payment interactions. These groups prefer mobile-friendly, self-service options—and increasingly expect to use payment methods like Apple Pay, Venmo, or Zelle. To keep up, providers need a cohesive payments strategy that unifies multiple payment types across channels and supports secure, compliant processing.

The Consumer Shift Is Already Here

According to Datos Insights, Americans paid an estimated $138 billion in health insurance premiums—nearly 90% of which was processed through digital methods. This figure includes ACH transfers, credit and debit card payments, and a growing number of transactions through digital wallets and peer-to-peer apps. While overall bill volume dipped slightly compared to 2020, largely due to pandemic-era coverage expansions and Medicaid shifts, the trend toward digital payments has only accelerated.

in premiums paid via ACH in 2023

of consumers say payment security is “very important”

say payment speed is a top priority

of younger millennials set up recurring payments

paper premium bills still in circulation

Recurring payments have emerged as a particularly strong trend within premium billing. With insurance premiums typically due monthly, it’s no surprise that more consumers are setting up automated payments. In fact, recurring payments accounted for $76.2 billion in 2023, surpassing one-time payments. Younger generations are leading the way: two-thirds of younger millennials and over 60% of Gen Z policyholders reported using automated payment setups. This not only supports consumer convenience but also improves reliability for insurers, reducing the likelihood of missed payments and the administrative burden that comes with them.

Consumers are also becoming more intentional about the channels they use to pay their bills. A majority—around 65%—now make premium payments through digital interfaces, whether that’s through the insurer’s website, a bank portal, or a mobile app. Interestingly, while payments through insurer websites dipped slightly, payments through bank platforms increased nearly 10% from 2020 to 2023. This shift suggests a growing preference for consolidated financial experiences, where consumers can manage multiple bills and accounts in one place.

Security, speed, and simplicity rank high on the list of consumer priorities when it comes to healthcare premium payments. In the Datos Insights survey, 83% of respondents said that protecting sensitive data was “very important” when making a payment. Speed of processing was also a top concern—particularly among millennials, who increasingly expect real-time confirmation and next-day reconciliation. Consumers also expressed a clear preference for having multiple payment options, including cards, ACH, and digital wallets, as well as the ability to automate payments or split them across multiple dates.

In addition to security and flexibility, clarity matters. Consumers want healthcare bills to be easy to read and understand, especially as healthcare continues to grow more complex. They want to view billing history, see what they owe, and manage payments on their terms— whether that means paying from their phone, getting a reminder by text, or setting up auto-pay from a checking account. The ability to access bills digitally has become the norm, and while paper is still in circulation, electronic delivery is clearly on the rise.

The Role of Flexible Digital Channels

As insurers adopt omnichannel billing strategies, members are gaining more control over how and when they pay. Digital-first payment platforms like Orbipay EBPP support a wide range of options—from web and mobile to Pay By Text, IVR, and chatbot interfaces. When members can choose their preferred method, they’re more likely to engage on time—and with larger payments. This flexibility is especially important for high-deductible health plans, COBRA payments, and supplemental insurance, where payment amounts often vary significantly.

As providers look to technology to offset operational and financial challenges, a modern EBPP platform is no longer a “nice to have”—it’s a strategic necessity that directly supports:

- Faster cash flow and liquidity

- Improved Days Sales Outstanding (DSO)

- Lower administrative burden for follow-ups and disputes

By investing in modern billing infrastructure, providers and insurers can meet members where they are—while driving financial outcomes that matter more than ever. Consumers are sending a clear message: they want payment experiences that are as modern and intuitive as the rest of their digital lives. Insurers, banks, and payment providers that invest in meeting those expectations will be better positioned to improve member satisfaction, increase retention, and drive long-term operational efficiency.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.