With today’s expectations for immediacy, it’s crucial for financial institutions aiming to lead the industry to apply real-time solutions effectively. No matter the size of the institution, each needs a unique strategy for modernization. A key element of this strategy is the integration of instant payment systems, which are becoming increasingly vital across all levels of the financial sector.

In an American Banker-hosted webinar, Jim Colassano, RTP Product Management, at The Clearing House, Jim Maimone, SVP, Senior Payments Solution Consultant at Citizens Bank, and Mark Majeske, SVP of Faster Payments at Alacriti, discussed technology enablers for real-time payments, clearing rules and message specifications, and customer support challenges in a real-time environment.

Download this article for a full recap.

Quick Links

Colassano began the webinar with an update from The Clearing House’s RTP® network. As of September 2023, The Clearing House had 375 financial institutions on the network—growing about 10% quarter over quarter for the past several years. “Not only do all of our owners participate, but 80% of the financial institutions on the network are credit unions and community banks.”

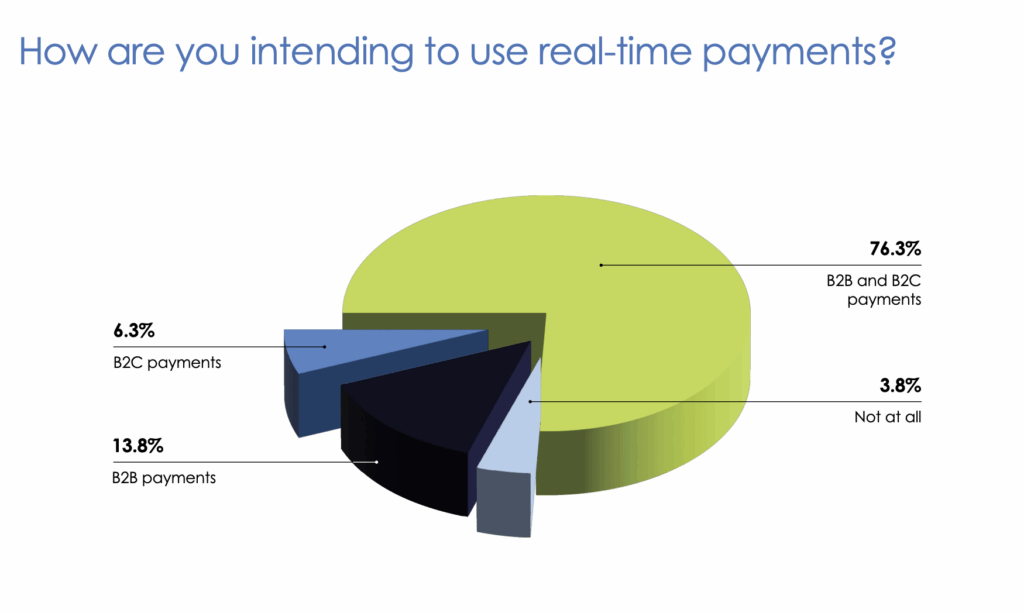

The audience was then polled about their intended use for instant payments, and the overwhelming majority (76.3%) of the 80 respondents said that both B2B payments and B2C payments were in their plans.

TCH is owned by 24 of the largest banks in the U.S. When they first launched the RTP network, it was the first new payment rail introduced in the U.S. in 50 years. “In order to get it off the ground, we knew we needed to build a very strong foundation,” Colassano explained. “So we started with the commitment of our owner banks and the first banks that were on the networks. The first 21 to 28 banks were the majority of our owners, and they created the foundation that allowed us to then go out and add more banks to the network.

To achieve this, TCH needed to start with a very strong foundation of customers that were going to be originating RTP transactions. So they started the network with a few foundational customers such as PayPal. Uber was also an initial user—using the network for gig economy payouts and wallet funding. That allowed many banks to come and allow their customers to move money from their PayPal wallet to their bank account, or to get a disbursement as an Uber driver into their bank account. From 2022 to 2023, TCH experienced a doubling of originators who were sending RTP payments, which only enriches the experiences of banks that are coming on board to Receive.

RTP Use Cases

Some of the most prevalent use cases on the network are:

- A2A

- Loan Funding

- Gig Economy

- B2B

- Payroll/EWA

- Merchant Funding

- Mortgage Closing

- Auto Finance/Logistics

- Wallets

- Insurance Claims

- Cash Concentration

- Bill Pay

Maimone shared his experience with businesses using the use cases. “For each use case, it’s not one size fits all. So for auto finance, they have their own internal processes, which could be batch, but they want to take advantage of the RTP network’s 24/7/365. So they’ve put in a process where they can make the payments throughout their loan approval process and pay their dealers. There are also small merchants that, because the card networks work on a Monday-through-Friday banking day transfer of funds version, providers are extending those funds to smaller mom and pops so that they can get it on the weekend. I think this is where the importance of RTP is evident. The business purpose will lead. How you do your business process will be how you can connect to your bank and to the RTP network.”

Looking Toward the Future

Majeske asked Maimone and Colassano what they envisioned for real-time payments in five years. “I think it all starts with education,” Maimone said. “We are providing more education because there are folks out there who are looking at asset sales and wanting to close on faster stock trades and want to be able to settle those financial transactions quickly. So a lot of transactions happen instantly, but they don’t settle instantly. I look at the industry moving more to wanting to actually move the money instantly. And I think it will help speed up business. It’ll shrink that cost of funds in that float game down. As our younger population matures, they’re going to bring that expectation of immediacy. I think that’s going to move into B2B payments as well. I would say in five years there’s going to be a broader use of RTP—even with FedNow®.”

Colassano felt that they were catching up with the expectations of the marketplace. “We are just actually starting to provide the capabilities that meet the expectations of buyers. This is an environment that is more digital. It supports the types of applications and the ways that commerce is moving today. One thing that we found pretty consistently, whether it’s a business, an individual, or a small business—it takes them a while to make their first transaction. But once they do it and they see the experience, they want more. Part of our challenge as a network operator is to be able to make sure we’re continually expanding our service to meet the needs of the market. As an example, when we started the network, our individual value limit was $25,000 because we wanted to be very careful and take a risk-managed approach to introduce this to the market. We very rapidly increased that. Our individual dollar limit is now $1 million a transaction, which is much more suitable for business-to-business transactions, and we’ll continue to raise that limit as we hear from the customers. You’ll see a lot of other capabilities that are going to build on this foundation. And if we do that, I think within five years we’re going to see explosive growth in real-time and instant payments.”

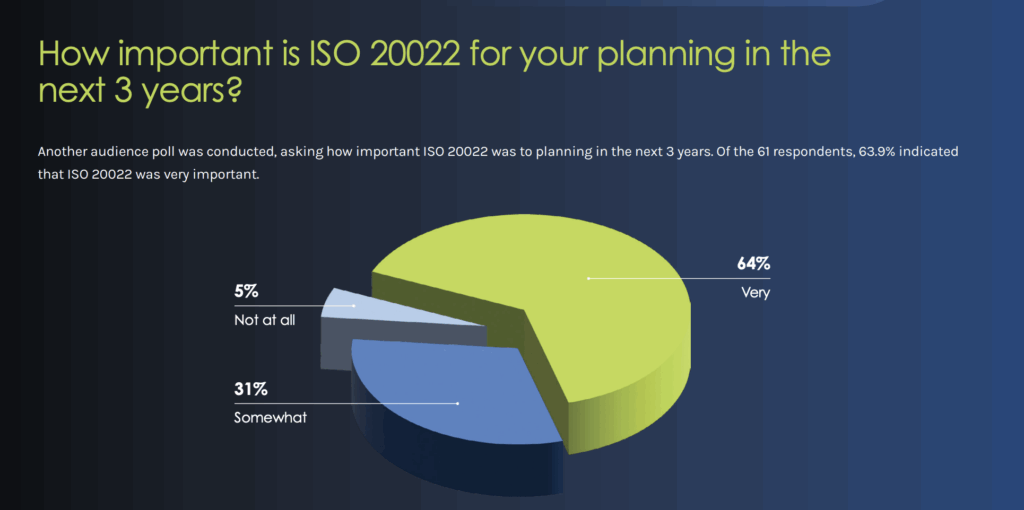

Maimone was not surprised by the poll results. “A lot of companies are doing ERP changes right now, and they’re updating their own infrastructure. The ISO 20022 standard fits into that, as well as for clients that transact internationally. It’s XML and it’s easy to reach, and much easier to read.” Maimone explained the value of the new ISO standard. “We’ll be moving to a more global standard. I’m going to call it simplified, even though it includes a lot of data fields, because it simplifies in that it has a solution for everything. I think there’s a lot of value in the ISO standard. And you’ll see ERP systems going that way too.”

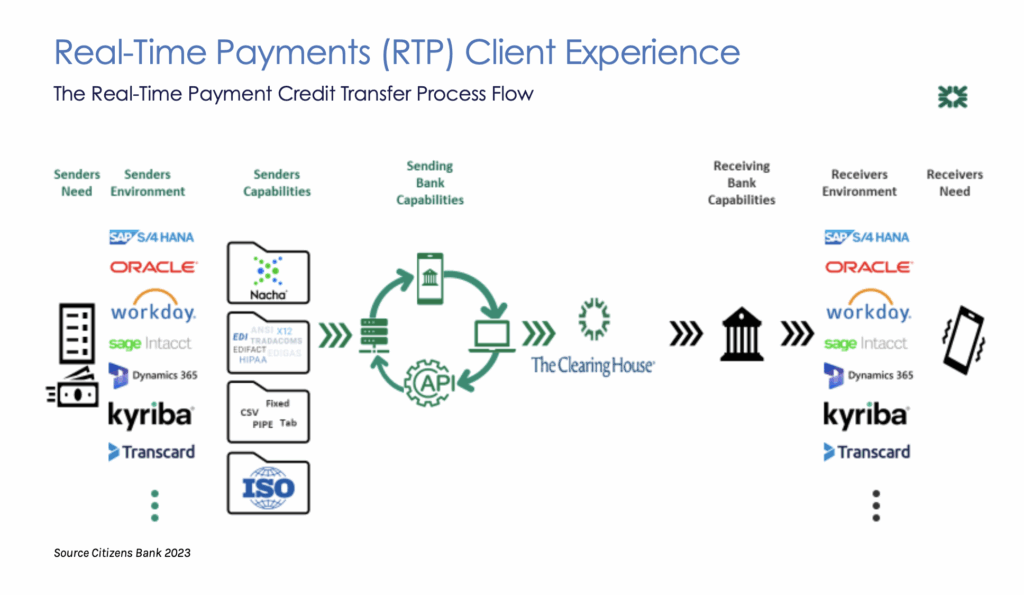

Maimone also presented a sample of the real-time payments client experience for the credit transfer process flow.

Real-Time Payments (RTP) Client Experience

When a company has invoice(s) to be paid, they can use their preferred payment method—accessOPTIMA, Direct Send, or Integrated Channel Services—for processing those payments with a real-time payment (RTP). The benefits for a company to make a payment via RTP are the precision of payment timing, immediate availability of funds, and value-added messaging capabilities. Citizens Bank will send the payment, along with any information requested for the receiver to have, to the supplier through the RTP network, e.g. Invoice or Customer ID, and up to 140 characters of remittance information with the payment. The supplier will receive the payment and remittance details almost immediately and can get near-instant notification from their bank.

“Not one solution fits all,” Maimone explained. “You are going to have a mobile experience, an online experience, clients that want to connect via API and then just the simple file transfer, etc. So when you’re moving to real-time payments, it’s precision. It’s making that payment like FedEx when it absolutely has to be there instantly, right? So how you connect doesn’t really matter. They’re going to use their mobile phone, they’re going to use their online computer, but companies still have batch processes and we have to fit that existing environment into the new payment environment.”

Maimone used dealer finance as an example. They approve loans throughout the day and need them to be paid as soon as they’re done. With RTP they can keep their process the same and still reach their West Coast dealers and provide the same client experience across the country. The transaction is moved through The Clearing House in an ISO format, and then it goes to the receiving bank. The consumer gets an alert on their phone that the funds have been received.

“On the B2B side, it’s the same environment. As soon as the transaction is complete, there is an acknowledgment that it has been deposited into the receiver’s account and is available to them. However, if the ERP system isn’t updated, it hasn’t happened for accounting. So on the receiving side, that is something that you have to deal with as well. You can work with your bank on getting that transaction immediately reported on weekends, and then you can update your buyer’s accounts receivable record too. So we will still work in this environment where their ERP is the payment network and then there’s the ERP for the receive side as well,” Maimone said.

ISO 20022

Colassano provided a brief overview of ISO 20022. “ISO messaging is a globally developed methodology for transmitting data designed to create consistent financial experiences for payments. ISO messages can carry a considerable amount of information and have a common dictionary that supports message flows end to end, and can support payment initiation messages, interbank settlement messages, bankto-bank messages, and cash management messages. It’s a pretty expansive lexicon, and it’s used pretty broadly around the globe. The ISO standard is also becoming the baseline for RTP networks that are evolving around the globe. The reason that we decided to adopt it in the U.S. is that we want instant payments to be a global capability. And we didn’t want to construct it in a way that would start out with any technical limitations to our ability to expand to real-time payment processing cross border.”

Around two years ago, The Clearing House did a pilot with EBA CLEARING where they connected their instant payment network to the RTP network in the U.S. They were able to complete and settle cross-border transactions, including foreign currency conversion in less than 10 seconds. This is a prime example of the usefulness of ISO 20022. Although the RTP network is domestic only, The Clearing House elected to use ISO 20022 because it is a global standard and because it has rich data about the payment that can be carried with the payment. It makes end-to-end processing a reality in a real-time space.

Connecting

Maimone recalled Citizen Bank’s experience connecting to the RTP network. “From our standpoint, connecting to the network was almost the easiest part, right? The technical implementation is easy, but it’s all the operations that go around that—really moving to a 24/7 environment. Weekends and holidays are very different for banks. This is now sending transactions, settling them, providing instant confirmation within 15 seconds, and providing immediate availability to the recipient. A lot of banks (Citizens Bank included) still work in the old way, but being able to provide that payments certainty in a 24/7/365 environment takes a lot to think about. And, just because it’s 24/7/365, I don’t think that automatically means you need people sitting at a phone 24/7/365.”

Colassano explained that although the technical connectivity is relatively straightforward, there is a set of operating rules financial institutions need to abide by. “It is the RTP operating rules, and these are the rules governing the operation of payments across the network. There is a set of schedules that supports those rules that talk specifically about security and authentication and about fraud reporting obligations. When we do have areas where banks need a bit more color, we also put out rule interpretations to give the banks additional guidance on how they should be implementing the rules. And then finally, we have a set of technical specifications, which really lays out the messages that are used within the ISO framework—how they should be used, and how the interoperability of these messages is for not only payment, messages but also nonfinancial messages, like requests for payment.”

There is a perception that faster payments mean faster fraud. Maimone provided his take. “I think with RTP, there’s a better opportunity to be able to look at your fraud and instantly analyze the transactions that fraud is coming from. There has not been very much fraud at all in the network, and I think that comes down to senders being more conscious when they’re sending the payment. So they’re making sure they know it’s irrevocable; they know it can’t just be debited. Because there are no debits in the network, it significantly reduces risk. So it’s not a matter of ‘I steal your account number and then I can just send you an ACH debit and boom I’m gone.’ There are no debits. Payments are irrevocable. But there is the opportunity for requesting a return of funds and a fraud category as well. And so we’ve designed things to be addressed in certain priorities (like fraud). So I think you can take advantage of your fraud tools. I think the messaging itself makes that easier to work with. You’re looking at a single transaction at a time, but then you’re comparing it to your whole universe of payments.”

Citizens Bank focused on enhancing the adaptability of its IT infrastructure environment to accommodate a 24/7 environment to help with client services, and integrated it right into its service model— including 7:00 PM Eastern Time service and their ATM and debit card service providers. They’ve also integrated into a 24/7 fraud system. So if they see payments fraud, they can address that immediately. Even though the typical commercial banking client services environment is not 24/7, a bank’s existing infrastructure can be adapted to satisfy those needs.

When Citizens Bank first rolled out real-time payments, they conducted daily meetings, which eventually were moved to weekly, then monthly, and then quarterly. They ended up being able to stop the meetings completely, as customers didn’t have a lot of questions or issues.

Roadmap for RTP

Many banks join the RTP network starting with Receive Only, as it’s the easiest way to connect. It has fewer downstream implications and requires the least amount of development by individual banks. TCH has also had banks join through third-party service providers, such as Alacriti, as they have already done the integration work, allowing connection to the network to be done quickly. Then customers can begin to receive instant payments e.g., from PayPal or gig economy payments. The next step is to be able to originate payments (Send).

Financial institutions can continue to develop ISO 20022 message capabilities to enable Request for Pay messages. RfP falls under the category of “conversational commerce,” making it possible to send invoices, ask questions, and receive confirmation in a bank-secure message flow. It’s a nonfinancial message that’s allowed in the ISO framework that is sent from a supplier to a buyer, telling them how much money is due and also allows them to simply pay with a credit transfer. The buyer wouldn’t have to know anything about the credentials of the person that they’re paying, and in most instances, the RfP will be associated with information about the invoice. It’s a very streamlined, very efficient process, but it also puts the payer in control.

Colassano elaborated on the safety of the RTP network. “In no instances can money be pulled out of your account. One of the key foundational elements of the network is that it is credit push only. You cannot pull money out of an account through the RTP network. The second piece of it is that we’re allowing document exchange services. We’re allowing buyers and sellers to be able to upload information into a repository and then with a secure link, send that information to the receiver of the message. It’s the equivalent of the way you see your check image when you go on a bank’s bill pay site. You see a thumbnail of it, and then you click on that while you’re in the bank bill pay experience, and you pull up a copy that you can store locally or return to the archive. Imagine that same experience for bills and invoices that are going back and forth between the buyer and the seller. That’s simple, that’s straightforward, and that could replace the actual movement of paper that goes back and forth in the current environment.”

The last step in the journey is a mature offering where the financial institution offers unique, value-added services that improve the customer experience and operational efficiencies.

RTP network functionality that is expected to add value and innovation in the future include:

RFP Bill Pay

a reimagined bill pay experience where a nonfinancial message allowed in the ISO framework that is sent from a supplier to a buyer telling them how much money is due and allowing them to simply pay with a credit transfer

Document Exchange

PDF documents accessible with the request for payment or payment

Immediate Cross border (IXB)

real-time processing with synchronized settlement of cross-border payments

DDA tokenization

another security measure that allows tokens to be used in place of real account numbers in the RTP and EPN networks

Majeske explained how it’s possible to connect to the RTP network with Alacriti’s Orbipay Payments Hub. “With Orbipay Payments Hub there are two important things to note: it’s a payment-as-a-service and is cloud based. It integrates with many banking cores and is ISO 20022 native.

We use open APIs for integration and offer smart routing, which means if you want to send us a batch file, we can decrypt that batch file and distribute it to various rails per your direction. Available rails in the hub are Fedwire, ACH, the RTP network, the FedNow Service, and Visa Direct (which is on both Visa and MasterCard). I’ve been deeply involved in over 30 implementations, and one interesting thing I’ve noticed is that if you are just Receive Only, whether you’re a small, mediumsized, or large bank, is that in the first five minutes after launch you start getting transactions from use cases (in most cases from larger banks). So your customers get to utilize it right away. Some of the reasons to consider Alacriti as your TPSP are our short time market and that we offer noncompetitive collaboration sessions. We’re also finding that after the initial connection with our payments hub, most of the infrastructure work is done to integrate. So it’s very easy to add an additional rail. So if you want to add RTP first and then go to FedNow, it’s very easy because a lot of the wiring is already done.”

Alongside the continuous growth of real-time payments, security, fraud prevention, and customer experience remain focal points as financial institutions navigate this shift. From Receive-Only to value-added services, convenience, and ever-evolving benefits drive the demand for instant payments.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.