The advantages of real-time payments for businesses, customers, and financial institutions are now widely known. Yet, when advocating for real-time payments within an organization, two critical questions often arise: How can this innovation generate revenue? What benefits extend beyond speed?

In an ICBA-hosted panel discussion, Dan Gonzalez of Federal Reserve Financial Services and Mark Majeske of Alacriti tackled these questions, offering insights into the FedNow® Service, the ROI of instant payments, and strategies for community banks to operationalize and monetize this transformative technology.

To read more, download the full article.

Quick Links

What Makes the FedNow® Service Different?

The FedNow Service stands apart in the world of payments, offering a transformative approach to instant payments in the United States. While many existing digital payment systems create the illusion of instant transactions, the FedNow Service ensures that funds are moved and settled between financial institutions in real time, providing true instant payment capabilities. This distinction not only reduces settlement risk but also enhances operational confidence for financial institutions.

Dan Gonzalez explained the difference at the beginning of the call. “When we talk about the FedNow Service, we are referring to instant payments. These payments settle within seconds. We have a clock that we run on every payment, but what we’re actually seeing is that the majority of these payments are now occurring in under five seconds.” This near-instant settlement ensures recipients have immediate access to funds while reducing risks associated with traditional payment methods.

Another key difference is the irrevocability of FedNow payments, making them “good funds payments.” As Gonzalez explained, “These payments are irrevocable, so that’s great for the recipient and may raise some questions for the senders. But at the end of the day, they are good funds payments. There’s no risk of returns on those payments.” This feature provides financial institutions and their customers with security and certainty, enhancing trust in the transaction process.

The FedNow Service also supports 24/7/365 availability, which allows for customizable transaction limits and offers the ability to carry extensive data within payment messages, making it especially advantageous for businesses. These innovations, combined with the FedNow Service’s focus on credit-push payments, position it as a groundbreaking solution for financial institutions looking to modernize their payment offerings.

Where Are Financial Institutions in Their Instant Payments Journey?

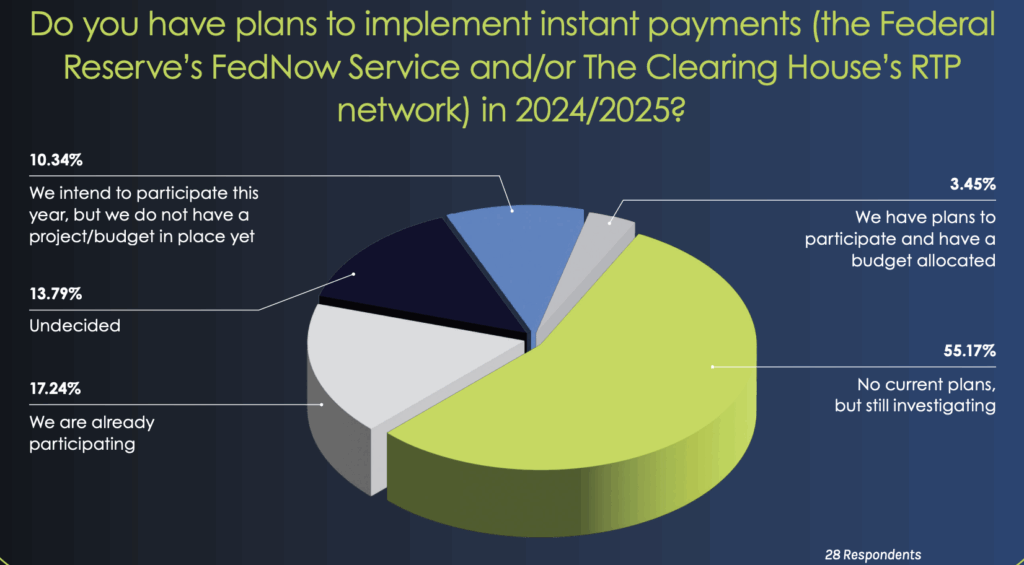

A poll question revealed insights into where financial institutions currently stand in adopting instant payments through the FedNow Service or the RTP® network. Gonzalez introduced the poll to gauge participants’ plans for implementation in 2024 or 2025.

The poll results provide a snapshot of where community banks stand in their journey toward implementing instant payments. Among the 28 respondents, 17.24% are already participating in instant payment systems. Meanwhile, 3.45% have plans to participate and have allocated a budget, and 10.34% intend to participate this year but have not established a project or budget yet. However, the majority—55.17%— have no current plans but are actively investigating the potential of instant payments, indicating that the vast majority are either planning to implement instant payments or are at least interested. The remaining 13.79% stated that they were undecided.

FedNow Service Update: One Year of Growth and Progress

The FedNow Service has seen remarkable growth since its launch in July 2023. In just over a year, the service has expanded from 35 participants to over 900 live financial institutions across all 50 states and the U.S. Virgin Islands. This rapid growth highlights the strong demand for instant payment capabilities in the U.S. financial market.

Gonzalez shared key milestones. “We’ve been able to grow the network to over 900 live participants. To me, what that actually says is there has been a lot of pent-up demand in the marketplace. Financial institutions are really looking at the value of what instant payments can bring to their organization as well as to their customers.”

A diverse group of institutions has joined the FedNow Service, ranging from small community banks with under $500 million in assets to major financial entities with over $3 trillion in assets. Community banks, in particular, have shown strong enthusiasm for the FedNow Service. “Currently, about 550 of those 900 participating institutions are community banks—a great response from the community bank sector, understanding and seeing the value of instant payments and getting on board pretty quickly.” Gonzalez shared.

Looking ahead, the Federal Reserve aims to connect as many of the nation’s 9,000 financial institutions as possible, enabling a robust and accessible instant payment ecosystem. While the majority of participating institutions are currently receiving payments, many are also ramping up capabilities to send transactions, which signals increasing adoption of the service’s full capabilities.

The Business Case for Instant Payments and Monetization

Gonzalez highlighted the many ways instant payments can deliver value across the financial ecosystem. “Number one is looking at an increase in wallet share—getting that money out of the digital wallets and getting it back into the bank, then improving customer service, reducing payment processing costs and delays, and generating new loan revenue.” He also addressed the competitive advantage instant payments offer. “As folks are looking at these capabilities and wanting to get money into their financial institution as quickly as possible, it will become a competitive differentiator.”

Majeske focused on the importance of a realistic approach to monetization. “I encourage people to be realistic regarding Send transactional growth. Keep it realistic and then surprise people when you exceed your expectations.” There are also opportunities for cost savings, including reductions in fraud, staffing requirements, or changes in member services.

The speakers also touched on monetization strategies, with Majeske pointing out that financial institutions could differentiate services based on value. “If you’re offering ACH for free, and you look at the value add of something like FedNow where you have 24/7 access, there’s a lot of value there in that transaction.” He also identified Request for Payment (RFP) as a promising opportunity for future monetization, explaining, “When Request for Payment becomes more mainstream, I think that’ll severely alter monetization opportunities within the payments realm.”

A question was raised from the audience about charging fees—Do you see banks charging fees on both the sending and receiving side? Majeske shared that most banks charge fees for sending payments but not for receiving them.

The approach may differ for treasury customers, but Majeske encouraged banks to evaluate the value-added nature of expedited payments when determining fees.

Operationalizing Instant Payments for Community Banks

Operationalizing instant payment capabilities involves careful planning and decision-making. One of the first decisions banks face is whether to connect directly to a network or work with a third-party service provider (TPSP). “About 96% of banks use TPSPs. The reason for that is it’s new, and you’re bringing it into your organization for the first time. We as a TPSP have done this several times and act as a partner to ensure the turnkey experience is very, very smooth and effective once launched.” Majeske explained.

During the webinar, an audience member asked, If a core provider offers connection to FedNow, what’s the benefit of using a TPSP versus leveraging the core provider? Majeske explained that while larger banks often connect directly to payment rails due to their resources, smaller to medium-sized institutions benefit significantly from using a TPSP. “In the TPSP model, there are a lot of things that have to happen. Smaller banks often find it easier to use a TPSP, one that has onboarded a number of banks and is familiar with the process. We’re able to partner with you and make the process a lot easier and maybe give you some suggestions on operational improvements.” For institutions with ample staff, direct integration may be a feasible option, but a TPSP offers streamlined processes and expertise, reducing the complexity of implementation.

There are also key internal considerations like settlement processes, customer service availability, and liquidity management. For instance, banks must decide whether to offer 24/7 customer service to support instant payments—a move most banks choose to avoid. Majeske pointed out, “24/7 is not equal to more people. In fact, in most organizations, they are adding zero to maybe one person to support instant payments.”

Another audience member asked, Is the bank able to set limits on when outbound items are sent, or do we have to allow customers to send 24/7? Gonzalez clarified that banks retain full control over payment timing and limits. “The network itself is always active, but ultimately, some of those controls are dictated by the bank themselves and their connectivity.” Banks can set customer-specific limits based on criteria such as creditworthiness or customer type, similar to controls for debit card usage. Majeske added that restrictions can also be implemented based on timing, “Banks can create scenarios in their UI to restrict maximum limits on weekends or other specific times, providing an added layer of comfort while maintaining network compliance.”

Another operational consideration is integration with existing systems. Partnering with a provider like Alacriti simplifies this process by integrating directly with the bank’s core system, eliminating the need for direct coordination with core providers. Additionally, banks must consider whether to create new general ledger (GL) accounts or use existing ones with new transaction codes, tailoring these decisions to align with their internal structures.

A major efficiency driver of instant payments is the high straightthrough processing (STP) rate.

This level of automation reduces the need for manual intervention, enabling banks to handle large volumes of transactions without significantly increasing staff or operational costs.

Promoting Instant Payments to Customers

Promoting instant payments is a crucial step in driving customer awareness and satisfaction, especially as banks adopt new capabilities like receiving funds in real time. Customers need to know they have the benefit of receiving funds instantly, even if the bank hasn’t yet enabled sending capabilities. “You can show your customers that there is positive movement in the modernization of payments. Let customers know you’re modernizing and investing in new instant payment capabilities that will ultimately enable expedited receipt of funds,” Majeske advised. He also pointed out that most customers will notice the difference quickly:

“At the end of the day, the use case for the receiver is just giving your customer that ability to get that money into that bank’s account a lot quicker than they could otherwise. So, absolutely promote it. Let your customers know that, hey, we have these capabilities now,” Gonzalez added.

While promoting receiving capabilities is beneficial, messaging around sending capabilities should wait until the bank has a product ready for customers to use. “Promote Send when you have a product for them to use. Consumers really like to read about something and then go try it,” Majeske recommended.

Lessons Learned From Early Adopters of Instant Payments

One of the critical takeaways from lessons learned from banks that have successfully implemented instant payment capabilities is the importance of understanding core integration. Banks must determine whether their system is hosted or on-premises, as this affects the integration process. “Will your core allow a third-party connection? That’s important for someone like Alacriti because what we do is we integrate to your core, and we actually do the transaction on your behalf. If you have a core that doesn’t allow third-party connectivity, then it makes it a little bit more challenging,” Majeske explained. Establishing a core implementation team with subject matter experts (SMEs) is essential to ensuring a smooth integration process.

Preparation for settlement and risk management is another vital consideration. Early adopters found success by engaging their accounting offices early to better understand transaction flows and make decisions on funding agents in advance. “Make sure that you’re prepared for the new products and understand the transaction flow… complete a risk review to ensure that internally, everyone is aware of the product, what it does, when it does it, how you do it,” Majeske suggested.

Documentation and internal training also play a key role in operational readiness. Community banks need to thoroughly document new processes, including GL configuration, reconciliation, and settlement workflows. Stakeholder education is equally important—they should all understand what the new product is, how it works, and what the new processes are.

Advantages of a Payments Hub

A payments hub offers a centralized, modern solution for managing various money transfer products across multiple payment rails. It can also streamline operations and enhance efficiency for financial institutions. One of the primary advantages of Alacriti’s payments hub is its modern and purpose-built design. Majeske explained:

This design allows financial institutions to consolidate payment processes into a single, efficient system, reducing complexity and improving automation.

Speed to market is another critical benefit. A payments hub enables institutions to deploy new capabilities quickly, avoiding lengthy project timelines. Majeske emphasized, “You don’t want them involved in this for a year, right? Rather costly. So getting to market quickly, being an innovator in the market, and making sure everything’s set up to do that.” This rapid deployment ensures institutions remain competitive in offering cutting-edge payment solutions.

Additional advantages include scalability through cloud-based infrastructure and future-proofing with ISO 20022 compliance, which supports interoperability across multiple payment rails. The use of APIs further enhances functionality, allowing institutions to customize and expand their payment offerings as needed.

The Path Forward for Community Banks

At a time when speed, efficiency, and customer experience define success in financial services, instant payments are no longer a future aspiration but a present necessity for community banks. The transformative potential of the FedNow Service and other realtime payment solutions is clear, offering opportunities to enhance operational efficiency, drive revenue, and meet evolving customer demands. As adoption continues to grow and new use cases emerge, community banks have a unique opportunity to position themselves as innovators in the payments space. By leveraging the right strategies, tools, and partnerships, they can not only meet today’s expectations but also shape the future of community banking overall.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.