In 2023, instant payments experienced a significant surge in transactions, along with the introduction of new services and use cases. As we look ahead, the progress and future of instant payments are hot topics.

In a CUInsight-hosted webinar, industry experts Cassandra Tucker, Director of Operations at ABNB Federal Credit Union, Mark Majeske, SVP, Faster Payments at Alacriti, Keith Gray, Vice President, Strategic Partnerships at The Clearing House, and Bernadette Ksepka, Vice President, Deputy Head of FedNow Product Management at Federal Reserve Financial Services, delved into the current state of instant payments, reflecting on the growth and development seen in 2023. Additionally, Cassandra Tucker provided valuable insights from ABNB Federal Credit Union’s experience implementing real-time payments, offering lessons learned and best practices for financial institutions.

Quick Links

Current State of Instant Payments

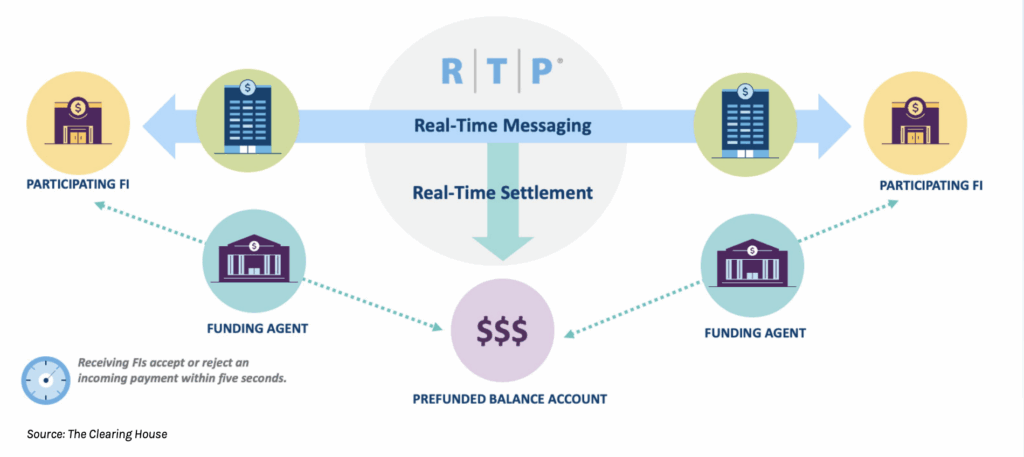

There has been significant growth and adoption of instant payments in 2023, including the launch of the FedNow® Service in July. In addition, the RTP® network has experienced rapid growth, reaching over 500 financial institutions and millions of transactions daily. “We have a great number of not only credit unions on the network, but companies like Alacriti that are providing services enabling banks and credit unions to leverage both RTP and FedNow. From a state-ofthe-industry standpoint and the options that financial institutions have to leverage funding agents to help manage the liquidity, I think we’re stronger than we’ve ever been. We continue to add more FIs and technology partners,” Gray shared.

One of the key drivers of RTP network volume growth discussed was the increasing adoption of instant payments in the gig economy. Companies like Uber and GrubHub use the network to pay their drivers, as there is a lot of payroll that happens in their industry. There’s also been a move to same-day payroll that has driven the need for instant payments. For example, in work today/get paid today scenarios, a waiter can cash out their tips immediately and get paid before leaving the restaurant. In addition, account-to-account payments and me-to-me payments, where people are moving money between brokerage accounts and bank accounts, also continue to grow.

The RTP network sees a lot of growth in insurance claims, which presents a significant value to people who want to get their money quickly when needed. Also, loan funding and P2P continue to be fast growing segments. Companies such as Venmo and Zelle have been on the RTP network for years as well as merchant funding companies like Square and Elon. Typically, when a credit union or a bank goes live, one of the first transactions they see is their small business customers moving money from their merchant account into their credit union account. And with Square doing so much volume and being so widespread in the country, banks and credit unions can expect to start seeing merchant payments from Square as soon as they go live.

Gray noted that the RTP network has been growing by about 15% a quarter in volume of transactions and projected a bump in 2024 due to high volume use cases.

Gray attributes that to the higher transaction limit ($1,000,000), which raises the transaction average across the whole network.

RTP Connecting and Funding Options

Ksepka provided insights into the momentum and excitement surrounding FedNow. Since its launch, which started with 35 organizations that included the U.S. Treasury, the network has grown significantly, celebrating a milestone of over 500 participating financial institutions in February 2024. Participants are financial institutions of all sizes, joining as Receive only or Send and Receive. “About 60% of those are FedNow participants only,” Ksepka shared. “Our focus since going live definitely has been on driving adoption and the numbers. We’ve been working closely with the industry, particularly service providers such as Alacriti, to help catalyze the service. And we recognize the importance of these service providers.”

The Federal Reserve is pleased with the robust level of adoption they’ve been experiencing and wants to make sure that the FedNow Service is as accessible as possible to any financial institution or service provider with the goal of ubiquity. However, if the history of ACH is a predictor, it will take some time to get there.

Majeske noted a trend where more financial institutions choose to use both FedNow and RTP, which wasn’t always the case. They start with Receive Only and then add Send later. This indicates a growing preference for a phased approach to integrating instant payment systems.

Projections

Majeske, a seasoned expert in the realm of faster payments, was optimistic about the trajectory of RTP in 2024. “After the remarkable growth we witnessed in 2023, I anticipate even bigger rates of growth in 2024,” Majeske said. He emphasized the immediate impact financial institutions can have on their customers, with many processing transactions within minutes of integrating with the RTP network.

Gray projected a significant increase in transaction volume for 2024 and delved into the anticipated high-growth areas. “We crossed the half-billion threshold in July 2023, and based on current trends, we expect to process over 1 billion transactions by the end of this calendar year,” Gray explained. He attributes this growth to the expanding use cases and adoption of RTP and FedNow by more originators and financial institutions. Similar to the FedNow Service, the goal of the RTP network is to reach ubiquity across the industry, where everyone has access to real-time payments. Gray also noted that early wage access is a fast-growing industry that is also a fastgrowing user of the RTP network, making it one of the big drivers of volume on the RTP network.

In 2024, Gray envisions a lot of bill pay, especially since there is a growing amount of bill pay capabilities at launch. B2C disbursements and P2P companies like Zelle are also expected to rise in prominence. More banks are using RTP to clear and settle Zelle transactions than they have in the past. Gray noted that Zelle is unique in that it feels like real-time to to the consumer because they have immediate access to those funds, but the money typically moves the next day using the ACH network or one of the debit rails. Having Zelle on the RTP network would make its backend clearing and settlement match the front-end customer experience, which a lot of the large Zelle banks are very interested in doing.

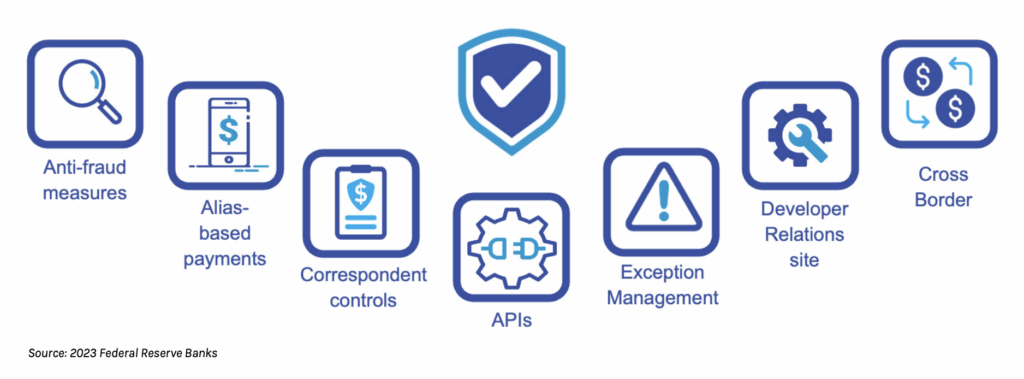

Ksepka outlined the focus areas for the service in 2024. “Our focus in 2024 is twofold. One is continuing to grow the network, and the second is around building out FedNow features. We will continue to focus on enhancing our onboarding process. We’ve made this a priority to develop a fully digital world-class onboarding system. We want to make adopting FedNow as easy as possible for our participants,” says Ksepka. She emphasized the importance of collaboration with the industry to deliver valueadded services, including improvements in risk management and correspondent controls.

The FedNow roadmap is focused on safety and ease of use. The Federal Reserve is prioritizing things around risk management and making instant payments easy, and then enabling additional use cases. They’re actively working on additional risk management functionality to help combat fraud, as well as correspondent controls to help manage liquidity. They’re also working on APIs, which will help drive innovation—enabling financial institutions and service providers to bring functionality to the market quickly. Alias-based payments, which provide the ability to pay to a phone number or email address, are a current area of exploration.

FedNow Service Roadmap

The FedNow Service will be enhanced through incremental releases to continue supporting safety, resiliency, and innovation in the industry as it expands. Potential candidates for future enhancements will be explored to better understand participant needs and include:

New Services and Emerging Use Cases

Gray shed light on the growing use cases driving the volume of RTP transactions in 2024. He emphasized the rise of bill pay services that not only request payments but also provide crucial information to consumers. “An invoice could be delivered directly to the consumer, saying, ‘Your mortgage is due tomorrow,’ or ‘This bill is due tomorrow. You need to pay it to avoid things like your electricity getting turned off.’ The consumer can push that payment immediately. We have a good bit of volume going on with that specific use case. However, compared to the whole, it’s very small. We expect a lot of growth in these Request for Payment based use cases,” explained Gray. This seamless integration of payment requests and information is expected to drive significant growth in transaction volume.

Document exchange services, which are cloud-based, have been recently piloted on the RTP network. It’s a cloud-based repository where, for example, an invoice can be uploaded, which creates a link that can be embedded within the Request for Payment.

This streamlines the process of delivering invoices to customers, enhancing convenience and efficiency. This could be particularly helpful for small businesses, where they could upload and provide an invoice to a customer without having to go through a lot of technical steps.

Tokenization, which has been around for a while, is the ability to replace an account number with a randomly generated number (that ties back to your real account number) that is easier to control, limit, and turn on or off. Therefore, what’s traveling over the network is the token vs. real account data. Gray predicts increasing adoption of tokenization in 2024.

Real-time cross-border payments, starting between the U.S. and U.K. were piloted on the RTP network in early 2023 and are getting closer to general availability. After that, TCH will be looking at some of their other trading partners south and north of the U.S. “There’s a lot of interest and excitement around real-time, cross-border payments, and a lot of people are going to be talking about that, and the impact on the industry,” Gray shared. “We’re hearing a lot of requests for cross-border and I think the reason is the user experience can be a complicated transaction. It’s hard to predict when the funds will be received and when they’re going to be useable. The fees on the bank side at the recipient level are also hard to predict because they’re not standardized,” Majeske added.

Ksepka discussed the diverse use cases driving innovation. “In some cases, we’re seeing financial institutions and service providers make instant payments available to their customers basically as another rail. And they’re integrating that into their digital offering and letting their customers choose which of their payments they would benefit from transferring funds instantly. So, they’re not taking a specific use case approach but are supporting any use case that their customers would want to make. Then, we see other financial institutions who are taking more of a targeted use case approach. In those cases, we’re seeing banks that are starting with A2A transfers (for example, funding or defunding a digital wallet).”

Ksepka sees significant potential in consumer-to-business (C2B) bill pay services, envisioning future experiences around recurring instant payments and autopay. Like the RTP network, the Fed has the Request for Payment functionality, which Kpseka predicts will have much more progress in 2024. The Federal Reserve has been working to reduce some of the barriers to adoption of Request for Pay as well as establish some market practices around the customer experience. “There’s going to be use cases that come up that we’re not even thinking about, which is really exciting,” Kpseka added.

Lessons Learned From ABNB FCU

Tucker provided a credit union’s perspective and emphasized the importance of access as a driving force behind ABNB FCU’s decision to adopt new payment rails. “We wanted our members to have access to this new rail…something that’s going to be so transformative to our industry and the way that individual consumers and members can manage their liquidity,” Tucker shared. By prioritizing account-toaccount (A2A) transfers, ABNB FCU aimed to provide members with an easy-to-understand and monetizable service, addressing both member needs and revenue generation.

The choice of a technology partner was crucial for ABNB FCU. They selected Alacriti because of their ability to integrate seamlessly with ABNB FCU’s online banking provider, enabling accessible and functional A2A services. This partnership also facilitated the simultaneous implementation of both Send and Receive functionalities across FedNow and RTP rails, ensuring members have comprehensive access. “The industry right now, when considering factors like fee reductions, leaves financial institutions wondering, ‘How do you offset that, and where can you obtain non-interest-based income?’ And so we looked at A2A, and that’s going to be our very first use case. And that’s accessible because of our partnership with Alacriti and the functionality that’s built into their product with our online banking provider. It allows us to offer A2A in a really accessible and functional way. That is also what drove our decision to implement both Send and Receive. We chose both rails because we wanted to make sure that if we’re offering this functionality, we’re giving our members the best chance at success and access as possible. We don’t want to market this as something new and great that they can do and then say, ‘Well, you can’t because your bank only accepts RTP and your bank only accepts FedNow,’” Tucker shared

Like many financial institutions, exception processing for wires, checks, and ACH took a great deal of staff time for ABNB FCU. Since the RTP network and the FedNow Service are low-maintenance rails, ABNB got the benefit of them behaving like a wire in the sense that it’s a credit push without all of the paperwork and admin pieces that touch wires. So, for ABNB, real-time payments were a way to solve some operational issues and potentially gain financially from product fees.

Lessons Learned

Education Matters:

Understanding the new payment rails and their value was a critical first step. Educating stakeholders, including the executive team and board members, helped overcome initial roadblocks and fostered a supportive environment for implementation.

Partnership Over Vendors:

Working with a partner like Alacriti, rather than just a vendor, provided ABNB FCU with guidance, support, and expertise throughout the process. "We needed some direction and guidance. We made the decision to partner with Alacriti and, hands down, that was the best decision we made during this process because they’ve been with us every step of the way," Tucker noted.

Data-Driven Decisions:

As a first step, Alacriti assisted ABNB FCU in identifying the data needed. Analyzing transaction data helped ABNB FCU understand member behavior and define relevant use cases for the new payment rails. This informed their strategy and set the stage for successful adoption.

Collaboration and Strategy:

Implementing new payment rails requires a concerted effort across the organization. Defining a clear strategy, involving the right people, and setting measurable goals are key components of a successful rollout

Risk Management and Operational Considerations:

Addressing concerns such as accounting and 24/7/365 operations early in the process is essential. ABNB FCU opted to use a settlement partner to mitigate some of the risk and time challenges.

ABNB FCU is exploring additional features such as enhanced bill pay for personal liquidity and competitive business banking products. With many facing economic challenges, the flexibility to pay a bill and have it transferred immediately vs. having to schedule a payment for the week before getting paid is important.

Tucker highlighted the potential for loan funding for auto loans and mortgage processing enhancements as areas where the new payment rails could add value and improve operational efficiency. “We’re also looking at loan funding for our indirect dealers for auto loans. There’s an opportunity to generate some income there as well and hopefully capitalize a little bit on our local market share by just providing immediate payment. Especially with car loans and things like that, those dealers, those merchants, they want to be paid, and they want to be paid quickly. A lot of times, the person that can pay the quickest tends to be their preferred lender. With our enhancements to our mortgage center that we’ve been doing, we’re also hoping to be able to leverage this to speed up those processes as well,” Tucker said.

ABNB FCU’s experience with implementing new payment rails offers valuable insights for other credit unions considering similar initiatives. Tucker’s last bit of advice focused on strategy. “Divide and conquer. This is not something that one person or a project manager can take on alone. Make sure that you’re utilizing your people in the best ways possible. And set your metrics for success ahead. We defined what we wanted our adoption to be within the first 90 days, and we planned that out over the course of two years so that we have something to work towards and measure against. And last but not least, is always plan your work and always work your plan. And again, make sure you have a partner and not just a service provider. I sat through a webinar recently on FedNow and RTP, and there were some pretty big financial institutions on there talking about how they thought they were prepared, and they started working that implementation process and realized they weren’t quite prepared. It was just more than what they expected it to be. And I can honestly say I don’t feel that way. I actually have so much confidence in this product and our strategy for implementing it. And that’s because of the work that we’ve done with Alacriti, the communication, and the partnership that’s there. Whatever vendor you choose, just make sure that you guys are partners in that relationship because it really makes a difference.”

Moving Forward

One of the first considerations when connecting to an instant payments rail is whether or not to use a TPSP (Third Party Service Provider). Ksepka emphasized the need for a tailored approach to instant payments where financial institutions begin by assessing their unique capabilities, goals, and opportunities. “A service provider like Alacriti can help with mapping out this journey. My advice here would be, if you haven’t already, it really is time to get engaged and start preparing for instant payments. And having a conversation with your service provider is a good place to start.”

Gray shared that of the ~500 financial institutions on the RTP network, all but about 20 or 30 have used a TPSP like Alacriti or one of the core providers. “In the early days of RTP, a lot of the technology providers were just getting into this. Now, many of them have years of experience, like the guys at Alacriti. They’ve been there and done that. They’ve been through the lessons learned themselves and have proven capabilities at this point, both on the Receive side and the Send side.” Gray encouraged institutions to seek guidance from industry experts to find the right technology partner for their needs.

Majeske provided an overview of how Alacriti’s Orbipay Payments Hub payments as a service solution enables financial institutions to connect to various payment rails, including FedNow and RTP. The cloud-based, ISO 20022 native payments hub offers a “grow as you go” model, allowing institutions to start with specific rails and easily add more over time. Smart routing for transactions makes it possible to route payments to the best possible rail, e.g., Wire, ACH, Visa Direct, RTP, FedNow, etc. Orbipay Payments Hub uses open APIs and has pre-existing integration with many banking core and digital banking systems, making a short time to market possible.

Conclusion

In 2023, the instant payments industry witnessed significant growth, with the launch of FedNow and the expansion of the RTP network driving new use cases and services. The adoption of instant payments is expected to surge in sectors such as the gig economy, insurance claims, and bill payments, fueled by innovations like real-time crossborder payments and enhanced bill pay services. Financial institutions are increasingly leveraging technology partners like Alacriti for seamless integration and adopting a phased approach to implementation. As the industry moves forward, collaboration, customer-centric solutions, and strategic partnerships will be key in achieving widespread instant payments adoption.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.