Instant payments have been a significant topic of discussion, but the Automated Clearing House (ACH) remains an essential payments network, continually evolving through “ACH Modernization” initiatives. These initiatives aim to overhaul traditional ACH payment systems by offering faster, more secure, and versatile payment solutions. In a Banking Exchange-hosted webinar, Alex Romeo, Operations Strategy Vice President at Federal Reserve Financial Services, and Paul Steinbrecher, Director of Payments Consulting at Alacriti, explored the ongoing changes and future breakthroughs in ACH. This included the critical modernization of ACH services, its impact on the industry and future projections, and the benefits these modernized processes offer to businesses and consumers.

Quick Links

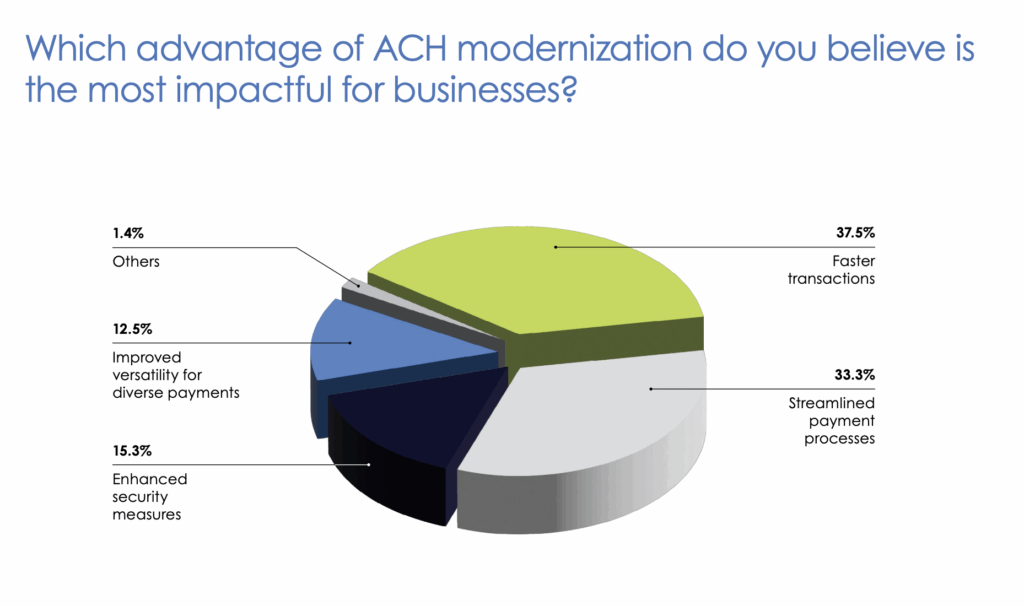

The webinar began with a poll that asked bankers what they believed was the top advantage of ACH modernization for businesses. Of the 72 respondents, faster transactions were the top advantage chosen at 37.5% with streamlined payment processes as a close second at 33.3%.

faster transactions were the top advantage chosen at 37.5% with streamlined payment processes as a close second at 33.3%.

The Evolution of ACH

Romeo provided a brief history of the ACH Network. The Federal Reserve Financial Services provides all the payment-related rails that the Federal Reserve System offers. They created the ACH network in the mid-1970s. It was stood up as an alternative to checks, which was the predominant payment channel. It was a batch store and forward system so data was originally transmitted with magnetic tapes couriered back and forth between third-party processors, banks, and operators. However, today there is electronic transmission.

Initially, there was one clearing and settlement window in the ACH network—8:30 a.m. ET on the following processing day. Forward credits originally were three business days. They evolved to two business days, then one business day, and by September 2016, there were Same Day ACH credits. Similarly, forward debits have evolved, beginning with two day debits then one day debits, and then same day debits, by September of 2017. “I think in the last few years, the greatest evolution made in the ACH network and modernization was the creation of Same Day ACH,” said Romeo.

Same Day ACH started with a dollar amount per transaction of $25,000. It increased to $100,000, and then $1m. There are three clearing and settlement windows (1:00 p.m. ET, 5:00 p.m. ET, and 6:00 p.m. ET) There are discussions of adding a later same day window, as well as weekend processing. While the network has evolved, the engine is still the same batch store and forward engine. The Fed has made it run faster, but it’s still based on the initial specifications. The modernization comes from all the players in the network— the entire ecosystem, third-party processors, and Nacha.

Financial Institution Platform Challenges

Steinbrecher shared what Alacriti has been hearing from clients as to what can be improved. One of the primary issues is the lack of automation, making it necessary for payment processing to have manual supervision. While a lot of systems are automated, sometimes they’re only partially automated. For example, it cannot originate a return or chargeback vs. having prebuilt rules. Manual fraud and risk analysis is another issue. For example, a financial institution will need to manually upload a file to a risk engine, wait for a response, and receive it via secure file transfer protocol or email, which ultimately expands the overall process and how many people have to interact with it. This adds to the manual data entries across customer and staff systems. Financial institutions are saying they would like exception management automation, such as rule-based intelligent posting that provides the ability to post differently for different segments of their clients. A potential use case involves preferential treatment for elite clients who desire expedited fund posting, as opposed to new accounts where there is a preference to delay the posting of funds. Deceased people can cause quite a few issues with a lack of automated exception management. If there’s a joint account with a deceased person and there’s a government payment that is delivered, it has to get rejected. Invalid account numbers are another example. Sometimes there are just leading zeros that can be easily corrected, but a lot of systems don’t have that capability. Late returns also require manual processing. The same applies to the creation of NOCs (Notices of Change). The absence of a system capable of automatically adjusting and distributing the NOC to the network is a significant limitation.

Steinbrecher also shared that disparate operations and reporting systems are a common problem. “Even if you have a solid reporting system for one rail and not the other, they’re generally separate and hard to bring together. Another thing that we’re hearing in the ACHprocessing world is there’s a lack of dynamic data. Getting overly raw data that is not specific to how many returns you may have had within a given timeframe. That makes it difficult overall to analyze and massage your overall payment strategy. At Alacriti we’ve built our system to accommodate these specific challenges.”

Rules

Nacha, the National Automated Clearinghouse Association, is a trade association founded in 1974 that promulgates the rules for the ACH network. They bring the industry together to not only create evolution, such as Same Day ACH, but also focus on risk management in the network. Nacha is the administrator of the ACH network. The rulemaking process at Nacha is an open and inclusive process. When creating a new rule, they will issue a request for comment, and then it goes to ballot for the Nacha members to vote on. Then there is an implementation process where Nacha provides resources, tools, and education.

Nacha is very engaged with both ACH operators. The three organizations convene monthly, and biannually they gather in person to discuss various topics related to the network, such as potential enhancements, issues pertaining to risk management, etc. There are a number of various committees that Nacha takes the lead on within their own organization, such as Risk Management Advisory, Rules and Operations, and System of Fines. Organizations can get involved in these committees to understand how the network and Nacha operate.

There are expected rule changes in 2024 which will need to go to ballot but have gone through the request for comment process and will likely pass based on initial feedback received by Nacha:

1

Expanded use of R17 funds

2

Funds Availability Exceptions

3

Timing of Written Statement of Unauthorized Debit

2

RDFI Prompt Return of Unauthorized Debit

Advantages of Modernized ACH Processes

Romeo spoke on the advantages of ACH evolution. “Whether you’re a business or a consumer, the advantages are being able to have options and choice. That’s good for all of us, whether we’re a business or consumer, because that oftentimes creates competition which leads to innovation and makes people’s lives better in general.”

Romeo asserted that ACH, Fedwire, and the FedNow Service shouldn’t be seen as competitive. “I see them as complementary. When looking at other geographies, the one that oftentimes is focused on UK’s Faster Payments Service (FPS). FPS was stood up in 2008. Meanwhile, the UK ACH network (Bacs) actually hasn’t lost volume. Instead, it has increased over time. Their wire system, (CHAPS), has also increased over time. So while FPS has taken hold and operates very well, some 15 years in the market, you can see in that marketplace, it hasn’t detracted from established and mature other payment systems. The volume comes from somewhere. So it may come from some other channels, and I’m not saying some won’t come from the ACH network or the Wire network, but I don’t think it’s going to be the type of volume that people are expecting where there’s going to be a mass migration of volume from these established networks over to the instant payment channel. So, complementary, not competitive, that’s my perspective. And again, it’s good to have options. Fed ACH clears and settles within hours. Fedwire funds clears and settles within minutes, and of course, FedNow clears and settles within seconds depending on what your needs are. Hours, minutes, seconds, what’s your preference? And depending on what that is, you can use that appropriate channel.” Romeo said.

“The last thought I want to share about the ACH network is you can see how it has evolved over time—the history of the ACH network is indeed rich. The network is industrial strength. It is tried, tested, and true. I believe when this year ends the network will have processed somewhere in the neighborhood of 31.5 billion transactions. That’s an awful lot of activity. And lastly, I believe the future of the ACH network is still bright,” Romeo concluded.

How Alacriti Can Help

Steinbrecher explained how Alacriti assists with the lack of automation in the ACH space. He emphasized Alacriti’s hub design to seamlessly accommodate instant payments rails, requiring automation from initiation to settlement around the clock. “Within our Orbipay Payments Hub, we can take that automation and that functionality and apply it across all rails,” Steinbrecher noted, highlighting the significant advancements in real-time validation and the creation of custom rules that facilitate a more streamlined, efficient process for handling ACH transactions.

Steinbrecher addressed the challenges financial institutions face with posting to different client segments, explaining how Orbipay’s rule-based payments routing allows for customized handling of incoming ACH transactions. This customization extends to managing ODFI transactions going outbound, with a comprehensive exceptionmanagement system that integrates with existing fraud and risk frameworks to automatically decide transactions based on established tolerances. “We have exception-management that could be fully automated,” he added, ensuring that transactions requiring review could be queued in real time for further inspection.

Orbipay Payments Hub provides substantial operational and reporting efficiencies. It is designed to manage daily workflows across all payment rails and use cases. Not only does the solution provide real-time data across all transactions, but it also simplifies risk management, daily operations, reconciliation, and settlement processes, as well as generates detailed, customizable reports. Stenbrecher stressed the importance of not only streamlining workflows, but also enhancing the payment experience for customers and members, many of whom might be unaware of the options available to them, such as FedNow alongside traditional ACH payments.

Looking towards the future, upcoming industry changes, such as the migration to ISO 20022 standards, make frictionless upgrades with minimal IT expenses and IT downtime critical. Orbipay Payments Hub does just that, while adapting to the specific needs of each financial institution.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.