Request for Payment (RFP) is emerging as a transformative capability that simplifies transactions and enhances customer experiences.

In the recent CUTimes-hosted webinar, Payments in 2025: Request for Payment Today and in the Future, Stuart Bain, SVP of Product Management at Alacriti, and Mark Majeske, SVP of Faster Payments at Alacriti, explored how RFP is already taking shape and what lies ahead. From the role of real-time payments networks like the RTP® network and FedNow® Service to the influence of Zelle, PayPal, and Venmo in shaping consumer behavior, the discussion covered current applications, future trends, and the potential for RFP to streamline account funding and other payment use cases.

Quick Links

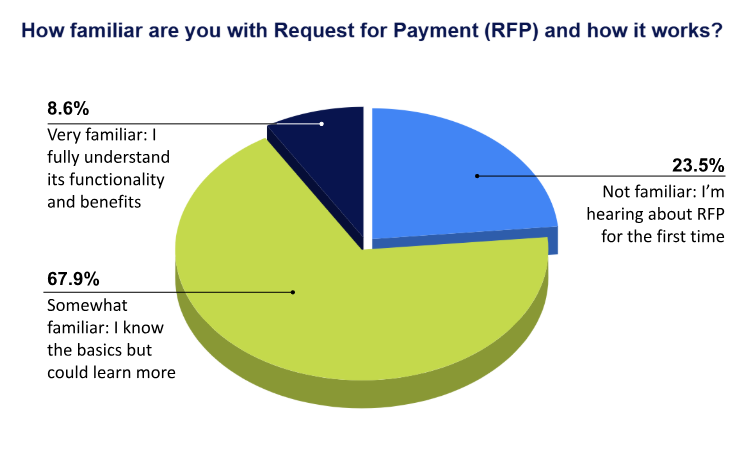

Audience Poll: Awareness of RFP

The webinar began with attendees participating in a live poll to gauge their familiarity with RFP. After collecting responses, Credit Union Times moderator Geoffery Metz shared the results, noting, “Looks like we have an audience that is somewhat familiar with RFP. Does that surprise either of you?” Both Bain and Majeske were unsurprised by the results. Bain responded, “No, no. That’s sort of what I was expecting,” Majeske agreed, stating, “Me as well.”

The poll results align with broader industry trends. While RFP is still evolving, financial institutions and credit unions are becoming increasingly aware of its applications. Consumers are already being introduced to similar functionalities through services like Zelle, PayPal, and Venmo, which allow users to request and approve payments seamlessly. With RFP set to become a key feature of the RTP network and FedNow Service, institutions with minimal understanding today will need to deepen their understanding to maximize the benefits in 2025 and beyond.

Network Updates: Understanding RFP

The RTP network has seen significant expansion since its launch seven years ago, now serving 800 financial institutions (FIs)1 . One of the most notable recent changes is the increase in the RTP transaction limit to $10 million, a substantial jump from its previous $1 million cap. “This was a rather bold move on The Clearing House to address some of those use cases that require larger amounts,” Majeske commented. For comparison, Same Day ACH remains at a $1 million limit, while the FedNow Service recently increased the $500,000 cap to $1 million.

On the FedNow side, 1,078 financial institutions have joined the network, with 1,289 routing transit numbers (RTNs) currently in the system. Unlike RTP, which has a mix of large and small institutions, FedNow primarily serves smaller financial institutions, leading to a different growth trajectory. While FedNow’s volume remains lower than RTP, it is steadily increasing, with 336,000 transactions processed in Q3 2024, totaling $17.5 billion in value. Majeske also noted that 656 RTNs are shared between the two networks, indicating a growing overlap in adoption.

The Evolution of RFP

RFP is currently in a proof-of-concept phase with The Clearing House, rolling out multiple phases to test various use cases. Phase 1 focused on low-risk transactions, such as account-to-account (A2A) wallet transfers and government payments, with participation from seven financial institutions. As the initiative expanded, Phase 2 introduced additional digital wallet and government payment use cases alongside an increase in adoption from billers. Majeske reported:

are now actively participating, reflecting growing industry interest in leveraging RFP for real-time transactions.

A key insight from early adoption is that most RFP transactions have been between financial institutions and brokerage firms, accounting for 98 percent of transactions in the pilot phase. This demonstrates RFP’s potential in fast-tracking money movement for investmentrelated transfers, ensuring timely funding for trades and financial transactions.

One of the first audience questions asked was how RFP guarantees payments. Majeske explained that payments through the RTP network settle immediately, ensuring that funds are available before the recipient even sees the deposit. “The settlement happens instantaneously, even before the funds get to the recipient,” he said. This contrasts with Zelle, which settles in three days via ACH, whereas RTP transactions are finalized in real time.

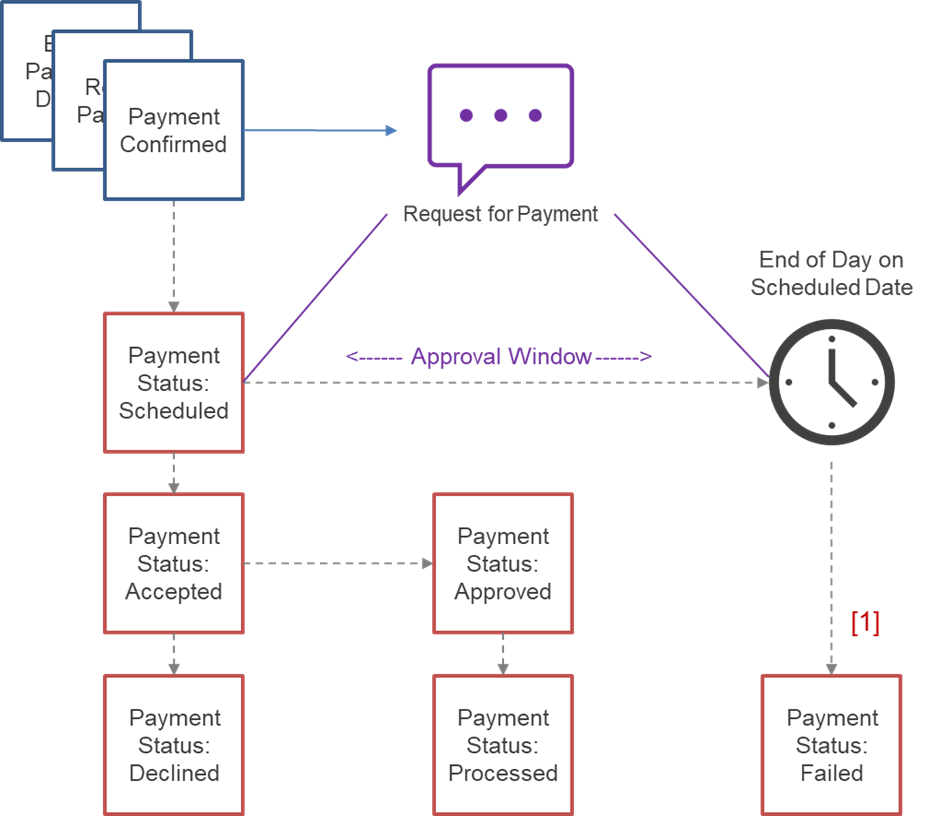

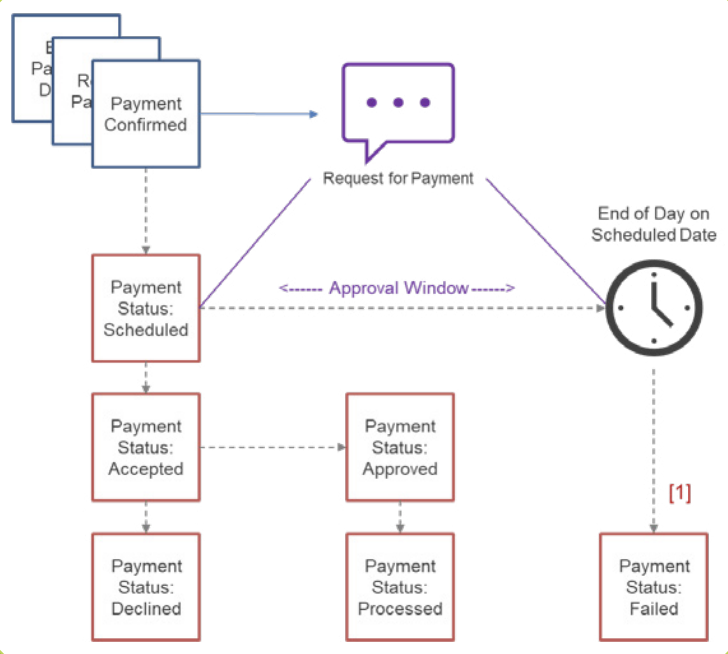

Understanding the RFP Process

Initiation and Processing

The initiation of an RFP payment follows the same fundamental steps as any other payment:

1

Enter

The payment details are entered into the system.

2

Review

The payer has the opportunity to verify the transaction details.

3

Confirm

Once confirmed, the RFP is sent to the receiving bank for processing.

At this stage, the receiving bank has the option to accept or reject the request based on its internal policies and security measures. If the RFP is rejected, the sender is notified immediately

Payment Confirmation and Messaging

If the RFP is accepted, the transaction moves to the confirmation stage. At this point, the payer receives messaging regarding the next steps and any relevant details about the payment. This communication ensures transparency and helps the payer understand what actions may be required.

The Approval Window: Expiration and Response Options

Each RFP includes an approval window, allowing the recipient to respond within a set timeframe before the request expires. Within this window, the payer has three options:

1

Decline the RFP

If the recipient chooses to decline, a realtime response is sent back to the requester, and no transaction takes place.

2

Approve the RFP

If the recipient approves, a credit transfer is generated and sent back to complete the transaction.

3

Take No Action

If the recipient does not respond within the expiration period, the RFP automatically expires and is marked as failed.

What an RFP Payment Flow Would Look Like

Adoption Challenges and Lessons Learned

Despite its promising use cases, RFP adoption is still in its early stages. However, one notable milestone occurred on November 2, 2024, when the network processed over 1 million RFPs in a single day. Majeske shared some of the early response rates:

of recipients responded with a payment.

let the RFP expire

The fact that one in four users allowed the RFP to expire suggests that some users may still be choosing to pay through other means, such as ACH or traditional payment methods. Majeske pointed out that one of the major takeaways from early RFP implementation is that billers need to educate recipients on how to receive and respond to an RFP, a crucial step in driving widespread adoption.

The Future of RFP in Payments

Looking ahead, Majeske and Bain emphasized that RFP is not intended to replace ACH debits but rather to complement existing payment methods. Bain addressed a common misconception, stating;

Instead, RFP will be most impactful for high-risk transactions and scenarios requiring user approval.

With networks expanding, transaction limits increasing, and early use cases proving successful, RFP is well-positioned to become a key component of real-time payment ecosystems in the coming years. However, financial institutions and billers will need to prioritize education and user experience enhancements to drive adoption and ensure seamless integration into consumer and business payment flows.

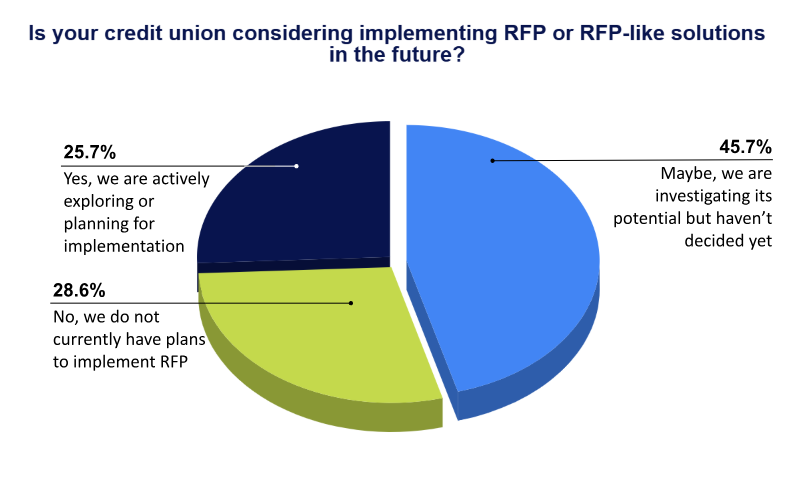

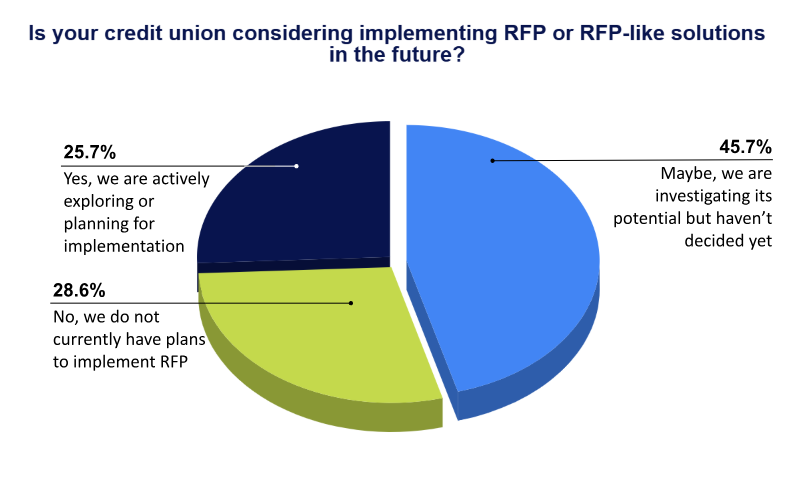

Audience Poll: Credit Union Interest in RFP

Attendees participated in a live poll to assess where credit unions stand on RFP adoption. The results reflected a wide range of perspectives, with some actively planning for implementation, others still in the investigative stage, and a significant number not currently considering RFP. After gathering responses, Metz shared the results. “Looks like a plurality is a maybe. There are some people who are definitely going ahead and taking a look and actively exploring, and a lot of people, though I’m surprised, are currently not planning to implement,” he said

Although the results aligned with Majeske’s expectations, he pointed out that many credit unions are taking an innovative approach. “I would say it’s what I expected. However, I would say that we’re working with a lot of credit unions today that are thinking outside the box and really starting to use these,” he said. He also noted that smaller credit unions, in particular, are leading the way in exploring RFP and finding ways to meet their members’ needs.

One of the biggest challenges for RFP adoption is network effects. “It currently faces a bit of a chicken and egg situation that you could spend the time and money to implement requests for pay, but there are not enough places to send it to. So why would you?” Bain said. He explained that greater adoption among large banks, reaching 60 to 70 percent DDA coverage, will likely drive broader adoption, making it more worthwhile for credit unions to invest in RFP solutions.

Current Use Cases and Solutions for RFP

One of the clearest examples of RFP-like functionality can be found in peer-to-peer (P2P) payment services such as Zelle, PayPal, Venmo, and Cash App. Bain pointed out that users of these platforms already engage in RFP-style transactions when they send payment requests to friends or family. He illustrated this with a real-world example, explaining how he and Majeske tested the feature in Zelle: “People are familiar with the concept of, ‘Hey, Marco owes me 20 bucks for dinner. I can send him a Request for Pay, and he can approve it and pay you back.'”

While these P2P services are primarily used for informal transactions, they provide a foundation for financial institutions considering broader RFP adoption. The challenge for credit unions and banks will be determining whether to integrate RFP into their existing money transfer functions or develop it as a standalone payment solution.

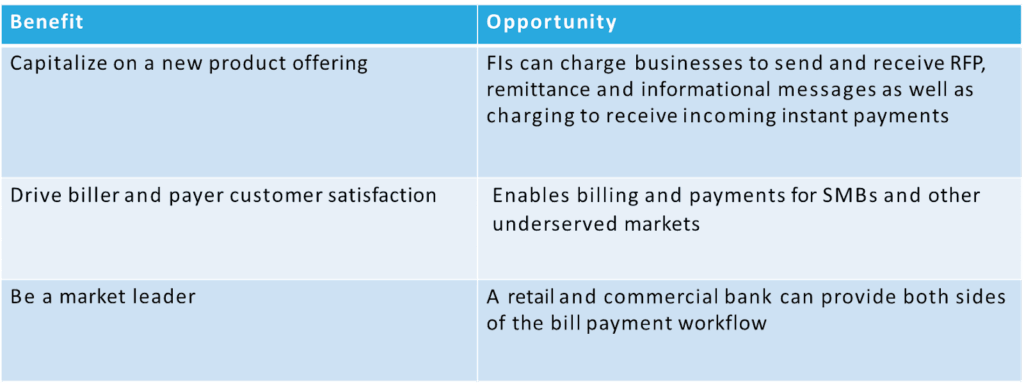

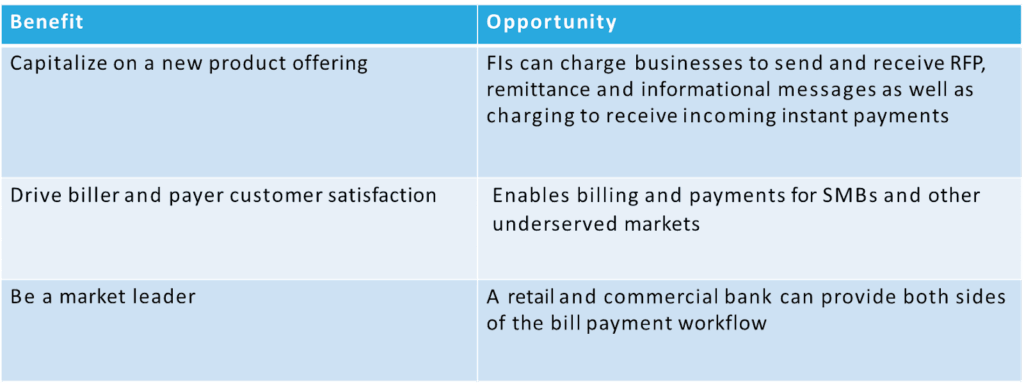

Benefits for FIs To Invest in Instant Payments and RFP

RFP in Bill Payments: Pay by Text and CSR Bill Notifications

Beyond P2P transactions, elements of RFP are already being applied to bill payments. Pay by Text, a service offered by Alacriti, is an example of an RFP-like model. With Pay by Text, users receive a bill reminder via SMS and can approve or decline payment directly from their phone. This process eliminates the need for traditional paper billing while maintaining the consumer’s ability to authorize payments before they are processed.

Similarly, customer service representative (CSR) bill notifications function as an on-demand request for payment. In this model, a CSR can send a payment request via email or text, including an embedded link that allows the recipient to sign in and authorize the transaction. These solutions help bridge the gap between traditional bill payment methods and real-time digital payments, offering a more interactive experience while preserving customer control.

Enhancing Payment Security

A key distinction between RFP and traditional ACH debits is its twostep authorization process. Unlike automated debits, RFP requires the recipient to actively approve the transaction, making it more secure and reducing payment disputes. “Some people think it’s just a faster ACH debit. It’s actually not. It’s a two-step process,” Bain explained. While RFP looks a bit like an ACH debit, it’s not because it’s not going to automatically debit the recipient’s account. They have to sign in to online banking and approve the transaction. This process ensures that payments are intentional and reduces the risk of insufficient funds or unauthorized debits.

Financial institutions implementing RFP have flexibility in how they allow users to approve payments. Some may choose to integrate approval mechanisms within online banking, while others could offer text-based confirmations, where users simply reply “Pay” or “Decline” to complete the transaction. This adaptability makes RFP a versatile tool for credit unions and banks as they develop their payment strategies.

With fraud concerns surrounding digital payments, an audience member asked how RFP addresses security risks, especially given issues that have arisen with Zelle. Majeske answered that financial institutions should screen RFP transactions just as they do payments.

Bain added that The Clearing House has taken lessons from fraud cases with Zelle and incorporated additional rules to prevent bad actors from misusing the network. “Looking at the messages, is it reasonable that this individual should be releasing a thousand requests for pays in a day and things like that?” he asked.

Moving Toward Widespread Adoption

While RFP is still in its early stages, it is already showing promise as a secure, user-friendly alternative to traditional payment methods. Bain and Majeske predicted that RFP adoption is likely to accelerate in a year as more financial institutions integrate the feature into their payment ecosystems. In the meantime, existing solutions like P2P payment requests, Pay by Text, and CSR bill notifications provide a strong foundation for familiarizing consumers with the concept.

Implementation challenges extend beyond network compatibility, requiring financial institutions to focus on refining the customer experience. Developing robust notification systems, clear approval flows, and effective user education will be essential to ensuring a seamless transition to RFP. Institutions must consider how best to inform members of incoming requests, provide intuitive approval options, and integrate these processes into their existing digital banking platforms.

Future Trends in RFP

One of the most significant drivers of RFP adoption is the push to eliminate paper checks and cash-based payments. Majeske explained that RTP was not built to compete with ACH or wire transfers but rather to reduce the reliance on paper-based remittances, which remain a major source of fraud. “If you avoid the paper check in the mail, you’re obviously increasing your ability to run liquidity management. You’re going to get your funds faster and help cash flow, but at the same time, it makes it safer as well from the consumer side.”

RFP has the potential to replace traditional invoicing methods by allowing businesses to send real-time payment requests directly to consumers or other businesses. This capability enhances cash flow management, ensuring payments are received on time while offering a more convenient experience for payers.

Another emerging trend is the use of RFP in loan disbursements and auto financing. Credit unions and other financial institutions are exploring how RFP can accelerate funding for car purchases and real estate transactions, eliminating delays associated with traditional payment methods.

Bain pointed out that loan disbursements are a key area where RFP can provide value, particularly in cases where borrowers need funds immediately. “People are borrowing money because they need the money. So how do you get it to them quickly, conveniently, safely where maybe other providers couldn’t?” He noted that some credit unions are already working with auto dealerships to facilitate instant loan disbursements via RFP, ensuring that dealerships receive guaranteed funds in real time.

Additionally, RFP can streamline the process of purchasing cars on weekends or outside of traditional banking hours. Instead of relying on cashier’s checks, which require a trip to a branch, consumers could authorize an RFP in seconds, providing dealerships with immediate access to secure funds.

Enhancing Security and Fraud Prevention

RFP is also gaining attention as a tool to combat fraud in high-value transactions, particularly in real estate. Majeske shared an example of how fraudsters exploit email communications in wire transfers, intercepting payment instructions, and redirecting funds to fraudulent accounts.

By leveraging RFP, title companies could request funds directly from buyers, ensuring that payments are sent securely and received instantly. This eliminates the risk of fraudsters intercepting wire instructions while providing a seamless and verified payment experience. With RTP’s new $10 million transaction limit, RFP is now even more well-suited for large transactions such as real estate closings.

The Path Forward for RFP

As more financial institutions recognize the benefits of RFP, adoption is expected to accelerate, particularly in industries that rely on fast and secure payments. Whether for replacing paper checks, improving loan disbursements, or securing high-value transactions, RFP offers a flexible and secure alternative to traditional payment methods.

However, widespread adoption will depend on ongoing education and standardization. Financial institutions must work closely with businesses and consumers to ensure they understand how RFP works and the advantages it provides. As Bain emphasized, “The goal here is to identify specifically where there are pain points with the existing payment solutions, and then also managing risk,” Bain emphasized. By integrating RFP into key use cases such as loan disbursements, delinquent payments, and high-value transactions, financial institutions can enhance both security and efficiency in real-time payments.

Audience Poll: Awareness of RFP

How familiar are you with Request for Payment (RFP) and how it works?

The webinar began with attendees participating in a live poll to gauge their familiarity with RFP. After collecting responses, Credit Union Times moderator Geoffery Metz shared the results, noting, “Looks like we have an audience that is somewhat familiar with RFP. Does that surprise either of you?” Both Bain and Majeske were unsurprised by the results. Bain responded, “No, no. That’s sort of what I was expecting,” Majeske agreed, stating, “Me as well.”

The poll results align with broader industry trends. While RFP is still evolving, financial institutions and credit unions are becoming increasingly aware of its applications. Consumers are already being introduced to similar functionalities through services like Zelle, PayPal, and Venmo, which allow users to request and approve payments seamlessly. With RFP set to become a key feature of the RTP network and FedNow Service, institutions with minimal understanding today will need to deepen their understanding to maximize the benefits in 2025 and beyond.

Network Updates: Understanding RFP

The RTP network has seen significant expansion since its launch seven years ago, now serving 800 financial institutions (FIs)1 . One of the most notable recent changes is the increase in the RTP transaction limit to $10 million, a substantial jump from its previous $1 million cap. “This was a rather bold move on The Clearing House to address some of those use cases that require larger amounts,” Majeske commented. For comparison, Same Day ACH remains at a $1 million limit, while the FedNow Service recently increased the $500,000 cap to $1 million.

On the FedNow side, 1,078 financial institutions have joined the network, with 1,289 routing transit numbers (RTNs) currently in the system. Unlike RTP, which has a mix of large and small institutions, FedNow primarily serves smaller financial institutions, leading to a different growth trajectory. While FedNow’s volume remains lower than RTP, it is steadily increasing, with 336,000 transactions processed in Q3 2024, totaling $17.5 billion in value. Majeske also noted that 656 RTNs are shared between the two networks, indicating a growing overlap in adoption.

The Evolution of RFP

RFP is currently in a proof-of-concept phase with The Clearing House, rolling out multiple phases to test various use cases. Phase 1 focused on low-risk transactions, such as account-to-account (A2A) wallet transfers and government payments, with participation from seven financial institutions. As the initiative expanded, Phase 2 introduced additional digital wallet and government payment use cases alongside an increase in adoption from billers. Majeske reported:

are now actively participating, reflecting growing industry interest in leveraging RFP for real-time transactions.

A key insight from early adoption is that most RFP transactions have been between financial institutions and brokerage firms, accounting for 98 percent of transactions in the pilot phase. This demonstrates RFP’s potential in fast-tracking money movement for investmentrelated transfers, ensuring timely funding for trades and financial transactions.

One of the first audience questions asked was how RFP guarantees payments. Majeske explained that payments through the RTP network settle immediately, ensuring that funds are available before the recipient even sees the deposit. “The settlement happens instantaneously, even before the funds get to the recipient,” he said. This contrasts with Zelle, which settles in three days via ACH, whereas RTP transactions are finalized in real time.

Understanding the RFP Process

Initiation and Processing

The initiation of an RFP payment follows the same fundamental steps as any other payment:

1

Enter

The payment details are entered into the system.

2

Review

The payer has the opportunity to verify the transaction details.

3

Confirm

Once confirmed, the RFP is sent to the receiving bank for processing.

At this stage, the receiving bank has the option to accept or reject the request based on its internal policies and security measures. If the RFP is rejected, the sender is notified immediately

Payment Confirmation and Messaging

If the RFP is accepted, the transaction moves to the confirmation stage. At this point, the payer receives messaging regarding the next steps and any relevant details about the payment. This communication ensures transparency and helps the payer understand what actions may be required.

The Approval Window: Expiration and Response Options

Each RFP includes an approval window, allowing the recipient to respond within a set timeframe before the request expires. Within this window, the payer has three options:

1

Decline the RFP

If the recipient chooses to decline, a realtime response is sent back to the requester, and no transaction takes place.

2

Approve the RFP

If the recipient approves, a credit transfer is generated and sent back to complete the transaction.

3

Take No Action

If the recipient does not respond within the expiration period, the RFP automatically expires and is marked as failed.

What an RFP Payment Flow Would Look Like

Adoption Challenges and Lessons Learned

Despite its promising use cases, RFP adoption is still in its early stages. However, one notable milestone occurred on November 2, 2024, when the network processed over 1 million RFPs in a single day. Majeske shared some of the early response rates:

70% of recipients responded with a payment.

let the RFP expire

The fact that one in four users allowed the RFP to expire suggests that some users may still be choosing to pay through other means, such as ACH or traditional payment methods. Majeske pointed out that one of the major takeaways from early RFP implementation is that billers need to educate recipients on how to receive and respond to an RFP, a crucial step in driving widespread adoption.

The Future of RFP in Payments

Looking ahead, Majeske and Bain emphasized that RFP is not intended to replace ACH debits but rather to complement existing payment methods. Bain addressed a common misconception, stating;

Instead, RFP will be most impactful for high-risk transactions and scenarios requiring user approval.

With networks expanding, transaction limits increasing, and early use cases proving successful, RFP is well-positioned to become a key component of real-time payment ecosystems in the coming years. However, financial institutions and billers will need to prioritize education and user experience enhancements to drive adoption and ensure seamless integration into consumer and business payment flows.

Audience Poll: Credit Union Interest in RFP

Attendees participated in a live poll to assess where credit unions stand on RFP adoption. The results reflected a wide range of perspectives, with some actively planning for implementation, others still in the investigative stage, and a significant number not currently considering RFP. After gathering responses, Metz shared the results. “Looks like a plurality is a maybe. There are some people who are definitely going ahead and taking a look and actively exploring, and a lot of people, though I’m surprised, are currently not planning to implement,” he said

Although the results aligned with Majeske’s expectations, he pointed out that many credit unions are taking an innovative approach. “I would say it’s what I expected. However, I would say that we’re working with a lot of credit unions today that are thinking outside the box and really starting to use these,” he said. He also noted that smaller credit unions, in particular, are leading the way in exploring RFP and finding ways to meet their members’ needs.

One of the biggest challenges for RFP adoption is network effects. “It currently faces a bit of a chicken and egg situation that you could spend the time and money to implement requests for pay, but there are not enough places to send it to. So why would you?” Bain said. He explained that greater adoption among large banks, reaching 60 to 70 percent DDA coverage, will likely drive broader adoption, making it more worthwhile for credit unions to invest in RFP solutions.

Current Use Cases and Solutions for RFP

One of the clearest examples of RFP-like functionality can be found in peer-to-peer (P2P) payment services such as Zelle, PayPal, Venmo, and Cash App. Bain pointed out that users of these platforms already engage in RFP-style transactions when they send payment requests to friends or family. He illustrated this with a real-world example, explaining how he and Majeske tested the feature in Zelle: “People are familiar with the concept of, ‘Hey, Marco owes me 20 bucks for dinner. I can send him a Request for Pay, and he can approve it and pay you back.'”

While these P2P services are primarily used for informal transactions, they provide a foundation for financial institutions considering broader RFP adoption. The challenge for credit unions and banks will be determining whether to integrate RFP into their existing money transfer functions or develop it as a standalone payment solution.

Benefits for FIs To Invest in Instant Payments and RFP

RFP in Bill Payments: Pay by Text and CSR Bill Notifications

Beyond P2P transactions, elements of RFP are already being applied to bill payments. Pay by Text, a service offered by Alacriti, is an example of an RFP-like model. With Pay by Text, users receive a bill reminder via SMS and can approve or decline payment directly from their phone. This process eliminates the need for traditional paper billing while maintaining the consumer’s ability to authorize payments before they are processed.

Similarly, customer service representative (CSR) bill notifications function as an on-demand request for payment. In this model, a CSR can send a payment request via email or text, including an embedded link that allows the recipient to sign in and authorize the transaction. These solutions help bridge the gap between traditional bill payment methods and real-time digital payments, offering a more interactive experience while preserving customer control.

Enhancing Payment Security

A key distinction between RFP and traditional ACH debits is its twostep authorization process. Unlike automated debits, RFP requires the recipient to actively approve the transaction, making it more secure and reducing payment disputes. “Some people think it’s just a faster ACH debit. It’s actually not. It’s a two-step process,” Bain explained. While RFP looks a bit like an ACH debit, it’s not because it’s not going to automatically debit the recipient’s account. They have to sign in to online banking and approve the transaction. This process ensures that payments are intentional and reduces the risk of insufficient funds or unauthorized debits.

Financial institutions implementing RFP have flexibility in how they allow users to approve payments. Some may choose to integrate approval mechanisms within online banking, while others could offer text-based confirmations, where users simply reply “Pay” or “Decline” to complete the transaction. This adaptability makes RFP a versatile tool for credit unions and banks as they develop their payment strategies.

With fraud concerns surrounding digital payments, an audience member asked how RFP addresses security risks, especially given issues that have arisen with Zelle. Majeske answered that financial institutions should screen RFP transactions just as they do payments.

Bain added that The Clearing House has taken lessons from fraud cases with Zelle and incorporated additional rules to prevent bad actors from misusing the network. “Looking at the messages, is it reasonable that this individual should be releasing a thousand requests for pays in a day and things like that?” he asked.

Moving Toward Widespread Adoption

While RFP is still in its early stages, it is already showing promise as a secure, user-friendly alternative to traditional payment methods. Bain and Majeske predicted that RFP adoption is likely to accelerate in a year as more financial institutions integrate the feature into their payment ecosystems. In the meantime, existing solutions like P2P payment requests, Pay by Text, and CSR bill notifications provide a strong foundation for familiarizing consumers with the concept.

Implementation challenges extend beyond network compatibility, requiring financial institutions to focus on refining the customer experience. Developing robust notification systems, clear approval flows, and effective user education will be essential to ensuring a seamless transition to RFP. Institutions must consider how best to inform members of incoming requests, provide intuitive approval options, and integrate these processes into their existing digital banking platforms.

Future Trends in RFP

One of the most significant drivers of RFP adoption is the push to eliminate paper checks and cash-based payments. Majeske explained that RTP was not built to compete with ACH or wire transfers but rather to reduce the reliance on paper-based remittances, which remain a major source of fraud. “If you avoid the paper check in the mail, you’re obviously increasing your ability to run liquidity management. You’re going to get your funds faster and help cash flow, but at the same time, it makes it safer as well from the consumer side.”

RFP has the potential to replace traditional invoicing methods by allowing businesses to send real-time payment requests directly to consumers or other businesses. This capability enhances cash flow management, ensuring payments are received on time while offering a more convenient experience for payers.

Another emerging trend is the use of RFP in loan disbursements and auto financing. Credit unions and other financial institutions are exploring how RFP can accelerate funding for car purchases and real estate transactions, eliminating delays associated with traditional payment methods.

Bain pointed out that loan disbursements are a key area where RFP can provide value, particularly in cases where borrowers need funds immediately. “People are borrowing money because they need the money. So how do you get it to them quickly, conveniently, safely where maybe other providers couldn’t?” He noted that some credit unions are already working with auto dealerships to facilitate instant loan disbursements via RFP, ensuring that dealerships receive guaranteed funds in real time.

Additionally, RFP can streamline the process of purchasing cars on weekends or outside of traditional banking hours. Instead of relying on cashier’s checks, which require a trip to a branch, consumers could authorize an RFP in seconds, providing dealerships with immediate access to secure funds.

Enhancing Security and Fraud Prevention

RFP is also gaining attention as a tool to combat fraud in high-value transactions, particularly in real estate. Majeske shared an example of how fraudsters exploit email communications in wire transfers, intercepting payment instructions, and redirecting funds to fraudulent accounts.

By leveraging RFP, title companies could request funds directly from buyers, ensuring that payments are sent securely and received instantly. This eliminates the risk of fraudsters intercepting wire instructions while providing a seamless and verified payment experience. With RTP’s new $10 million transaction limit, RFP is now even more well-suited for large transactions such as real estate closings.

The Path Forward for RFP

As more financial institutions recognize the benefits of RFP, adoption is expected to accelerate, particularly in industries that rely on fast and secure payments. Whether for replacing paper checks, improving loan disbursements, or securing high-value transactions, RFP offers a flexible and secure alternative to traditional payment methods.

However, widespread adoption will depend on ongoing education and standardization. Financial institutions must work closely with businesses and consumers to ensure they understand how RFP works and the advantages it provides. As Bain emphasized, “The goal here is to identify specifically where there are pain points with the existing payment solutions, and then also managing risk,” Bain emphasized. By integrating RFP into key use cases such as loan disbursements, delinquent payments, and high-value transactions, financial institutions can enhance both security and efficiency in real-time payments.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.