As the demand for speed and convenience in payments continues to grow, credit unions face the challenge of modernizing without abandoning the reliability of legacy systems.

In a recent CUTimes-hosted webinar, ACH & Real-Time Payments: Finding the Right Mix for Your Institution, Alacriti’s Neeraj Gupta, SVP of Product Management, explored how credit unions can navigate this shift by leveraging both ACH and instant payments through a unified payments hub. The discussion covered how to balance payment rails effectively, optimize smart routing, enhance the member experience, and strategically price services to drive revenue—all while laying a foundation for long-term growth.

Quick Links

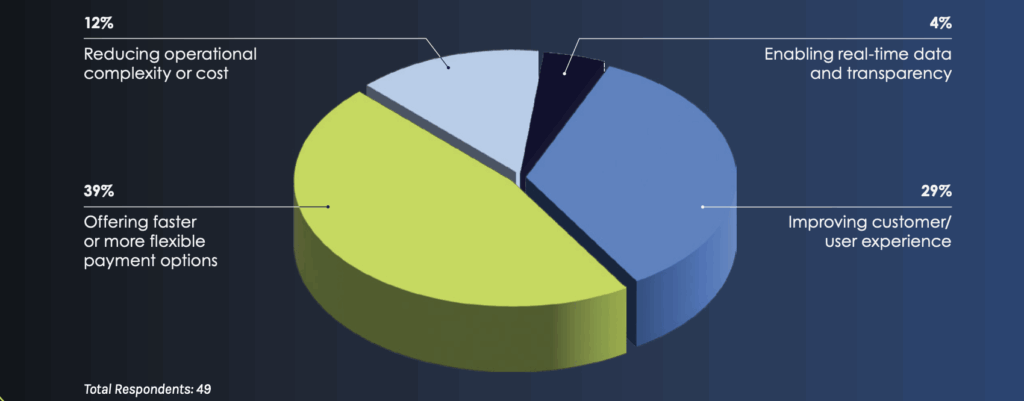

Audience Poll: What’s Driving Payments Modernization for Credit Unions?

What is the primary goal of your payments modernization efforts?

The webinar opened with a poll asking attendees to identify their primary goal for payments modernization. The leading response was offering faster, more flexible payment options.

This focus on speed comes as no surprise to Gupta, who noted that nearly every conversation with credit unions points to one common theme.

While the poll offered five choices—including improving customer experience, reducing operational complexity, and keeping up with industry change—Gupta suggested that these goals are often interconnected. “Clients will want to [offer faster payments], but they’re hampered by old legacy tech, hard to update, hard to maintain,” he explained. “That may be something that’s within their vendor ecosystem, or it could be around bolstering the member experience.”

Whether the motivation is user experience or competitive parity, credit unions recognize that time-to-market is a critical factor in payments innovation.

How Credit Unions Are Rethinking Payments Modernization

While the industry has long understood the importance of digital transformation, the urgency around payments modernization has reached a tipping point—driven by shifting consumer expectations, rising competition from fintechs, and rapid adoption of real-time payment rails.

Today’s consumers aren’t just looking for sleek mobile apps—they’re demanding fast, seamless, always-on money movement experiences. And they’re willing to walk if they don’t get them.

of U.S. consumers said they would consider switching their primary financial institution to a more innovative credit union or bank. By the end of 2022, that number had surged to 29%.

What’s behind this shift? A Salesforce report showed that 49% of consumers cited digital experience as the leading reason they’d switch providers, followed closely by ecosystem integration (31%)—the ability to connect seamlessly with other apps and services they use every day.

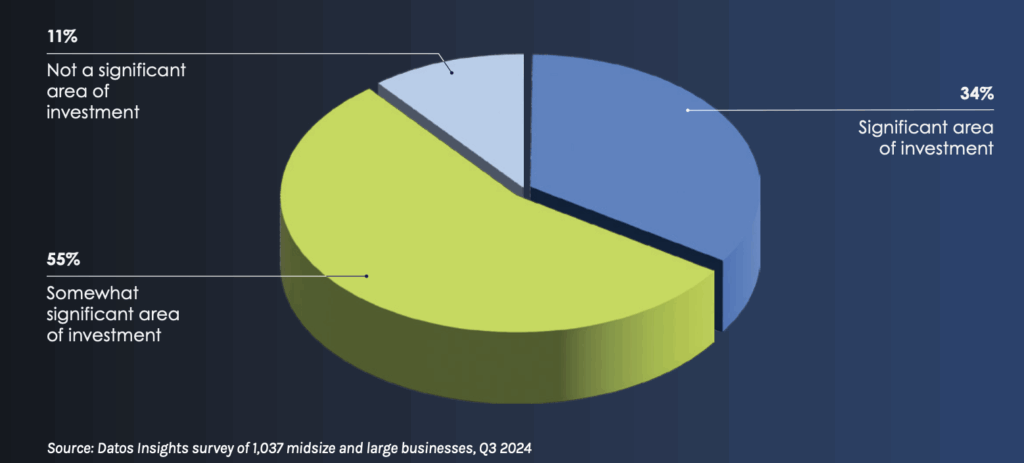

Not surprisingly, credit unions are re-evaluating their payments tech stacks to better compete. “We find that nearly… almost 90% of institutions across the U.S. are investing and investing materially in their payments tech stack,” Gupta added, referencing Datos Insights research.

How significant do you expect your organization’s investment in improving payments technology to be in the next 24 to 36 months?

(Base: 296 midsize and large U.S. businesses)

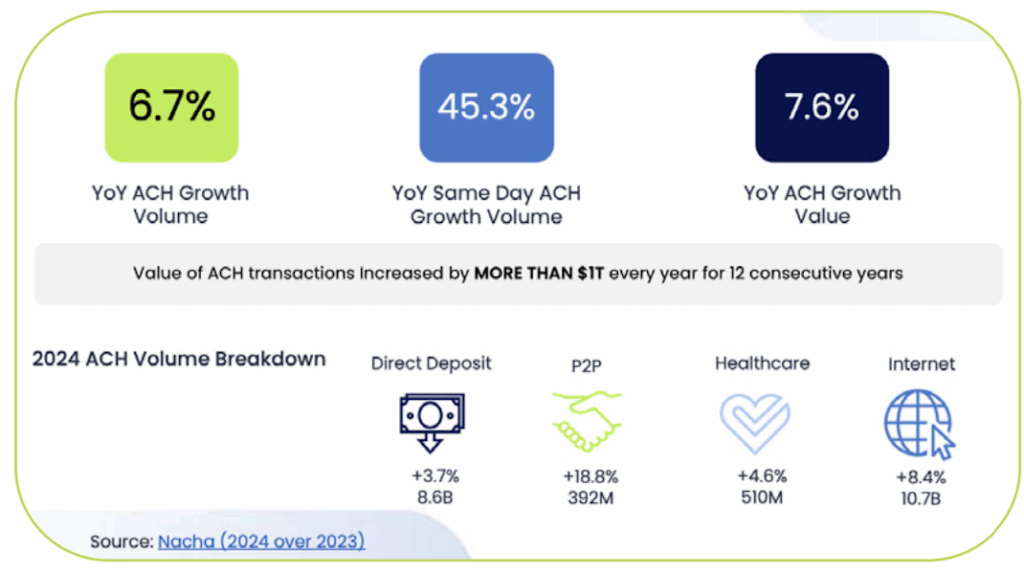

But modernization isn’t just about new technology—it’s about rebalancing the payments mix. Real-time payment networks like the RTP® network and the FedNow® Service are seeing significant year-over-year growth in both volume and institutional adoption. At the same time, ACH remains the most widely used rail, with steadily rising volumes across a variety of use cases, including direct deposit, P2P, and healthcare disbursements.

The key takeaway is that payment rails aren’t in competition—they’re complementary. Credit unions need both. And while real-time payments are on the rise, ACH is “not going anywhere,” Gupta affirmed. But he also cautioned that legacy ACH systems present challenges: “It’s often a bit of a lead balloon that delays time to market, that undermines member experience and continues to accrue expense.” Success lies not in choosing between payment rails but in orchestrating them intelligently to deliver the seamless experiences members expect.

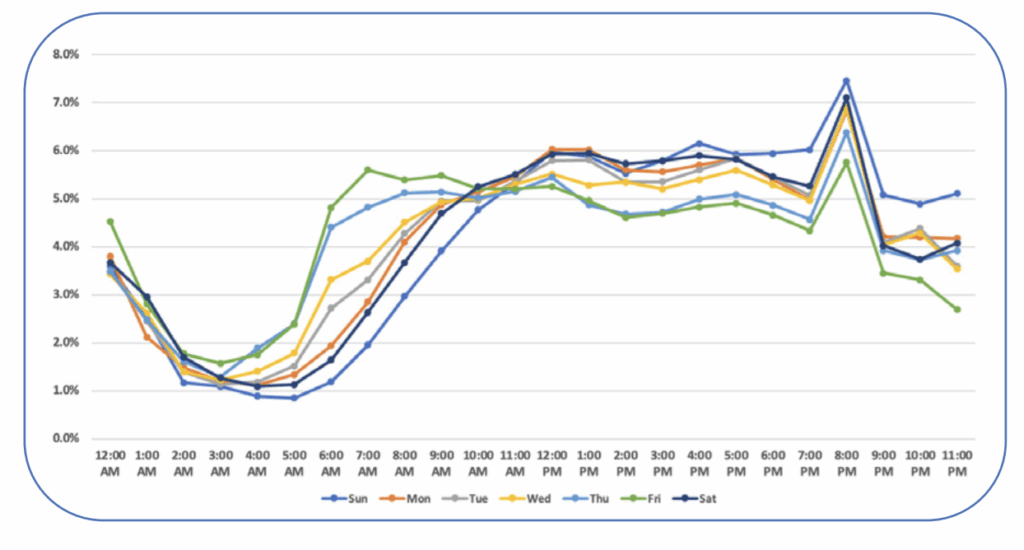

Interestingly, usage data from Alacriti revealed that 69% of real-time payment activity occurred outside of traditional banking hours—early mornings, evenings, and weekends—confirming that demand for around-the-clock access to funds is not just real but accelerating

Audience Poll: Balancing ACH and Real-Time Payments

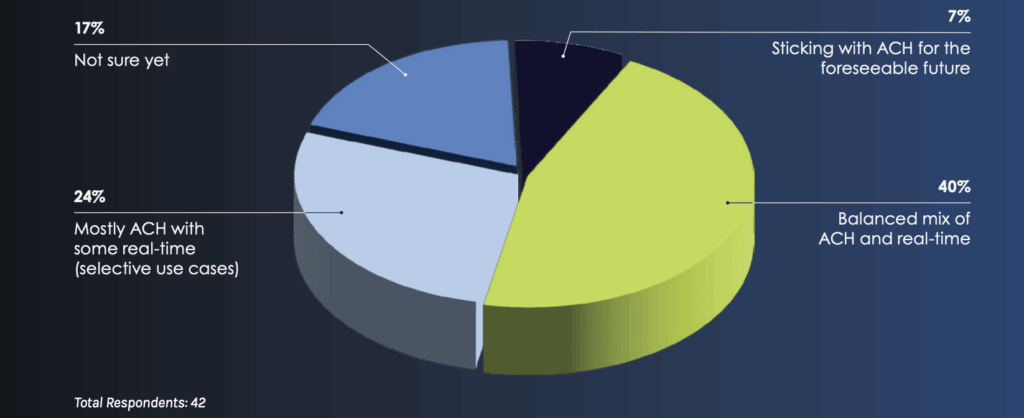

How do you see the future mix of ACH and real-time payments in your organization?

The audience was asked to weigh in on how they see the future mix of ACH and real-time payments evolving at their institutions. The results: 40% of attendees indicated they expect a balanced mix of both. That outcome aligns closely with what’s being seen in the market today. “I think for the next few years at least, I expect to see a balanced mix,” said Gupta. “ACH is the lead dog here, right? In terms of it doing a lot of heavy lifting. I don’t see that going anywhere.

While instant payments are gaining ground in adoption and relevance, ACH continues to serve as the backbone of routine money movement— especially for high-volume, recurring transactions like payroll, bill pay, and government disbursements. For now, most financial institutions aren’t looking to replace ACH but rather to augment it with real-time options for speed-sensitive or after-hours use cases.

Matching Use Cases to the Right Payment Rail

As financial institutions expand their payments capabilities, the question is no longer whether to adopt real-time payments—it’s how and where to use them. For credit unions especially, understanding which payment rails are best suited for specific use cases is becoming a strategic differentiator in serving members, managing costs, and unlocking new opportunities.

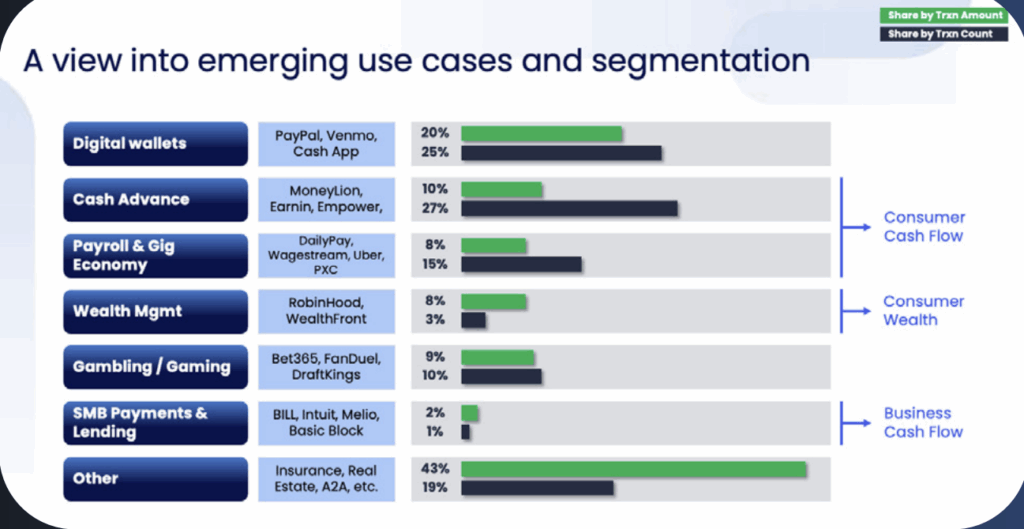

For Alacriti’s client base, one area seeing substantial activity is digital wallet defunding—customers moving funds out of platforms like PayPal, Venmo, and Square into their credit union accounts. “We see 1 in 5 is being sent by one of those,” Gupta noted, making it clear that these real-time rail use cases are already deeply embedded in daily financial habits.

But real-time usage extends far beyond wallets. Gupta shared that by grouping use cases like cash advances, earned wage access, gig economy payouts, and payroll under a category called consumer cash flow, a clear trend emerges. Across all Alacriti clients, these use cases represent about 18% of the total real-time payment dollar volume. In some cases, however, they dominate.

Still, ACH remains critical—especially where predictability and cost efficiency matter more than speed. “We see ACH to be most relevant, where predictability and efficiency trump speed,” Gupta explained. Examples include regular bill payments, payroll, tuition, and government disbursements—transactions where timing is planned and costs are kept low.

In contrast, real-time rails shine in scenarios where immediacy is essential. “This is where availability and real-time action over cost is prioritized,” Gupta said. Use cases like loan disbursements, emergency funds access, and peer-to-peer transfers are proving to be well-suited to the always-on nature of RTP and FedNow.

The takeaway for credit unions? It’s not about replacing one rail with another. It’s about building a smart, adaptable ecosystem—one that routes payments based on the needs of the moment, the preferences of the member, and the strategic goals of the institution.

Interoperability in Action

Many credit unions are realizing that simply adding new rails isn’t enough. The future lies in orchestrating seamless connectivity across legacy and real-time systems—creating a unified, intelligent engine that manages the full lifecycle of payments. That’s the promise of true interoperability, which can be achieved with a centralized, cross-rail payments hub.

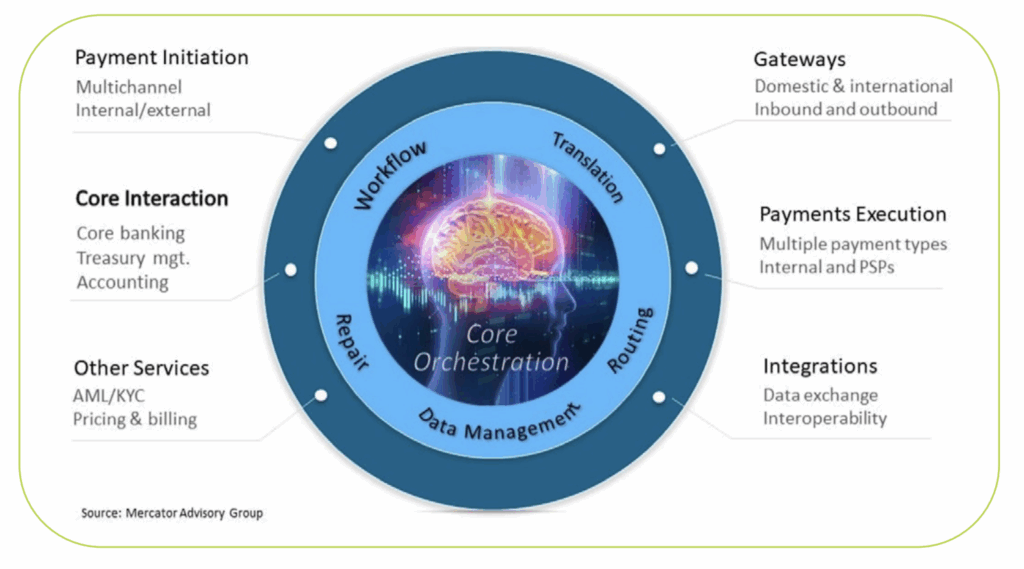

This concept goes beyond technical integration. “It’s about building a cross-rail engine that helps both in managing and executing payments across the entire lifecycle, but also gaining visibility therein,” said Gupta. These centralized systems—also known as payments hubs—serve as the orchestration layer between internal systems and the variety of external payment rails, including ACH, RTP, FedNow, and wires.

Gupta referred to a Mercator (now Javelin) framework to illustrate the value of this structure. At the core is an orchestration “brain” tailored to each credit union’s specific policies and procedures. Surrounding it is a network of workhorses that execute payments in line with those rules. On the outer edge is the integration layer that connects to digital banking, core systems, fraud management, CRM, document workflows, and, of course, the payment rails themselves.

The benefit of interoperability isn’t just in technical performance— it’s in delivering a consistent, intelligent member experience. “These engines are going to be helpful in terms of operational efficiency. But where we find our clients start telling us they find a lot of the power is in bolstering that member experience,” Gupta explained.

A well-designed hub enables financial institutions to present a single, user-friendly interface—regardless of rail. For instance, members no longer need to know whether a transaction is best handled through ACH or FedNow. The system can recommend the optimal path based on speed, cost, or destination. “A central cross-rail engine has helped a lot of institutions to present a rail-agnostic origination experience to their members,” Gupta noted. Instead of multiple buttons and pathways, members are shown a streamlined interface that hides the complexity and highlights what matters: outcomes.

This model also creates opportunities for intelligent routing and behavioral steering. Whether it’s driving lower-cost rails, prioritizing certain partners, or presenting promotional offers, interoperability becomes a strategic tool.

How Credit Unions Are Monetizing Real-Time Payments

Credit unions face a critical business question: how can these services be monetized without alienating members or disrupting long-standing pricing models? While ACH has long operated as a cost-effective backbone of payment processing—often priced per transaction or bundled into business packages—real-time payments require a new mindset. To turn this shift into a revenue opportunity, many credit unions are adopting tiered and value-based pricing strategies.

According to Gupta, traditional ACH pricing models typically fall into one of three categories:

A per-click or per-payment fee (typically with all these waived for the retail/consumer segment)

Flat monthly fee for SMBs or commercial clients allowing for a set number of payments

A bundled approach where ACH transactions are included in a broader treasury package

The monetization of real-time payments, however, introduces new possibilities. One increasingly popular method is a tiered, valuebased pricing structure—charging a premium for the added speed and convenience of instant settlement. “Maybe it’s 5 cents for an ACH, 25 cents for a real-time payment,” Gupta shared. “We find that helps empower the consumers to make that choice and to make it very clear what they’re paying for.” This transparency can work in favor of both institutions and their members. By clearly delineating the cost and benefit of each payment rail, credit unions can enhance the member experience while supporting new revenue streams—without completely overhauling their existing model.

Several audience questions addressed how to drive real-time payment adoption through pricing. Gupta shared that some financial institutions are offering discounted or even free receipt of instant payments to grow usage. Others are subsidizing infrastructure costs to “tilt the table” toward real-time. These early efforts aim to make instant payments more attractive, especially for commercial clients where the demand—and revenue potential—is greater.

As credit unions face increasing pressure to modernize, the path forward isn’t about choosing between ACH and real-time payments— it’s about orchestrating both for maximum flexibility, efficiency, and member satisfaction. By adopting centralized payment hubs, implementing smart routing, and exploring thoughtful pricing strategies, credit unions can transform their payments infrastructure into a competitive advantage. The future of payments is not one-sizefits-all—it’s agile, interoperable, and aligned with both the evolving needs of members and the institution.

As credit unions face increasing pressure to modernize, the path forward isn’t about choosing between ACH and real-time payments— it’s about orchestrating both for maximum flexibility, efficiency, and member satisfaction. By adopting centralized payment hubs, implementing smart routing, and exploring thoughtful pricing strategies, credit unions can transform their payments infrastructure into a competitive advantage. The future of payments is not one-sizefits-all—it’s agile, interoperable, and aligned with both the evolving needs of members and the institution.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.