In the payments industry, the adoption of real-time payments has become a focal point for businesses, both within the small and medium-sized business (SMB) sector and among mid-to-large corporations. While there is an eagerness of businesses to invest in new payments technologies, there are also challenges faced by financial institutions in adapting to these changing demands.

Erika Baumann, Director of Datos Insights’ Commercial Banking & Payments practice, leveraged extensive data gathered from over 120 banks and surveys of more than a thousand businesses, to provide insight into this transformative trend in a presentation to Alacriti. Download this report for survey results.

Quick Links

A Surge in Investment in Payments Systems

Erika Baumann, Director of Datos Insights’ Commercial Banking & Payments practice, leveraged extensive data gathered from over 120 banks and surveys of more than a thousand businesses, to provide insight into this transformative trend in a presentation to Alacriti. The data revealed a remarkable shift:

of businesses are gearing up for substantial investments in payment systems in the next 2-3 years—a rate unprecedented in the industry.

This surge in investment interest coincides with a critical juncture where financial institutions (FIs) are grappling with strategic decisions about vendor selection and business case development, all while fintech companies are increasingly filling gaps left by these institutions.

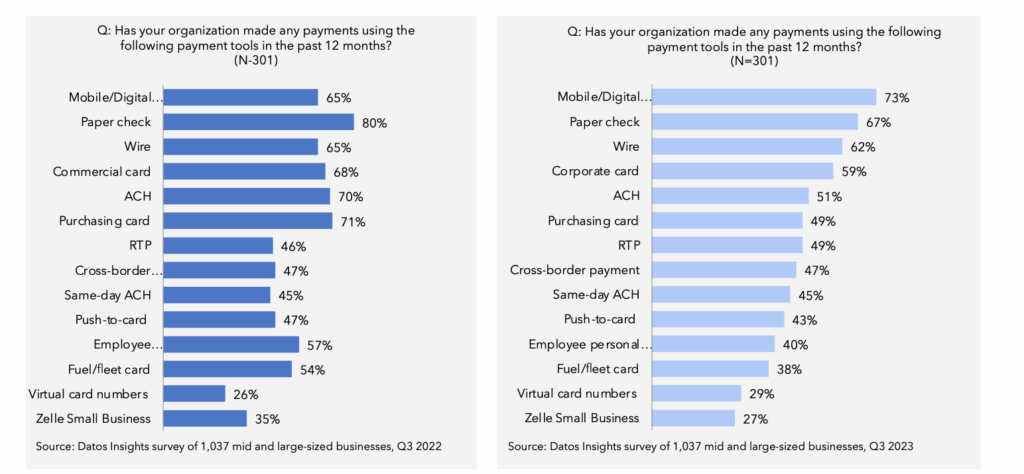

According to Baumann, the surge in investment in payments systems is largely driven by the expanding diversity and number of payment methods. “A few years ago, only about 9% of businesses were using a faster payment method. Last year, that number was close to 50%. Now, we’ve reached 49% for real-time payments (RTP) and 43% for push-to-card. This shift is not just about adopting new technologies; it’s a fundamental change in how businesses approach financial transactions.”

Businesses are Using a Different Mix of Payment Methods

Where Businesses Need Help

One of the most significant findings from Datos Insights’ research is the discrepancy between bank implementations and business usage of realtime payments. Many businesses are turning to financial institutions with the necessary capabilities or directly engaging with fintechs, especially for intelligent or automated payable solutions. Baumann pointed out, “Businesses need help with determining what payment method they’re going to use, when, and what’s the most cost-effective and fastest method.”

Interestingly, the adoption of real-time payments in the SMB sector is lagging, particularly among smaller businesses. Baumann attributed this to several factors, including neglect by financial institutions and misconceptions about the needs and capabilities of SMBs. She noted, “Financial institutions, even the largest ones, continue to overlook this segment, thinking they aren’t willing to pay or don’t need the capability. Fintechs see this as an opportunity, focusing heavily on the SMB space.” Baumann highlighted the importance of real-time payments for SMBs, stressing that liquidity issues, not product or service quality, are often the downfall of many small businesses. “The ability to at least receive a real-time payment is super important to this segment”

The increasing diversity in payment methods also reflects the evolving needs of businesses. “In 2021, 36% of businesses were using different payment methods for different use cases. Now, we’re up to 75%,” Baumann shared. This shift underscores the growing demand for flexibility and choice in payment solutions.

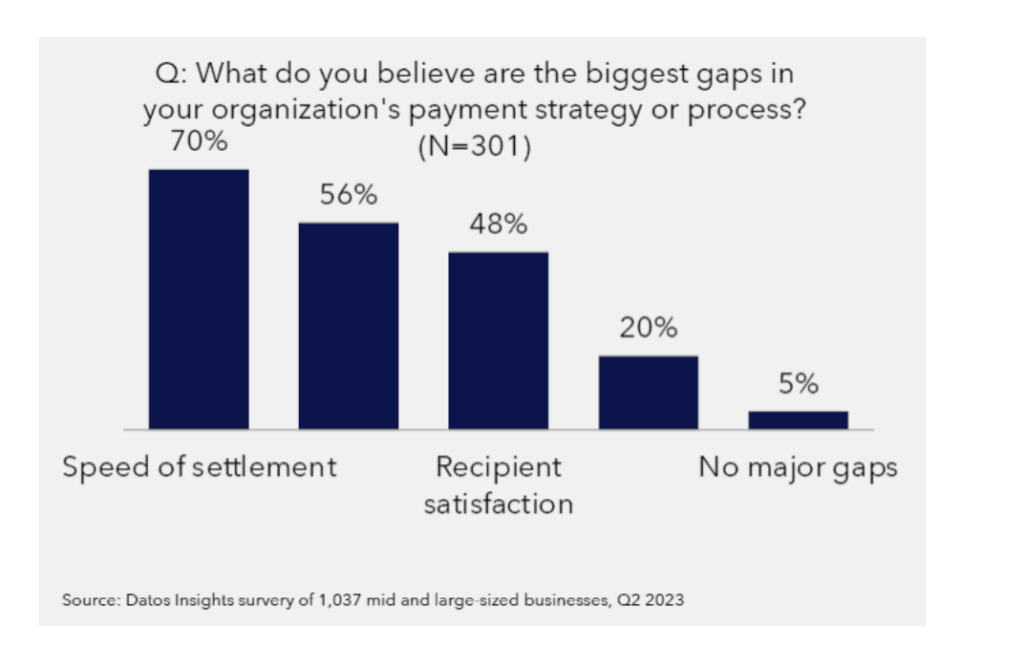

Research reveals that the need for faster settlement is a common theme across various countries. Despite the high availability of faster payments in some regions, businesses still cite speed of settlement as their biggest gap, which shows that offering the capability isn’t enough—there has to be a clear value proposition and integration into their back-end processes.

Speed of Settlement is the Biggest Gap Businesses Have

There is a clear market opportunity in the U.S. for financial institutions capable of effectively deploying real-time payment solutions as real-time usage by SMBs increases. Only 8% of SMBs do not plan on considering using real-time payments in the next year. 40% are currently considering real-time payments, and 18% are using real-time payments already.

Real-Time Usage By SMBs Will Increase…

Instant payments can bring questions about fraud. Baumann stressed the importance of addressing SMBs’ concerns about fraud in the context of RTP. “Fraud has not increased due to RTP,” she clarified, dispelling a common misconception. This revelation is pivotal for SMBs, which, as Baumann noted, “will pay for a service if it makes their life easier or makes them safer.” Addressing these security concerns is crucial for financial institutions to encourage SMBs to adopt faster payment methods.

The segmentation of the SMB market reveals varying needs and behaviors. Businesses in the $10 to $20 million range exhibit characteristics akin to mid and large corporations, particularly in valuing speed of payment and customer experience. These businesses are often overlooked, yet represent significant opportunities due to their unique requirements

Disintermediation

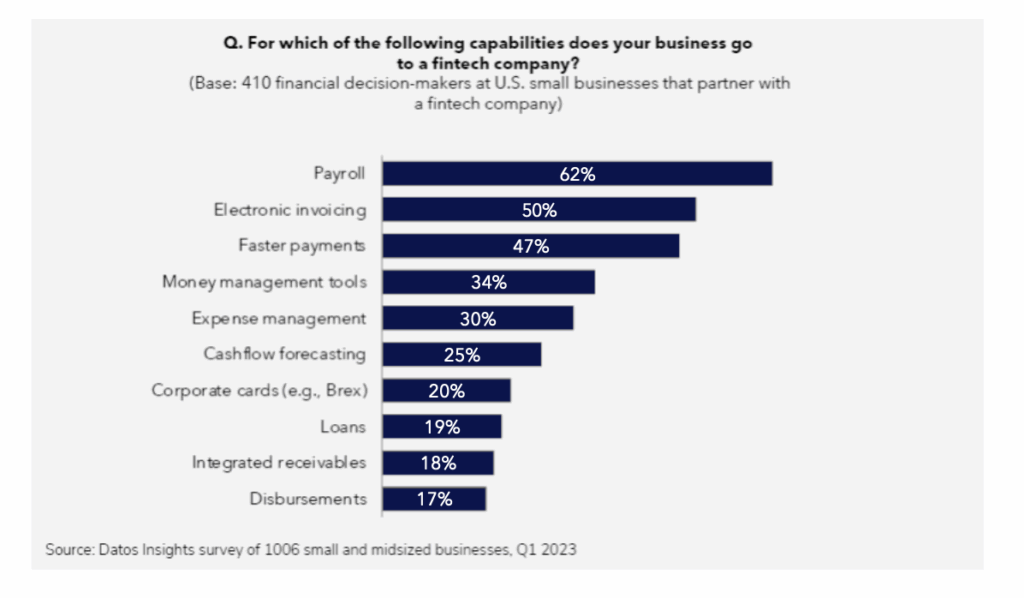

The banking industry has seen a shift beneficial for regional and super-regional banks. The pandemic saw a movement towards the Big Four, attributed to their automation capabilities. However, the recent regional banking crisis sparked an unexpected change. Businesses diversified their deposits among various financial institutions, including those they hadn’t used before. “For the banks that were able to show their end-to-end value and have a great onboarding experience, they kept that business,” Baumann explained. She also pointed out that 5% of businesses have completely disintermediated their bank, relying solely on fintechs for cash management and payment needs, with even the Big Four losing some market share. The chart below details pain points in the payment process that cause SMB’s to seek solutions from fintechs.

SMBs are Seeking Fintech Partners to Solve Pain Points in the Payments Process

The number of businesses partnering with a fintech for payments services is increasing significantly. 65% of businesses say they’re partnering with a fintech for core cash management or payment needs, showing that payments functionality is a huge market opportunity for fintechs to out-sell banks. This disintermediation is driven by factors such as ease of submitting payment files, better reporting, and access to faster payments. In addition, banks recognize that payment volumes are being lost to fintechs.

Opportunity for Traditional Financial Institutions

However, there is still an opportunity for traditional financial institutions. Despite the migration to fintechs, many SMBs express a preference for sticking with their banks if they offer comparable services. 81% say if the same capabilities were offered, they would prefer to get them from their primary bank/ credit union. This preference highlights a significant market opportunity for banks to reclaim some of the business lost to fintechs. Financial institutions that are not competing well with robust payment functionality should focus on partnerships and integration to be able to add the level of service the market demands.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.