COVID-19 hit every corner of the world, and people around the globe had to alter their everyday behavior in some way. People turned to technology for things like grocery shopping, cinematic experiences, and even banking.

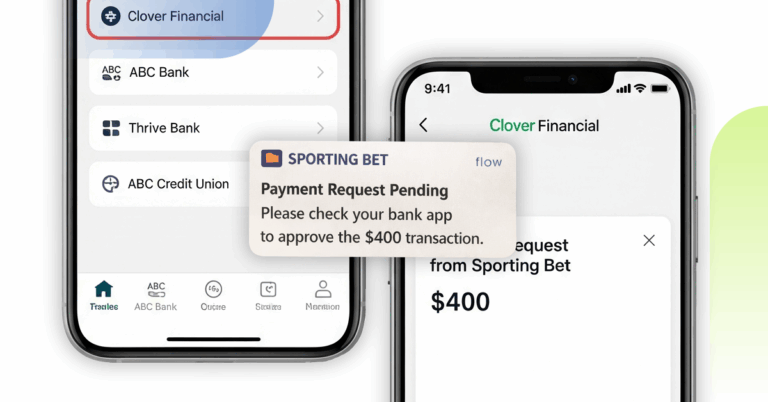

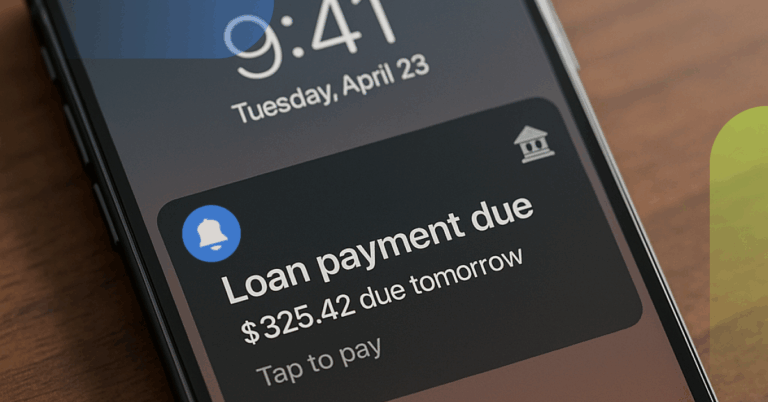

With this sudden surge in an already tech-saturated society, the on-demand mentality of everyday consumers grew stronger. This way of thinking reached the world of payments, with apps such as Venmo and PayPal leading the charge. People began to expect immediacy when sending and receiving money

To further discuss payments technology modernization and the importance of implementing real-time payments for banks and credit unions, PaymentsJournal sat down with Mark Ranta, Payment Practice Leader at Alacriti, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Listen to the podcast here and download our recap of the discussion.