As financial institutions prepare for the future of payments, many are balancing the need for technology and innovation with the complexities of legacy infrastructure and rising client expectations.

In a recent American Banker-hosted webinar, Payments in 2025: What You Need to Know, Mark Majeske, SVP of Faster Payments at Alacriti, and Erika Baumann, Director at Datos Insights, explored key trends shaping payments modernization. The discussion covered the growing demand for real-time payments, the role of education in accelerating adoption, and how banks and credit unions can leverage data, use cases, and unified payment hubs to compete with fintechs and meet evolving business needs.

of corporate treasurers at large and midsize companies would switch FIs for better payment automation tools

of businesses/ corporates feel their primary bank’s reporting capabilities meet all their needs

Quick Links

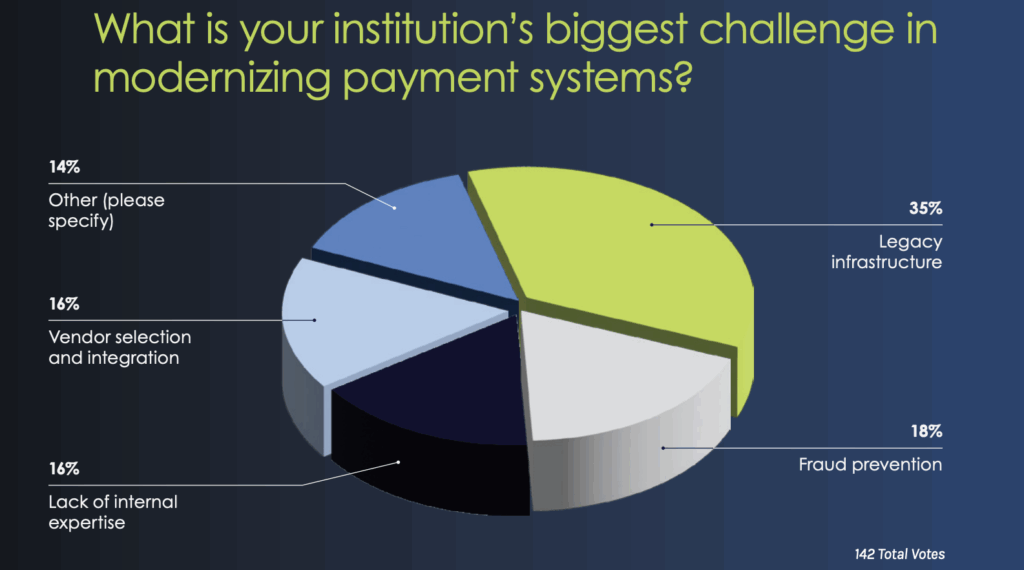

Audience Poll Question: Challenges in Payments Modernization

Baumann anticipated the most common answer with confidence: “I’m going to put money on the fact that it was probably legacy infrastructure.” Her instincts were correct—over a third of survey participants (142) cited aging systems as their top barrier to modernization.

Baumann added that while many banks are increasing investments in payment technologies, there’s still a disconnect between those investments and achieving measurable outcomes. “There’s obviously an expectation of increased revenue… but when we have those conversations and say, how exactly do you do that… that’s where the conversation starts to get just a little bit fuzzy,” she explained.

Legacy systems continue to be one of the biggest barriers to payment innovation, particularly for mid-tier and regional financial institutions. As demand grows for real-time payments and automated processes, many institutions are grappling with outdated technology that limits speed, flexibility, and visibility.

Majeske emphasized the role of modern infrastructure in overcoming these limitations, sharing that Alacriti supports payment transformation through its “cloud-based payments hub, which includes Fedwire, ACH, RTP, FedNow, and Visa Direct.”

Why the Time To Modernize Is Now

Baumann opened the discussion by highlighting the growing urgency among banks to modernize their payment infrastructure. “One thing that has been super surprising to us in a good way in the last 12 months is the increase in investment in payment technology,” said Baumann. “It’s not just about I’m going to find a vendor for one solution; it’s about enabling and future-proofing what is to come.”

That growing investment spans institutions of all sizes. “Even the kind of downstream banks plan on spending more than $20 million,” she noted, adding that legacy infrastructure remains a top hurdle to modernization

Baumann emphasized that solving those challenges begins with technology—and the clarity to act. “There is a large portion of businesses that are current FI clients that say, I would switch FIs for better automation tools,” she said.

Datos had the following data about expectations for modernization:

Key Metrics and Trends Shaping Payments

New data sheds light on shifting expectations. “The number one gap that businesses report is speed of payment or settlement, and followed by the visibility of payments in real time,” said Baumann. “They’re not saying real-time payments, they’re saying visibility in real time.”

Complexity is at the heart of today’s payment challenges. This complexity is driving businesses to demand more robust capabilities from their financial institutions—and many are willing to switch providers to get them. Alacriti’s client data reinforces these trends. “About 69% of our customers and clients are moving money outside of bank business hours,” said Majeske. “The key message here is people want to bank on their own terms.” About 95% of Alacriti’s customers receive payments from instant payment networks in the first five minutes that they’re live, with digital wallets, cash advances, and microloans leading the way.

These metrics suggest a growing opportunity for financial institutions to use their transaction data to inform product development. “If your customers are receiving a lot of activity from microlenders, you may want to create a micro-lending product,” said Majeske. Request for Payment (RFP) is also gaining momentum. Majeske shared that The Clearing House saw over 1 million RFPs sent in a single day in November 2024. “70% of the recipients responded with a payment, 25% left it to expire, and 5% out and out rejected the request,” he noted. However, for RFP adoption to truly scale, billers must educate recipients on what to expect.

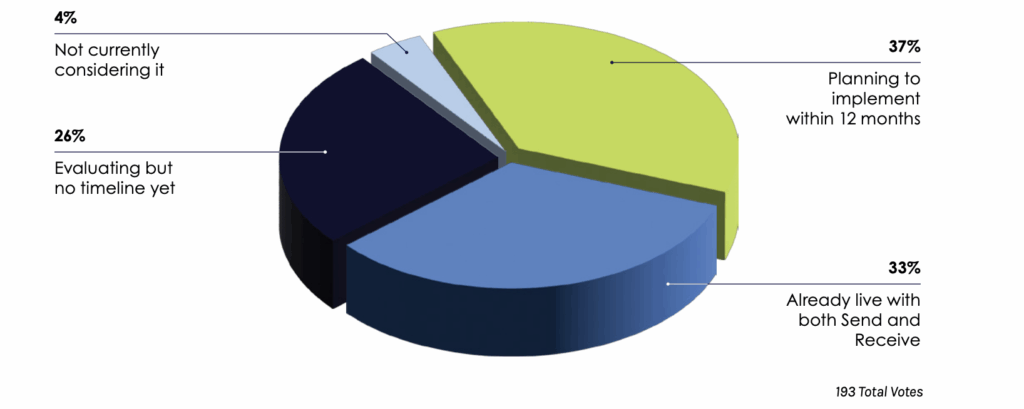

Audience Poll Question: Real-Time Payments Adoption

Audience participants weighed in on a critical question: Where does their institution currently stand on adopting real-time payments (RTP)?

Poll results revealed a fairly even distribution across stages of adoption. A third of survey participants (193) indicated their institution is already live with both Send and Receive capabilities, while 37% said they plan to implement RTP within the next 12 months. Another 26% are still evaluating with no defined timeline, and just 4% said their institution is not currently considering real-time payments at all.

What is your institution's current stance on adopting real-time payments?

The results suggest momentum is building across the industry, but many institutions are still in the planning or early implementation phases—particularly when it comes to enabling outbound RTP transactions. As the payments continue to shift toward real-time, the question is no longer whether to modernize but how quickly institutions can move to keep pace with demand and minimize opportunity costs.

Real-Time Payments Evolution: Education, Adoption, and the Dual-Rail Approach

As real-time payments (RTP) adoption accelerates across the financial services industry, many institutions are encountering the same core challenge: understanding how to operationalize and deliver faster payments effectively. While momentum is building, a clear education gap remains between what institutions offer and what their customers understand.

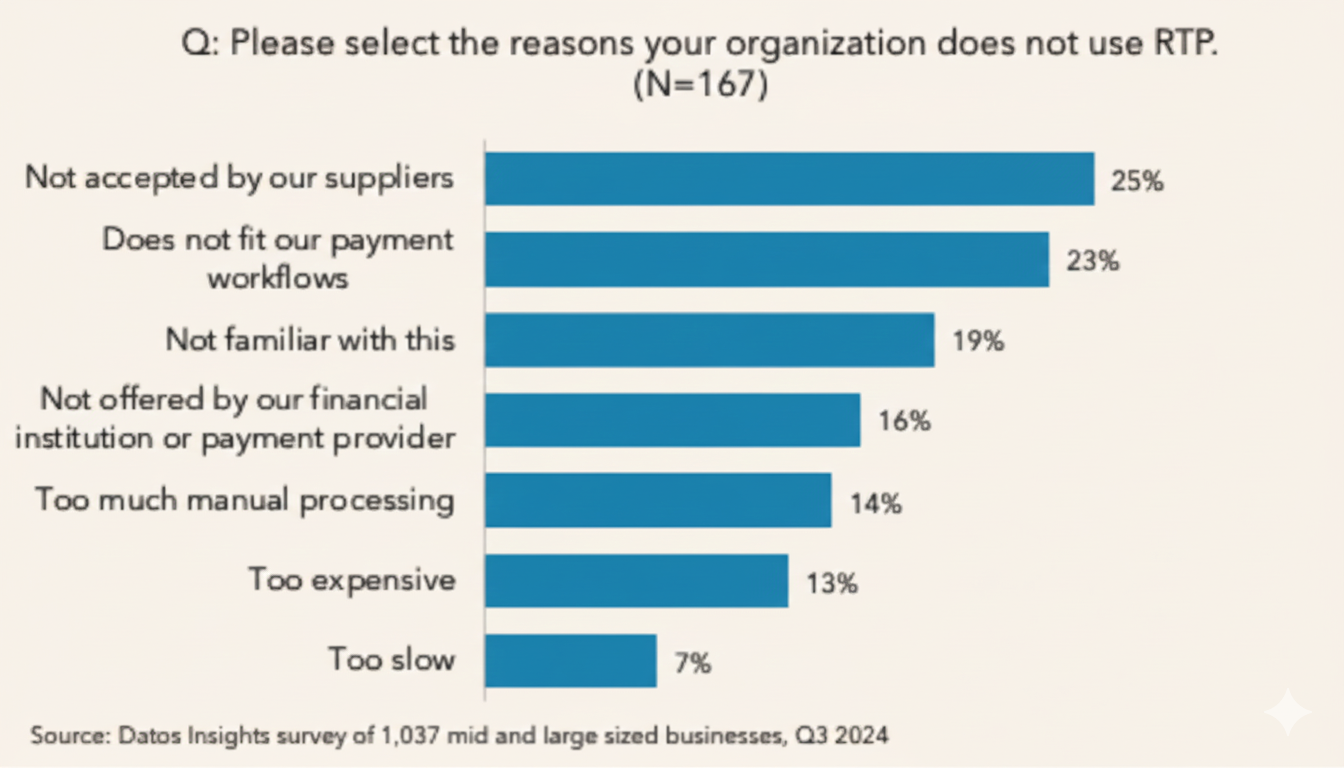

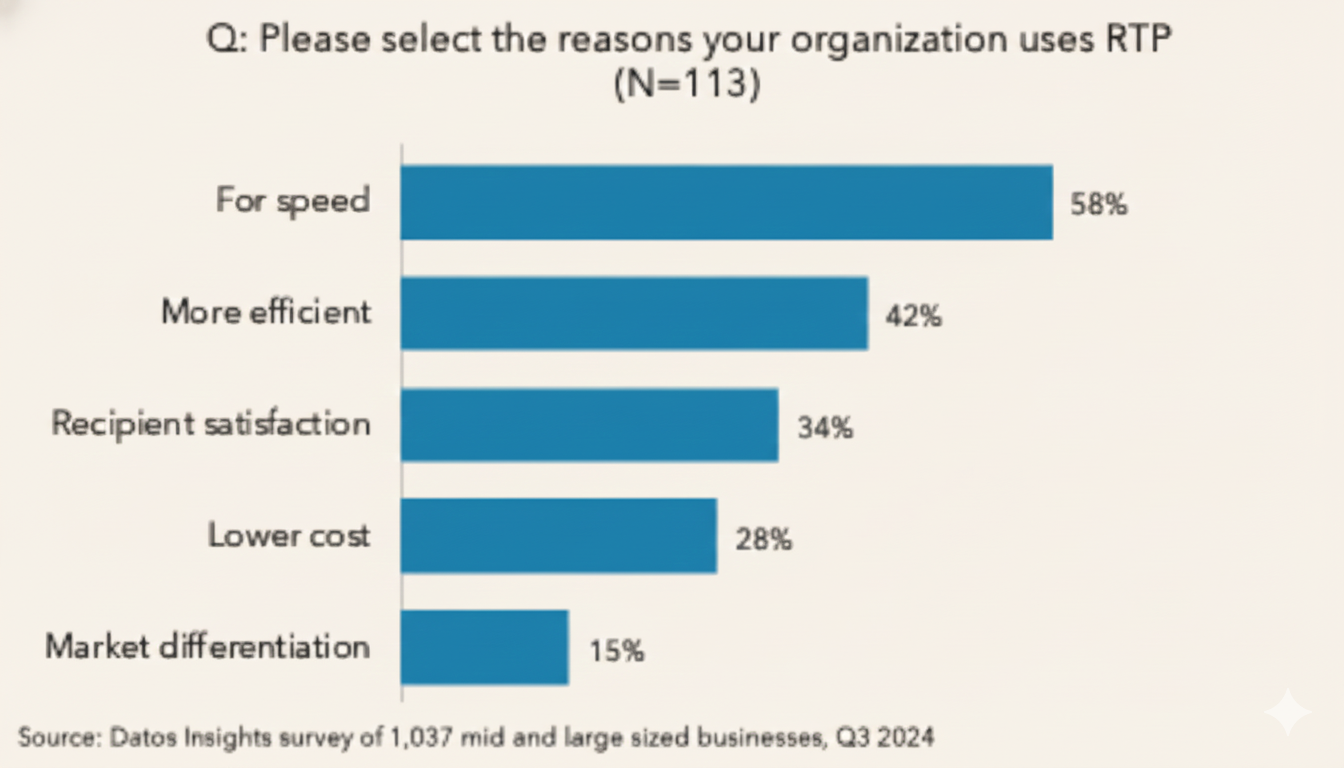

Businesses cite speed of settlement and payment visibility as top concerns—ironically, even when their financial institution already supports faster payment options. This disconnect often stems from a lack of awareness and understanding of how real-time rails like the RTP® network or FedNow® Service fit into existing workflows. However, fewer businesses don’t understand RTP, as evidenced by the shrinking number that states ‘too slow’ as the reason they don’t use RTP. More FIs are offering RTP, and more clients are shifting to a provider that does have RTP if their FI did/ does not.

What’s encouraging is that businesses are increasingly recognizing the benefits. Speed, efficiency, and improved recipient satisfaction are now leading drivers for RTP usage. Market differentiation has also become a key motivator—not just for large enterprises but increasingly for mid-market organizations trying to stay competitive.

The RTP network and FedNow Service play essential roles but are at different stages of maturity. RTP has been live for over seven years and is seeing continued volume growth, while FedNow is earlier in its lifecycle but gaining traction. To future-proof their payments strategy, many institutions are now pursuing a dual-rail approach.

RTP

RTP Participants = 920 FIs – 1000 by EOQ 1

In Market 7+ Years

RTP volumes set new records in Q3 2024

- Quarterly Volume: 87 million (Current 1.1 Mil/Day)

- Quarterly Value: $69 billion

Objective:

Emphasis on growing Participant FI’s, increasing Use Cases, growing Customer usage, and adoption.

FedNow

FedNow Participants = 1100 + FIs

In Market 2 Years

FedNow volumes in Q3 2024

- Quarterly Volume: 336,487

- Quarterly Value: $17.5 billion

Objective:

Emphasis on growing Participant FI’s and Increasing Use Case (SEND) transactions

Payments Rails – Understanding Your Customers To Drive the Right Strategy

The biggest barriers to modernizing payment rails, such as security concerns and integration complexity, are not insurmountable. “Organizations that have come into and are using instant payments have gotten over all of these items,” said Majeske. “What I generally hear is implementation wasn’t as hard as I thought it would be.”

Modernization strategies should vary based on the customer base. Majeske shared insights from three different financial institutions using instant payments. A consumer-heavy bank in the Eastern U.S. with less than $1 billion in assets saw 57% of its transactions coming from digital gig platforms like Uber and Grubhub—far above the 18% industry benchmark. A regional bank focused on wealth management reported 14% of inbound transactions from platforms like Robinhood and Wealthfront, nearly double the typical 8%. Meanwhile, a $3 billion community bank serving both consumers and small businesses showed that 18% of its transactions came from marketplaces like Amazon, compared to the standard 2%.

His advice to banks and credit unions is to establish focus groups, study customer behavior, and tailor your modernization efforts accordingly. In doing so, institutions can identify the most relevant use cases for real-time payments, avoid costly missteps, and better position themselves to meet today’s—and tomorrow’s—expectations.

Emerging Fraud Trends and Prevention in the Age of Faster Payments

As instant payments continue to rise in popularity, the question on many financial institutions’ minds is whether real-time rails like the RTP® network and the FedNow® Service also mean real-time fraud. The good news? The rails themselves aren’t the problem.

According to Baumann and Majeske, financial institutions have not reported an increase in fraud directly tied to the integrity of faster payment networks. The underlying issue isn’t the rail—it’s what’s happening outside the bank. “Most of the fraud is happening outside of the four walls of the bank,” said Baumann, pointing to client-side vulnerabilities and a lack of user education as the bigger concern. Phishing, social engineering, and poor payment hygiene among customers can expose institutions to risk, regardless of how secure the infrastructure is.

Still, the speed of real-time payments demands an equally fast and proactive approach to fraud prevention. Traditional systems designed for ACH and wire may struggle to keep pace when transactions must be analyzed and either approved or stopped within milliseconds. Institutions must now reassess whether their existing fraud prevention tools are equipped for this rapid environment

The key is layered protection. Fraud detection strategies should combine transaction-based analysis, user behavior insights, and device-level tracking. If one layer misses a red flag, another can catch it—reducing the likelihood of a breach.

AI and machine learning are playing an increasingly vital role, especially when paired with consortium data that can reveal fraud patterns across institutions. “You want to really prevent that transaction from happening before it occurs,” said Majeske, emphasizing the importance of real-time, preemptive decisioning.

Financial institutions are urged to keep an eye on emerging threats like synthetic identity fraud, insider abuse, and business email compromise while also considering the challenges of cryptocurrency scams, mobile payment fraud, and regulatory compliance. Ultimately, the institutions that invest in modern, adaptable fraud solutions—and educate their customers on how to stay safe—will be best positioned to thrive.

Expanding Possibilities: Instant Payment Use Cases

Instant payments are quickly becoming table stakes—not just for innovation but for customer retention and competitive differentiation. Yet beyond the speed and convenience, the real value of real-time payments lies in the use cases they unlock. There are two key categories of instant payment use cases: Receive Only and Send use cases. Understanding the difference is critical for institutions developing strategies to meet current demand—and to shape future growth.

Receive Use Cases

Receive Only use cases are driven by third-party providers. These are the payment flows that banks and credit unions don’t initiate—but must be ready to accept. Think of peer-to-peer payments through platforms like Venmo, PayPal, and Square or employer-driven disbursements via DailyPay and other payroll providers. “If you were able to accept an RTP or a FedNow transaction, then employees can participate. They’re going to notice if they can’t,” said Majeske. That visibility makes it all the more urgent for institutions to support Receive capabilities—because customers already expect them.

Other growing Receive Only cases include online gambling, microloan repayments, and wallet-based transfers. While these may not originate within the FI’s systems, failing to support them can frustrate users and cause them to look elsewhere.

Send Use Cases

Unlike Receive Only, Send use cases are driven by the financial institution itself. These are the services developed in response to customer needs. For example, loan disbursements. When accountholders receive loan funds instantly, satisfaction increases, and operational friction decreases. Top Send use cases include:

Loan disbursements

B2B payments, particularly through Request for Payment (RFP)

Payroll disbursements

Insurance claims

Gig economy payouts

Real estate closings (now increasingly possible with RTP’s new $10 million limit)

Peer-to-peer (P2P) payments

Auto purchasesGig economy payouts

Each one not only solves a specific problem—it also helps position the financial institution as a nimble, customer/member-first partner

Infrastructure Support

To support these dynamic scenarios, banks and credit unions need more than just access to payment networks—they need infrastructure that’s ready to scale and adapt. Alacriti’s Orbipay Payments Hub offers this flexibility, supporting ACH, wire, RTP, FedNow, and Visa Direct under one cloud-native platform. By investing in this foundation, institutions can enable smarter routing, integrate with existing cores, and future-proof their payments.

An audience member asked how it was possible to monetize a payments hub. Baumann emphasized the importance of looking beyond infrastructure. “It’s the revenue streams that come from those products with those value-added services that are really the basis of your ROI and your business case, not the payment hub,” she said. She advised institutions to think about what they can enable—like reporting modules or AP automation—and how those capabilities help attract and retain clients.

Who Is at Risk?

The promise of faster payments has dominated headlines in recent years, but behind the buzz lies a pressing concern: what’s at stake if banks and credit unions wait too long to modernize?

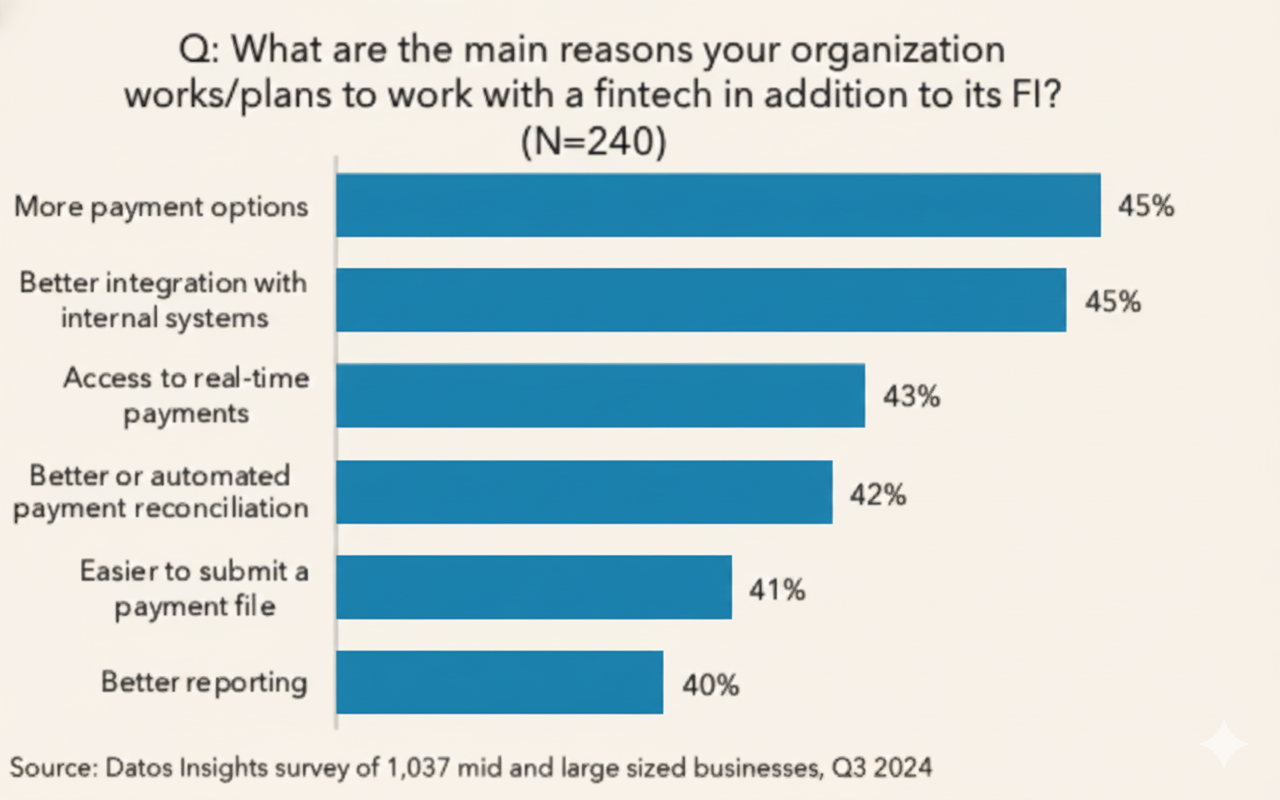

Disintermediation is no longer a distant threat; it’s happening now. While large national banks have made considerable progress in their real-time payments capabilities, smaller institutions are still playing catch-up—and that gap is where fintechs are thriving. According to Datos Insights research, 58% of businesses are already working with a fintech provider for core cash management or payment services, and another 25% plan to do so in the future. In many cases, the reason why is not because they want to break away from their banks. It’s because they need better tools, particularly around payment speed, visibility, and automation. “The number one reason is just to have more payment options,” Baumann said. Businesses increasingly expect flexibility in how they send and receive money, and when their financial institution doesn’t provide that, they’re willing to go elsewhere—even if that means using a non-bank provider.

The impact is subtle but significant. Institutions may not even realize they’re losing business. Baumann explained, “You may not even know that they are using another provider until those transactions are already gone.” The migration happens quietly—through payroll services, AP automation platforms, or online lending tools—and unless banks monitor payment data closely, they may miss early warning signs of customer churn.

But there’s a silver lining. While fintechs are winning business, they’re also validating the demand for faster, smarter payment experiences. “If you build it, they will come,” Baumann emphasized, encouraging financial institutions to focus less on product specs and more on solving real client problems. Institutions with instant payment functionality are already seeing quicker adoption rates than in the past—because the need is real and growing.

Adoption isn’t just about flipping a switch. There are hurdles to overcome, especially in terms of internal education, fraud readiness, and process redesign. “Start doing research on fraud and risk and figuring out what works for you,” advised Majeske. But fear shouldn’t paralyze decision-making. Most organizations, he noted, don’t need to overhaul their entire system or hire new staff to support instant payments—they just need to plan wisely and communicate effectively.

And perhaps most importantly, institutions need to listen to their customers. Transaction data can reveal patterns that help banks tailor use cases—from loan disbursements to payroll and beyond.

But there’s a silver lining. While fintechs are winning business, they’re also validating the demand for faster, smarter payment experiences. “If you build it, they will come,” Baumann emphasized, encouraging financial institutions to focus less on product specs and more on solving real client problems. Institutions with instant payment functionality are already seeing quicker adoption rates than in the past—because the need is real and growing.

Adoption isn’t just about flipping a switch. There are hurdles to overcome, especially in terms of internal education, fraud readiness, and process redesign. “Start doing research on fraud and risk and figuring out what works for you,” advised Majeske. But fear shouldn’t paralyze decision-making. Most organizations, he noted, don’t need to overhaul their entire system or hire new staff to support instant payments—they just need to plan wisely and communicate effectively.

And perhaps most importantly, institutions need to listen to their customers. Transaction data can reveal patterns that help banks tailor use cases—from loan disbursements to payroll and beyond.

Real-time payments aren’t a nice-to-have—they’re a strategic imperative. Financial institutions that take a wait-and-see approach may find themselves sidelined, not just by big banks but by agile fintechs offering exactly what businesses want. Those that move forward thoughtfully, however, have a unique opportunity to strengthen relationships, win new business, and future-proof their payments ecosystem

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.