In 2024, the payment industry is in a state of major change, with the rapid adoption of real-time payment systems and advancements in artificial intelligence and machine learning. These changes lead to a future where

payment experiences are more personalized, secure, and heavily automated. Amidst these developments, cross-border transactions are being redefined to be smoother, cost-effective, and faster than ever before. Additionally, the impending adoption of the ISO 20022 standard is set to revolutionize the industry with enhanced efficiency and detailed, data-rich transfers.

In an American Banker-hosted webinar, Payments in 2024: What You Need to Know, Erika Baumann, Director, Commercial Banking & Payments Practice at Datos Insights, and Mark Majeske, Senior Vice President, Faster Payments at Alacriti, discussed the impending change and more.

Quick Links

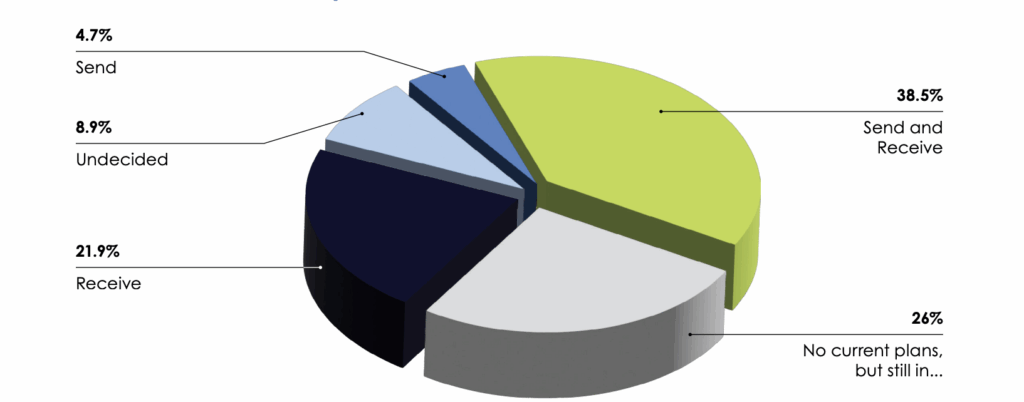

The webinar began with two poll questions for the audience. Attendees were asked about their engagement with the instant payments marketplace, specifically whether they planned to Send, Receive, or both or had no current plans regarding real-time payment rails. The results highlighted a strong inclination towards both sending and receiving payments, reflecting a comprehensive adoption strategy among participants.

Mark Majeske opined that this indicated a strategic approach adopted by many institutions. “What we’re finding in the industry is that 90% of the people who we are signing up for access to instant payments are choosing both rails, and they’re choosing now,” Majeske noted. He further explained that most entities start by setting up receiving capabilities and then gradually add sending options, allowing them to manage the operational changes effectively.

What best describes your participation in the instant payments marketplace (defined as real-time payment rails from The Clearing House and the Federal Reserve) (RT and/or FedNow) in 2024?

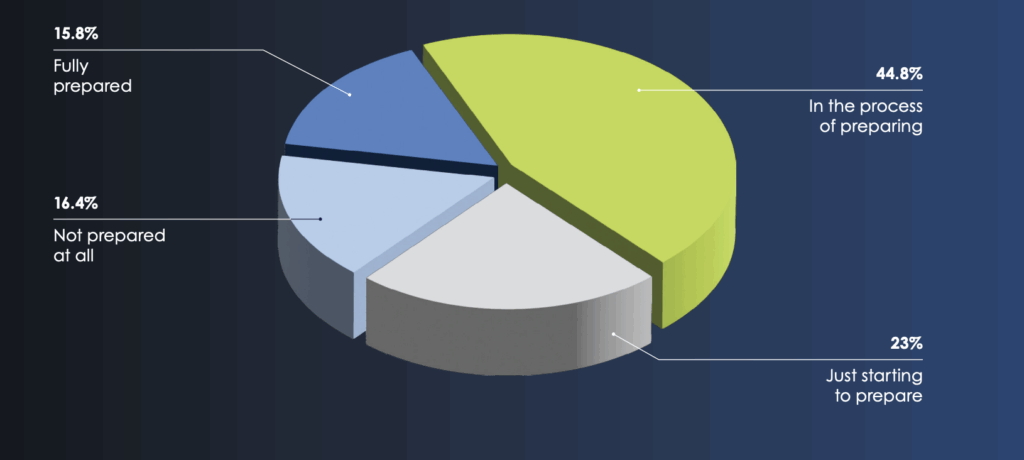

The second webinar poll focused on assessing the banks’ preparedness for implementing real-time payments. Participants were asked to evaluate their readiness, ranging from fully prepared to not prepared at all. This question aimed to gauge the sector’s operational readiness to adopt and integrate real-time payment systems effectively.

Mark Majeske discussed the poll results, noting that a significant portion of the audience was in the process of preparing, showing a proactive but still developing approach to real-time payments.

Operationally, how prepared is your bank to go to market with real-time payments?

Instant Payments Network Update

Instant payments, powered by advanced technologies such as artificial intelligence and machine learning, are speeding up transactions and enabling highly personalized, secure, and automated payment experiences. These advancements include seamless cross-border transactions and the global adoption of the ISO 20022 standard.

The RTP® network has been on the market for a while now, and it has recently been growing faster in terms of growth and transactions. At the time of the webinar, the RTP network was up to 485 banks and credit unions live on the system and had 624 million payments to date from inception. The average RTP payment is $514, and there is a maximum send of $1m.

485 Banks and Credit Unions live on RTP | More than 624 million RTP payments to date

Money Moved via RTP

Average RTP Payment

Maximum Send: $1 mil

payments over $100k since Apr'22 value change

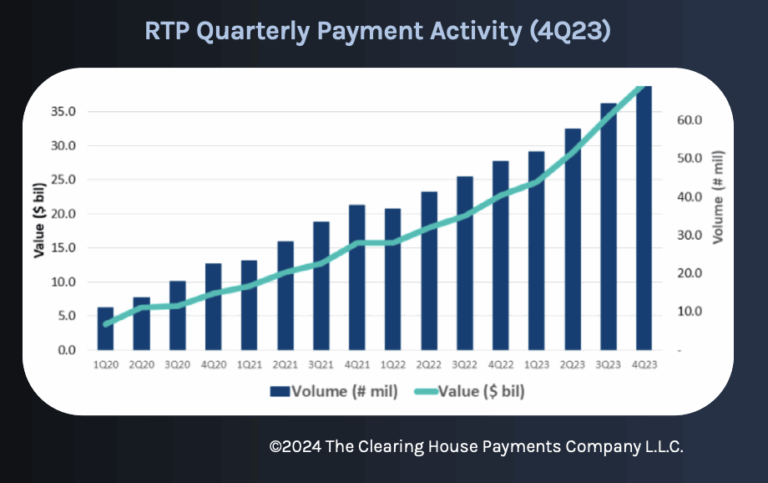

There has been consistent growth in both volume and value since Q1 2020 for the RTP network:

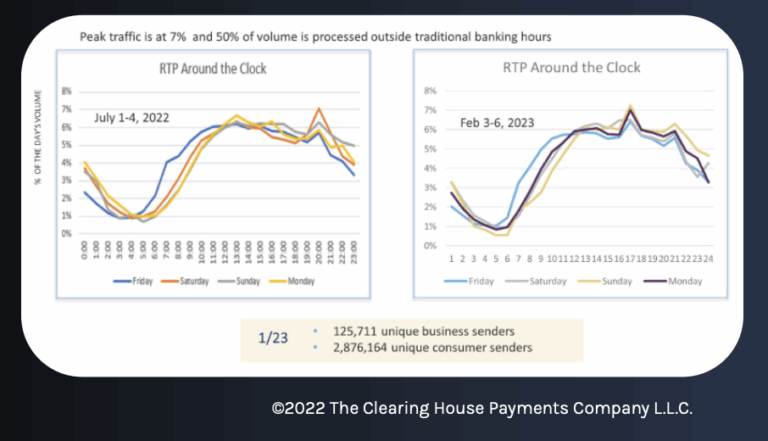

However, what may be most interesting is that 50% of the volume is processed outside of traditional banking hours, which shows a huge demand to move money outside of traditional banking hours.

As for use cases, the RTP network is seeing a great deal of loan funding. “The first thing a bank will do once they can Send is loan funding. That’s an easy task for them to do. As a first Send initiative, we’re also seeing a lot of payroll. We see a lot of insurance claims, gig economy companies, and payments title companies are starting to use it for closings on real estate. I also talk to a lot of utility companies that want to use it for loan collection. The $1m transaction limit that was placed in RTP has greatly lifted the use cases from the business side,” noted Majeske.

Majeske compared the progress of the RTP network with the FedNow® Service. “When you look at Fed, they’re six months in, and it’s interesting to draw a contrast because FedNow is where RTP was six years ago. The great thing about FedNow is everyone knows what instant payments are. The Fed launched in July. RTP is just short of 500 banks today, and FedNow has just 400 today. So, I think the adoption rate in FedNow will be much faster as a result of the work that was done in RTP. I don’t really see many use cases in FedNow that are different from RTP. They’re very similar, though, for the growth of instant payments in general, it’s important that we have use cases and people using the networks for them to grow properly.

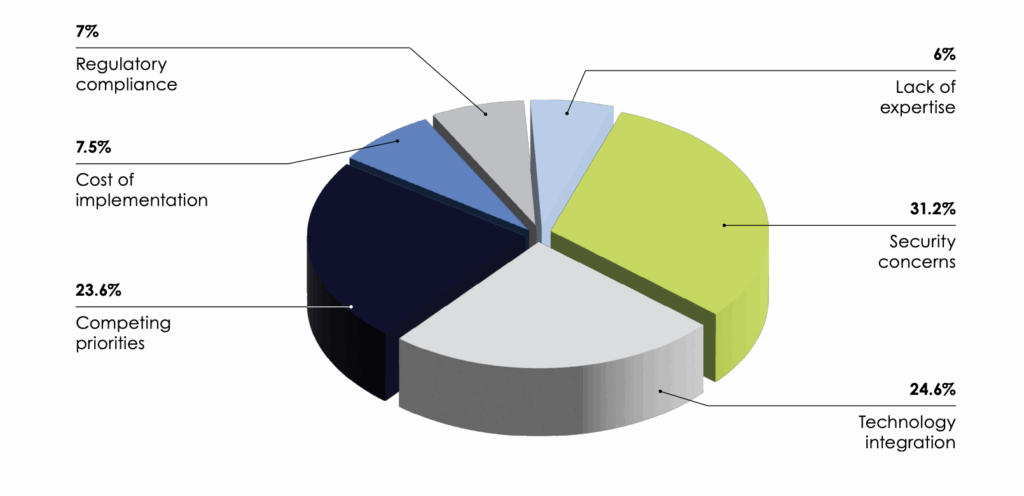

In the third webinar poll, participants were asked to identify the biggest challenge in modernizing payment systems from a list that included technology integration, security concerns, regulatory compliance, cost of compliance, lack of expertise, and competing priorities. Security concerns emerged as the primary issue, closely followed by technology integration and competing priorities.

What do you believe is the biggest challenge in modernizing payment systems?

Majeske reflected on these results, indicating they aligned with industry observations about the difficulties of modernizing payment infrastructure. He emphasized that “security concerns” and the challenges of “technology integration” are especially pronounced, as these areas are crucial for the successful implementation and operation of advanced payment systems. Majeske mentioned, “It is one that I think we as an industry have to do better at dealing with.”

Baumann also weighed in, noting that despite the increase in fraud due to real-time payments observed globally, the U.S. has managed to keep such issues relatively contained thanks to lessons learned from other regions. She also pointed out that the issues of technology integration and competing priorities reflect significant operational challenges that require substantial investment to overcome.

Investment in Payment Technology

Baumann provided data regarding how the market is spending on payment technology. While there are hurdles to modernization, Datos does see banks investing—banks that are not investing are actually in the minority. Only 6% of banks do not plan to invest in payments technology in the next 24-36 months. At the same time, 94% of businesses expect at least somewhat significant investment in payments technology in the next 24-36 months. Therefore, FIs that are not positioning how their tools can solve the primary problems of businesses are missing out on valuable market share.

State of the Market

In 2021, Datos’ research showed that the penetration of faster payments was less than 10% across all businesses that said they had used a particular disbursement type. Between 2021 and 2022, Datos observed that the majority of banks that hold the largest chunks of the deposit accounts in the U.S. had gone live on RTP. “They were utilizing Zelle for small business or utilizing push-to-card. But that is more isolated to some of the larger banks. Of course, there are banks downstream, but what I know is that the bank implementations have not kept up with the actual user activity. So when we look at how this has kind of shaken out, we see that this movement to digital payments, to mobile wallets, to faster payments, it’s finding this normalization. It’s a non-starter to have a conversation about payments, and that includes some sort of faster and more efficient payments. So, where the banks are lacking, the fintechs are stepping up. While the implementations of the banks do not match one for one, for the businesses that are utilizing the technology versus who their financial services provider are, this is what’s opening the door for fintechs to step right in,” Baumann shared.

Interest in automation tools is at an all-time high. Over 60% of businesses that have not implemented an automated receivables solution or an automated payments solution will be focused on this in the next 12-24 months. “You can’t have these automation tools, be completely robust, and offer everything that businesses need without considering faster payments. Over 60% of businesses that have not implemented an automated receivables or payables solution plan on doing so within the next 12-24 months. So, as you’re thinking as a financial institution about ‘where’s my roadmap going?’ ‘Where do I need to focus? I can’t do everything.’ There are a couple of points. One is do something—doing nothing is not the right strategy. There’s interest across tools; there’s interest across automation solutions payment rails, payment choice, etc., that any move forward absolutely will help the financial institutions position and know that there is a market out there,” Baumann continued.

Financial institutions that have incorporated faster payments will have a competitive advantage. Some industries that are most interested in functionality are construction (leading the way), manufacturing, food and beverage, and professional services close behind. Although it’s important to know the adoption rate of technology, it’s also important to understand what’s driving it. In a global Datos survey where thousands of businesses were asked what their biggest gap is for payment strategy or process, 70% said the speed of settlement. “My message to all of you is that it’s not enough to just check a box. You can’t just have the offering. You have to have a robust go-to-market strategy. One way to do that effectively is with a vendor partner that can help guide you through that process. We also know that faster payments have become critical for businesses,” Baumann advised.

Real-time payments were once more valued for the ability to make urgent or emergency payments—now, it’s all about the customer experience. The need to provide a better recipient experience has actually doubled since 2021. Now, 80% of businesses say it’s best to use a faster payment type to provide a better customer experience. Instant gratification has been growing. For example, payroll for gig economy workers or waitstaff, or even insurance, where it’s become table stakes.

Access to real-time payments is a primary motivator for businesses in selecting a financial services provider—43% say they have changed or would change to another financial institution to access real-time payments. “And that goes back to my point that it’s not enough to just offer it. You have to show your clients how they incorporate this and, where their value is, and how it’s solving a business problem, and be able to utilize the help of the other experts. You know, one of those reasons on that last poll question we had of the hurdles was lack of internal expertise. Your vendor partners absolutely can help provide that internal expertise,” Baumman commented.

Use Cases

Datos has researched businesses making payment decisions based on use cases. In 2021, there were only about 36% of businesses making payments decisions based on use cases. However, that number has climbed to 75% (as of Q3 2023). So, bank clients need a partner to help with intelligent routing. They also asked businesses how important it is to utilize faster payments. However, businesses don’t always base their responses on what their banks already have—they want to know what their financial institutions will need down the line. 45% of businesses said the use of real-time payments was very important to their organization, and 45% said it was important. Datos is seeing the trend be less about the threat of businesses leaving their financial institution and more of actually leaving. “And the other evidence for that is looking at that on the fintech side, there is an incredible uptick of business and market share that fintechs have been able to capture away from the financial institutions,” explained Baumann.

The use cases for real-time payments are expanding. For example, in today’s tough labor market, it’s important for someone like a contractor to be able to attract the highest-skilled workers. Any business that has a high volume of low-dollar checks, important real estate transactions, or small businesses with liquidity challenges can reap significant benefits.

Examples of use cases:

1. Insurance claims:

Waiting for a check or ACH payment during a critical and urgent scenario is not ideal for individuals or businesses. It is an industry expectation that these payments be immediately available regardless of the day or time of need.

2. Payroll:

Businesses that can offer non-traditional payroll cycles, such as getting paid the same day as work is performed and having the ability to offer spot bonuses or earned wage access, can attract and retain the most desirable talent.

3. Tips for wait staff:

Within the restaurant industry, there is a danger in carrying around cash at the end of a shift. Real-time payments eliminate the need for this with an instant deposit into a bank account for tips.

4. General contractor:

The construction and skilled trade industry is just one more example of an industry impacted by labor shortages. A contractor that can pay subcontractors and tradesmen upon completion of work or instantly upon receipt of a customer payment instead of waiting for the end of a week will have the loyalty of the top talent.

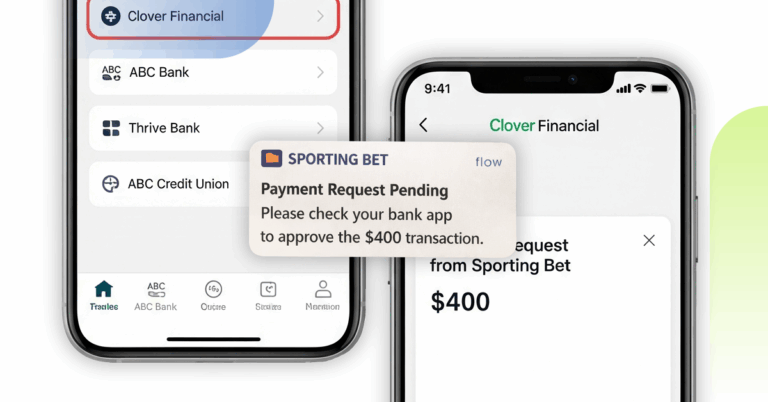

5. Billing utility/telecom clients:

Bill pay is a large market opportunity for real-time payments. Through request-forpayment (RfP), businesses and their customers acquire efficiencies and ease of payment settlement. Businesses can more easily digitize all parts of the payments process with more robust data, and payees can settle their bills instantly when ready to release the funds.

6. High volume of low-dollar checks:

Generally, any business issuing a high volume of low-dollar checks (e.g., for breakage, refunds, rebates) can save significant money and time by shifting to real-time payments while creating a more pleasant recipient experience.

7. Real estate:

One of the key moments when purchasing real estate is waiting on the final settlement transaction. Realtime payments can remove much of the anxiety and wait time associated with this process, making it more accessible on an everyday basis.

9. Small businesses with liquidity challenges:

Unfortunately, many small businesses shut down yearly—not because of a poor product or service but because of liquidity challenges. Having the ability to at least receive real-time payments can significantly impact a small business’s financial health. Making just-in-time payments can have an equal impact and allow small businesses to have a positive cash flow.

ISO 20022 and Cross-Border Payments

ISO 20022 is a standard message set to help financial institutions communicate across themselves, making it easier for businesses to communicate and to have standard reconciliation data, etc. Baumann discussed the significance of ISO 20022 in banking and cross-border payments. It’s a significant consideration for financial institutions to think about, especially with the impending deadlines of the Fedwire migration. “Businesses are way more ready to utilize ISO 20022 than banks think that they are.” She emphasized the discrepancy between banks’ perceptions and the actual readiness of their clients, citing survey data indicating that 63% of mid-market clients are either currently using or planning to adopt ISO 20022 messaging. Baumann also emphasized the pivotal role of enriched data facilitated by ISO 20022 in automation solutions and modernization efforts, remarking, “It’s the data that is the most helpful piece.” However, she acknowledged a significant obstacle: financial institutions’ inclination towards proprietary fields in standard messaging, echoing challenges encountered with MT messages.

Use cases for ISO 20022 include:

- Support for enriched data (.e.g., purpose codes)

- Verification to reduce misdirected payments

- Enhanced analytics

- Better cash flow forecast

- Automatic reconciliation

Baumann stressed the importance of cross-border payments. “Even though a lot of times they’re low volumes, they’re really important payments.” She highlighted the need for financial services partners who can provide guidance on cross-border payments as they have rebounded from pandemic lows and are a significant market opportunity for both businesses and banks.

Cross-border payments have points of friction that need to be addressed. They are often expensive, unpredictable, and slow—in striking contrast to faster domestic payments. SWIFT GPI does help with this, but there is still room for innovation. Baumann urged institutions to consider cross-border payments as a crucial component of their modernization efforts, emphasizing the importance of addressing the challenges and seeking solutions. “As part of your whole modernization efforts that you’re going through, it’s important to think about. Is there a vendor partner that can guide us on that as well?”

Majeske concluded the webinar by explaining Alacriti’s approach to modernizing payments for its clients, emphasizing the Orbipay Payments Hub solution as a central integration point with banking cores. The hub’s capabilities encompass various payment services, including Fedwire, ACH, RTP, FedNow, Visa Direct, and Mastercard payments. Orbipay Payments Hub is cloud-based and features ISO 20022 native open APIs, and a smart routing system that allows flexibility in selecting payment rails based on customer preferences. “Smart routing is part of what I call a FedEx model. And it enables you to ask your customers what they want to do. You suggest a rail, and we can accommodate that payment in any which way in our available rails.” Majeske also emphasized Alacriti’s “grow as you go” approach, enabling clients to expand their payment offerings incrementally. For example, a financial institution could just do instant payments and add ACH or Wire later. “Once you utilize one of our rails, you’re already integrated into the hub, and you can add additional rails very easily.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.