Community banks are at a pivotal point in adapting to the changing dynamics of payment rails. The introduction of instant payments and the upcoming ISO 20022 migration for Fedwire are transforming how transactions are processed and how financial institutions compete.

In an ICBA-hosted webinar featuring Alacriti’s Neeraj Gupta, SVP of Product Management, industry experts provided insights into these critical developments. Gupta discussed the lessons learned from the increased number of instant payments go-lives and the necessary preparations for community banks to adapt to upcoming changes in wire transfers and payment automation by 2025. Gupta also explored the adoption and operationalization of instant payments, the implications of ISO 20022 for wire transfers, and strategies for reducing costs and improving efficiency with a centralized payments hub

Quick Links

Poll Question

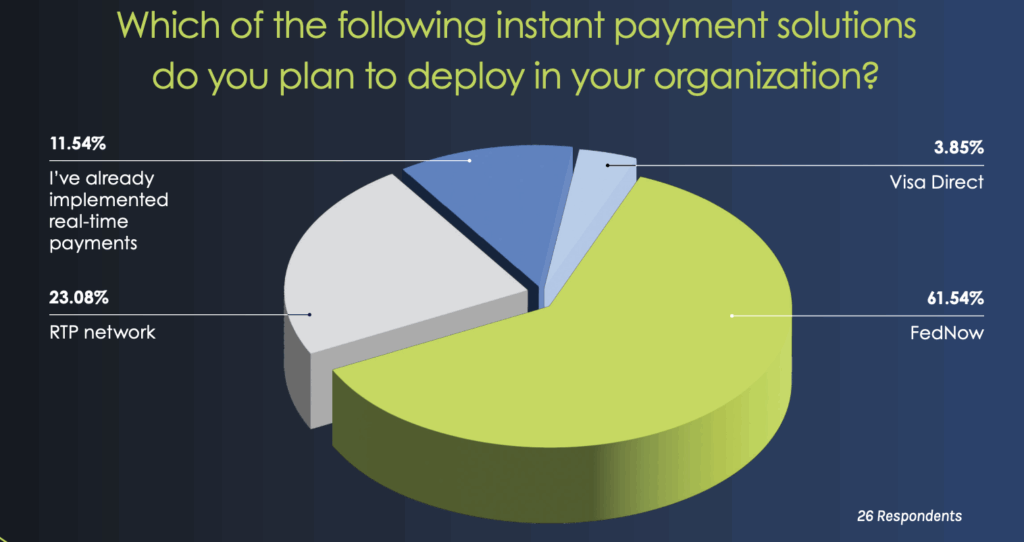

The webinar began with a poll question to gauge which instant payment solutions participants plan to deploy at their organizations in the coming year. Gupta shared his insights, noting the strong interest in the FedNow® Service, with a significant majority (61.54%) of participants planning to connect. “A lot of people are speaking about FedNow, which is appropriate given the stage and the evolutionary lifecycle where they sit. It’s not surprising at all,” Gupta commented. Gupta also acknowledged the continued interest in the RTP® network, with 23.08% of respondents planning to connect, and pointed out the niche interest in Visa Direct.

Instant Payments Update

Gupta began by discussing the broader context of the instant payments journey in the U.S. “We are almost seven years deep into the U.S. instant payment journey from The Clearing House launching the RTP network.” This extensive period has seen a lot of market movement and substantial progress in the adoption and operationalization of instant payments.

The RTP Network

The RTP network has matured with robust growth and widespread adoption. Gupta shared some impressive statistics:

- Nearly 500 financial institutions (FIs) are live on the RTP network

- Close to $300 billion has been moved through RTP, with the average payment being around $500.

- 90% of the adopted FIs comprise credit unions and community banks.

The FedNow Service

In contrast, FedNow, launched in 2023, is at a different phase. Despite its early stage, FedNow has shown strong adoption:

- Over 500 live participants and 25 certified service providers have joined since the launch.

- The advisory board for FedNow has been established.

Instant Payments Lessons Learned

The adoption of the FedNow Service has been supported by the trailblazing efforts of the RTP network, which has paved the way for a smoother transition and greater acceptance of instant payments. Gupta shared key lessons learned:

Coexistence of Payment Rails:

“We don’t expect them to consolidate or interoperate. They’re going to coexist,” Gupta explained. This coexistence will allow each network to carve out specific market segments and use cases, providing diverse options for financial institutions and their customers.

Dual Adoption Strategy:

Many financial institutions are adopting both RTP and FedNow simultaneously, along with Send and Receive capabilities. This dual adoption strategy offers several benefits, including maximizing the return on investment and ensuring comprehensive coverage of instant payment solutions.

Overlapping Investments:

Financial institutions that invest in both networks can leverage a one-time investment to achieve broader capabilities and reach. This strategy is particularly beneficial for credit unions and community banks, which form a significant portion of the adopters

Start With a Clear Use Case:

Successful FIs begin with a well-defined use case aligned with a specific customer need or gap. This approach prevents the common pitfall of presenting a solution in search of a problem.

Internal Advocacy and ROI:

Building a strong business case and demonstrating return on investment (ROI) is crucial. This includes substantiating cost savings from automation and straightthrough processing.

Monetization Strategies:

Effective monetization involves offering instant payments complementary to existing rails like ACH and wires. For instance, some FIs offer ACH for free or at discounted rates while charging a nominal fee for instant payments.

Exploring the Use Cases of Instant Payments

One of the most immediate and natural starting points for instant payments is on the Receive side. Financial institutions (FIs) see immediate transaction activity when they enable the receive functionality. Some notable receive use cases include:

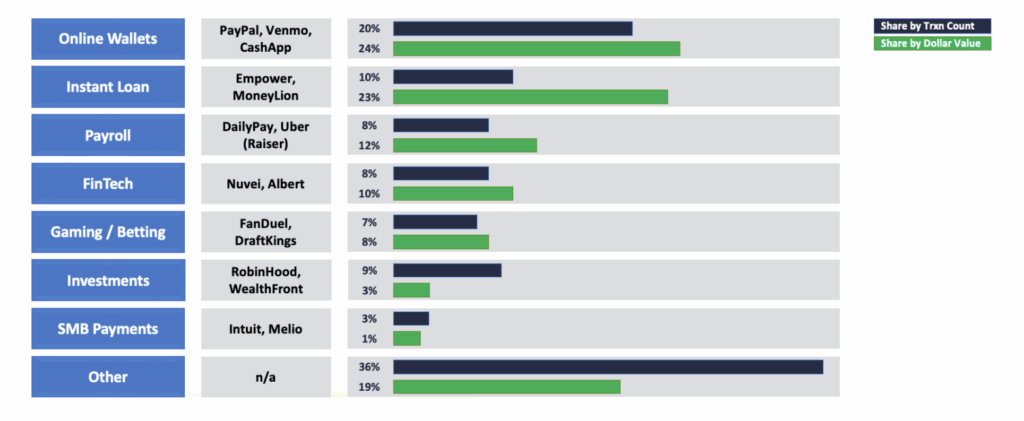

- Online Wallet Transfers: Consumers frequently transfer money from their online wallets, such as PayPal, Venmo, and Square, to their bank accounts. These wallets often auto-

- Consumer Payments: Consumer-initiated day-to-day transactions, such as peer-to-peer (P2P) transfers, have seen significant uptake.

Gupta provided an example of a community bank that observed 70% of its incoming transactions initiated by Venmo and PayPal within minutes of going online.

The Send side of instant payments presents substantial opportunities, particularly in generating fee revenue and enhancing customer service. Key Send use cases include:

1

Loan Disbursements:

Financial institutions can disburse loans instantly, providing quick access to funds for borrowers.

2

Account-to-Account Transfers:

Facilitating transfers between accounts, both within the same institution and across different institutions.

3

Title Companies:

These entities can use instant payments to distribute funds quickly and securely.

Gupta noted that these use cases have been particularly successful when FIs work closely with their retail and commercial customers to identify and address their specific needs. While TCH has seen 50% of its transaction volume take place outside of business hours, Gupta shared data from Alacriti’s live systems, revealing the number to be 69%. Over the past 12 months, online wallets dominated transaction count and dollar value. However, other interesting trends included:

■ Instant Cash Loan Senders: This use case comprised an 18% share of dollar volume in the previous calendar year, increasing to 23% in the past 12 months.

■ Investment Platforms: Services like Robinhood and Wealthfront saw lower-than-expected dollar volumes but maintained a high transaction-to-volume ratio

Operational Considerations for Implementing Instant Payments

Implementing instant payments involves a series of critical operational considerations to ensure a smooth and successful rollout. Gupta listed several key areas that financial institutions (FIs) must focus on to get ahead of common challenges.

One of the foundational steps in implementing instant payments is assembling a capable project team early in the process. This team should outline and prioritize use cases, ensuring that the solutions being developed align with actual customer needs. It’s essential to identify the right individuals for document completion and to plan the testing process meticulously, including creating detailed test cases. Education is also critical; all staff members involved should be well-informed about the new systems and processes to avoid any operational hiccups.

Technical integration is another significant aspect that requires careful planning. Financial institutions need to decide whether to connect directly to the network or through a third-party service provider (TPSP). This decision will influence the implementation approach and the complexity of the integration. It’s vital to define a core implementation team to assess the digital banking integration models, options, and constraints. This team will ensure that all technical aspects are covered, from system compatibility to security protocols, facilitating a seamless integration.

Early coordination with the accounting department is crucial for addressing funding and settlement considerations. Institutions must decide on a funding agent early in the process and understand the preferred transaction flow in the context of the general ledger (GL). Proper planning in this area helps avoid any financial discrepancies and ensures that transactions are recorded accurately and efficiently

Risk management involves documenting policies and procedures, conducting thorough internal and third-party risk reviews, and updating member agreements and disclosures. This comprehensive approach helps identify potential risks and establish robust controls to mitigate them. Institutions must ensure that their risk management frameworks are updated to accommodate the nuances of instant payments.

Lastly, fraud prevention is critical to the operational considerations for instant payments. Institutions need to assess their current models, such as ACH and wire transfers, to identify gaps and the specific risks associated with instant payments. They must also consider implementing new types of fraud detection capabilities to address emerging threats. Continuous monitoring and updating of fraud prevention strategies are essential to protect against evolving fraud tactics.

As Gupta emphasized, preparation and proactive planning are key to overcoming common challenges and leveraging the full potential of instant payments.

Wire Transfers: Navigating the ISO 20022 Transition

One significant change on the horizon is the migration to the ISO 20022 standard for Fedwire transfers. This transition, set by the Federal Reserve, promises to revolutionize how data and payments move across financial rails.

Adopting ISO 20022 will make a powerful impact on standardized data exchange. Rather than just streamlining payments, it also enhances the quality and richness of the data accompanying these transactions.

One of the standout benefits is interoperability. By converging on a domestic and increasingly global standard, financial institutions can eliminate the cumbersome process of message translation and imprecise mapping. This interoperability extends beyond FedNow and RTP, potentially transforming global financial transactions. Additionally, ISO 20022 opens doors for optimization opportunities, allowing banks to build value-added services on top of robust data frameworks.

Looking ahead to the ISO transition, Gupta shared insights gleaned from working with numerous financial institutions. He emphasized the importance of a strategic approach, starting with evaluating existing solutions for Fedwire and exploring complementary providers if necessary. To aid this process, Alacriti has developed a practical checklist that spans the lifecycle of a wire transfer—from initiation to review and submission.

Initiation:

A key focus is delivering a seamless, consumercentric money movement experience. For frequent wire initiators, having templates to ease entry and comprehensive document management capabilities is crucial. This ensures that all necessary regulations and terms are accessible and efficiently managed.

Review:

Strong authorization controls remain imperative. These controls should be user-specific and designed to streamline the approval process, reducing friction and enhancing security.

Submission:

The transition to ISO 20022 is central here, and Gupta also emphasized the importance of efficient exception management. By automating the identification and resolution of exceptions, institutions can significantly reduce the time spent on these tasks, allowing staff to focus on more value-added activities.

Across all stages, integration is a must-have. Ensuring that wire transfer systems integrate smoothly with the broader banking ecosystem is vital for a cohesive operational flow. “Being able to bring your ecosystem together, with your wire provider working seamlessly alongside other systems, can provide a holistic view and control over all processes,” Gupta noted.

Whether dealing with instant payments, ACH, or preparing for Fedwire and ISO 20022 changes, a payments hub can centralize and optimize operations. “A payments hub can be a game changer, providing automation, optimization, and strategic positioning for financial teams,” Gupta concluded.

Poll Question

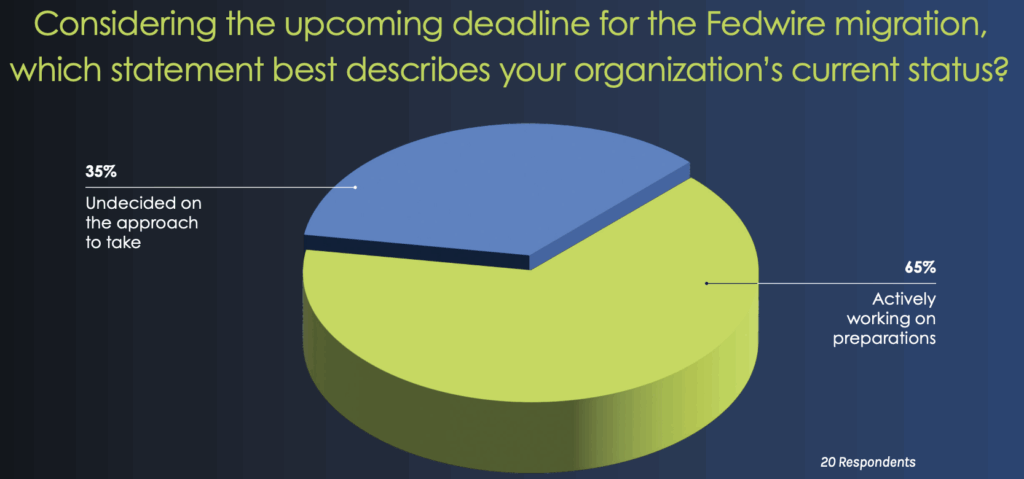

Webinar attendees were asked about their current preparation status for the Fedwire migration to the ISO 20022 standard. The poll results revealed that none of the participants felt fully prepared for the migration. The majority (65%) indicated that they were actively working on preparations. However, 35% were still undecided on the approach to take. “We see larger FIs that are scrambling to put together a strategy at the last minute while some smaller institutions are fully ready to go. This complexity shows that there is no clear clustering in preparedness based on the size of the institution,” Gupta noted. Gupta emphasized the importance of utilizing available resources and expert advice to navigate the migration process effectively. “With about 11 months remaining until the deadline, it’s encouraging to see a good two-thirds of respondents actively working on preparations. For those still undecided, there are plenty of resources and subject matter experts available to help guide the way.”

Centralized Payment Hub: A Strategic Advantage

Implementing a centralized payments hub has emerged as a strategic advantage for financial institutions. Gupta described the advantages of a payments hub in two layers: the visible benefits and the foundational elements.

Visible Benefits:

Modern Technology:

A payments hub built with contemporary technology and use cases in mind provides a robust and adaptable solution that is far superior to outdated systems.

Operational Efficiency:

Designed to automate transactions and daily operations, a payments hub enhances efficiency for the transactions being orchestrated and the business users within the financial institution.

Rapid Time to Market:

A well-implemented payments hub facilitates a quick path to adoption and revenue generation for new initiatives. Its flexible nature allows institutions to choose how they leverage the hub as they grow, enabling swift adaptation and deployment.

Foundational Elements:

Cloud-Native Infrastructure:

Ensures speed and scalability, crucial for handling spiky transaction volumes such as those seen with RTP. The ability to quickly and effectively calibrate capacity is essential for maintaining performance and reliability

ISO Native:

Being ISO 20022 compliant across all payment rails is crucial for future interoperability. This standardization supports new use cases and value-added services, ensuring the institution remains competitive and innovative.

API Accessibility:

Facilitates seamless integration within the institution and with third-party partners. This openness allows the entire ecosystem to work harmoniously, enabling partners to consume APIs and build additional value-added solutions.

A centralized payment hub has the transformative power to not only drive efficiency and modernize operations, but also to position financial institutions to swiftly respond to market changes and opportunities. As the industry moves forward, payments hubs become more critical for future success.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.