In 2024, the swift adoption of real-time payment systems and the integration of advanced technologies are transforming payment experiences to be faster, more efficient, and increasingly automated. Adopting systems like the RTP® network and the FedNow® Service is crucial for financial institutions to stay competitive as they address the growing consumer demand for instantaneous transactions and seamless user experiences.

In an insightful webinar, Integrating Instant Payments: An Operational Perspective, payments experts Paul Steinbrecher, Director of Payments Consulting at Alacriti, and Jeff Bucher, Senior Product Manager at Alkami, provided a comprehensive guide on how to operationalize real-time payments with minimal staffing. They also discussed best

practices for implementing and rolling out instant payments efficiently and effectively.

Quick Links

The State of the Market for Instant Payments

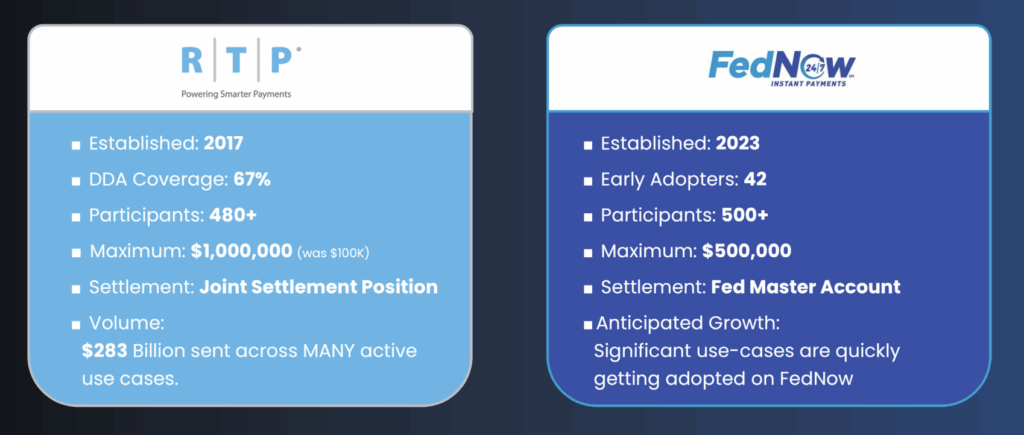

The demand for instant payments has grown substantially, driven by the need for faster, more efficient, and reliable payment solutions. The introduction of instant payment systems has significantly changed financial transactions in the U.S. With RTP established in 2017 and the FedNow Service launched in 2023, there has been an exponential increase in the adoption of these systems. “We’re seeing instant payments grow at a really rapid pace, especially since the announcement of FedNow,” Steinbrecher noted.

At the time of the webinar, the RTP network boasted 67% DDA (Demand Deposit Account) coverage and had processed $283 billion, with 480 participants on the network. In addition, the recent increase in the maximum payment limit to $1m has further boosted the average payment amount.

Although the FedNow Service is newer, it has also shown impressive early adoption. With 42 early adopters and 500 participants already on board in March, the market is eager to leverage the advantages of real-time payments.

The utility of instant payments extends beyond basic transactions, addressing various needs across different sectors. Use cases such as online wallet disbursements, instant cash loans, daily payroll for gig economy workers, and even larger transactions like retirement payments and title payments are becoming increasingly common. “A really popular one we’re seeing as a use case is daily payroll,” Steinbrecher explained, referencing companies like DailyPay that facilitate real-time access to earnings for workers.

Additionally, the integration of instant payment systems with other platforms, such as the partnership between Alacriti and Alkami, has been pivotal in advancing the adoption and functionality of these systems. This integration enhances the user experience and drives operational efficiency for financial institutions.

The future of instant payments looks promising, with continuous growth and adoption expected. The presence of 24/7/365 operational capabilities marks a significant shift in payment paradigms, allowing transactions to occur outside traditional banking hours. “52% of all transactions on the RTP network are happening after hours,” Steinbrecher pointed out.

The Treasury is one of the early adopters of the FedNow Service and is currently in pilot for one-time payments, and manually processed disbursements such as urgent or unpredictable payments. Collaboration between instant payment providers, the U.S. Treasury, and other federal entities, opens up new possibilities for government disbursements, including social security, veteran benefits, and tax refunds.

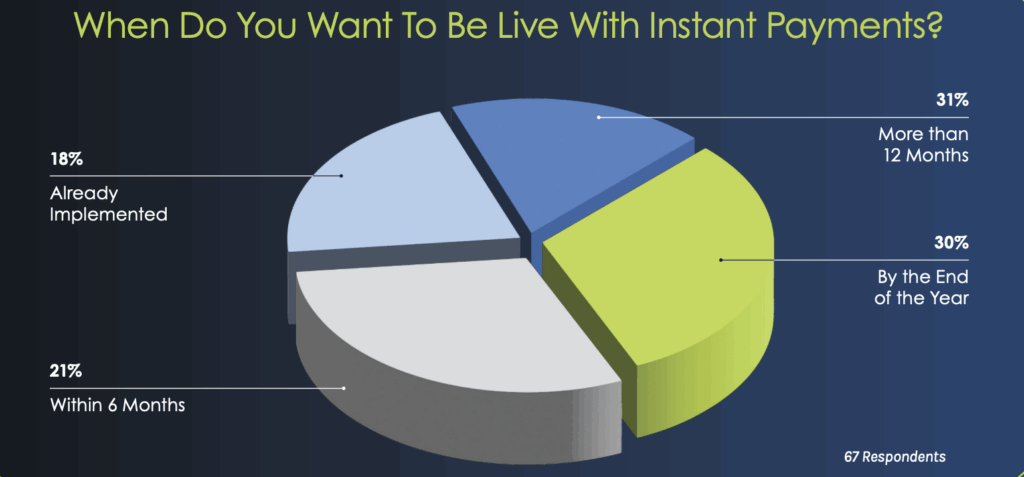

Poll Insights: The Urgency of Adopting Instant Payments

During the webinar, a poll was conducted to gauge participants’ readiness to go live with instant payments. The poll results revealed significant interest in implementing instant payments quickly. Approximately 50% of respondents indicated they plan to go live with instant payments either by the end of the year or within the next six months. Steinbrecher reflected on these results, stating, “I would say this is in line with what we’re seeing in the market. The demand for instant payments is high, and institutions are eager to adopt these systems as soon as possible.”

Bucher also commented on the poll results, noting the impact of FedNow’s recent marketing efforts. “FedNow did a ton of marketing, which raised interest not only in their platform but also in RTP and faster payments in general. The buzz around instant payments has certainly accelerated institutions’ timelines for adoption.”

Implementation

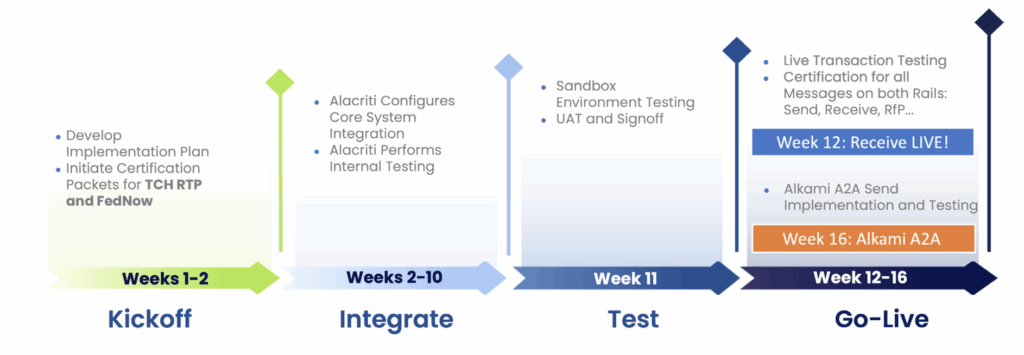

Integrating instant payments involves a meticulously planned and executed process designed to minimize the burden on financial institutions. Steinbrecher explained, “Our goal is to simplify this implementation and take as much weight off your shoulders, so we do a lot of those ditch-digging-type exercises for you.” This approach ensures that institutions can focus on their core operations while Alacriti handles the technical complexities.

One key advantage of partnering with Alacriti is the ability to implement both the RTP network and the FedNow Service simultaneously. This dual-rail implementation means financial institutions can go live on both systems within the same timeframe, significantly reducing the overall project duration. “We can bring you live on both rails from a Receive and Send perspective within this timeline when you partner with Alacriti,” Steinbrecher noted.

Implementation Steps:

1. Developing the Implementation Plan

Alacriti works closely with the institution to develop a comprehensive implementation plan. This includes initiating certification packets for both the RTP network and the FedNow Service, setting up settlement positions, and ensuring all regulatory and operational requirements are met.

2. Integration and Testing

Alacriti’s developers perform the necessary integrations into the institution’s core systems. This phase includes rigorous testing to ensure seamless operation. Steinbrecher commented on the depth of Alacriti’s integration capabilities, stating, “We perform all the integrations and the testing to ensure that they’re in a good place.”

3. Sandbox Environment

A sandbox environment is established to facilitate user acceptance testing (UAT). This controlled setting allows the institution’s team to interact with the new systems, provide feedback, and ensure everything functions as expected.

4. Live Testing and Certification

The next step involves live testing, where actual transactions are processed to validate the system’s performance. This phase culminates in full certification for all message types, including Receive, Send, and Request for Payment.

5. Hand-Off to Alkami

Once the initial implementation and testing are completed, the project is handed over to Alkami. “We assign a project manager to help with configurations, testing on our side (making sure the limits are set right, configurations, MFA, everything is kicking in appropriately),” Bucher explained.

6. Collaborative Partnership

The seamless collaboration between Alacriti and Alkami is a cornerstone of the implementation process. Both companies provide dedicated project managers who coordinate closely, ensuring smooth transitions and effective communication. This partnership allows for a comprehensive integration that leverages the strengths of both platforms.

Operational Transformation in Instant Payments

Implementing instant payments involves some changes in operations. One of the standout benefits of instant payments is their push-only, irrevocable nature, which minimizes the need for interactive oversight. “We’re seeing 99+% being processed in a straight-through process,” Steinbrecher explained. This efficiency means that most transactions are completed automatically without manual intervention, significantly reducing the operational burden on financial institutions.

Alacriti’s data supports this claim, showing only one exception per every 20,000 transactions. This high rate of automation implies that financial institutions do not need to increase staffing levels, even during non-traditional banking hours. Steinbrecher addressed a common concern, stating, “A common question I get is, do we need to have people there on Sundays? Do we need to have people there at midnight? We’re not seeing financial institutions add people in this regard.”

Alacriti provides robust back-office operations portals that offer comprehensive visibility into transaction workflows and settlement positions. These portals are crucial for managing liquidity in real-time and ensuring the smooth operation of instant payment systems.

This tool allows financial institutions to easily pull data, manage exceptions, and understand transaction patterns—vital for effective operational management.

The portal’s capabilities extend to generating daily settlement reports, which are essential for reconciliation processes. These reports can be accessed manually or through automated transfers to data lakes, ensuring financial institutions have up-to-date information on their transactions and balances. This seamless integration of reporting tools simplifies the reconciliation process, making it more efficient and accurate.

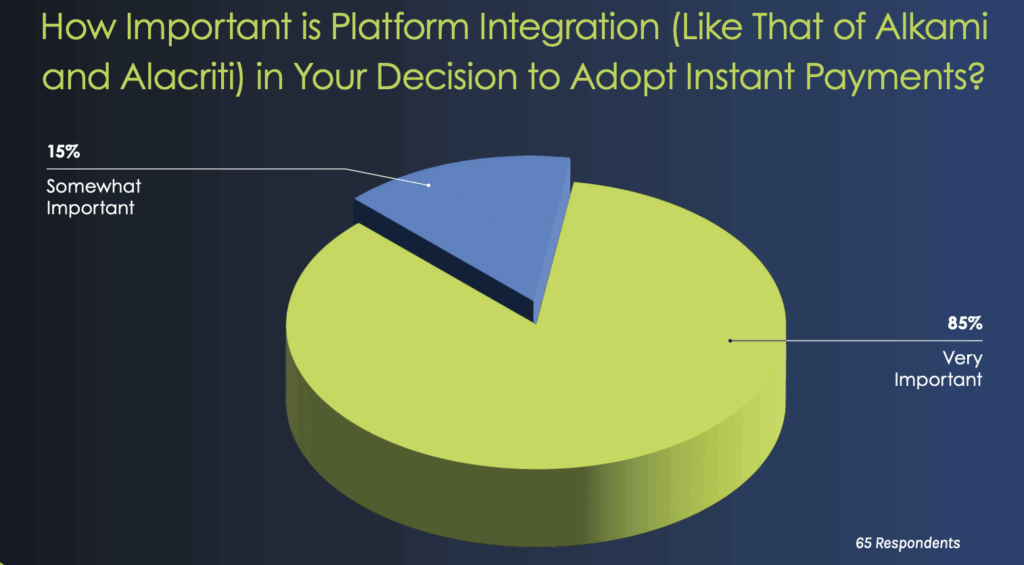

Poll Insights: Importance of Platform Integration

Another poll was conducted during the webinar to gauge the importance of platform integration in the decision to adopt instant payments. The results were overwhelmingly clear, with participants indicating that platform integration is very important. “I think a lot of users want that consistent experience,” Bucher commented on the poll results.

Bucher elaborated, “They want to be able to go to the different parts of the platform, the digital platform, like an Alkami platform, and be able to see that consistent user experience where they know where to click, they know how to use it.” This consistency is crucial for user adoption and satisfaction, ensuring customers can easily navigate and utilize the instant payment features.

Platform Integration

Bucher emphasized the importance of integrating instant payments platforms into financial institutions’ digital banking solutions. This integration enhances user experience and ensures the smooth operation of instant payment systems.

Bucher highlighted three critical areas within the Alkami platform that facilitate the integration of instant payment solutions:

Digital Banking Solutions

The Alkami platform offers robust digital banking solutions that seamlessly integrate instant payment functionalities. “We have the platform that we offer to financial institutions along with data and marketing solutions,” Bucher explained. These solutions enable financial institutions to monitor user activities and leverage marketing data for cross-selling opportunities, thus enhancing overall operational efficiency

Provider Integrations

The Alkami platform supports numerous integrations with various providers, offering extensive functionalities and solutions. “One of the things our providers can do, in addition to connecting via SSO or an API connection to our platform, is we offer an SDK,” Bucher noted. This Software Development Kit (SDK) allows third-party providers to build within the Alkami platform, ensuring a consistent user interface and experience across all functionalities.

Use Case Implementations

Alkami has successfully implemented several use cases for instant payments, including account-to-account (A2A) and person-to-person (P2P) transfers. “We have several clients that are implementing this,” Bucher stated, referring to the A2A use case. This functionality allows users to link external accounts and perform instant transfers seamlessly. The platform checks if the external account is on the RTP network or the FedNow Service and offers instant transfer options if available.

Integrating instant payment functionalities into the digital banking platform ensures a consistent and intuitive user experience. “They want to be able to go to the different parts of the digital platform, Alkami, and be able to see that consistent user experience where they know where to click, and they know how to use it,” Bucher emphasized. This consistency is crucial for user adoption and satisfaction, allowing users to perform instant transfers effortlessly.

Monetization of Instant Payments

As the demand for instant payments grows, financial institutions are exploring effective monetization strategies to capitalize on this trend. The desire for instant gratification among younger generations drives the need for faster money movement. Bucher noted that “90% [of younger users] want an option for faster transfers, and 70% really like card-based transfers because they equate card-based transactions with faster.” This demand is influenced by popular platforms like Venmo and PayPal, which have set high expectations for quick and seamless transactions.

The growing wealth among millennials, Gen Z, and subsequent generations further amplifies the need for instant payments. With an estimated $16 trillion expected to be transferred from parents to these younger generations, the frequency and importance of money movement are set to increase significantly. “Faster money movement needs will only accelerate as millennials and Gen Y and Gen Z get older and build their wealth,” Bucher added.

Financial institutions can implement various fee structures to offset the costs associated with providing instant payment services through FedNow, the RTP network, and other platforms. Bucher explained that while certain transactions, like P2P payments, are typically free due to competition from services like Zelle and PayPal, other use cases present opportunities for monetization.

- A2A Transfers: Financial institutions can charge fees for instant A2A transfers, especially for larger amounts. This approach allows institutions to recoup some of the expenses of offering these services.

- Business Transactions: Charging a fixed percentage or flat fee for instant business transactions is another viable monetization strategy. Businesses are often willing to pay for the convenience and speed of instant payments, making this a lucrative area for financial institutions.

- Tiered Fee Structures: Implementing tiered fee structures based on transaction volume or amount can also be effective. For example, institutions might offer a certain number of free transactions per month, with fees applied to additional transfers.

Benefits of Connecting Through Alacriti

Partnering with Alacriti offers numerous advantages for financial institutions looking to implement and monetize instant payments. Alacriti provides comprehensive solutions that streamline the integration process and ensure the smooth operation of instant payment systems. Steinbrecher emphasized, “Our goal is to simplify this implementation and take as much weight off your shoulders and take it onto our shoulders.”

Alacriti’s partnership with Alkami further enhances the user experience by offering seamless integration with digital banking platforms. This collaboration ensures that financial institutions can provide consistent and efficient instant payment services, meeting the high expectations of modern users.

Real-time payment systems like the RTP network and FedNow Service have had a transformative impact. These advancements are essential for financial institutions to meet growing consumer demands for fast, efficient, and seamless transactions. As time goes on, adopting these technologies will be increasingly crucial for staying competitive and enhancing both operational efficiency and customer satisfaction. Financial institutions stand to benefit greatly from having their connection with instant payment rails seamlessly integrated with their digital banking solutions.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.