The Federal Reserve Banks’ mandate requiring all wire transactions to comply with the ISO 20022 message format for the Fedwire Funds Service by March 10, 2025, represents more than just a regulatory obligation. For financial institutions, this deadline is a strategic opportunity to enhance wire transfer capabilities significantly.

In a webinar hosted by American Banker, Alacriti’s SVP of Product Management, Neeraj Gupta, discussed how compliance through automation can transform this regulatory requirement into a pivotal growth opportunity. Gupta also explained how automation is revolutionizing the wire transfer process and the critical benefits of transitioning to ISO 20022, such as driving modernization, enabling straight-through processing, and supporting globalization.

Quick Links

Wire Transfers: Navigating the ISO 20022 Transition

Gupta started the webinar by discussing The Federal Reserve Banks. “March 10, 2025, the Federal Reserve has mandated that all participating FIs and vendors on their behalf will be communicating with the Fedwire Funds Service using ISO 20022 standards. There are a lot of implications here.” The transition to ISO 20022 offers numerous advantages, including enhanced data quality and improved interoperability between payment schemes. Gupta pointed out the benefits of automation in this process: “Automation is revolutionizing the wire transfer process, drastically reducing manual labor and error rates that can result in up to 50% cost savings.”

An audience member asked Gupta to explain how those savings are achievable through the automation of wire transfers with ISO 20022 compliance. “We’ve analyzed the automation of wire transfers and categorized them into two groups: those that process smoothly (the ‘happy path’ wires) and those that encounter issues (the ‘exception’ wires). For the ‘happy path’ wires, which don’t face any problems, automation significantly reduces manual labor. These typically take anywhere from 5 minutes to an hour to process manually, but with automation, this time is greatly reduced. For the ‘exception’ wires, which do face problems and require more attention, the processing time can be 30 minutes or more. Here, automation also helps by handling many of the routine tasks, which can save a substantial amount of time. Overall, we’ve seen that automation can save between 20 to 40% of the time spent on all wire transfers.

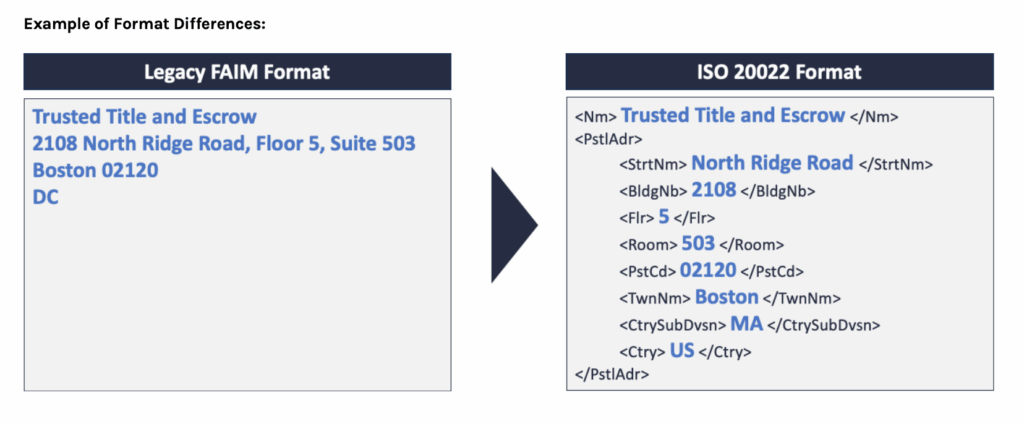

Adopting ISO 20022 facilitates modernization, enabling straightthrough processing and supporting globalization. It goes beyond operational efficiency and benefits customers with smoother and faster transactions. “This is a highly structured, highly robust messaging system, which is where it differs in a lot of ways from some of the other legacy, more proprietary formats,” Gupta said. However, the transition is not without its challenges. There are concerns about the complexity of implementation and the potential for proprietary deviations from the standard. Despite these hurdles, Gupta remains optimistic: “Where there’s complexity, where there’s fear and uncertainty, there is opportunity, especially for those that will embrace that in spite of the hesitation and really nail the transition and be out in front.” As institutions navigate this transition, the focus should be on leveraging automation, improving data quality, and enhancing customer experiences to fully capitalize on the opportunities presented by ISO 20022.

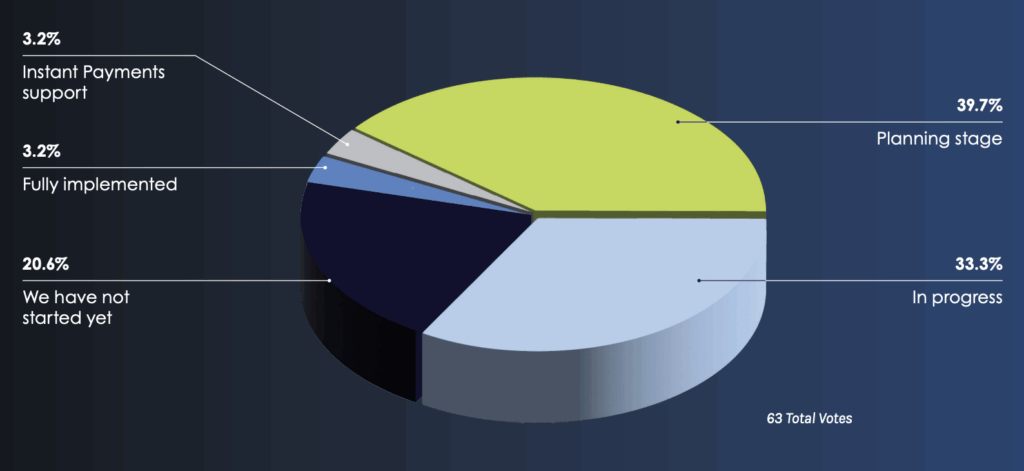

Poll Question

During the webinar, a poll was conducted to gauge the current state of ISO 20022 implementation among attendees. The poll revealed that 39.7% of organizations are in the planning stage, 33.3% are in progress, 3.2% have fully implemented the standard, and about 20.6% have not started yet. “Typically, what we’ve seen is about a third, a third, a third.

A third that are still formulating their plans, a third that are actually progressing now they’ve formulated their strategy, and then the other third either fully done or haven’t started yet,” Gupta noted. The results showed how varying financial institutions are in their stages of ISO 20022 readiness.

At What Stage is Your Organization in Implementing ISO 20022 for Wire Transfers?

Automation and Wires: Revolutionizing the Wire Transfer Process

Despite the industry’s traditional reliance on manual processes, automation has the potential to significantly enhance efficiency and reduce costs. “It’s a shame that we don’t think about automation when it comes to wires because I think there’s real value being left on the table,” Gupta commented.

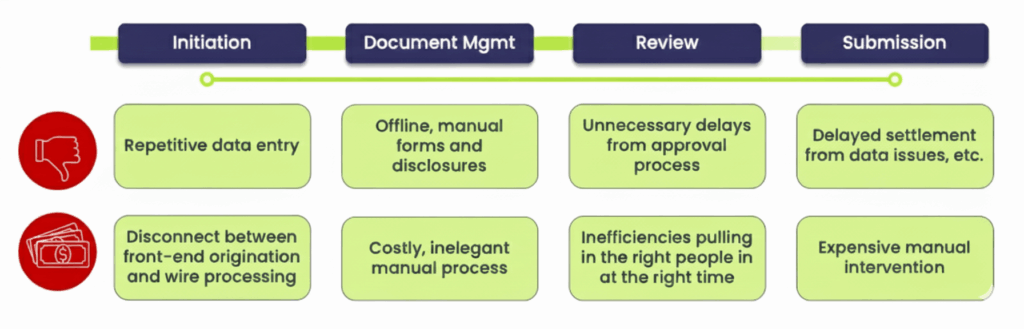

The typical lifecycle of a wire transfer has various pain points and inefficiencies that could be mitigated through automation. From the initiation of a wire to its final disposition, multiple steps involve repetitive manual tasks that not only increase operating costs but also negatively impact customer experience. For instance, power users who frequently submit wires often face the tedious task of entering repetitive data fields. Automating this process can save significant time and effort for both users and financial institution (FI) staff. Another area ripe for automation is the disconnect between originating channels, such as online banking platforms and wire providers. Many institutions still rely on manual intervention to transfer wire data, creating inefficiencies and potential errors. As Gupta explained,

Document management also stands to benefit from automation. The traditional process of handling paper or digital documents, requiring signatures and acknowledgments, can be cumbersome and errorprone. Automating document management through digital platforms can streamline this process, making it easier for both payers and bank staff while reducing costs and improving accuracy.

The review and approval process for wire transfers is another critical area where automation can make a difference. By implementing automated controls and precise authorizations, financial institutions can ensure timely and accurate transaction approvals, reducing unnecessary delays and manual labor. Finally, addressing issues that arise during wire submissions, such as missing data fields or incorrect values, can be automated to save time and prevent delays.

FIs can save up to 30-50% in operating expenses by automating the wire process

Pain Points Across the Wire Lifecycle Impacts Customer Experience and Drives Operating Cost

Moving Forward After Instant Payments

The progress of instant payments steadily moves forward. “We’ve been really excited by the adoption of instant payments over the last few years,” Gupta said. “RTP is close to 500 institutions, growing by almost 50% year over year in terms of count—80% in terms of amounts. With FedNow, we’re seeing nearly 600 FIs that are participating.”

The increasing adoption of instant payments is also reflected in transaction patterns. Gupta shared an interesting observation: “One of the ways that we measure this is by the share of instant payments that are taking place outside of typical banking hours. When TCH launched RTP, they estimated about 50% of transactions would be expected outside business hours. We’ve seen closer to 70% of instant payments over the RTP rails take place outside business hours.” This is a great example of the growing reliance on instant payments.

As the market continues to shift towards real-time transactions, the importance of a unified, consumer-centric initiation experience (rather than one organized by payment rail) grows. “We advocate for a unified, more consumer-centric initiation experience. Not so much organized by rail, but organized by what’s the job to be done,” Gupta explained. This approach, combined with a complementary pricing model and the ability to quickly adapt to evolving use cases, will be critical for financial institutions to succeed in the increasingly real-time market.

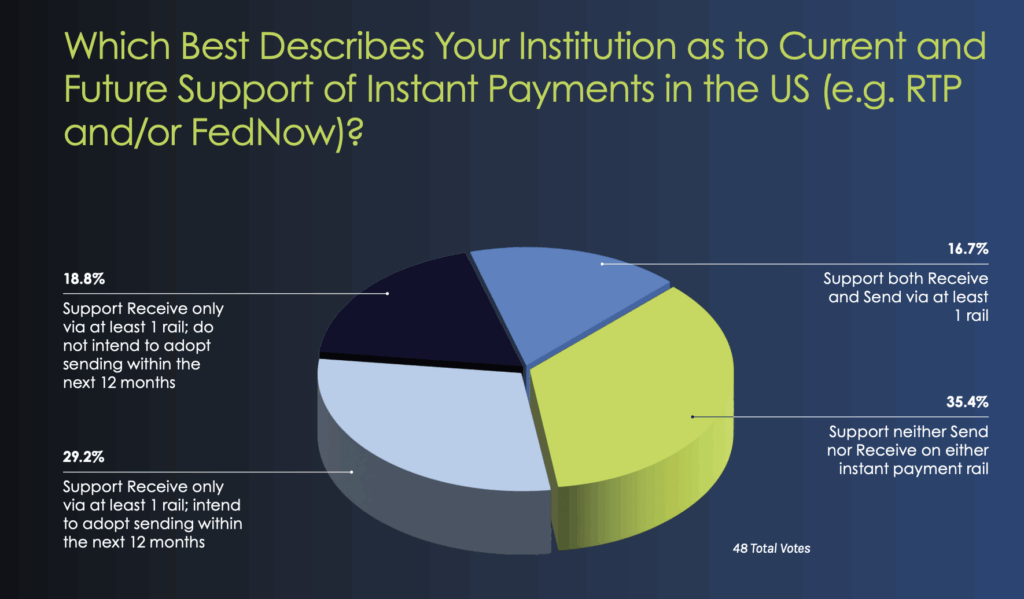

Poll Question

A second poll was conducted during the webinar to understand financial institutions’ current and future support of instant payments in the U.S. The results revealed that 35.40% of respondents neither Send nor Receive on either instant payment rail, while 29.2% support Receive Only via at least one rail and intend to adopt Send within the next 12 months. Additionally, 16.7% support both receiving and sending via at least one rail. “What surprises me here the most is actually the support of both Receive and Send. I wasn’t expecting that high, actually. We’re seeing still some reluctance around the Send, of course, it’s going to depend on segment and tier,” Gupta observed.

The Strategic Advantage of Payments Hubs

Given the advantages, the concept of a centralized payments hub is increasingly being recognized for its potential to drive efficiency

Modern and Future-Proof Infrastructure:

One of the primary advantages of a payments hub is its ability to remain modern and future-proof. A well-constructed payments hub is built on an ISO 20022 foundation and designed to be less railspecific and more cross-rail-oriented. This architecture allows financial institutions to adapt seamlessly to changes and updates over time, making it easier to integrate new payment methods and comply with evolving standards. The inherent flexibility of a payments hub ensures that financial institutions can “roll with it” as the industry progresses, maintaining their competitive edge.

Rapid Time to Market:

A centralized payments hub also enhances an institution’s ability to respond quickly to market trends. With Alacriti’s Orbipay Payments Hub, financial institutions can minimize operational overhead and leverage a cloud-native, ISO 20022, API-enabled framework, enabling them to rapidly deploy new features, functionalities, and payment rails. This agility enables institutions to capitalize on emerging trends and opportunities, driving revenue growth and innovation. The modular nature allows FIs to “pick and choose” the services they need, scaling their operations efficiently as they grow.

Meeting Institutions Where They Are:

The adaptability of Alacriti’s payments hub extends to its implementation. Financial institutions can select the features and functionalities that align with their specific needs, ensuring a tailored approach that meets them “where they are.” This customization capability is crucial for FIs looking to enhance their payment systems without undergoing a complete overhaul. By integrating value-added services and payment rails as needed, institutions can provide superior services to their customers while maintaining operational efficiency.

A centralized payments hub offers financial institutions a strategic advantage by providing a modern, flexible, and efficient infrastructure. The ability to adapt to changes, reduce operational costs, and quickly bring new services to market positions financial institutions to thrive. The power of a well-designed payments hub truly lies in its capacity to support institutions as they grow, ensuring they remain agile and customer-focused in an ever-changing environment

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.