Since its July launch, the FedNow® Service, the Federal Reserve’s always-available real-time payment and settlement service, has been an appealing new instant payment option for community banks. However, questions about its integration and customer impact remain. In an ICBA-hosted webinar, Siobhán O’Malley of Federal Reserve Financial Services and Mark Majeske of Alacriti addressed many of those questions. They discussed the tangible benefits and the return on investment that real-time payments offer, delved into how community banks can connect, and shared experiences from financial institutions that have successfully implemented the service. The webinar equipped community banks with the necessary insights to harness the power of the FedNow Service in their operations.

To read more, download this webinar recap article.

Quick Links

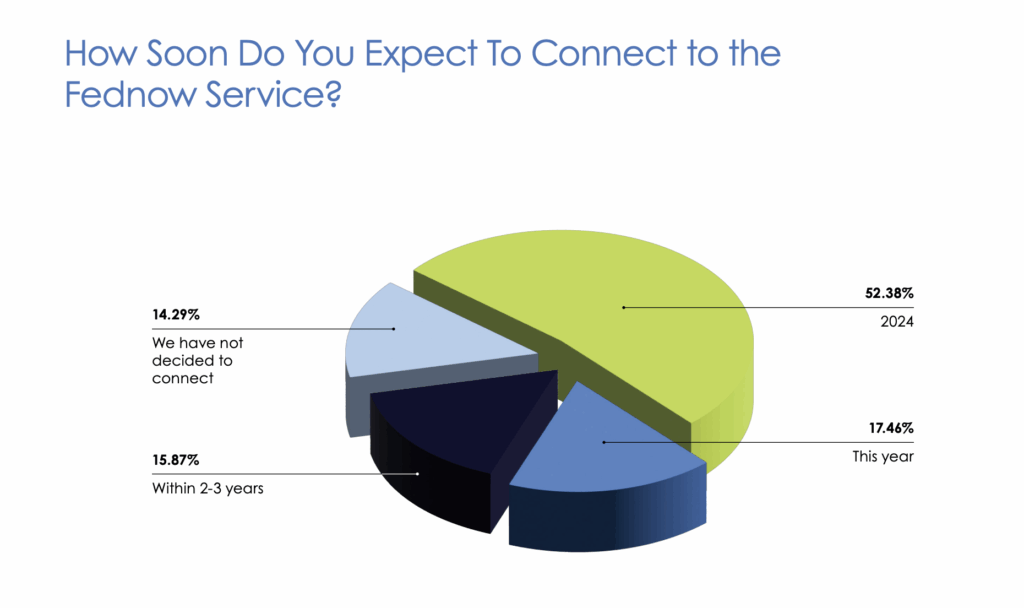

The webinar began with an audience poll, where they were asked how soon they planned to connect to the FedNow Service. A huge majority of the 64 participants, 52.38%, planned on connecting in 2024, 17.46% in 2023, and 15.87% within 2-3 years.

FedNow Service Update:

Siobhan O’Malley with Federal Reserve Financial Services began the webinar by stating the basic purpose of the FedNow Service. “We’re introducing a service that operates around the clock, every day of the year, enabling financial institutions of every size to offer instant payment services,” she shared. In July 2023, the FedNow Service launched with 35 live participants, the U.S. Department of the Treasury’s Bureau of the Fiscal Service, and 16 service providers. As of early October 2023, over 100 financial institutions had gone live and there were 20 certified service providers. Those numbers continue to grow all the time.

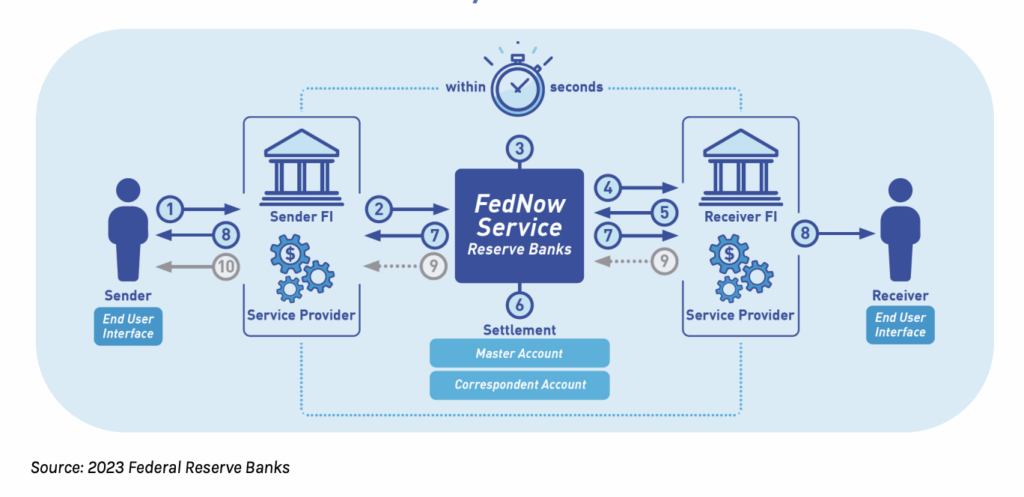

The FedNow Service has the immediate settlement and credit push characteristics of a wire payment. Yet it has the immediate availability of funds of cash, and very powerful remittance capabilities, like an ACH. O’Malley explained the flow of a FedNow Service transaction from initiation to settlement. To start, a sender will initiate a payment, which is always going to be a credit push payment (there is no debit function), which makes it an inherently safe payment flow. The sender’s financial institution submits a payment to the FedNow Service, leveraging the ISO 20022 messaging standard.

One of the many benefits of the FedNow Service is that payments will clear and settle between financial institutions in real-time, in a Federal Reserve master account, with no prefunding required. This all happens within 20 seconds. If it doesn’t, the payment will actually timeout. The FedNow Service supports the use of a third-party service provider such as Alacriti as well. “Alacriti is a great partner in the FedNow space,” said O’Malley.

FedNow Service Payment Flow

FedNow Services Features and Benefits

O’Malley discussed the benefits of the FedNow Service. “By bringing FedNow into the market, it will allow you to stay competitive and meet your customer’s current and future expectations and demands. It will allow financial institutions to leverage a neutral platform that supports a variety of use cases. Another way of saying this is that the payment service that we launched is truly payments agnostic. It also provides a choice.” One of the choices that the FedNow Service offers is how to connect. Financial institutions can connect directly with the Federal Reserve or with their third-party processor.

The FedNow Service leverages ISO 20022, a standard that enables a common global “language” for payment messaging. ISO 20022 has several benefits, including:

- Provides a common foundation for exchanging payment messages

- Supports the exchange of data (e.g., remittance information)

- Offers greater end-to-end efficiency of payments

- Helps remove barriers to interoperability

- Provides a platform for continuing industry innovation

The FedNow Service has built-in risk mitigation. Transaction limits make it possible for financial institutions to adjust the transaction value limit for credit push (send) transactions. The initial credit transfer value limit in market now is $500,000. However, when participants go live on the network that defaults down to $100,000. From there, financial institutions have the option to adjust it up or down to meet their risk tolerance. In addition, each RTN or ABA live on the FedNow Service can have its own send limit on transactions.

The Fed began with negative lists for both Senders and Receivers. This will reject transactions going to or coming from specific accounts. In addition, if an account is under suspicion of being risky or fraudulent, or the financial institution doesn’t want to conduct business with it because it’s in a morally sensitive area such as gambling, the negative list feature can be leveraged. This list is managed distinctly by each participant on the network, but only applies to transactions for a given financial institution.

Fraud reporting provides the ability for FIs to work with the network to reduce fraud exposure. Participants on the FedNow network are required to report confirmed instances of fraud within specified time limits. The Fraud Classifier Model offers a clear paradigm for defining and describing fraud, making it easier to help prevent it moving forward.

The Fed also built risk mitigation solutions at an overall service level, which include:

Message authentication:

Ability for each party to verify the authenticity and integrity of messages

Data encryption:

Data will be encrypted at rest and in flight to protect digital data confidentiality transmitted over FedNow Service network

Tokenization:

Tokenize certain sensitive data within FedNow Service data stores

Network transactions limits:

FedNow Service will have limits on the maximum value that can be sent across the network

Flexible participation options:

Participants can choose to be enabled for sending and receiving payments or start by receiving payments only

O’Malley provided a glimpse of the product enhancements that the Fed is hoping to launch in the near future. “So, things like remittance information, to better support B2B payments. We also want to be able to support alias-based payments through directory capabilities. We’re thinking through how we can enable APIs for informational (and maybe transactional) needs in the future, and an additional tool to help detect and prevent fraud. We are continuing to refine and roll out elements of our FedNow enhancements product roadmap, but we’re always interested to hear your feedback about what you’d like to see in future iterations of the service.”

Use Cases and Participation Types

O’Malley discussed the benefits of the FedNow Service. “By bringing FedNow into the market, it will allow you to stay competitive and meet your customer’s current and future expectations and demands. It will allow financial institutions to leverage a neutral platform that supports a variety of use cases. Another way of saying this is that the payment service that we launched is truly payments agnostic. It also provides a choice.” One of the choices that the FedNow Service offers is how to connect. Financial institutions can connect directly with the Federal Reserve or with their third-party processor.

The webinar offered clarification on how community banks can participate on the network. Community banks can start with Receive Only, which of course means that instant payments can only be received, and customers won’t be able to initiate credit push transactions (send) across the network. They will be able to return payments as needed through the FedNow Service if a request for a return is initiated on the service.

Another option is to Send and Receive which has more use cases on the network. There is also the option to Send and Receive with Requests for Payment. O’Malley emphasized that when working with a third-party service provider, it’s paramount to be sure that they can support Send if that is something a financial institution is looking to do immediately or down the line. For example, Alacriti has offered the capability to support Send since the beginning, as a member of the pilot program, and is one of the first to be certified and live on FedNow.

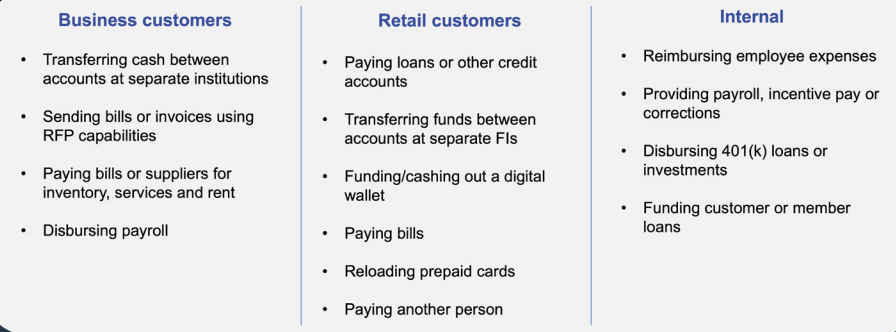

Before walking through the high-value use cases, O’Malley noted, “It’s important to note that we’ve purposely made the services I’ve referenced earlier use case agnostic, meaning that FedNow payments, including requests for payments, can be used to enable any sort of payment style, as long as there’s an RTN or ABN account number associated with it.”

The FedNow Service has seen high-value use cases in:

- On-Demand Payments: Business to Business (B2B) Example: A restaurant can pay its food and equipment supplier

- Immediate Payroll: Business to Consumer (B2C) Example: Employers providing daily payments to employees, sometimes even multiple payments a day, such as paying a delivery person after each delivery they complete.

- Me-to-Me: Account to Account (A2A) Example: An individual moving funds from their financial institution to their brokerage account at another institution.

To determine how to participate in the FedNow Service, community banks should evaluate what instant payment solutions they plan on offering:

Majeske then polled the audience once more. The audience was asked how they planned to address the need for the creation of instant payment use cases. A very large majority of the 49 respondents, 69.39%, stated that they planned on using a third-party service provider (payments), which showed that financial institutions prefer assistance when it comes to fully leveraging the benefits of real-time payments.

A very large majority of the 49 respondents, stated that they planned on using a third-party service provider (payments)

The ROI of Instant Payments

Majeske began his discussion about the ROI of real-time payments by stating that many of the use cases that would build a proper business case would come from Send. “And I’m speaking specifically to Send. Because if you’re receiving, most banks do not charge for receiving transactions on FedNow (at least I haven’t seen that). However, what we’re finding at Alacriti is that 100% of our banks that are currently in the queue for implementation are doing both. What I usually find is they’re doing Receive first, because that’s the path of least resistance, but then they’re also planning or scheduling to do Send.”

“When we do a business case for this, and I’ve done a number of them, I look at two major components. ‘Can I experience some cost reduction?’ And then, ‘What is my revenue generation model?’ I would urge you, since this is a new payments rail, to be realistic in terms of setting your expectations for year one,” Mark advised.

While it’s important to not set false expectations internally, it is possible to decrease costs by using the FedNow Service. A Deloitte report found that the average cost of real-time payments amounts to $1.95 for 10 transactions per capita. “So, when you compare that to a check of $2.79, but for the same number of transactions, I think you’ll find that cost is less of a factor in terms of selecting FedNow as your capability to move money,” Majeske explained. “And it’s not just that it’s less, or it costs less from the provider. When you look at it internally, and the electronic nature of FedNow, it does bring the cost down. One way that I’ve experienced it in banking is we used to have a lot of our call center answering questions regarding ‘Did my transaction get there?’. FedNow gives you that answer. We had about 70% of our calls coming in asking if transactions had been completed, and people wanted closure on them. FedNow is giving that information instantly, so it reduces call volume.”

Although banks aren’t really charging for receiving instant payments transactions, many people are looking at the opportunity to charge a fee for an outbound FedNow transaction. For example, banks can leave ACH as free, and then charge a fee for FedNow.

As an automated end-to-end solution, the FedNow Service goes beyond moving funds and moves data. For instance with Request for Payment, there can not only be a lot of cost savings, but a lot of revenue-driven growth as well. The benefit goes beyond the financial institution and goes to the client experience. “Your customers will be happier if they not only use FedNow as an option, but in a way that makes their lives easier,” said Majeske.

Instant data and cash flow projections have tremendous value. Faster money movement enables better projections for cash flow and enhanced process efficiencies e.g., better end-to-end margins, streamlining operations, and reducing manual intervention, which also drives revenue growth.

For B2B, the FedNow Service creates a new way to communicate and interact with customers. For instance, sending an RfP and the customer can respond to that invoice electronically through FedNow. It’s a big win as it streamlines and provides more ways for the customer to interact with the business.

Moving Forward with FedNow

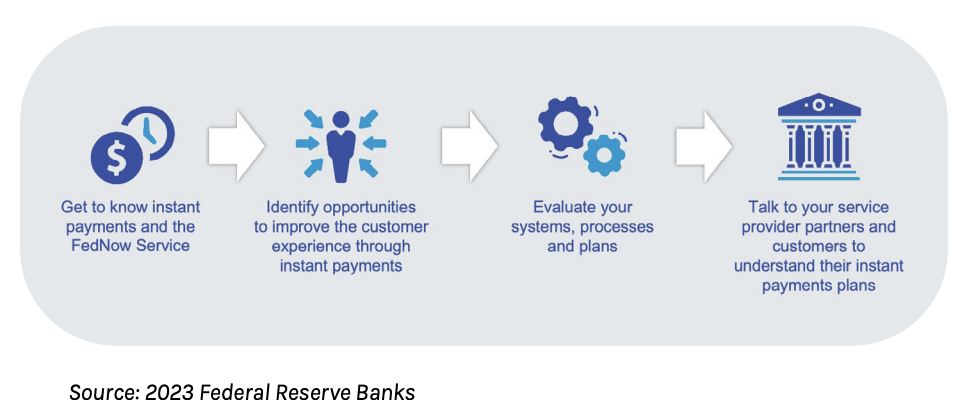

Community banks can get general information and background on instant payments, as well as take a deeper dive into FedNow Explore.

O’Malley recommended the following steps for community banks to prepare:

Majeske and O’Malley recommended that community banks let their business objectives and customer demands guide them through several key operational decisions. “Let’s say that, for example, you want to offer FedNow for your small business customers to pay their suppliers in real-time, at the point of exchange of materials. With this B2B use case in mind, you can then think through what type of customer credit transfer will you offer. If you would like to support a business in paying their supplier, you would need to enable both Send and Receive. You can also opt to offer Request for Payment, which would essentially act as an instant bill pay. The other thing you would want to think through is the type of connection you’d need. Do you plan to connect directly, using your own traveling connection? Or are you going to leverage a service provider? If you’re going to leverage a service provider and want to support send and receive you need to make sure that they’re enabled to do that. Once you’ve thought through your use cases, and generally how you’re going to participate, you want to think through how you can prepare your organization. Do you already offer any sort of customer support on a 24/7 basis? If not, think about entities that you can partner with to offer that. You want to think about what you’re doing already, and how you can apply those same strategies to your instant payments adoption to lessen the change impact to your organization,” O’Malley advised.

“Think through debit and credit card transactions—you’re not approving those after 5:00 p.m. The FedNow payment is ISO 20022 payment flow, so it’s not a human-sourced transaction. It is moving across the network as a customer enters it into the FedNow Service. Think about all the things that you could change in order to become operational around the clock, and if there are things that you can leverage that you’re doing today into the future. You want to think through as well how you’re going to handle settlements. And then how do you want to carry that forward into instant payments? And if at any point in these considerations you want to bounce ideas off of an expert, you have your Fed relationship manager awaiting your call to help guide you through some of these thoughts and considerations.”

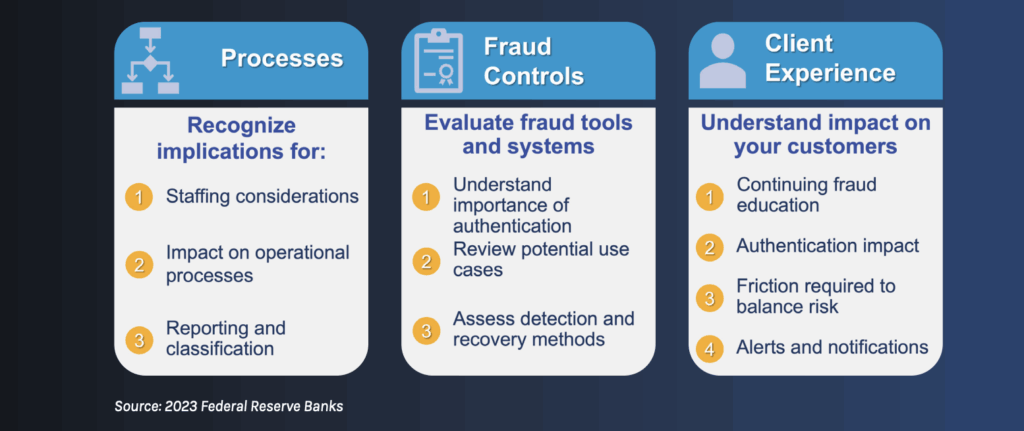

The below guide helps community banks think through what should be considered for potential risks and opportunities:

The Fed strives to offer as smooth and efficient an onboarding process as possible. A community bank of course has access to their Fed Reserve relationship manager, but they also have access to a FedNow Service onboarding manager. In addition, there is 24/7/365 customer service from the Fed, and access to product experts. “You’re not alone in the journey, you’ll have a robust team, and not to mention that the service providers that you choose to work with (should you do that), will also be available to help you through the process,” O’Malley assured.

Majeske explained how Alacriti’s Orbipay Payments Hub connects community banks to the FedNow network. The hub connects to the FedNow Service, FedWire, ACH, the RTP® network, and Visa Direct. “It’s one place to go to have access to all those rails. Our payments hub is set up as a payments-as-a-service solution. We’re cloud-based through AWS, it integrates with many banking cores, so if you’re on a particular banking core, but you want to access the network outside of your core provider, you have the capability of doing that. It’s ISO 20022-native, and uses open APIs, so we can smart-route the transactions. This acts as a grow-as-you-go model. For instance, if you just wanted to do FedNow, we can do that. Once you put the infrastructure in place to support FedNow, you could also support any of the other rails that we have in place, so it makes it nice and easy.”

Alacriti was involved in the FedNow Service early on as they were a part of the pilot program, so it had customers on at launch. Alacriti also plans on offering use cases (UI/UX) for customers that banks can utilize and offer products early in their process. Majeske also explained the timeframe that community banks can expect to implement realtime payments. “In most cases, we’re looking at a 90-day period. We offer out-of-the-box integration with many cores and digital banking solutions as well. We can work with them to collectively create a very good turnkey process. After the initial connection with Alacriti, adding additional rails is very easy.”

In Conclusion

The increasing adoption of the FedNow Service is driven by the need to meet evolving customer expectations for speed and efficiency in transactions. The fundamental features of the FedNow Service, such as immediate settlement and powerful remittance capabilities, are valuable tools for community banks to enhance their operational efficiency and customer service. As community banks navigate these changes, their focus on leveraging innovative payment solutions will be crucial in staying competitive.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.