On July 14, 2025, the Federal Reserve successfully completed its long-planned migration of Fedwire® to the ISO 20022 messaging standard. This move aligns the U.S. high-value payment system with global standards, enabling richer, structured data, better automation, and improved interoperability across payment systems. For financial institutions, the transition marks the beginning—not the end—of the modernization journey.

With the technical lift complete, the real opportunity lies in what comes next: using ISO 20022 to create new services, streamline operations, and offer more value to customers.

Quick Links

What Is ISO 20022?

ISO 20022 is a globally accepted messaging standardization approach (methodology, process, repository) to be used by all financial standards initiatives as a common platform for the development of messages. It was introduced in 2005 by the International Organization for Standardization to help financial institutions streamline their communication infrastructure by using the same language for all financial communications.

Why ISO 20022 Is Important

ISO 20022 provides a common language and model for payment data, enabling better communication between financial institutions, fintechs, corporations, and government entities. Unlike legacy formats, it allows for the inclusion of structured remittance data, purpose codes, and detailed sender/receiver information—all of which open the door for operational and strategic improvements.

This enriched data creates the foundation for better decision-making, automation, and customer experiences. And as global adoption grows, with countries like the U.K., Canada, and those in the EU already live, U.S. financial institutions must now use this momentum to drive business outcomes.

of financial institutions were fully prepared for ISO 20022 by late 2024—despite impending deadlines—indicating significant transformation pressure across the industry

Benefits of ISO 20022

There are many benefits beyond compliance with ISO 20022.

- McKinsey also found that automating up to 70% of manual payments operations with structured data can reduce costs by 20-35% and process times by 50-60%.

- EY highlights that structured ISO 20022 messages provide clearer identification of entities and parties, which implies a potential of 25–30% false-positive reduction as ISO 20022 becomes widely adopted.

EY also notes the following benefits:

Greater efficiencies:

ISO 20022’s enriched data-carrying capacity enables operational efficiencies and better management of transactions and customer information with global interoperability.Improved customer experiences: Payments are processed and settled more quickly through STP, thanks to reduced errors/failures and investigations throughout the payment lifecycle.

Enhanced communications:

By driving structured data and formalized content, ISO 20022 has wellformatted and dedicated messages for both bank-to-bank and bank-to-customer experiences. Standard message types cater to the pain and pacs formats.

Additional customer insights:

Robust data provided by ISO 20022 standards enables banks and nonbanks to better identify customer trends and provide improved services to their clients.

Faster and more accurate compliance:

The standardized messages across flows help improve fraud prevention capabilities and regulatory reporting activities.

More opportunities for innovation:

Improved infrastructure provides banks the opportunity to implement leading-class technology solutions and capitalize on operational efficiencies, resulting in faster time to market and reduced infrastructure cost.”

Key Use Cases for ISO 20022

Here are real-world use cases for financial institutions that go beyond simple wire processing and showcase how ISO 20022 can drive business value:

Commercial Real Estate Escrow and Settlement

ISO 20022’s structured remittance fields and reference IDs allow for fully automated reconciliation of wire transfers, reducing friction in high-value real estate deals.

Example: A commercial bank uses ISO 20022-enabled wires to automate the funding and settlement of large real estate transactions, including property IDs and tax documentation directly in the message. This cuts backoffice reconciliation time by hours per transaction and reduces manual errors.

Government and Municipal Disbursements

Municipalities and agencies often manage high volumes of payments with strict reporting needs—think grant disbursements, utility rebates, or property tax refunds. ISO 20022 enables standardized formats and cleaner reporting to meet those obligations.

Example: A regional credit union partners with a local government to manage emergency assistance payments. Using ISO 20022, the institution includes structured fields such as resident ID and benefit category, allowing for faster approval and audit compliance.

Cross-Border B2B Payments

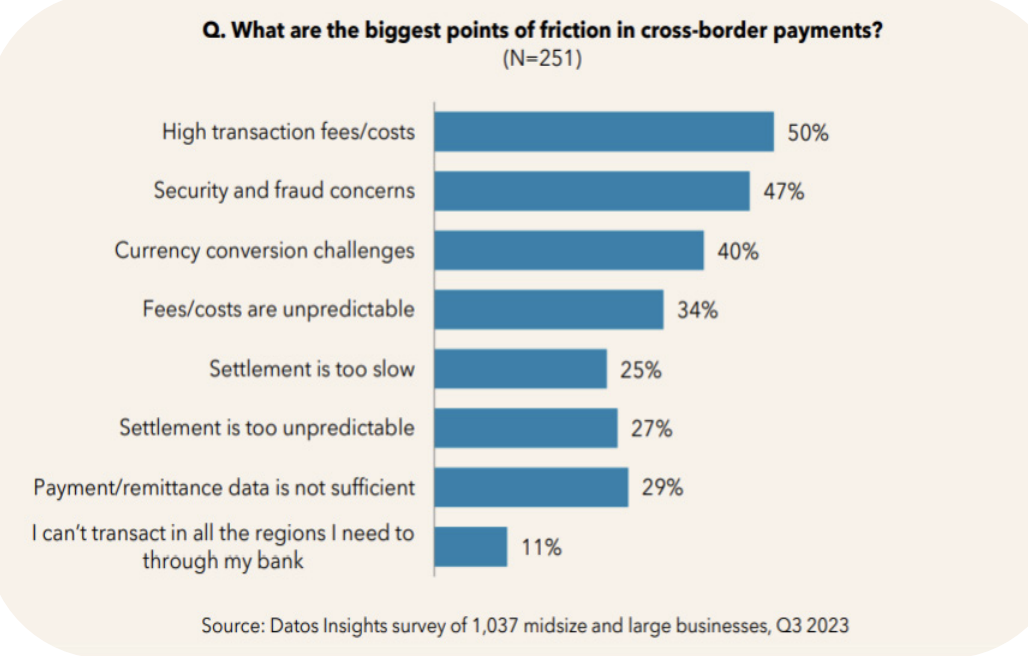

Global B2B payments demand precision, compliance, and speed. According to a Datos Insight survey, Fedwire Migration and ISO 20022 Readiness, some of the main concerns around cross-border payments are around high costs, security and fraud, and slow settlements.

The BIS notes that data standardization like ISO 20022 is a foundational building block to achieving faster, cheaper, and more transparent cross-border payments, which is key to cutting processing times from days to minutes. ISO 20022’s structured format reduces ambiguity, supports automation, and simplifies cross-border transactions by:

- Reducing false positives in sanctions screening.

- Enabling full end-to-end transaction visibility

- Improving reconciliation and settlement efficiency.

Example: A mid-sized U.S. textile distributor regularly sources raw materials from a partner in Turkey. Using ISO 20022 messaging, the bank embeds a detailed invoice reference, contract ID, and origin of goods in the payment message. This enables automatic screening and reconciliation, allowing both parties to confirm receipt and release inventory faster—while reducing costs tied to manual processing delays or compliance holds.

Tourism and FX Payments

Banks serving global travelers and FX customers benefit from ISO 20022’s ability to embed structured remittance and transaction context. The standard helps:

- Improve FX rate transparency and reduce conversion errors.

- Support QR-code payments and local rails abroad.

- Enable secure authorization and reduce chargeback risk.

Example: A digital-first U.S. bank integrates ISO 20022 support into its travel wallet. A customer visiting Thailand scans a merchant QR code to pay via PromptPay. ISO 20022 allows structured payment details (merchant name, purpose, FX rate, location) to be included in the message, allowing instant confirmation, realtime FX conversion, and detailed digital receipts within the app—avoiding ATM fees or foreign card surcharges.

Small Business Invoice Matching

Small and midsize businesses (SMBs) frequently struggle with manual reconciliation of incoming payments against open invoices. With ISO 20022, FIs can offer automated invoice-matching solutions by embedding invoice numbers and reference details directly in wire messages.

Example: A mid-tier bank launches an “invoice reconciliation assistant” for business clients, built on ISO 20022 message parsing. The feature uses structured remittance fields to automatically match payments to invoices in the SMB’s accounting system.

Wire Fraud Monitoring and Risk Scoring

With ISO 20022, payment messages include far more metadata—payer/payee info, reason codes, etc., making it easier to build real-time fraud detection models.

Example: A bank uses ISO 20022 fields to analyze transaction patterns and identify anomalies like invoice mismatches or unusual purpose codes. A rules engine flags potentially fraudulent wires for review before release, improving fraud prevention without delaying valid payments.

Financial Inclusion and SMB Enablement

Small businesses and underbanked communities often lack access to fast, reliable payment infrastructure. ISO 20022 enhances financial access by:

- Enabling low-cost, high-transparency remittances.

- Supporting real-time digital disbursements and microloans.

- Allowing easier integration with mobile-first wallets and tools.

Example: A community bank in the southwestern U.S. uses ISO 20022 to launch an instant loan disbursement product for small agricultural businesses. Farmers approved for seasonal working capital receive funds instantly into digital wallets, with ISO 20022 enabling structured references like crop type, season, and grant source. This data enables better portfolio tracking and faster reporting to grant agencies, reducing disbursement timelines from days to minutes.

Additional Strategic Applications

Beyond immediate process improvements, ISO 20022 lays the foundation for long-term capabilities such as:

- Enhanced liquidity management with real-time visibility into payment flows.

- Integrated wire and instant payment orchestration, where message context guides rail selection.

- Value-added services like automated tax form generation or ESG-linked payment tagging for corporates.

- Improved compliance and audit readiness with embedded structured data

What Financial Institutions Should Do Next

1

Inventory Your Wire Ecosystem

Map out all internal and vendor systems that touch wire payments and verify ISO 20022 compatibility— not just at the network level, but at the datahandling layer.

2

Analyze Your Payment Data Flow

Explore how richer message content could reduce exceptions, speed reconciliation, or support new services.

3

Engage Business and Operations Teams

ISO 20022 is not just a technical format— collaborate with product and operations to identify friction points it can solve.

4

Work With a Partner Who’s Already There

Alacriti has all clients live and processing Fedwire transactions in ISO 20022 today, with APIs and infrastructure also built to support the FedNow® Service and the RTP® network under the same standard.

Alacriti’s Role in Supporting ISO 20022

Alacriti has built its payments solutions, including Orbipay Payments Hub, with ISO 20022 support from the ground up. All APIs and message formats natively support ISO 20022—not just for Fedwire, but also for RTP network, FedNow Service, and Visa Direct—enabling a truly modern, future-ready platform. For institutions still relying on manual wire processes, Alacriti offers guidance on upgrade paths, compliance readiness, and longterm operational planning

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.