Financial institutions are under growing pressure to deliver faster, more efficient, and customer-centric payment experiences. In response, many are exploring how real-time payments can unlock new value across consumer, small business, and commercial segments.

Alacriti’s latest fact sheet, Instant Payments Use Case Framework: Use Cases and Revenue Drivers, breaks down the most impactful applications of real-time payments—from loan disbursements and earned wage access to vendor payouts and treasury optimization. It also explores monetization strategies such as speed-based fees, Request for Payment (RfP) services, premium treasury offerings, and deposit growth via gig economy and investment account inflows.

This guide highlights the top real-time payment use cases across the RTP® network, the FedNow® Service, ACH, and Visa Direct, and explains how institutions can use centralized payment hubs to streamline operations and drive new revenue opportunities.

Quick Links

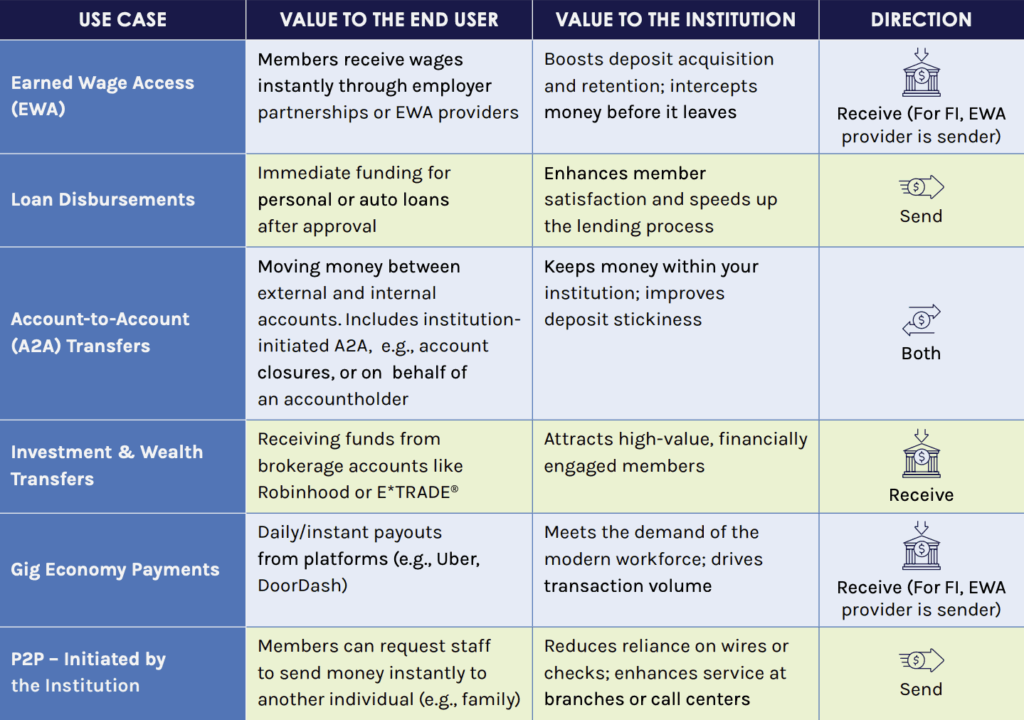

Consumer Use Cases

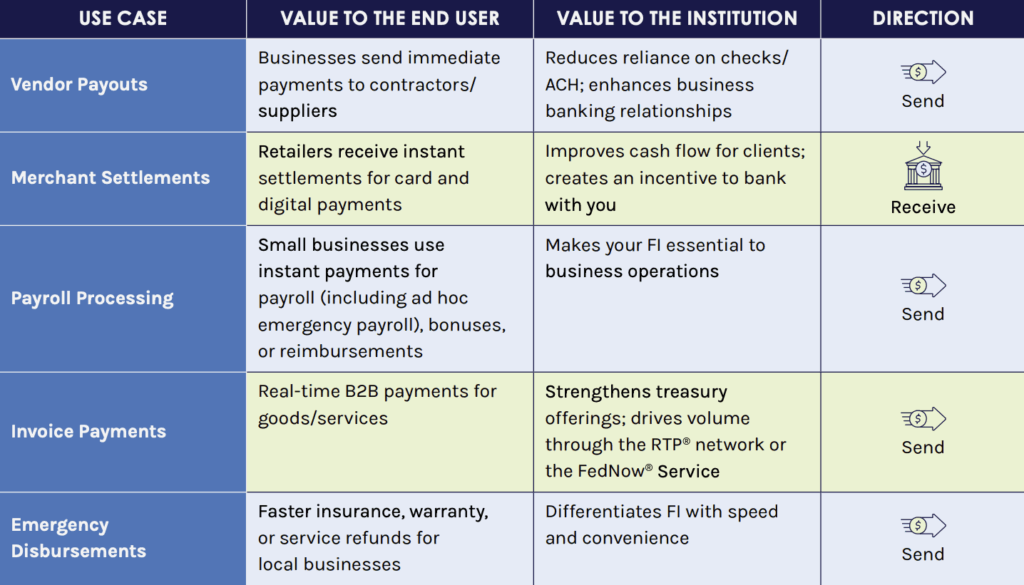

SMB (Small and Midsize Business) Use Cases

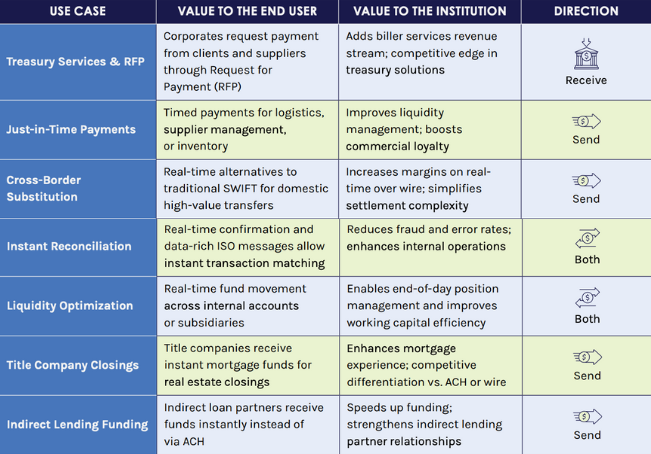

Commercial Use Cases

Revenue Opportunities

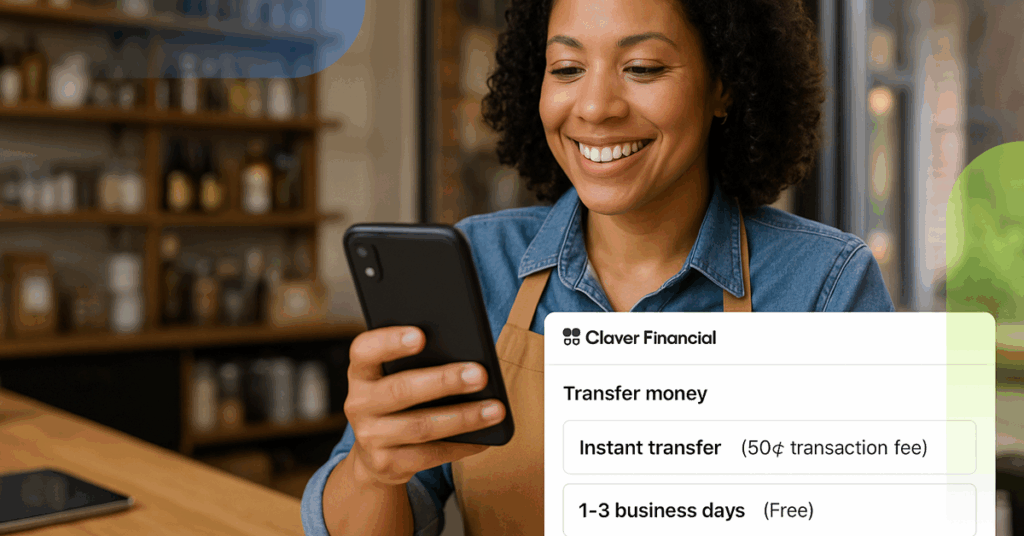

Charge Convenience or Speed Fees

Offer expedited payment or instant transfer options for a small fee—particularly useful for billers, small businesses, or consumers needing last-minute payments or disbursements.

Earn Interchange on Increased Debit Usage

RTP and RFP often lead to more payments made via debit cards, especially when paired with mobile-first experiences like “magic links.” This increases transaction volume and interchange revenue.

Enable Early Access to Earned Wages (EWA)

Partner with employers or EWA providers to offer real-time payroll capabilities. FIs can charge a service fee for each transaction or monetize through partnerships.

Offer Premium Treasury Services

Embed RTP and RFP into Treasury Management solutions and create new premium offerings for corporate clients, such as real-time liquidity dashboards or real-time receivables processing.

Expand Small Business Accounts With Value-Added Features

Use RTP and RFP to attract and retain small business customers with bundled packages — e.g., instant invoicing + instant payments — priced with monthly or usage-based fees.

Generate New Deposit Flows via Real-Time Receipts

Capture inflows from external sources like gig economy platforms, investment accounts (e.g., Robinhood, E*TRADE), and fintech wallets—boosting deposits that can then be leveraged for lending or balance sheet strategies.

Charge for Request for Payment Capabilities

Allow businesses to initiate RFP messages with embedded payment options (e.g., text, email, app) and charge a per-use or monthly platform fee

Develop White-Label Payment Solutions for Businesses

Offer branded RTP and RFP capabilities to businesses (e.g., Pay By Text with the business’s branding), and charge implementation and recurring usage fees.

Cross-Sell Lending and Investment Products Based on Payment Behavior

Use RTP and RFP transaction data to identify timely upsell or cross-sell opportunities (e.g., pre-qualified personal loans after tax refunds land) and generate revenue from new product adoption.

Additional Data

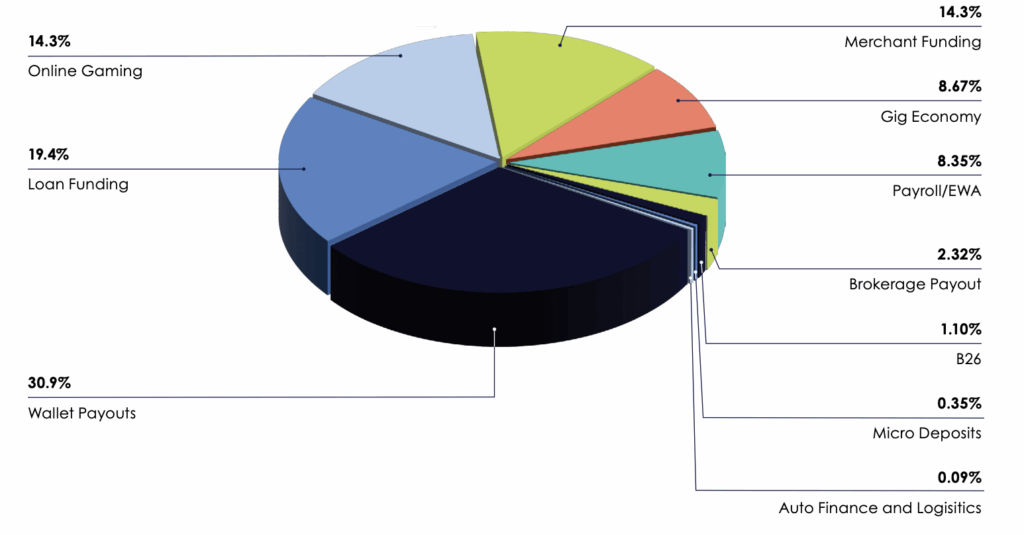

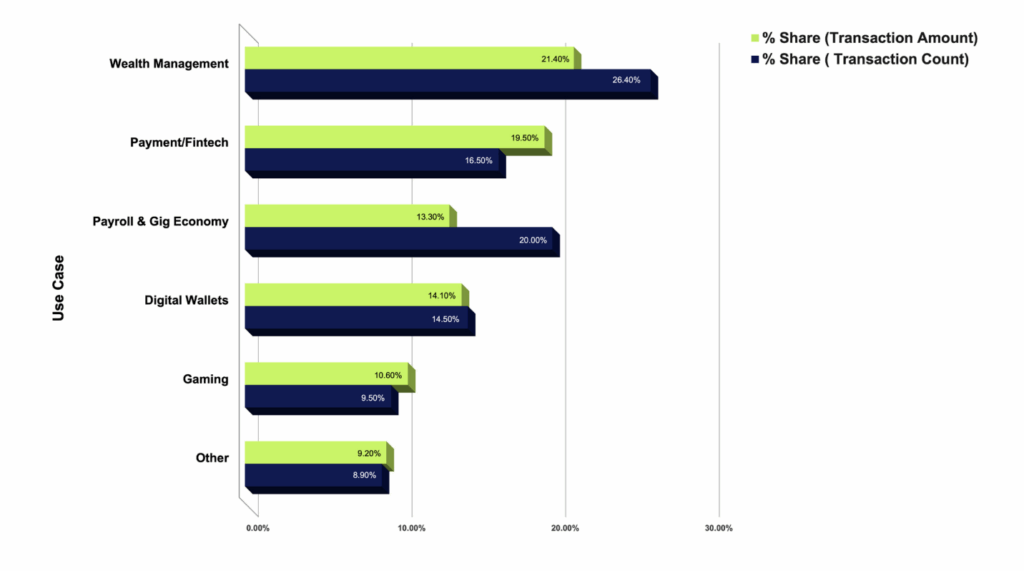

Top FY 2024 The Clearing House RTP Network Use Cases

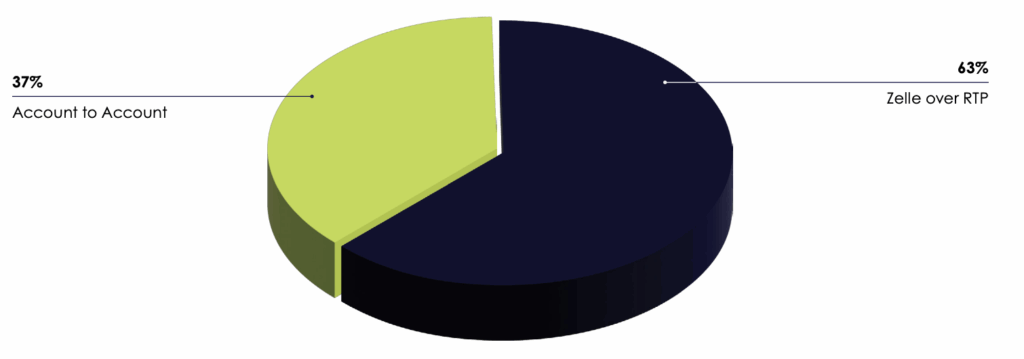

Consumer Originated Use Cases (21% of network volume)

Business Originated Use Cases (79% of network volume)

Source: TCH 2024, Q1 2025 Quarterly Update

Alacriti's Top 6 Instant Payment Client Use Cases

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.