With the global pandemic still raging and 2021 looming, all thoughts are focused on operating in the “new normal.” For property and casualty (P&C) and health insurers, the pandemic is accelerating the need for technology-driven solutions that meet the rapidly changing expectations of consumers for convenience and safety.

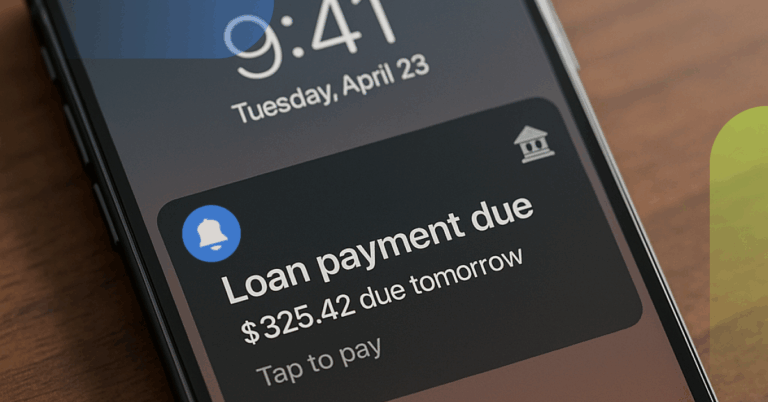

Insurers who fail to meet the demand for electronic bill pay and presentment (EBPP), digital disbursements, and 24/7 online support risk being left out of the decision-making process of consumers.

To read more, download the article.