Driven by consumer expectations for instant gratification set by retail and tech trailblazers, the world has been on a steady trajectory toward 24/7/365 availability for years already. This need for instant gratification is now impacting payments in a way that is more urgent than ever, necessitating actionable plans for financial institutions to begin their digital payments transformation journey.

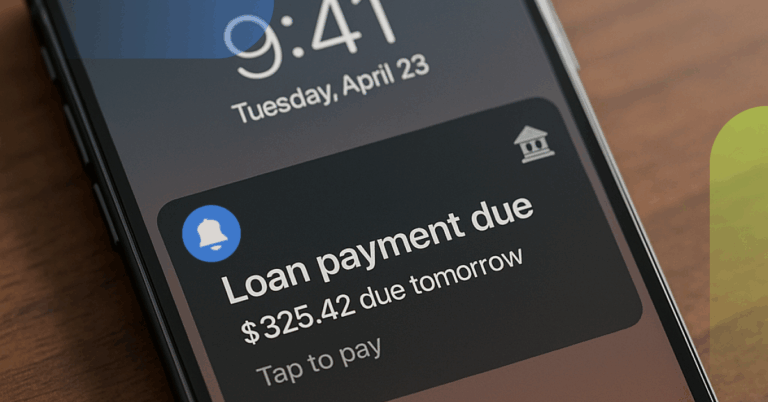

Businesses and financial institutions must begin to modernize their digital infrastructures — with payments as a foundation — to improve the customer experience to meet rapidly increasing expectations for access, convenience, transparency, and functionality.

Download our latest article.