Modern loan payment solutions are more than just a convenience; they’re a necessity for credit unions to offer a better experience for members. Utilizing your solution’s reporting capabilities to their full potential is a key component in delivering this enhanced experience. From monitoring payment trends to tracking refunds and managing proactive member outreach, comprehensive reporting provides the necessary insights to optimize operations and enhance member satisfaction. Going beyond basic settlement reporting to include detailed, visualized data and dashboards ensures that credit unions have the tools they need to navigate the complexities of financial management effectively.

In a Finopotamus-hosted webinar, Alacriti’s Stuart Bain, SVP of Product Management, delved into the transformative power of Electronic Bill Presentment and Payment (EBPP) reporting and how dynamic reporting capabilities can affect billing and payments for credit unions.

Quick Links

How Credit Unions are Using Reports To Make Decisions

The webinar began with a discussion of the multifaceted role that Bain has witnessed reporting play in the operational and strategic functions of credit unions. Credit unions use reports to monitor and analyze various payment trends, such as return rates, payment concentrations, and staffing needs. By examining these trends, credit unions can make data-driven decisions to improve their operations. For instance, they can adjust staffing patterns based on the concentration of payments at certain times of the day or identify the need for additional support during peak hours in the call center. Reports also help identify correlations between specific payment channels or types and issues like returns or fraud, allowing credit unions to take proactive measures to mitigate risks.

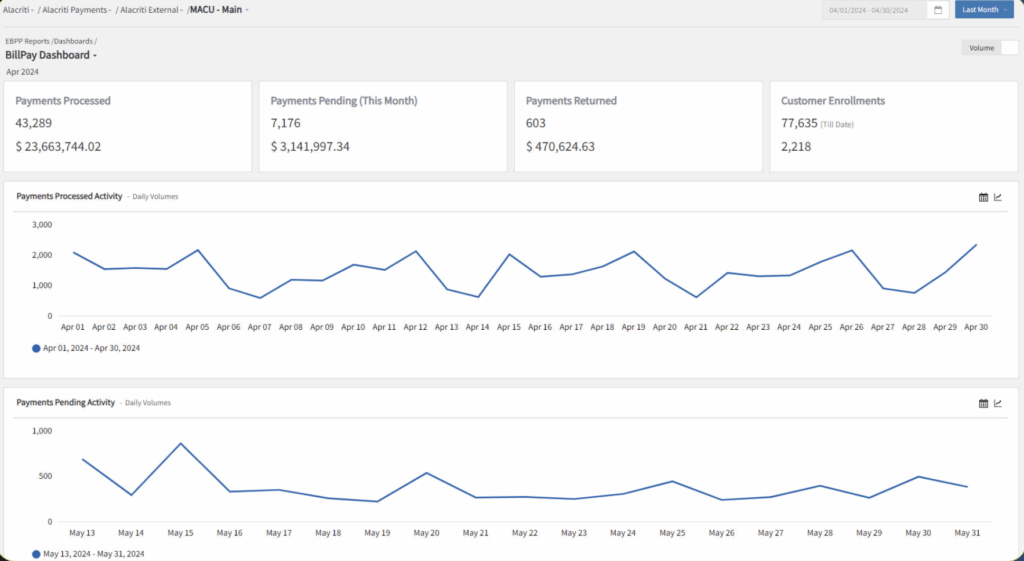

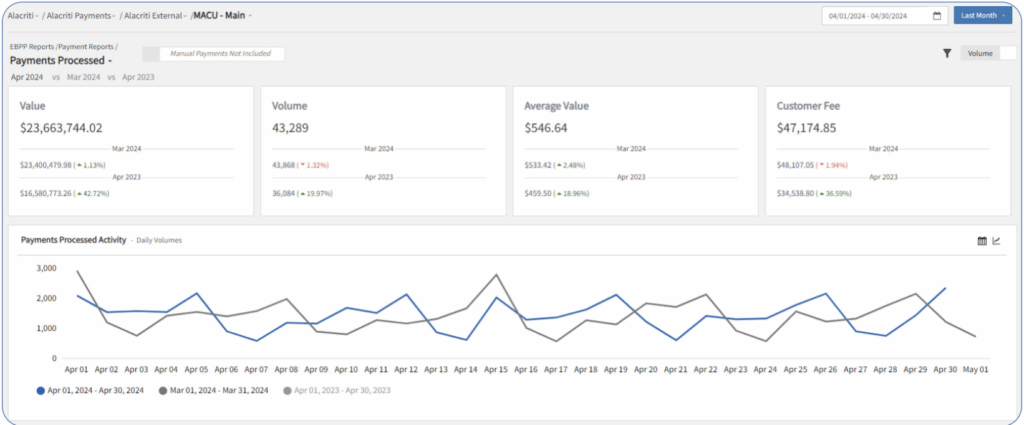

While basic settlement reporting provides essential information on processed, refunded, and returned payments, Bain emphasized the importance of deeper insights. Detailed reports differentiate between ACH payments, funded through bank accounts, and card payments, allowing credit unions to reconcile these with settlement amounts for loans. However, reporting should go beyond these basics to include comparisons over different periods, enabling credit unions to track changes in volume, value, and average transaction amounts. Visualizing this data helps in understanding trends and making necessary adjustments.

Tracking refunds and returns is another critical aspect of reporting. Credit unions need to monitor not only the processed refunds but also those that are returned or canceled before the end of the day. This comprehensive tracking ensures that credit unions clearly understand the movement of funds and can address any discrepancies quickly. Bain pointed out the necessity of having reports that show the value and volume of returned payments and notices of change, which can indicate issues such as incorrect account flags.

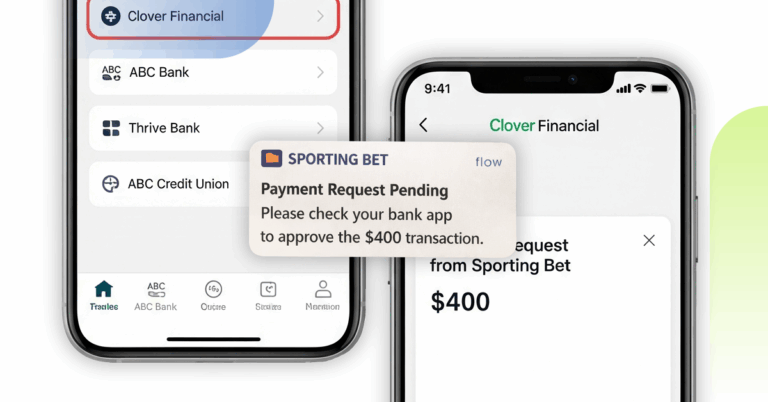

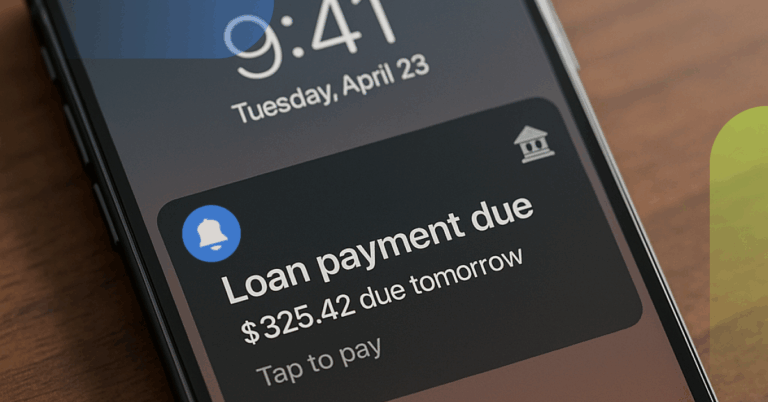

In addition to payment-related reports, credit unions benefit from non-payment reports, such as those tracking card expirations. These reports enable credit unions to manage proactive outreach to members whose cards are about to expire, ensuring a smooth transition and continued access to services. Visual representations of this data help credit unions plan and take timely actions, which is helpful for both member satisfaction and operational efficiency.

Bain demonstrated the usefulness of dashboards that present ata-glance information on payments, returns, and customer behavior. These dashboards provide a quick overview of past and upcoming activities, allowing credit unions to identify trends and potential issues without running separate reports. Bain noted:

Finally, detailed reporting on payment creation and member behavior offers valuable insights. Credit unions can track when payments are entered into the system, identify spikes in activity, and compare payment timings to due dates. Understanding these patterns helps credit unions optimize their processes and address any anomalies in member behavior, ultimately leading to better service and operational efficiency

Unexpected Member Payment Trends

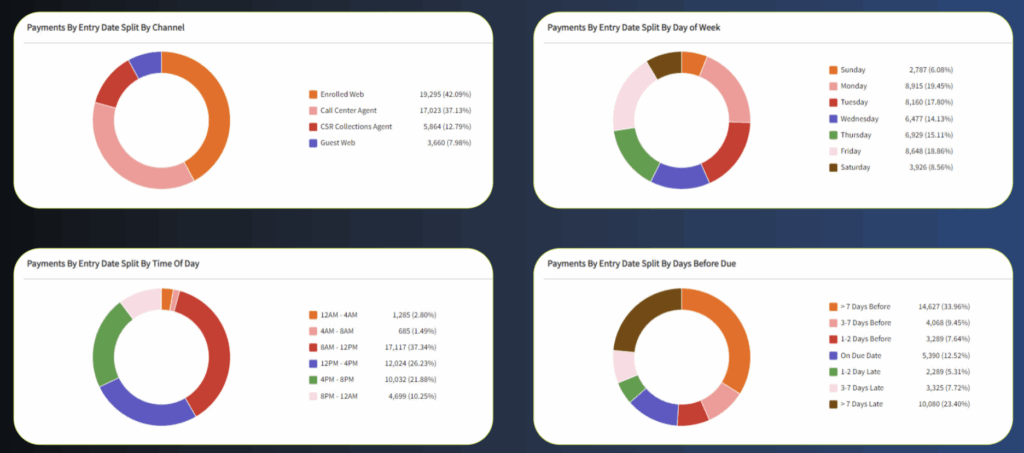

Bain discussed some unexpected member payment trends that credit unions are encountering. One surprising trend Bain illustrated is the unexpected volume of one-time payments made during late-night hours. “For some reason, 3.5% of one-time payments for our credit union clients are made between 12:00 a.m. and 4:00 a.m. Eastern Time,” Bain noted. While it may seem unusual, it supports the need for financial institutions to ensure their systems are operational and secure 24/7.

Another intriguing trend is the proactive behavior of members scheduling payments well in advance. Bain shared that around 32% of one-time payments are made 7 days before the due date. This suggests that members are planning ahead and leveraging the ability to schedule payments to ensure they meet their financial obligations on time. This behavior is critical for credit unions to understand as it can influence the features and functions they implement in their payment channels.

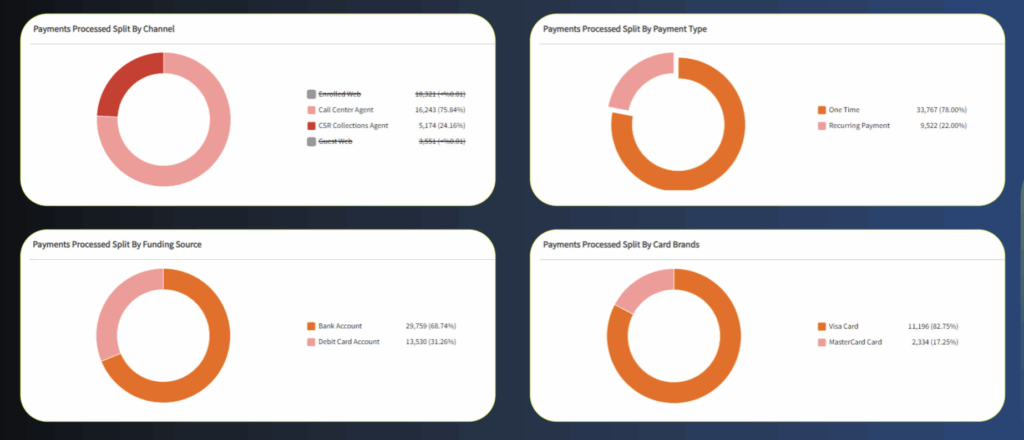

Understanding the various channels through which payments are made is important. Credit unions need to differentiate between member-led and staff-led payments, which can offer insights into member behavior and preferences. Bain explained, “Are the average value of your call center payments higher than the average value of the customer’s scheduling payments? Are the fees higher or lower?” Hence, these insights can help credit unions tailor their services to better meet member needs.

Credit unions should also examine when payments are made to identify any significant patterns. Bain pointed out that many payments are created between 8:00 a.m. and 12:00 p.m., suggesting that members prefer to handle their financial transactions early in the day. This information can be crucial for credit unions in planning their staffing and resources to effectively accommodate peak transaction times.

Understanding the behavior of automated and recurring payments is another essential aspect of reporting. Credit unions can analyze these payment types to identify predictable patterns or unexpected spikes. Bain emphasized the importance of visualization in spotting trends, stating, “Without that visualization, it’s difficult to spot that just from the raw numbers.”

Lastly, credit unions need to consider the payment methods members use. By analyzing the split between bank account payments and debit card payments, credit unions can gain insights into member preferences and tailor their services accordingly. Bain noted that debit card behaviors might differ slightly from ACH payments, affecting the overall payment patterns.

The Importance of Visuals vs. Spreadsheets

Visual representations of data can transform raw numbers into actionable insights. They provide an immediate understanding of complex data sets, allowing for quicker and more intuitive comprehension. Line charts are particularly effective for displaying data over time. These charts can reveal patterns, spikes, and trends that might be missed in a spreadsheet. For example, a line chart can show month-on-month payment processing volumes, enabling credit unions to identify any anomalies or significant changes in their data.

One of the key benefits of visual reporting is the ability to interact with the data. Bain emphasized the importance of zooming in on points of interest, such as unexpected spikes. “If you do have a point of interest, you should be able to zoom in. So we did spot that, say, April 15th had a spike compared to everything else; I should be able to zoom in on that to call that out,” he said. This interactive capability allows for a deeper dive into specific data points, facilitating more detailed analysis.

Visual tools also simplify comparative analysis. By switching views between different time frames, such as month-on-month or year-onyear, credit unions can gain different perspectives on their data. Bain illustrated this by showing how removing certain data sets can alter the view of the remaining data, offering a more focused comparison. “You can see that you see a slightly different pattern of data if we’re looking at month-on-month compared to all three together,” Bain noted.

Ring charts, also known as donut charts, are excellent for visually representing ratios and percentages. These charts can quickly show the proportion of payments coming from different channels, payment types, or methods. “Yes, you could add the numbers together in the spreadsheet and get the percentages, but it’s much easier to visualize them,” Bain explained. This visual representation can help identify areas of concern or interest at a glance.

Bar charts are particularly useful for breaking down data into detailed categories, such as the types of return payments and their contributing factors. Bain pointed out, “You can see visually the types of returns that are contributing. So yes, there have been returns, yes, you’ve been debited for them, but what are the R codes behind them?” This level of detail can help credit unions identify specific issues, such as a rise in disputed transactions or ‘account not found errors,’ and take corrective action.

Ultimately, using visual tools in reporting enhances decision-making by providing clear, concise, and actionable insights. As Bain put it, “The reporting tool should really be able to do that for you because it’s got the numbers, and it should be able to render those on demand.” Visuals not only make it easier to understand the data but also enable credit unions to make informed decisions based on real-time insights.

What Member Activities Credit Unions Find Most Helpful

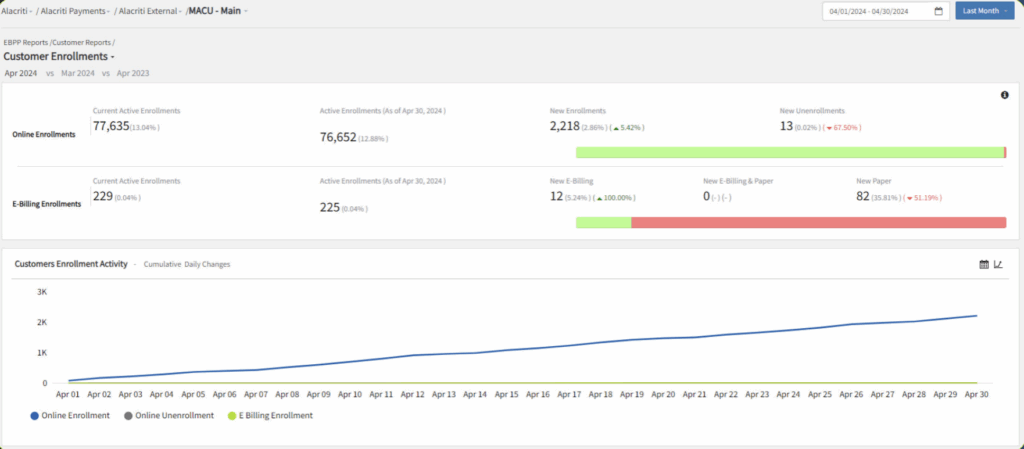

Understanding member activities is crucial for credit unions to optimize their offerings and improve member engagement. By tracking active engagement, self-service enrollment, and potentially risky behaviors, credit unions can make informed decisions that benefit both their operations and their members. Bain discussed the member activities that credit unions have found most helpful. One key activity is the sign-up and active use of electronic payment systems. “The active customers are actually going up because we have more and more customers using the system. This doesn’t necessarily mean they’re signing up for payments, but at least it’s trending in the right direction,” Bain explained.

Monitoring active customer engagement helps credit unions understand the adoption rates of their digital services. As more members transition from traditional methods like mailing checks to using electronic payment systems, credit unions benefit from increased efficiency and reduced processing times.

While tracking positive trends is essential, credit unions also need to monitor potentially negative activities, such as excessive returns or revoked statuses due to bad behavior. Bain emphasized the importance of understanding these trends, “How many people are being revoked? How many customers are being disabled because of tripping over business rules? Do I need to do something about that?”

By closely examining these patterns, credit unions can fine-tune their processes to minimize risk without compromising member service. For example, if a significant number of members are getting flagged for excessive returns, it may indicate the need for stricter validation rules or enhanced member education about the payment processes.

Another critical activity credit unions focus on is the enrollment in selfservice options. Self-service capabilities empower members to manage their finances independently, which can lead to higher satisfaction and engagement levels. Bain notes, “How many people are enrolling in things like recurring payments? Online enrollment activity tracks this, showing customers choosing to go fully self-service.”

Tracking self-service enrollment helps credit unions gauge the success of their digital initiatives and identify areas where additional support or features might be needed. For instance, the introduction of recurring payments via debit cards can be monitored to see if members are adopting this new feature, providing insights into its effectiveness and potential areas for improvement.

In addition to monitoring member activities, credit unions must stay attuned to broader economic trends that may impact member behavior. Economic fluctuations can influence member payment patterns, return rates, and overall financial behavior. By analyzing these trends, credit unions can proactively adjust their strategies to better support their members during challenging times. “Are our return rates trending? Are they going up, are they going down? You can start to see if there’s been an increase and decide if you need to do something about that,” Bain advised.

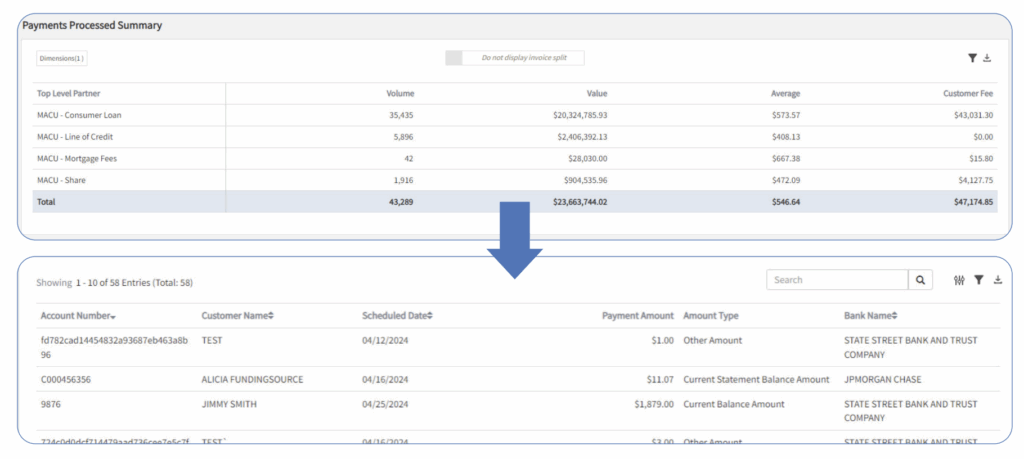

Leveraging Detailed Reports To Uncover Payment Issues

The ability to access detailed reports is paramount for uncovering and resolving payment issues. Bain talked about the critical role that granular transaction data plays in identifying and addressing discrepancies in payment processes. Unfortunately, basic settlement reports and charts often fail to provide sufficient detail to pinpoint specific transactions. “Charts are good, but they don’t give you enough detail, nor does the basic settlement report. It doesn’t actually show you individual transactions. So if you have to find a payment amongst all of these, how would you go about doing it without the ability to access the details?” Bain explained.

Having the capability to drill down into transaction details to resolve various scenarios is necessary. For example, when a customer contacts a financial institution about an unexplained debit, the institution needs to filter through transaction data to find the specific payment in question. This requires a reporting system that allows for filtering by date, amount, and other relevant parameters. “So the reporting should allow you to drill down. You should be able to select a date range. Let’s say you’re playing on the transaction, you’ve either got a settlement mismatch and you need to find the payments that could be causing it. Or somebody calls your institution and says, ‘Hey, who are you? Why have you debited me? My Wells Fargo account? I don’t know who you are. All I can tell you is the amount of the payment and the date it was done.’ In order to find that, you need to be able to drill down to transaction detail and be able to go through it to find that particular information,” Bain elaborated

Advanced reporting tools are versatile and can break down data by different dimensions, such as payment channels and methods. This functionality enables institutions to gain deeper insights into their transactions and identify potential issues more effectively. Additionally, the ability to download and schedule detailed reports enhances operational efficiency, allowing financial institutions to automate routine tasks and focus on more critical aspects of their operations.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.