Credit unions are under increasing pressure to deliver seamless and efficient payment experiences to their members. Greater Nevada Credit Union (GNCU) embraced this challenge by modernizing its loan payment system through a partnership with Alacriti and Q2. The results have been transformative, with GNCU seeing an 85% reduction in call center volume and significant improvements in member satisfaction.

In a panel discussion, Veronica Gomez, VP of Digital Member Experience, and Boden Dullanty, Digital Solutions Analyst at GNCU, as well as Stuart Bain, SVP of Product Management at Alacriti, and Abeer Thomson, Director of Partner Engineering & Operations at Q2 discussed the signs that signal it’s time for payment modernization, the essential steps for implementation, and the metrics that drive success. The session educated the audience on how credit unions can optimize digital loan payments and elevate member experience.

Quick Links

GNCU’s Story

GNCU embarked on a transformative journey to modernize its loan payment process, driven by a commitment to enhance the digital experience for its members. As the credit union sought ways to streamline operations and improve member engagement, they turned to insights gathered from annual member surveys. One of the recurring requests from members was for a user-friendly loan payment portal, allowing them to easily fund their payments from accounts outside of GNCU. “A common theme was we were missing a portal where they could make a quick loan payment when they wanted to fund it from an account other than Greater Nevada,” said Gomez.

At the same time, GNCU’s call center faced high call volumes due to the complexity of processing loan payments, costing the credit union significantly each year. Recognizing these challenges, GNCU partnered with Alacriti to integrate their loan payment solution into the credit union’s existing Q2 digital banking platform. The partnership was built on key priorities. “We were really looking for three key things. We were looking for a partner that was going to continually innovate, we wanted to have a frictionless experience, and we also wanted them to integrate with our current technology,” Gomez explained.

Panel Questions

1

What are the common reasons credit unions stay with the same loan payment systems despite the issues?

Several common reasons emerge when discussing why credit unions often hesitate to switch loan payment systems despite known challenges. Credit unions frequently cite resource limitations and the perception of the change as too burdensome. “The first one being, changing my solution is too much like hard work. I don’t have the resources or the budget to be able to make that change,” Bain noted. This inertia can lead to a decision-making stalemate where institutions choose to stay with their current systems even when more efficient, cost-effective solutions are available.

Another reason credit unions often stick with outdated systems is that their existing solution seems “good enough.” However, while it may function adequately, it might not offer the modern features members expect, such as a variety of payment channels or real-time processing. This can result in member dissatisfaction, potentially leading to a loss of future business as members look for more user-friendly options elsewhere.

Cost is another factor that plays into this decision. The current system may appear inexpensive in terms of upfront costs, but credit unions often fail to consider the hidden expenses, such as staff time required to manage manual processes or field customer service calls, due to a lack of self-service options. Bain emphasized this, saying, “That mindset then ignores the intangible costs.” These hidden inefficiencies can add up over time, making the “cheap” solution more expensive in the long run.

2

What are the essential steps that credit unions should take before modernizing their payment systems?

Before modernizing their payment systems, credit unions must take several essential steps to ensure success. The first and perhaps most critical step is gathering all key stakeholders for a comprehensive whiteboarding session. “It’s important to understand and map out what the current experience is like not only for members but also for the internal teams that support payments,” advised Gomez. This means considering the perspectives of call center staff, account reconciliation teams, fraud teams, and others involved in the payment process. By doing so, credit unions can gain a holistic view of the current pain points and areas for improvement.

Equally important is taking the time to fully understand what the credit union is trying to achieve with the new system. Dullanty discussed the importance of “understanding what you’re solving for” and ensuring the new system not only benefits the credit union but also improves the experience for members and staff. This design thinking approach helps create a clear vision for the end result, ensuring the new system is purpose-built to address specific challenges.

Bain added that identifying the root cause of dissatisfaction with the current system is key. “Ask yourself, what don’t I like about my current loan payment processing? What irks me? What doesn’t work?” Whether it’s a lack of payment options, slow processing times, poor integration, or a cumbersome member experience, it’s essential to pinpoint the specific problems to solve. Credit unions should also evaluate in-house challenges, such as difficulties in back-office functionality or limited reporting capabilities, to ensure the new system offers measurable improvements.

3

How did the implementation of a new loan payment solution affect your day-to-day operations?

The implementation of a new loan payment solution had a transformative impact on GNCU’s day-to-day operations, particularly in their call center. Gomez explained how the new solution dramatically reduced call center volumes. “They averaged, depending on the month, anywhere from 600 to 900 calls, and they weren’t always able to take all of those calls.” The overflow to third-party call centers added significant costs, but with the new system in place, call volumes have decreased to about 100 calls a month. This reduction not only resulted in substantial cost savings but also allowed the call center staff to focus on higher-priority issues, such as fraud concerns, enhancing the overall member experience.

The benefits extended beyond the call center, improving reporting capabilities and member engagement. With Orbipay EBPP’s extensive reporting options, GNCU has been able to better track member interactions and demonstrate the value of the investment to executive management. “It has really helped with knowing how engaged our members are with using the tools. It’s really worth the investment that we’ve made,” Gomez shared.

Dullanty also stressed the importance of the new system’s real-time reporting and integration with its core banking platform. “Having direct core connection between Orbipay and Q2 improves the member experience with that instant payment.” This has further solidified the new loan payment solution’s value, improving operational efficiency while delivering a seamless, enhanced member experience.

4

How did the integration with Q2 make a difference?

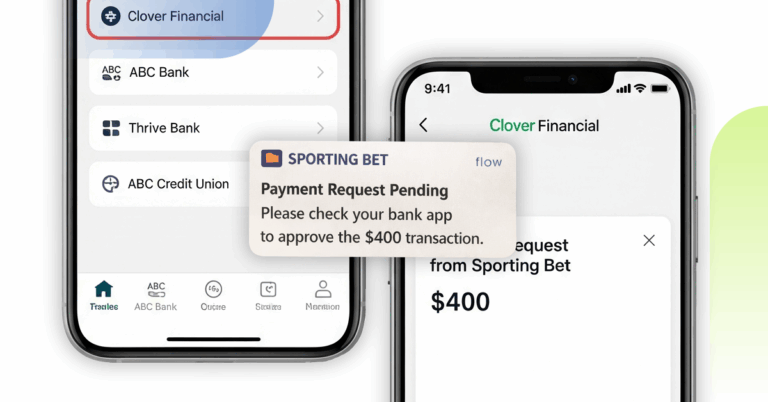

The integration of GNCU’s loan payment solution with Q2 significantly enhanced the member experience by creating a seamless, unified platform for managing payments. According to Dullanty, the integration was part of a broader roadmap designed to reduce friction for members. Before the integration, members had to navigate a separate portal to make loan payments, which added unnecessary complexity. The goal was to make Q2’s digital banking platform a “onestop shop” for members, allowing them to manage everything in one place. “They don’t have to worry about more usernames or logins or accessing more solutions. It’s all in one place,” he said.

This streamlined approach not only simplified the user experience but also increased payment capture rates and reduced late fees. The integration between Q2 and Alacriti’s Orbipay EBPP loan payments solution allowed members to make payments faster, eliminating delays that could lead to fees. By removing these barriers, GNCU was able to offer a more efficient and member-friendly experience. Dullanty shared the impressive growth in usage following the integration. “When we first went live, we only had utilization of our SSO [single sign-on] at 16%. As of this month, 30% of Orbipay users use the SSO to make those payments.”

The project itself was a smooth process, thanks to the close collaboration between Alacriti, Q2, and GNCU. Dullanty attributed theease to the strong project management and pre-built integration of Q2 and Alacriti. “It was definitely one of the easier projects, that’s for sure.” This pre-certified integration allowed GNCU to focus on testing and fine-tuning the system rather than the heavy lifting of building and implementing a new solution from scratch.

5

What are the benefits of streamlined loan payments?

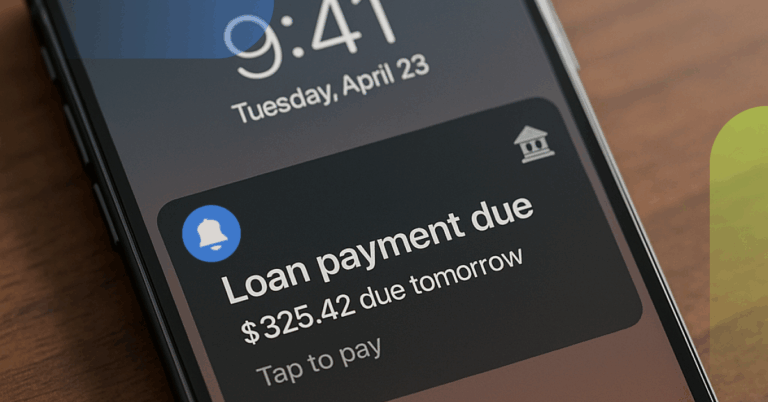

There are numerous benefits to implementing a streamlined loan payment solution. Dullanty talked about the convenience and confidence that members gain from instant payment connections.

“It’s that instant payment to the core that’s such a big benefit,” he explained, referring to the integration between Alacriti’s Orbipay system and GNCU’s core. With multiple channels available—digital banking, guest web access, and SMS—members now have flexibility and ease of use, enhancing their payment experience.

A streamlined payment system not only reduces operational costs but also increases efficiency. “You know exactly everything’s going to happen when it’s supposed to happen because it’s all happening in real time,” said Bain. This eliminates delays and errors that may arise with file-based payments. By automating these processes, credit unions can free up call center and support staff to focus on more high-priority tasks, leading to a more effective use of resources.

Another major benefit is improved member satisfaction and retention. Members expect the same real-time processing they get in other transactions, such as tracking food delivery or online shopping. Offering this kind of immediate service builds “stickiness,” meaning that members are more likely to stay loyal to their credit union because they experience fewer frustrations when managing their loans.

Gomez brought up another important advantage: the credit union’s ability to show members their feedback is valued. “If they’re seeing you continually innovate and take the feedback that they’re providing, they’re going to want to stay with you because they are being heard,” she said. This fosters a sense of trust and loyalty, encouraging members to remain engaged with their credit union.

Streamlined Loan Payments Benefits

Deploying a streamlined, modern loan payments solution brings multiple benefits:

Cost savings

Accept payments more efficiently while reducing overhead costs, by alleviating support/call center time.

Create operational efficiencies

Streamlined, automated, self-service experience.

Achieve greater adoption and stickiness

Delight customers or members with the Payment Channels, Payment Types, and Payment Methods they want to use

Frees up FTE

Reduced support efforts frees up staff to be directed toward other priorities.

Ease of use

Offer a simpler user experience when making payments, while still offering them control, choices/options, and flexibility.

Supplement fee income

Capture convenience fees with debit card payments to offset the costs of processing the loan payments

GNCU Today

GNCU made significant strides in modernizing its loan payment system with Alacriti’s Orbipay platform, leading to impressive results. Dullanty shared insights on the credit union’s progress and the massive growth in digital adoption.

“Our biggest channel is enrolled web, with utilization at 63%,” Dullanty shared regarding how members have embraced the digital experience. This utilization includes both GNCU’s site and the integration through Q2’s digital banking platform. Another particularly impressive metric is the dramatic reduction in call center volume. As Dullanty explained, “The call center, which used to handle about 900 payments a month, is now down to 140,” even as the overall number of loan payments continues to rise.

This not only improves operational efficiency by reducing the labor required to manually process payments but also proves how members are increasingly using the self-service options available to them. GNCU’s success with Orbipay exemplifies how understanding member preferences and targeting specific needs can drive adoption while lightening the load on internal resources.

GNCU’s ability to maintain strong payment volume while reducing employee involvement in processing these transactions has been a major win for the credit union. As Dullanty put it, “It’s such a huge win to keep that increase going while reducing the employee labor on taking those payments.”

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.