As financial institutions face growing demands for faster, more efficient payment solutions, payment modernization has become a top strategic priority. However, legacy infrastructure continues to pose significant hurdles.

In a recent Banking Exchange-hosted webinar, Strategic Growth: How FI Execs Leverage a Payments Hub, Neeraj Gupta, SVP of Product Management at Alacriti, explored how a modern payments hub can help banks overcome these challenges. Gupta discussed how payments hubs can uncover new revenue opportunities through data-driven insights while adapting to evolving industry trends in transaction volume and channel origination.

Quick Links

Understanding Payments Hubs

The webinar began by exploring the evolution of payments. “A payments hub is very much a fluid term that’s evolved a lot over the years. It’s been out there for quite a long time and carries a lot of baggage for some institutions,” Gupta noted. Traditionally, the term evoked images of cumbersome, monolithic systems designed for large financial institutions, often requiring years of painstaking efforts to implement. However, modern payment hubs challenge this notion, offering more agile, scalable solutions tailored to institutions of all sizes.

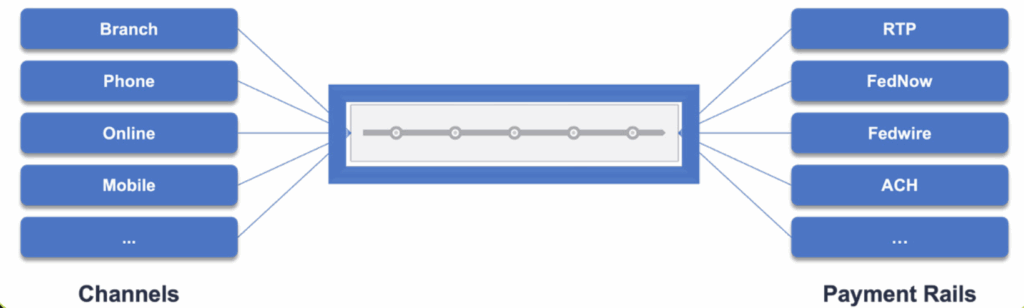

Modern payment hubs are designed to streamline payment processes, improve operational efficiency, and enhance client experiences. Gupta provided the definition of a payments hub: A payments hub is a solution that orchestrates and automates the end-to-end lifecycle of each payment per a financial institution’s unique workflow, policies, etc. This approach ensures consistent efficiency across channels and rails and is managed via a single command and control point in lockstep with a preferred integrated vendor ecosystem via a model that enables progressive modernization. “We’re laser-focused on moving money for financial institutions in alignment with their ecosystem,” said Gupta. This focus not only reduces costs and risks but also opens doors for growth through better client retention and faster time-tomarket for new initiatives.

Several factors are propelling the adoption of payments hubs:

Legacy Infrastructure Challenges:

Many financial institutions struggle due to outdated systems that hinder modernization efforts.

Operational Efficiency:

Payments hubs reduce manual interventions, minimize errors, and lower operational costs.

Revenue Growth and Client Retention:

An effective payments hub can help get to market quicker with new initiatives. It also supports client acquisition and retention through improved experiences.

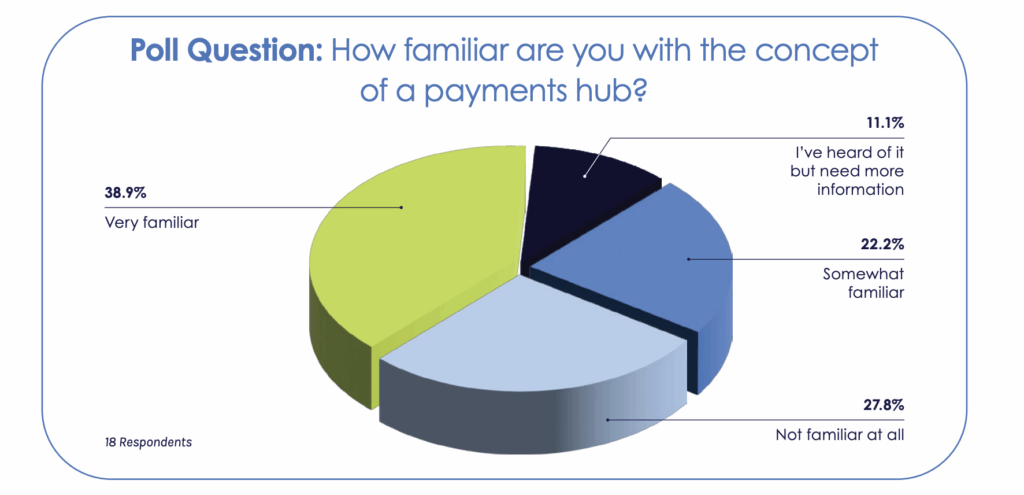

Industry Poll Insights

To gauge the audience’s familiarity with payments hubs, a live poll was conducted during the webinar:

The fact that 38.9% of respondents reported being “very familiar” with the concept of a payments hub suggests a solid foundation of understanding within the industry. However, this also means that the majority—61.1%—either have only a basic grasp or lack familiarity entirely. This points to a significant opportunity for education and outreach.

Familiarity doesn’t always equate to a deep, functional understanding. “I bet there’s a portion of that 40% who’s turning around and saying, I know what a payments hub is, and I know what I need a payments hub to do for me. Do you know what a payments hub is?”

These results reveal a clear need for continued education on payments hubs. While a significant portion of professionals are well-versed in the concept, many still require more information to fully understand its potential impact on payment modernization.

The Impact of Payments Hubs on Financial Institutions

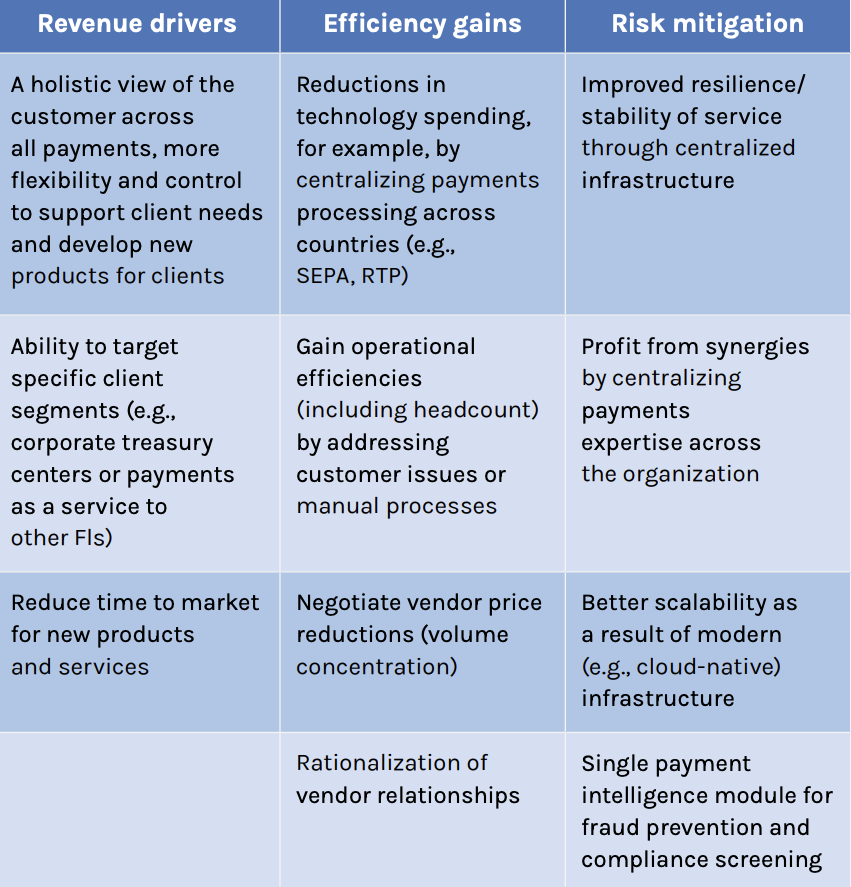

Understanding the importance of payments hubs requires looking beyond the technical aspects. “Certainly, there’s cost minimization, risk reduction, and inefficiencies to be gained operationally through a payments hub,” Gupta shared. While these operational benefits form the foundation of the business case, the true value extends to revenue growth, client retention, and enhanced customer experiences.

The primary drivers for adopting payments hubs are efficiency gains and cost reduction. Payments hubs streamline money movement across various payment rails, minimizing manual processes and reducing operational overhead. By consolidating payment workflows, institutions can optimize resource allocation and achieve significant cost savings.

Beyond operational efficiency, payments hubs offer strategic advantages in revenue generation. Payments hubs provide a comprehensive view of client behaviors and preferences—a cross-rail/ cross-channel/cross-lifecycle view. This holistic view enables FIs to identify latent demand, tailor product offerings, and enhance client retention through personalized services.

Payment hubs bolster member or accountholder satisfaction by streamlining transactions, reducing errors, and facilitating seamless interactions across products and services. They also accelerate timeto-market for new initiatives, enabling financial institutions to adapt quickly to emerging payment rails and value-added services.

At its essence, a payments hub performs every step required to execute money movement efficiently, both incoming and outgoing

Modern payments hubs also ensure consistency across channels— whether in-person, mobile, or online—and across all payment rails. This centralized approach simplifies policy configuration, risk management, and transaction approvals, enhancing operational efficiency and customer experience.

A critical feature of effective payments hubs is seamless integration with an institution’s existing vendor ecosystem, including core banking systems, digital platforms, fraud prevention tools, and more. “One of the first lessons I learned in this industry is the criticality of that integrated vendor ecosystem to financial institutions,” Gupta noted. Alacriti, for instance, supports a “bring your own ecosystem” model, allowing institutions to plug and play with various integrations. This flexibility reduces the burden on financial institutions and supports incremental modernization strategies.

Data-Driven Insights for Strategic Growth

Another compelling benefit of payments hubs is their ability to generate actionable data insights. Gupta shared real-world examples demonstrating how FIs leverage these insights:

1

Consumer Cash Flow Analysis:

An East Coast FI discovered that 57% of incoming instant payment transactions originated from consumer cash flow apps, such as gig economy platforms and payroll services. This insight led the institution to explore new short-term lending solutions to better serve its customers.

2

Wealth Management Opportunities:

A $5 billion FI identified a higher-than-average volume of transactions from wealth management apps like Robinhood and Wealthfront. This data assisted institutions in developing well-informed strategies to cross-sell investment products and strengthen customer relationships

3

SMB Cash Flow Optimization:

A community bank with a balanced retail and commercial portfolio used payments hub data to identify significant transaction volumes from SMB payment platforms like Bill.com and Amazon. This insight guided the bank in developing tailored financial solutions for small businesses.

Gupta also emphasized the importance of progressive modernization. “One of the things that we talked about being critical to a modern, effective payments hub is the ability to not have to adopt a big bang approach,” he said. Instead of taking on everything at once, FIs can incrementally deploy new payment channels and rails, ensuring operational readiness and minimizing disruption.

Poll Insights: Challenges in Payment Modernization

During the webinar, attendees participated in a poll identifying their biggest challenges in payment modernization:

The poll showed that 57.1% of participants identified legacy infrastructure as their biggest challenge in payment modernization. Gupta wasn’t surprised by this result, noting, “It’s more so a testament to the scour of legacy infrastructure, really a lead balloon that makes it very difficult to move.”

Coming in second, 28.6% of respondents cited integration with new technologies as a significant challenge. This finding points to the complexities financial institutions face when attempting to bridge the gap between existing systems and modern payment platforms.

of participants identified the high cost of implementation and regulatory compliance as major challenges.

This result surprised Erik Vander Kolk, CEO of Banking Exchange, as smaller financial institutions often express concerns about compliance burdens. “Honestly, I’m really surprised that the high cost of implementation is not higher on that. And also compliance, ‘cause we get a lot of concerns from especially smaller banks.”

Gupta offered his perspective, suggesting that while cost and compliance are genuine concerns, they are often overshadowed by the operational inertia caused by legacy systems. Additionally, he pointed out that legacy issues aren’t confined to internal infrastructure. “Legacy infrastructure could mean a number of things. It could be certainly legacy infrastructure within the FI. It could also be within another vendor, for instance, one where the banking core might sit,” he explained.

Addressing legacy infrastructure is critical for financial institutions aiming to modernize their payment systems. Overcoming these barriers requires not only technological upgrades but also a shift in strategic thinking—moving away from piecemeal solutions toward comprehensive modernization efforts. For institutions grappling with these challenges, the path forward may involve reevaluating vendor relationships, investing in flexible technologies, and fostering a culture that embraces change. Modernization isn’t a one-size-fits-all journey; understanding the most significant obstacles is the first step toward meaningful progress.

Industry Trends and Future Implications in Payments Hubs

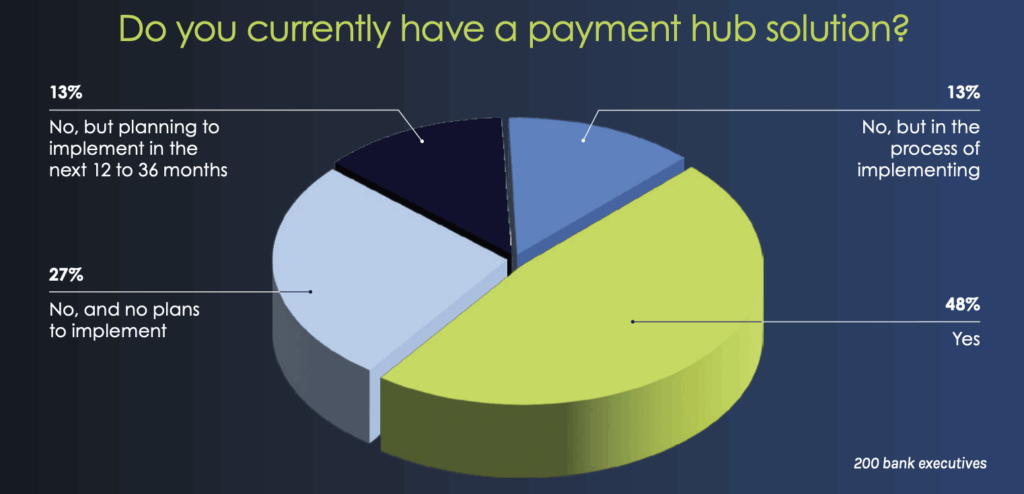

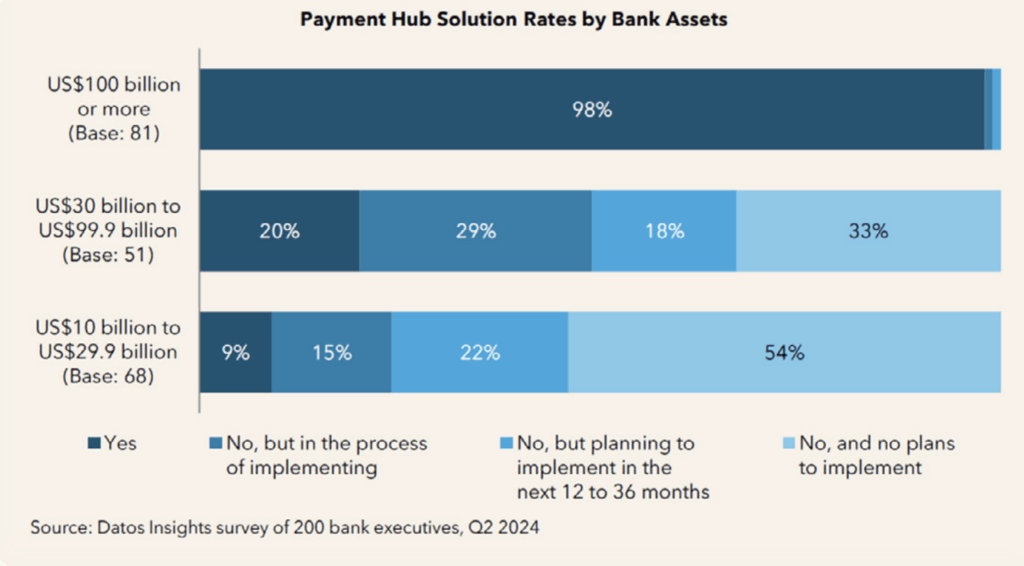

Emerging trends highlight a significant shift toward the adoption and integration of payments hubs—with both large and small institutions recognizing their strategic value. Gupta cited data from Datos Insights: “Given the landscape, 60% have either already implemented some part or some portion of a payments hub.” This adoption rate can be attributed to the increasing pressure on financial institutions to address challenges such as legacy infrastructure, rising payment volumes, and heightened competition. Institutions are not just implementing full-scale payment hubs but are also focusing on specific rails or channels.

While larger financial institutions have historically led the charge in adopting payments hubs, the trend is shifting. We see the intent to adopt, or already adopting, broken up by asset size, is certainly heavily skewed towards those larger FIs. But we do see some pretty material response here as we go sub 100 billion,” Gupta observed. This shift indicates that smaller institutions are increasingly recognizing the benefits of payments hubs despite traditional perceptions that these solutions are primarily for larger entities.

Orbipay Payments Hub

Alacriti’s technology-first approach has shaped the development of its own payments hub. Orbipay Payments Hub is designed with scalability and adaptability at its core. This includes features like ISO-native architecture and microservices, enabling seamless integration with current and future payment modalities. “One of the advantages in being technology first is that we started with a cloud-native platform,”

Gupta explained, noting that what sets the Orbipay Payments Hub apart is its ability to support incremental modernization. Financial institutions can adopt new payment rails and services progressively without the need for disruptive overhauls. “It’s poised for those future modalities, those future rails, those value-added services that may emerge,” Gupta explained.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.