With over 200 credit unions now live on the RTP® network, the journey to harnessing the full potential of instant payments is well underway. Credit unions are exploring how these innovative payment solutions can strengthen member relationships, drive growth, and unlock new revenue streams.

In a Callahan-hosted panel discussion, Maximizing Growth and Member Engagement With Instant Payments, industry experts Keith Gray, Vice President of Strategic Partnerships at The Clearing House, and Mark Majeske, SVP of Faster Payments at Alacriti, delved into actionable strategies and real-world use cases for credit unions. From enhancing financial inclusion and streamlining loan funding to leveraging Request for Payment (RFP) and driving deposit growth, the discussion provided a comprehensive guide to navigating the opportunities presented by instant payments.

Quick Links

Market Overview: The Rise of Instant Payments and Its Opportunities for Credit Unions

Instant payments offer unprecedented opportunities for credit unions to enhance member relationships and drive growth. With 59% of U.S. consumers living paycheck to paycheck, the demand for faster, more reliable payment solutions has never been greater. Majeske found a positive take on this statistic, stating, “Although that’s not a great thing, I think it’s worth noting because what we’ll find in this presentation is that that’s an opportunity for banks to help service those individuals better.”

Consumer behavior is evolving rapidly, with 53% of U.S. consumers using digital wallets and 78% expressing high satisfaction when receiving disbursements via instant payments. These trends indicate a growing preference for real-time payment solutions. Businesses are also adapting, with digital wallet use among businesses of all sizes growing by 31% (47% to 62%) in 2023. There is also a “stickiness” that instant payments create, with 69% of consumers reporting that they are very likely to continue their client relationship with an issuer if offered free instant payments

Gray shared that more than 750 financial institutions, including over 250 credit unions, are live on the RTP network. These institutions are leveraging instant payments to enhance member control and transparency. RTP provides 70% reach across U.S. accountholders and supports a quarter of a million businesses and over 5 million consumers. With origination volume growing by 15% per quarter, the RTP network is proving to be a critical tool for credit unions aiming to remain competitive.

Use cases driving adoption, such as payroll, loan funding, and investment transfers, address the needs of underbanked members and businesses alike. With instant payments offering a competitive edge to 61% of businesses, credit unions are positioned to capitalize on this opportunity to deepen member engagement and generate new revenue streams with small businesses.

Fraud in Instant Payments: A Controllable Concern

One of the audience questions addressed a common concern: does the speed of instant payments increase the risk of fraud? Gray clarified that this has not been the case. “One of the things from an industry standpoint that was a concern about just the movement towards instant payments was faster payments equating to faster fraud. Well, it hasn’t after seven years.” This can be attributed to the nature of RTP and the FedNow® Service as credit-push networks with no debit capability, which inherently reduces fraud opportunities.

The industry has bolstered security with measures like multi-factor authentication, device biometrics, and Know Your Customer (KYC) routines. In addition, instant payments require proactive fraud detection systems capable of analyzing transactions in milliseconds.

He then recommended a layered approach to fraud prevention, combining transactional analysis, user behavior monitoring, and device-level management to ensure secure transactions.

Growth Opportunities Through Instant Payments

The demand for instant payments stems largely from consumer expectations for faster, smarter, and more secure transactions. “If you do a poll of your membership and you say, ‘Hey, would you like to get paid faster, smarter, and more securely?’ I would say about a hundred percent would say, ‘Yeah, how come you’re not doing that already?’” noted Gray. Credit unions that embrace the RTP network not only meet these expectations but also gain new deposit channels and additional revenue opportunities through fee-based services.

The use cases for instant payments are vast and growing, spanning account-to-account transfers, payroll disbursements, and merchant settlements. Gray pointed out that instant payments encourage members to maintain higher balances with their credit unions: “It encourages members to keep funds parked in their credit union longer because they’re not having to push it out to the Starbucks app. They know they can do that immediately and get it there when they need it.”

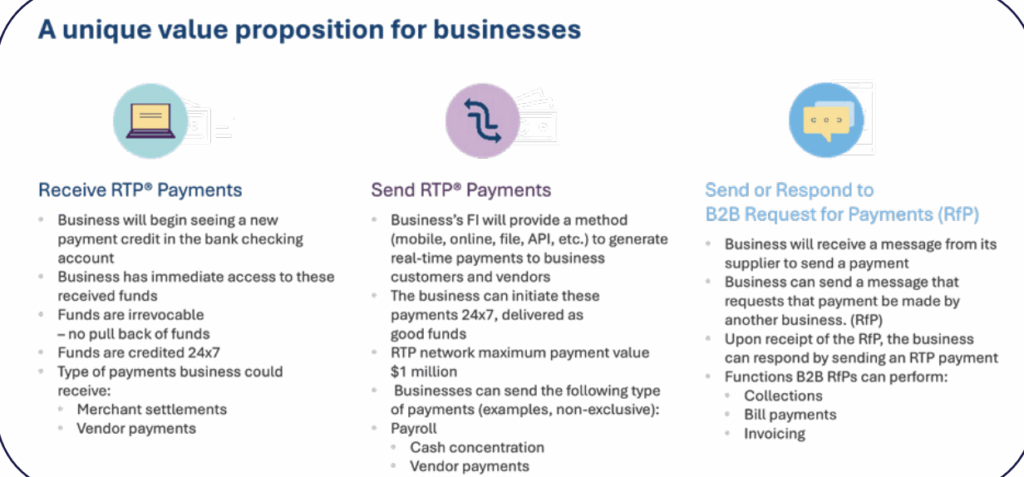

Majeske explained the dual nature of RTP use cases, expounding on the Receive and Send personas. On the Receive side, members immediately benefit from faster payments through digital wallets like PayPal and Venmo, which are seamlessly converted from ACH to RTP. “I haven’t seen one bank yet that hasn’t had transactions come in after about five minutes of being in production,” said Majeske. On the Send side, credit unions can create value-added services like instant loan disbursements and real estate settlements, offering safe and efficient transaction options.

Small Business Use Cases in Instant Payments: Meeting the Needs of a Growing Sector

With increasing financial pressures and the need for constant access to working capital, small businesses are turning to instant payment networks like RTP to meet their needs. The flexibility and visibility offered by RTP have proven essential for small businesses that require immediate access to funds, especially during weekends and nonbusiness hours. Gray pointed out that “the RTP network never goes completely quiet,” with peak activity occurring at the close of business on Fridays and continuing steadily throughout the weekend. This around-the-clock availability allows small businesses to make and receive payments seamlessly, ensuring they can manage cash flow and maintain operations without delays.

RTP’s ability to provide complete visibility into transactions and instant clearing and settlement reduces reconciliation challenges, allowing businesses to focus on growth and customer satisfaction. “The information about the payment can travel with the payment,” enabling straight-through processing into tools like QuickBooks and improving the overall efficiency of business operations,” Gray explained.

Beyond operational benefits, RTP enables small businesses to enhance their customer experiences by ensuring they can meet their expectations for faster and more transparent transactions. Gray emphasized that members and customers now “expect to be able to have 24×7 access to their funds,” and financial institutions that fail to meet these demands risk losing customers to competitors that offer instant payment capabilities.

For credit unions, supporting small business members with RTP provides a vital opportunity to build stronger relationships, increase engagement, and remain competitive. “What this network enables is for me to be able to get the types of services I want to provide where I want it, which is typically at my financial institution or my credit union,” Gray concluded.

Instant payments are no longer a convenience—they are a necessity for small businesses seeking to streamline operations, improve cash flow, and deliver a superior customer experience. Credit unions that embrace RTP are positioned to meet these demands, ensuring their small business members have the tools they need to thrive.

Member Engagement and Financial Inclusion Through Instant Payments

Instant payments are not just about speed—they transform how financial institutions engage with members and expand financial inclusion. As Majeske explained, credit unions have a unique opportunity to use instant payments to “fill a gap, solve a problem for your members… it all starts there.” Member value and experience are at the heart of this shift, and by addressing specific member needs, credit unions can create meaningful engagement and improve satisfaction.

One of the most critical aspects of instant payments is their ability to provide convenience and flexibility. Majeske shared that “53% of the transactions are done outside of business hours,” which shows the possibilities when payments are not restricted to conventional business hours. Whether it’s late at night or over the weekend, the ability to send or receive money in seconds ensures that members can manage their finances when it’s most convenient for them, even during emergencies.

Financial inclusion is another area where instant payments are making a significant impact. For underbanked members—those who rely on alternative financial services like payday loans or check cashing—instant payments offer a path to better manage cash flow and avoid unnecessary fees. “It helps manage cash flow for those living paycheck to paycheck… providing faster access to paychecks and loan disbursements 24/7. It enables last-minute bill payments to avoid late fees,” Majeske explained.

Beyond individual benefits, instant payments also contribute to broader economic benefits. For example, in Europe, industry statistics estimate over €200 billion is tied up daily due to archaic settlement and reconciliation processes.

By leveraging instant payments, credit unions can drive deeper member engagement, provide financial tools that genuinely make a difference, and support economic inclusion. The result is a stronger connection with members and a more significant role in addressing the financial needs of underbanked and underserved populations. “Once customers and members use instant payments, they never turn back,” Majeske said.

With instant payments, credit unions can transform member relationships and extend critical financial services to those who need them most, creating a future where financial inclusion and member satisfaction go hand in hand.

Unlocking the Potential of Request for Payment (RFP)

Gray explained how RFP can transform the traditional bill payment process and empower members with greater control over their finances. “The way to think about it is the RTP network is a messaging network that also carries the payment with it. One of those messages is a Request for Payment,” explained Gray. Unlike traditional bill pay methods, where members might receive an email bill but need to log into their banking platform to make a payment, RFP consolidates the process into a single, seamless transaction. Delivered over the secure RTP network, an RFP includes not just the payment request but also relevant details like the amount owed, the reason for payment, and the recipient’s information.

This streamlined approach gives members more control. “It puts the member in more control of his funds while also allowing those people that want to be paid to be able to request the funds to be paid,” Gray noted. Members decide when and how much to pay, eliminating the need to share sensitive account information with billers or rely on direct debits that lack flexibility.

The benefits of RFP extend beyond consumer payments. It’s also growing in use for account-to-account transfers and business transactions. For instance, members can send RFPs to themselves to move money between brokerage and credit union accounts, making fund transfers faster and more efficient. “We’re seeing a higher spike in requests for payment-based payments,” Gray said, citing examples like one-time bill payments and account transfers as key drivers of adoption.

Looking ahead, RFP adoption is expected to accelerate significantly. “As we move through the end of this year, and especially as we get into 2025, we’re going to be seeing a substantial growth in multiple different use cases that leverage the request for payment capability,” Gray predicted. The adoption of RFP by large financial institutions and credit unions is poised to unlock new opportunities for member engagement, operational efficiency, and growth. “I absolutely agree. And I think it’s going to create massive growth for business, for B2C and for B2B,” Majeske added

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.