Credit unions increasingly seek ways to integrate instant payments within their existing infrastructures while combating the rising threat of payments fraud. In a NACUSO-hosted webinar, industry experts Mark Majeske, SVP of Faster Payments at Alacriti, and Andrew Muzzatti, Head of Fraud Product Marketing at Verafin, provided insights into these pressing challenges. Majeske discussed effective strategies for seamless integration and the hurdles credit unions face, while Muzzatti offered a comprehensive overview of emerging fraud trends, such as Business Email Compromise (BEC) and elder scams.

Together, they explored fraud prevention strategies, real-life examples, and the top use cases and monetization opportunities for instant payments, equipping credit unions with the knowledge to enhance their operations and protect against fraud.

Quick Links

Integrating Instant Payments Into Credit Union Operations

One of the primary steps for credit unions is understanding the different integration options available. “A lot of credit unions are unaware of the fact that they can either integrate directly to the RTP® network or FedNow® Service or use a TPSP,” Majeske explained. Utilizing a TPSP (third-party service provider) can simplify the process by handling direct connectivity, facilitating testing and certification, ensuring regulatory compliance, and managing liquidity and funding accounts.

Majeske emphasized that credit unions can be independent of their current core providers to offer instant payments. Alacriti works with various cores using APIs to integrate instant payment capabilities. This flexibility allows credit unions to maintain existing systems while adopting new technologies.

Operational adjustments are crucial for successful integration. For example, credit unions need to think about settlement processes. Alacriti provides end-of-day reports to assist with reconciliation and settlement, ensuring that all transactions are accurately accounted for. Customer service is another important aspect. While many might assume that 24/7 support is necessary for real-time payments, Majeske pointed out this is not typically the case. “I don’t know a lot of credit unions that are offering 24/7 customer service for instant payments,” he said.

Effective liquidity management is vital when setting up sub-accounts, e.g., The Clearing House. The Clearing House and the Federal Reserve have begun paying interest on funds parked in sub-accounts, encouraging credit unions to keep more funds available. On the general ledger side, credit unions typically do not need to create new accounts and can simply add new transaction types instead.

Integrating instant payments also offers an opportunity to streamline existing processes. Majeske reassured that most credit unions do not need to hire additional staff for this transition. Instead, they can focus on optimizing their current operations. “The first question I always get is, how many people do I have to hire in order to address instant payments? And I can tell you that over 90% of the cases, no one’s hiring additional people,” he shared. By leveraging the support of a TPSP, credit unions can handle the increased volume of instant payments without a significant operational burden.

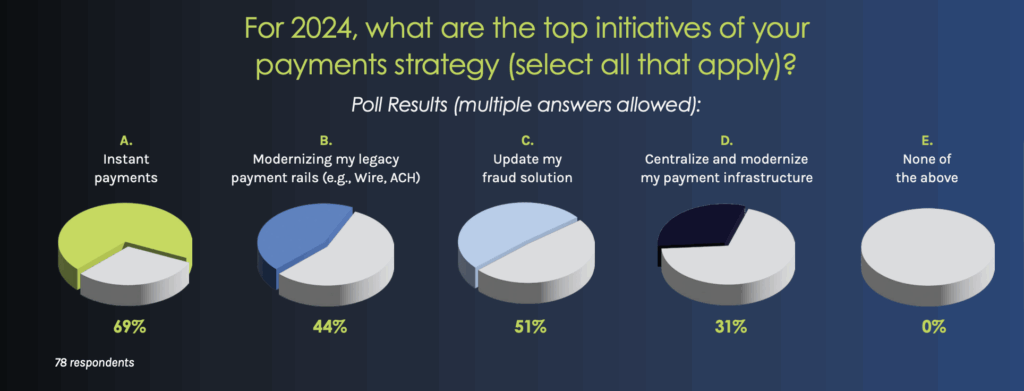

Poll Insights – Payment Strategy Initiatives

During the webinar, a poll was conducted to understand the top initiatives in payment strategies for 2024. The results showed a significant interest in integrating instant payments with enhanced fraud solutions and modernizing payment systems. The results revealed that 69% of respondents prioritized instant payments, 51% focused on updating fraud solutions, 44% aimed at modernizing legacy payment rails, and 31% intended to centralize and modernize their payment infrastructure.

The results show credit unions’ growing recognition of the need to leverage advanced technology and data analytics to ensure robust and efficient payment systems. “It’s clear that credit unions are looking to upgrade their transaction monitoring solutions to fully integrated, enterprise-based systems, offering a comprehensive view of their customers,” noted Muzzatti.

Integrating instant payments into credit union operations involves careful planning and strategic adjustments. Credit unions can successfully adopt instant payments by understanding the available options, utilizing third-party providers, and streamlining existing processes. “At the end of the day, an instant payment transaction is not a heavy lift on behalf of the bank, particularly when you’re using a TPSP because we do a lot of the heavy lifting with and for you,” Majeske added.

Emerging Trends in Payments Fraud

As payments modernize, so do fraudsters’ tactics to exploit vulnerabilities within financial systems. One of the significant emerging trends highlighted by Muzzatti is the increasing prevalence of Authorized Push Payment (APP) scams. According to the FBI’s internet crime reports, these scams, where individuals are tricked into authorizing payments to fraudsters, have become one of the top threats. “Credit unions are struggling with APP fraud because these payments are made voluntarily,” Muzzatti explained. “Someone is socially engineered into sending money to a payee because it’s a romance scam or some other type of scam.” This type of fraud is particularly challenging to detect and prevent because the transactions appear legitimate.

Muzzatti emphasized the severe impact of fraud on vulnerable populations, especially the elderly. He noted that his own credit union had posted warnings about elder abuse scams. “They had this 8.5” x 11” printout posted at the teller… it was an elderly abuse scam alert,” he said. The scams targeting elders include:

- Government imposters

- Romance scams

- Emergency/Person-in-need scams

- Lottery/Sweepstake scams

- Tech/Customer support scams

Data from the FBI indicates that seniors make up 50% of fraud cases and account for over 66% of losses, a trend corroborated by Verafin’s data.

Credit unions should adopt a multi-faceted approach that combines advanced technology with comprehensive education to effectively tackle the growing threat of payments fraud. Implementing robust fraud detection systems, conducting regular fraud risk assessments, and maintaining open lines of communication with members about potential scams are essential components of an effective strategy. “Education is key,” Majeske stressed. “Electronically, we can track, we can try to remediate fraud, but at the same time, it has to go hand in hand with a good education program.” “Having a strong and effective fraud program means staying ahead of these trends and continually adapting to new threats,” Muzatti added. By educating members, particularly the elderly, on recognizing and avoiding scams, credit unions can significantly reduce the risk of fraud.

Challenges in Managing Fraud Across Multiple Rails

With the adoption of faster payment networks, managing fraud across multiple payment rails has become increasingly complex. One key challenge is the limited time available to detect fraud in real-time transactions. “The network expectations are that transactions are available 24/7 and settled within seconds,” Muzzatti stated. If fraud detection systems generate false positives and hold transactions for review, it undermines the promise of instant payments. This affects member satisfaction and erodes the competitive advantage of providing faster payment options.

Muzzatti emphasized the importance of integrating fraud detection systems across all payment rails. Leveraging data from various channels, such as ACH and wire, can provide a comprehensive view of member behavior and improve fraud detection. “If you could leverage data from your other rails like ACH and see that this client has paid this person before, you could use those behavioral insights to inform faster payment transactions,” Muzzatti suggested.

Effective transaction monitoring is crucial for managing fraud across multiple rails. Muzzatti noted that many institutions still rely on manual processes and disparate systems for fraud investigations. “You’re probably going into different systems and pulling and gathering evidence from those systems and risk-rating it,” he explained. Centralizing transaction monitoring and leveraging advanced analytics can significantly improve detection rates and reduce false positives. “Having a strong and effective fraud program means staying ahead of these trends and continually adapting to new threats. Through strategic integration and advanced analytics, financial institutions can better manage fraud across multiple rails and maintain a competitive edge in the evolving payments landscape,” said Muzzatti.

These systems pull in all relevant evidence for review, significantly reducing the manual effort required to monitor transactions.

In addition to automation, Muzzatti noted the growing preference for managed analytics. Credit unions are increasingly seeking external expertise to develop and maintain fraud detection rules and behaviorbased analytics.This approach allows credit unions to stay on top of emerging trends without dedicating extensive internal resources. “More and more I’m hearing… we don’t want to be building our own rules, our own behavior-based analytics. We would like somebody else to manage that for us,” he shared.

Addressing Authorized Push Payment (APP) fraud and money mule detection are also essential components of an effective fraud strategy. APP fraud involves fraudsters tricking victims into authorizing payments to them, often facilitated by money mules. Muzzatti highlighted the importance of detecting these mules to prevent fraud. “APP fraud requires a money mule on the other side, whether they know they’re the mule or not,” he explained. Credit unions can protect their members from significant financial harm by identifying and intercepting these fraudulent transactions

Credit unions also have the option of setting limits for instant payments. Majeske explained that while the RTP network has a maximum transaction level of $1 million and the FedNow Service up to $500,000, credit unions have the flexibility to set their own limits based on member history and other factors. He advised credit unions to start with conservative limits and adjust them as they become more comfortable with the system.

When asked about the future of instant payments, Majeske advised credit unions to join the network and engage with their members to identify needs and gaps in service. “Talk to your members, find out what they want to do, and start to think about use cases that you can build out for them,” he recommended. He emphasized the importance of designing products around member needs and using instant payments as a tool to enhance service delivery.

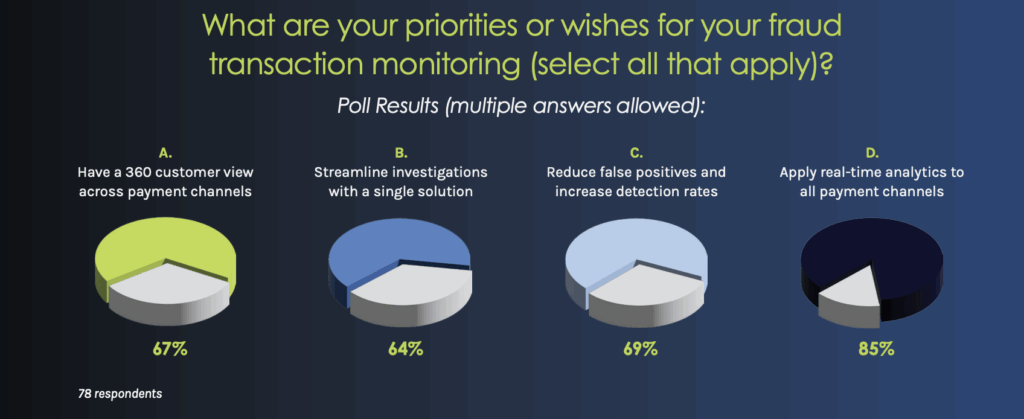

Poll Insights – Fraud Transaction Monitoring

During the webinar, a poll was conducted to understand the priorities for fraud transaction monitoring. The results indicated a clear focus on improving real-time analytics, with 85% of respondents highlighting the need to apply these analytics to all payment channels, showing the importance of detecting and preventing fraud as quickly as possible in a rapidly evolving payment landscape. Additionally, reducing false positives was a significant concern, with 69% of participants seeking to enhance detection accuracy while minimizing disruptions caused by incorrectly flagged transactions. And 67% of respondents emphasized the necessity of achieving a comprehensive, 360-degree view of customer activity across all payment channels to better understand and mitigate fraud risks. “These poll results demonstrate that credit unions are committed to leveraging advanced technologies and integrated systems to enhance their fraud monitoring capabilities, ensuring a more secure and efficient payment environment,” remarked Muzzatti.

Instant Payments Use Cases and Monetization Opportunities for Credit Unions

When credit unions decide to integrate with instant payment networks, they often begin with receiving transactions before enabling Send capabilities. This phased approach allows them to familiarize themselves with the network’s operations and the types of transactions they will encounter. “98% of institutions that join these networks, particularly the RTP network, will receive transactions on day one,” Majeske noted. This immediate activity is driven by a variety of use cases, such as online wallets, instant cash loans, microlending, daily payroll, retirement payments, title payments, and sports betting payouts.

For example, Uber drivers may use instant payments to receive their earnings more quickly, or members might benefit from faster retirement payments. These Receive use cases illustrate how members interact with services that other financial institutions have already established.

As credit unions become more familiar with receiving transactions, they can develop their own use cases for sending instant payments, opening the door for monetization. Historically, many credit unions have offered ACH payments for free. However, the benefits and convenience of instant payments justify charging a fee for expedited services. “There are enough benefits to instant payments to warrant charging a fee,” Majeske explained, emphasizing the 24/7 availability and speed of these transactions.

Real-World Examples

Alacriti’s data reveals compelling insights into how credit unions and banks are utilizing instant payments:

Micro-Lending:

18% of instant payments received by Alacriti’s customers last year were from instant cash loan companies. This indicates a strong demand for quick access to funds, presenting an opportunity for credit unions to offer similar services.

Daily Payroll:

One $3 billion credit union saw 28% of their received instant payments come from daily payroll solutions. This growing trend in earned wage access demonstrates the value of offering real-time payroll options.

Venmo and PayPal Transactions:

A $2.5 billion community bank observed that almost 70% of its incoming instant payments were conducted via Venmo or PayPal. These platforms utilize RTP to expedite transfers, charging users a fee for the service. Majeske pointed out that “When they do see it, 76% of customers pay the fee,” highlighting users’ willingness to pay for the convenience of instant payments.

Credit unions can capitalize on these trends by developing tailored use cases and monetization strategies. For instance, offering instant payroll services to business clients or enabling expedited transfers for members using online payment platforms can generate additional revenue. Furthermore, integrating these services seamlessly with existing systems ensures a smooth user experience.

“Credit unions should view the adoption of instant payments not just as a compliance requirement but as a strategic opportunity to enhance member services and drive revenue,” Majeske concluded. By leveraging the benefits of instant payments and implementing effective monetization strategies, credit unions can stay competitive and meet their members’ evolving needs

How to Connect Through Alacriti

Alacriti offers a seamless solution for credit unions through its cloudbased payments hub, which is designed to simplify the connection process for instant payments. Alacriti’s Orbipay Payments Hub is a comprehensive Payments-as-a-Service (PaaS) solution that facilitates easy integration with various banking cores. It features:

1

Cloud-Based Infrastructure:

The Payments Hub operates 100% in the cloud, leveraging AWS (Amazon Web Services) to ensure reliability, scalability, and security

2

Integration With Banking Cores:

The platform integrates with many banking core systems, providing flexibility and compatibility with your existing infrastructure.

3

ISO 20022 Native:

The Payments Hub is designed to support the ISO 20022 messaging standard, ensuring compliance and facilitating enhanced data exchange.

4

Open APIs and Smart Routing:

Open APIs allow for seamless integration and customization, while smart routing optimizes transaction processing across various payment rails..

5

Available Payment Rails:

The platform supports a wide range of payment rails, including Fedwire, ACH, RTP, FedNow, and Visa Direct. This ensures that the credit union can handle all types of transactions efficiently

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.