Orbipay Payments Hub for ACH

Modular, Scalable, Automated

Improve efficiency and reduce costs with modern ACH processing—leaving legacy limitations behind.

Problem

Batch-Based ACH Wasn’t Built for Today’s Expectations

ACH systems often rely on aging legacy technologies that are increasingly difficult to maintain and rapidly becoming obsolete. These challenges make modernizing ACH a necessity:

Labor-heavy, manual ACH workflows that slow processing, increase costs, and introduce errors

Fragmented ACH systems for origination, posting, and exceptions that create operational drag

Limited visibility into ACH transactions, returns, and settlement that restricts real-time oversight

Manual compliance, fraud, and reversal processes that increase risk and strain staff resources

Modernize ACH With Orbipay

ACH Payments Processed

Value of ACH Payments Processed

Experince in ACH and Payments Innovation

Platform Uptime

Key Capabilities

Automation-First ACH Solution

Orbipay Payments Hub for ACH delivers end-to-end automation, advanced exception handling, and pre-transaction compliance screening—all within a unified platform that supports ACH, wires, the RTP network, and the FedNow Service.

End-to-End Automation:

Automate the full ACH lifecycle—from origination through exceptions—to reduce costs, errors, and processing time.

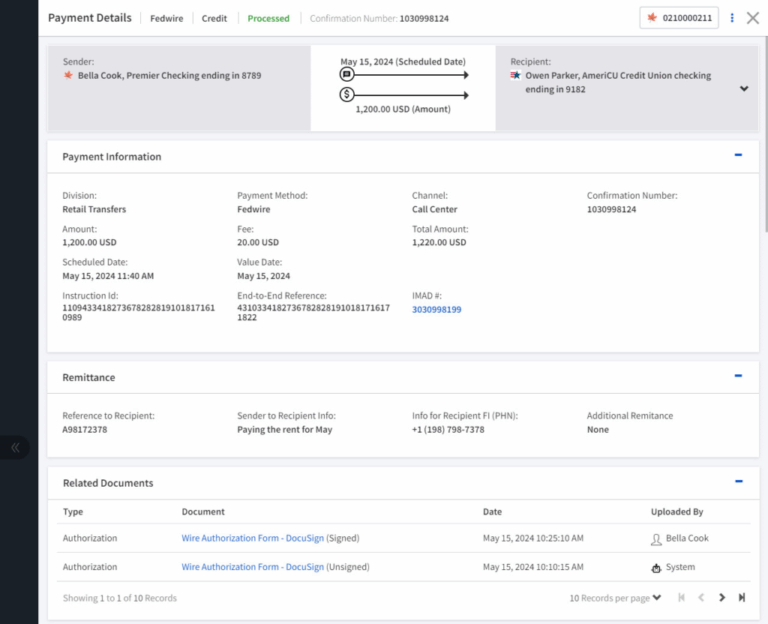

Centralized Oversight & Reporting:

Manage ACH activity and approvals in a single platform with unified visibility across payment rails.

Automated Exception Handling:

Streamline returns, dishonors, and reversals to shorten resolution times and reduce manual effort.

Compliance & Risk Controls:

Built-in OFAC screening, exposure monitoring, and return-rate tracking help reduce regulatory and reputational risk.

Rapid System Integration:

Out-of-the-box connectors and open APIs support fast deployment with existing core, digital banking, and fraud systems.

Scalable Growth Platform:

Cloud-native, ISO 20022–based architecture supports extensibility and long-term growth.

Key Benefits

The Business Case for Orbipay Payments Hub for ACH

Cost Savings

Faster ACH Operations

Unified ACH Control

Reduced Risk Exposure

Scalability & Future Readiness

End-to-End Automation

Case Studies

What Our Customers Say

Veridian Credit Union

|

Credit Union

Veridian Credit Union Among the First To Connect to the FedNow® Service

Jeni Brantner, VP of Payments

Frequently Asked Questions

How quickly are ACH payments processed today?

Standard ACH transfers typically settle in one to two business days, while Same Day ACH enables faster processing when needed. Although ACH may offer cost advantages (in some scenarios) for the end user, manual processing can result in higher costs and increase the potential for human error for the financial institution. Orbipay Payments Hub for ACH gives your accountholders the opportunity to get the right speed and cost for each payment.

What ACH timing considerations should financial institutions keep in mind?

There are cut-off times for Same Day ACH transactions. Understanding those windows is critical for businesses managing cash flow. Knowing when settlement occurs and when funds are available helps organizations better manage and forecast their liquidity.

What is the best way to secure ACH transactions?

Security starts with account validation—making sure the account is legitimate before a transaction is initiated. Nacha compliance is key, as is ongoing risk monitoring to detect anomalies. Alacriti’s Orbipay Bank Account Validation & Verification Service offers an even higher level of protection.

What risk management features are typically available in a modern ACH solution?

Institutions can monitor credit risk exposure, set transaction limits, and enable return rate monitoring controls. Having strong pre-transaction validation helps reduce fraud.

Let’s Talk About Your Payments Strategy

See how Orbipay Payments Hub for ACH modernizes processing, reduces manual work, and lowers operational risk.