Quick Links

Zelle® – What It Is and How It Works

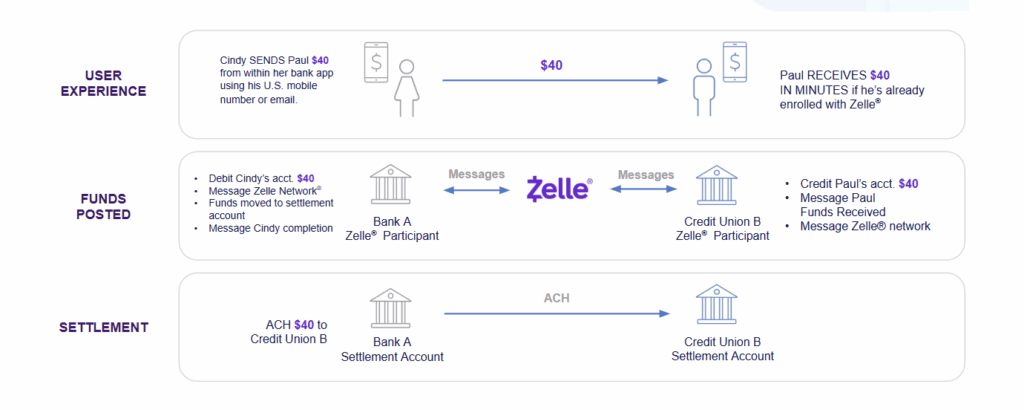

Zelle® is transforming how money moves, with more than five billion digital payments sent since its launch in 2017. The Zelle® network connects over 2,200 banks and credit unions of all sizes, enabling consumers and businesses to send digital payments to people and businesses they know and trust with an eligible bank account in the U.S.

Zelle® Use Cases

Personal

Gift money, pay the babysitter, or split the cost of a night out.

Small Business

Accept payments from customers or pay an eligible vendor, supplier, or employee.

Disbursements (to be launched at a later date)

A fast and easy way for companies and government entities to send money directly to their customers’ checking or savings accounts.

Why Financial Institutions Should Care About P2P:

Why should banks and credit unions implement a P2P solution?

When customers use Zelle® through your bank or credit union’s app, everyday payments—like paying rent, splitting bills, or sending funds—stays inside your digital ecosystem. This drives more frequent logins, increases engagement, and naturally exposes users to other offerings such as loans, credit cards, and promotional rates. Unlike third-party apps that divert attention and deposits away, Zelle® within your app keeps your institution front and center, strengthening relationships, creating cross-sell opportunities, and helping attract and retain new accountholders.

Zelle® App Discontinuation – Background

In October 2024, Zelle® announced that it would phase out its standalone mobile app by March 2025. The vast majority of users were accessing Zelle® directly through their bank or credit union’s mobile app; only about 2% of transactions were occurring on the standalone app. Going forward, Zelle® will be available through financial institutions’ digital channels, while repurposing the app as an educational resource on scams, fraud, and participating banks and credit unions.

Finding a Solution: What Happens Next?

What alternatives exist now that the standalone Zelle® app has been discontinued?

Some financial institutions have turned to third-party wallets or proprietary core-based P2P solutions to fill the gap. While these can enable basic transfers, they also shift transactions outside the FI’s ecosystem—leading to lost engagement, displaced deposits, and reduced visibility.

Alacriti’s Orbipay Payments Hub for Zelle® provides a better option by integrating Zelle® directly into your online and mobile banking. This approach keeps everyday payments within your brand, enhances customer loyalty, and avoids costly core upgrades. With unified reporting, fraud prevention, and orchestration across all major rails, Orbipay Payments Hub delivers the secure, modern payments experience your customers expect.

How do FIs prevent their P2P transaction volume from shifting to outside fintech providers?

The best defense is offering customers the convenience they’re seeking inside your own channels. Embedding Zelle® into your digital banking with Orbipay Payments Hub means customers can send and receive money in minutes1, backed by your brand and security controls. By keeping P2P transactions in-app, you not only meet customer expectations but also drive more logins, increase opportunities for cross-sell, and protect deposits and revenue that might otherwise flow to third-party wallets.

Messaging that blends fast availability, ease of use, and trusted security—all within the familiar banking environment—resonates strongly with users.

Alacriti’s Solution

Orbipay Payments Hub for Zelle® is an all-in-one payments platform system that provides financial institutions with all the tools, services, and technology infrastructure they need to quickly enable Zelle® for consumers, small businesses, and disbursements. The solution offers built-in fraud prevention tools, real-time reporting, and integrations to core and digital banking systems.

Alacriti’s solution is an integral part of the Orbipay Payments Hub, which unifies everything payments end-to-end—from wires and ACH to instant payments—into a single, modern platform.

Feature | What It Means for Your FI |

Unified Platform | Manage all Zelle® payments through a single cloud-based hub, reducing multiple vendor integrations. Zelle®-compliant UX supported via vendor partnerships. |

Core & Digital Banking Integrations | Out-of-the-box built-in integration with existing core, digital banking, and other existing banking legacy infrastructure simplifies implementation and expedites time-to-value. |

Built-In Fraud Tools | Alacriti’s proactive, layered approach to fraud prevention is designed specifically for real-time payments. It layers best-in-class fraud prevention capabilities across multiple dimensions to provide a comprehensive and adaptive defense. |

Custom Implementation | Highly flexible payments hub architecture, and modular implementation allowing users to modernize and automate their payments at the pace that fits their needs and organization’s business rules. |

Multi-Channel Support | Functional on the online banking portal and mobile app. |

Pre-Certified UI | API and SSO implementation options with Zelle®certified UI, giving you maximum flexibility within the requirements Zelle® has in place. |

Value Proposition/Benefits:

How do financial institutions (banks and credit unions) benefit from Orbipay Payments Hub for Zelle®?

Retain competitive advantage against P2P wallets. Orbipay Payments Hub makes it cost-effective to offer Zelle® directly in your digital banking, helping reduce disintermediation and strengthening customer loyalty.

Offer SMBs a quick way to get paid. Give SMB accountholders fast access to funds with no fees from Alacriti. Improved cash flow can translate into stronger relationships and deposits that stay with your institution.

Bundle instant and fast payments with traditional rails all on one unified platform with cohesive reporting.

Consolidate fraud and back office. Orbipay Payments Hub fraud prevention tools integrate directly with the FI’s fraud offering or can be offered as a service to FIs who do not have a fraud solution. FIs can access both transaction and fraud data in a consolidated back-office portal.

No change or update to the core required. FIs can access Orbipay Payments Hub for Zelle® capabilities without changing or updating their core banking system. This is a huge cost saving for the FIs when they use Alacriti.

How do end consumers benefit from Zelle® offered by their credit union or bank?

Continuity: End users of the discontinued Zelle® app can now continue using Zelle® through your mobile banking.

Broader Coverage: The Zelle® shared directory offers an alternative when the sender or receiver doesn’t have the RTP® network or FedNow® Service coverage.

The Largest P2P Network: Zelle® has the largest P2P network, offering it to the accountholders to increase the chances that both sides are on the network.

Integration With Cores:

Is a core change or upgrade required to deploy Zelle®?

No, Alacriti delivers a flexible, core-agnostic solution that works with any core or digital banking platform.

How does Alacriti’s solution differ from that of traditional core providers?

Unlike traditional core providers, Alacriti delivers a flexible, core-agnostic solution that works with any core or digital banking platform. Orbipay Payments Hub enables rapid deployment and seamless interoperability, giving financial institutions a modern, unified way to offer Zelle® and other payment rails. On top of that, Alacriti’s best-in-class, multi-layer fraud solution—purposely-built for instant payments—helps protect against evolving threats where other solutions often fall short.

Keeping Faster Payments Safe

Why is fraud a concern across fast payments?

Irreversibility of Payments: One of the defining features of modern payment rails (Zelle®, RTP network, FedNow Service, Visa Direct, etc.) is that transactions settle quickly and are generally irreversible once authorized. While this provides unmatched speed and convenience, it also reduces the ability to recover funds after a fraudulent event.

Unique Fraud Considerations: Due to the broad adoption and efficiency of these payment methods, they require financial institutions to account for different fraud scenarios, such as impersonation, false sales, rental scams, or account takeovers. These schemes often rely on tricking users into “authorizing” a payment, making education and preventive controls especially important.

Limited Dispute Options: Unlike credit or debit card rails, which have long-established chargeback processes, modern payment rails operate with different dispute frameworks. This means institutions need tailored strategies for managing disputes and supporting members when issues arise.

Consumer Awareness Gap: As adoption of these modern payment methods continue to grow, many users are still learning how these systems differ from traditional payment methods. This learning curve can create opportunities for fraudsters to exploit misunderstandings about available protections and the finality of transactions.

How does Alacriti’s multi-layered approach to fraud prevention help safeguard against these risks?

Alacriti takes a proactive, layered approach to fraud prevention designed specifically for real-time payments. Our strategy centers on layering best-in-class fraud prevention capabilities across multiple dimensions to provide a comprehensive and adaptive defense. Key components include:

- Transactional anomaly detection

- Identity risk assessment (including behavioral biometrics, device/IP intelligence, etc.)

- Business/entity risk assessment

This integrated, multi-layered approach is designed to deliver effective protection as real-time payment volumes continue to grow. It also ensures that our solution remains robust, scalable, and flexible—able to evolve with emerging threats and industry demands over the long term.

Ready To Bring Zelle® to Your Accountholders?

Give your customers the convenience of fast P2P payments while keeping payments inside your banking ecosystem. With Orbipay Payments Hub, your institution can connect to Zelle®—alongside the RTP network, FedNow Service, ACH, and more—through a single, modern platform.

Schedule a Demo Today

To see how easy it is to deliver Zelle® with Orbipay Payments Hub.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. To send or receive money with Zelle®, both parties must have an eligible checking or savings account. 1Transactions between enrolled users typically occur in minutes.