As demand for instant payments accelerates, both businesses and consumers expect faster, more seamless ways to move money. Real-time payments are here to meet these expectations—not only reducing settlement times, but also strengthening cash flow and improving overall customer and member experiences. However, with multiple payment options now available—the FedNow® Service, The RTP® Network, and Zelle®—many financial institutions and businesses are unsure which rail best aligns with their needs.

What Is Zelle®?

Zelle® is a peer-to-peer payment network integrated with U.S. banks and credit unions, allowing consumers to send and receive money within minutes. Key advantages include wide consumer adoption and the ability to pay with just an email or U.S. mobile number—removing the need to share banking details or use third-party accounts. Although Zelle®’s primary audience remains consumers and small businesses, it also supports certain business-to-consumer payment needs for larger companies and government entities interested in using it for B2C disbursements.

For financial institutions, payment rails like RTP and FedNow complement P2P solutions like Zelle®, serving broader use cases such as payroll, bill pay, account-to-account transfers, and disbursements. What began as a consumer convenience has evolved into an interconnected real-time payments ecosystem, driving a redefinition of speed, reach, and customer expectation across all payment types.

What Is RTP?

The RTP network, operated by The Clearing House (TCH), is a private-sector real-time payments network owned by a consortium of U.S. banks. Similar to the FedNow Service, the RTP network enables immediate push transaction access to funds 24/7, but it places stronger emphasis on business-to-business and corporate payment use cases. This focus delivers advantages such as enhanced cash-flow management and improved operational efficiency for businesses.

Developed and maintained as a private network, the RTP network offers customization, flexibility, and robust integration capabilities. While Zelle® offers a consumer-focused model and standardized experience, the RTP network allows financial institutions to build richer workflows and deeper integrations, supporting faster processing and streamlined reconciliation. The RTP network also offers Request for Payment (RfP) transactions, which will enrich corporate/business-generated transactions, including invoice distribution and other use cases.

What Is FedNow?

The FedNow Service, launched in 2023 and fully compliant with ISO 20022 standards, is the Federal Reserve’s real-time payment network designed to modernize the U.S. payments ecosystem. While Zelle®is a front-end P2P messaging service along with existing bank rails, the FedNow Service is an instant payment network that enables instant, 24/7/365 settlement between participating financial institutions. This provides accessible and reliable options for banks, credit unions, and service providers.

One of its key benefits is its ability to help smaller financial institutions compete more effectively with larger banks by offering direct access to a Federal Reserve Master Account–operated as a real-time network. This reduces reliance on private-sector intermediaries and promotes efficiency for both consumers and businesses. The FedNow Service supports peer-to-peer (P2P), bill payment, and business-to-business (B2B) transactions as well.

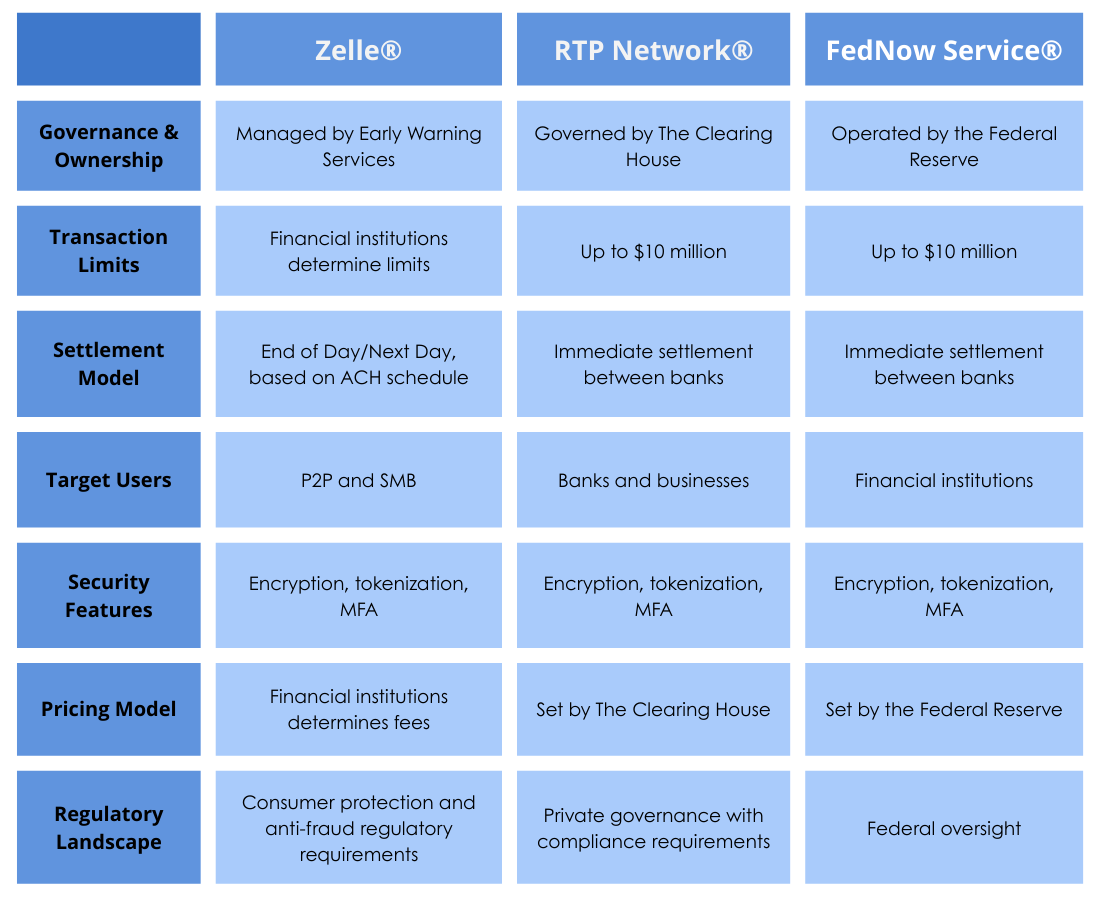

In this table, we compare the variances within these rails in governance, users, settlement, security, pricing, and oversight.

*MFA = Multi-Factor Authentication (i.e., password, PIN, facial recognition, etc.)

Security Protocols and Fraud Prevention

Security is foundational across FedNow, RTP, and Zelle®. All three use encryption, tokenization, and multi-factor authentication to safeguard sensitive payment information. The FedNow Service and RTP network also offer corporate-level controls, enabling financial institutions to manage fraud risk more effectively. Zelle® incorporates real-time monitoring tools and risk-detection filters to help identify suspicious transactions. Across all three rails, fraud-prevention measures include proactive warning alerts, multi-channel verification, and ongoing customer education to strengthen transparency and trust. All three networks depend on accomplishing effective fraud detection by the combined efforts of data provided directly by the networks and solutions emanating from the FI’s to effectively control fraud.

The Future of Instant Payments

The future of instant payments points toward a more unified, streamlined real-time infrastructure. Smaller financial institutions—including community banks—are increasingly benefiting from these payment services. Emerging trends include broader adoption across both retail and commercial use cases, deeper integration into mobile and digital banking channels, and continued emphasis on security and regulatory compliance.

Equally important is elevating the customer experience, ensuring that speed is matched with transparency, reliability, and trust. The combination of an effective Instant Payments infrastructure and innovative end user use cases will continue to drive use and adoption of these three networks.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with TCH’s RTP® network, the FedNow® Service, Zelle®, Fedwire, ACH, and Visa Direct, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes.