One Platform. Every Rail. Now With Zelle®.

Offer fast, secure P2P and small business payments through Orbipay Payments Hub for Zelle®—delivered inside your digital banking experience.

Problem

P2P Payments Are No Longer Optional

Customers expect Zelle® directly within their digital banking experience. When it isn’t available, money movement migrates to third-party wallets—taking engagement, deposits, and data with it.

P2P activity happens outside the FI ecosystem

Increased customer frustration and service inquiries

Deposit loss to fintech wallets

Operational silos and fragmented reporting

The Gap Is Growing

of users say Zelle® positively impacts how they view their FI

of consumers would switch banks for access to Zelle®

Zelle® users make ~3.2 more debit transactions/month

increase in payments to small businesses in the first half of 2025

Solution

Fast, Secure Money Movement — Right Inside Your Digital Banking Solution

Your accountholders expect to send money in minutes—not days. Zelle® lets them send and receive payments fast using just a U.S. mobile number, email, or Zelle® tag—while keeping account details private. With Orbipay Payments Hub, you can launch Zelle® directly in your digital channels—no core changes, no delays, and no reason to let members turn to another provider.

Value

Simplify Ops, Amplify Growth: Modern Payments Hub for Banks & Credit Unions

Orbipay Payments Hub provides a unified, cloud-native platform that integrates seamlessly with existing systems and supports all major payment rails, enabling faster deployment, secure operations, and scalability.

Value

Why Orbipay Payments Hub?

Built to power innovation, scale, and agility in payments

Orbipay Payments Hub goes beyond simply enabling Zelle®. It allows financial institutions to deliver Zelle® as part of a broader, unified payment strategy without adding vendors or operational burden. We empower your institution to:

- Accelerate deployment through our turnkey reseller model

- Mitigate risk with built-in, multi-layered fraud controls

- Drive customer engagement and increase deposits/transactions

Key Capabilities

A Faster, Lower-Lift Path to Offering Zelle®

Getting Zelle® through Alacriti simplifies how financial institutions offer Zelle®, with Alacriti handling operational and compliance requirements.

Person-to-Person (P2P) Payments

Send and receive money between enrolled users in minutes using email addresses or U.S. mobile numbers.

Eligible Small Business Payments

Give small businesses a simple, familiar way to get paid by consumers.

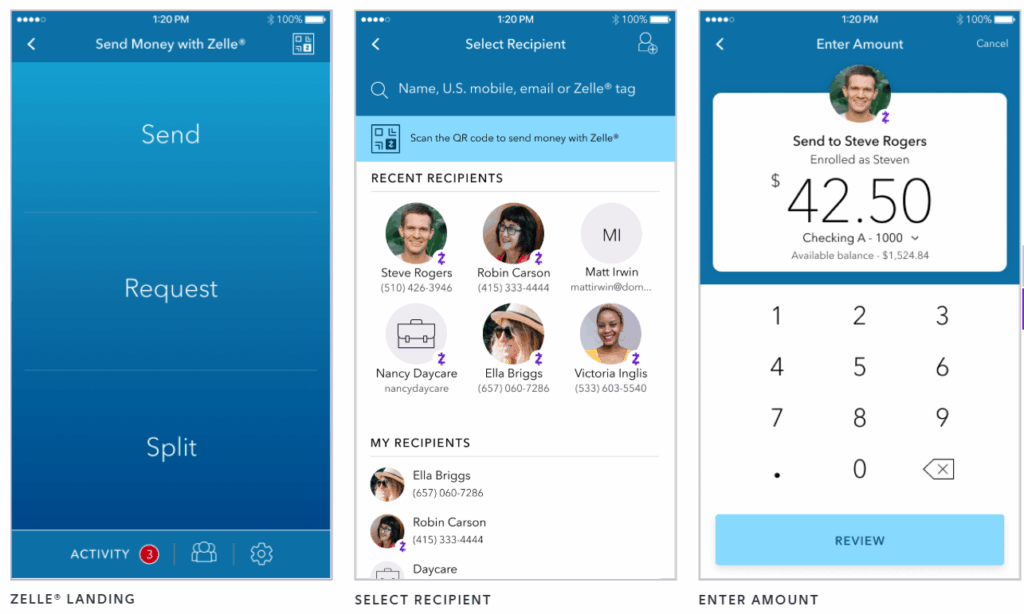

In-App Zelle® Experience

Offer Zelle® directly within your online and mobile banking experience.

Real-Time Payment Confirmation

Provide fast confirmation and visibility for both senders and recipients.

Network-Based Reach

Connect customers to the broad Zelle® network of 2,300+ participating banks and credit unions.

Key Benefits

The Business Case for Zelle® Through Alacriti

Increase Engagement & Retention

Reduce Wallet Displacement

Simplify Operational & Compliance Requirements

Reduce Implementation Efforts

Offer an Accountholder Secured P2P WithTheir Trusted FI

Customer Perspectives

We Help Customers Achieve Superior Business Outcomes

Launched Instant Payments and processed $15.5 MM in 3 months

Customer

Royal Credit Union

Industry

Credit Union

Veridian Credit Union Among the First To Connect to the FedNow® Service

Customer

Veridian Credit Union

Industry

Credit Union

Real-Time Results: 2,300+ Transactions and $5M Moved in Two Months at ABNB

Customer

ABNB Credit Union

Industry

Credit Union

Frequently Asked Questions

How do customers enroll in Zelle® through their bank or credit union?

Customers enroll in Zelle® directly through their bank or credit union’s online or mobile banking experience using an email address or U.S. mobile number.

What happens if a recipient isn’t enrolled in Zelle®?

If a recipient isn’t enrolled, they receive a notification with instructions to enroll through their bank or credit union before completing the payment.

Can banks and credit unions offer Zelle® alongside other payment rails?

- Yes. Zelle® is commonly offered alongside other payment options, allowing financial institutions to support a wider range of real-time payment use cases and reach more recipients.

Is Zelle® intended for consumer use only?

Zelle® supports both consumer payments and eligible small business use cases, enabling businesses to receive payments directly from consumers.

Let’s Talk About Your Payments Strategy

See how Orbipay Payments Hub can simplify operations, accelerate innovation, and future-proof your payments ecosystem.