Orbipay Payments Hub for RTP®

Keep Your Core, Add Real-Time Payments

Orbipay Payments Hub for RTP® lets you deploy instant payments fast, enhance the customer experience, and defend your primary relationship by reducing deposit displacement and churn.

Problem

A Growing Need for Change

Without instant payments, you fall behind member expectations and lose everyday transactions to faster alternatives from your competitors. The fallout shows up quickly:

Funds take hours or days, driving members to fintech wallets for speed

Missed 24/7 use cases (loan funding, payouts, account-to-account) reduce deposit growth

Support and ops strain from “where’s my money?” calls and manual workarounds to rush payments

Increased fraud and returns from users retrying or switching rails to get faster outcomes

The average daily RTP volume grew from $909.2 million in January to $2.8 billion by mid-March 2025

of real-time payment implementations are expected within the next two years—banks that delay risk losing market share

The RTP network hit 1 billion payments in January 2025, doubling from 500 million in just 18 months (versus 5+ years for the first half-billion)

of FIs that enable instant payments say they have at least a somewhat positive impact on customer retention

Key Capabilities

Make Instant Payments Simple

Orbipay Payments Hub for RTP delivers always-on, ISO 20022-native real-time payments through a unified platform. It centralizes orchestration, routing, liquidity, compliance, and settlement across rails—integrating seamlessly with existing systems to provide:

Unified Orchestration:

End-to-end processing of all payment rails on one platform.

Smart Routing & Rules:

Optimize by cost/speed and enforce limits, cutoffs, and compliance logic.

Liquidity & Settlement:

Monitor positions, manage prefunding, and streamline reconciliation.

Fraud & Compliance Controls:

Apply instant, consistent screening, velocity checks, and sanctions review across rails.

Open Integration:

Out-of-the-box integration to core or digital banking with APIs—no overhaul.

ISO 20022 Data Model:

ISO 20022-based messaging for interoperability today and future schemes tomorrow.

Did you know?

91%

of Alacriti's customers deploy the RTP network and the FedNow® Service at the same time.

Key Benefits

The Business Case for Real-Time Payments With Alacriti

Cost Savings

Revenue Opportunities

Unified Payment Processing and Settlement

Future-Proof Your Payments Infrastructure

Agile Cloud-Based Platform for Innovation and Scale

Increased Accountholder Satisfaction

Customer Perspectives

We Help Customers Achieve Superior Business Outcomes

Real-Time Results: 2,300+ Transactions and $5M Moved in Two Months at ABNB

Customer

ABNB Credit Union

Industry

Credit Union

Frequently Asked Questions

What is the RTP network?

The RTP network, developed by The Clearing House, is the first new payments infrastructure built in the U.S. in 50 years and empowers financial institutions and businesses to implement innovative, value-added use cases for faster payments. The RTP network gives the banking industry a modern platform for 24/7 domestic real-time payments, which include rich data capabilities and immediate payment confirmation. The network enables instantaneous settlement and availability, so funds can be used or withdrawn as cash within seconds. TCH is owned by 24 of the largest banks in the U.S.

What’s the difference between the RTP network and the FedNow® Service?

Payments hubs act as the infrastructure that connects financial institutions to various payment networks. They generate and route payment messages, ensure compliance, apply business rules (e.g., fraud checks), and convert messages between different standards like ISO 20022. By offering a single point of control and integration, they modernize and simplify payment operations.

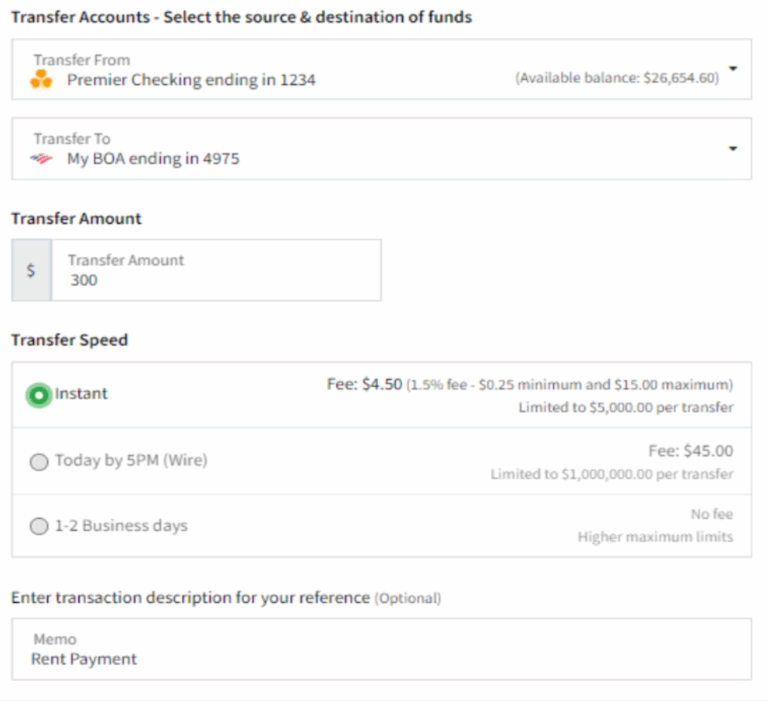

What’s the difference between the RTP network and PayPal/Zelle/Venmo?

PayPal operates as a private money transfer service, distinguishing itself from the RTP network. In contrast to platforms such as PayPal, Zelle, and Venmo, users of the RTP network are required to go through their financial institution for access. PayPal, Zelle, and Venmo users can manage their accounts and send, request-to-receive, and receive money directly from the app. The RTP network offers real-time money movement by enabling users to send and receive money within seconds. Services such as Venmo impose a fixed rate of 1.75% on instant transfers sent to a credit union or bank account. For example, if someone is transferring $200 to their bank account, they incur a $3.50 fee, while a $50 transfer results in a $0.87 fee. Users may opt for a free transfer option, however, they are required to wait 1-3 business days. On the RTP network, senders incur a $0.045 per credit transfer fee (including returns). Alternatively, a $0.01 fee is charged for the RfP (Request for Payment), which must be paid by the requesters.

Who is on the RTP network?

Over 655 financial institutions, 16 funding agents, and 22 technology providers are participating on the RTP network.

Let’s Talk About Your Payments Strategy

See how Orbipay Payments Hub for RTP enables you to access instant payment rails, streamline operations, and enhance your customer experience.