Faster Payouts, Fewer Checks

Quick, secure, and cost-effective digital disbursements—without the hassle of paper checks.

Challenges

The High Cost of the Status Quo

Sending payments should be as fast and efficient as the rest of your business, but relying on outdated methods creates friction for both your staff and your recipients. Disconnected systems and manual workflows make it difficult to support the instant payout options today’s customers expect. Common pain points include:

Excessive operational costs from printing, postage, and manual reconciliation

Reduced customer satisfaction due to slow delivery and clearing times

Enrollment friction, slow delivery, and low visibility are driving an increase in call center calls

Security and compliance risk due to lost checks or fraudulent transactions

of consumers prefer to receive disbursements immediately

the median cost of issuing a check for businesses

the median cost of initiating and receiving an electronic ACH payment

of organizations face check fraud

Solutions

Modern Digital Disbursements for Every Organization

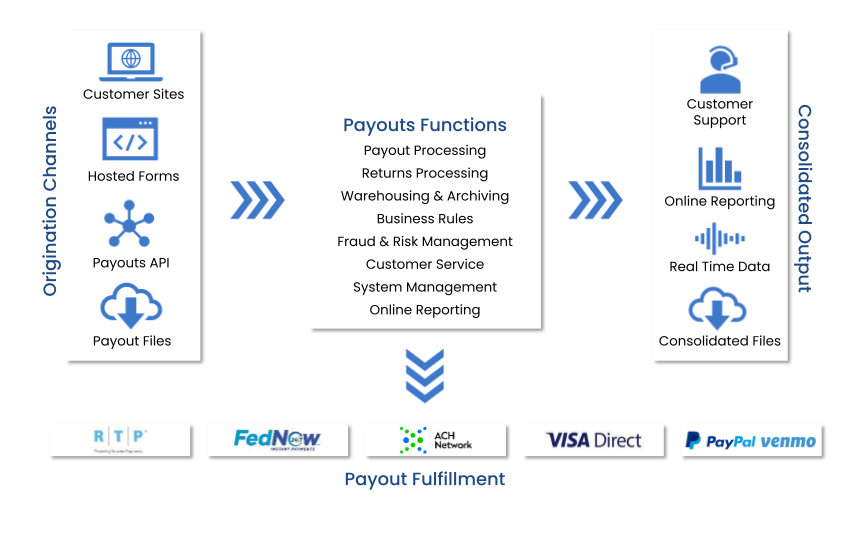

Orbipay Payouts (part of the Unified Money Movement suite) makes it easy to replace slow, expensive paper checks or mailed physical gift cards with fast electronic payments that go exactly where your customers want them. Our platform connects directly to your current systems, allowing you to send money instantly using modern options like the RTP® network the FedNow® Service, and Visa Direct. You’ll save time on manual work, lower costs, and give your recipients a much better experience.

Payout B2C Payments Scenarios

Straight-Through:

Designed for businesses that have all the required information they need to make payouts directly into payees’ bank accounts. In this scenario, the business provides full payment instructions for their payees, including the destination bank account information.

One-Off:

Facilitate ad hoc payouts when the payee’s bank account information is unavailable. In this scenario, the business will notify payees of an upcoming disbursement and provide a link to the Payee Portal that they can visit within a specific date range to receive it electronically.

Recurring:

Allow businesses to process recurring payouts when payees’ bank account information is not available. Businesses will notify their payees of the option to receive them electronically and provide a link to the Payee Portal where they can enroll.

Types of Payouts the Platform Supports

Orbipay Payouts supports a wide range of outbound payment scenarios to help businesses replace paper checks. Common use cases include:

- Claims Payouts – Insurance and healthcare payments for approved claims

- Refunds and Rebates – Consumer refunds, overpayment reimbursements, and promotional incentives

- Vendor Payments – Transfers to contractors, suppliers, and third-party service providers

- Global Payouts – Send secure cross-border transfers via international wire or Visa Direct, reaching 120+ countries in 200+ currencies

We also support more specialized disbursement needs, including:

Loan Disbursements

Deliver approved loan funds directly to borrowers

Incentive and Stipend Payments

Issue bonuses, reimbursements, or non-payroll payouts

Settlement and Legal Payments

Manage secure transfers related to legal claims or class-action resolutions

With flexible delivery methods like ACH and a streamlined digital customer experience, Orbipay Payouts enables businesses to scale disbursement operations securely and efficiently.

Value

Why Orbipay Payouts?

Built to drive efficiency, choice, and trust in disbursements

Orbipay Payouts provides a single, secure platform that makes sending digital payments fast and easy. It connects directly to the tools you already use, allowing your business to move away from slow manual processes and give your customers better ways to get paid. Our solution empowers your organization to:

- Offer unmatched payment choices

- Eliminate manual check dependencies

- Optimize speed and costs through intelligent routing

Key Capabilities

Secure, Fast, and Cost-Effective Payouts

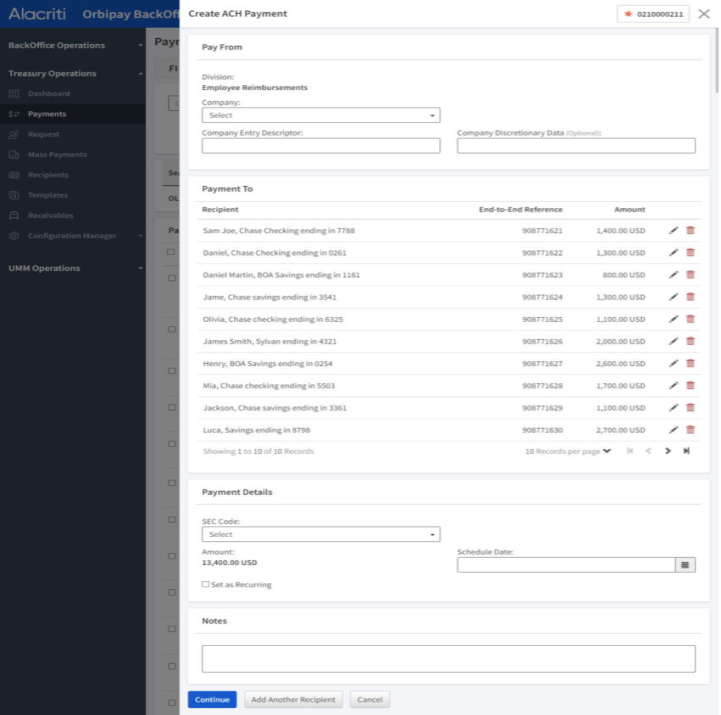

Orbipay Payouts provides a unified, bank-grade platform offering modern electronic payouts. It bridges the gap between your back-office systems and modern payment rails, such as RTP®, FedNow®, and Visa Direct. Integrate seamlessly with your existing ERP systems to provide:

International Wires:

Access ACH, RTP, FedNow, and Visa Direct through a single, future-proofed platform

Payer & Payee Portals:

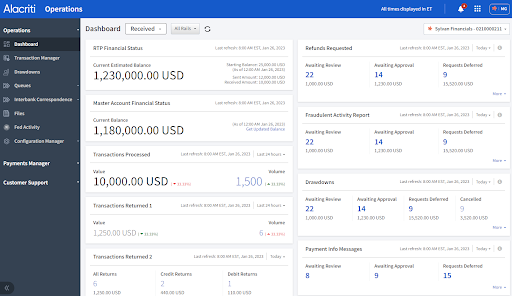

Recipients can securely manage enrollment and payout history, while staff use a centralized dashboard to access profiles and track disbursement status

Reporting:

Quickly access reports related to payees’ historic and upcoming payouts

Alerts & Notifications:

Payout-related alerts and notifications via email and/or SMS text messages

Security & Compliance:

Built-in security features ensure data privacy and protection for payees

Real-Time Status & Traceability:

Eliminate status-inquiry calls with automated webhook notifications and a centralized dashboard for transaction-level details

Key Benefits

The Business Case for Modernizing Your Disbursements

Significant Cost Savings per Payout

Streamlined Operational Efficiency

Real-Time Traceability & Transparency

Unified Multi-Rail Disbursement Orchestration

Built-in Security & Compliance

Increased Recipient Satisfaction & Choice

Frequently Asked Questions

How do digital disbursements through Orbipay Payouts work?

Orbipay Payouts acts as a centralized orchestration layer that replaces manual check printing with a fast, electronic workflow. Organizations can initiate payments through real-time APIs, secure batch file uploads, or backoffice payment portal. The system then uses intelligent routing to deliver funds through the most efficient rail—such as RTP, FedNow, ACH, or Visa Direct—based on cost, speed, and the recipient’s preferences.

What is the difference between One-Time and Recurring Disbursements?

One-time disbursements are designed for ad hoc payments, such as a single insurance claim or a loan overpayment refund, where you may not have the recipient’s bank info on file. Recurring disbursements allow recipients to enroll once through a secure portal to receive periodic payments—like expense refunds or dividends—automatically to their preferred account moving forward.

What if I don't have my recipient's bank account information?

Orbipay Payouts facilitates One-Off Disbursements specifically for ad hoc payouts when bank details are missing. In this scenario, you notify the recipient of an upcoming payout and provide a link to a secure portal where they can authenticate themselves and enter their own bank account or debit card information. If they do not take action by a specific date, the system can fallback to issuing a paper check.

How does this solution reduce our customer service call volume?

By providing self-service payee portals, recipients can independently enroll, update their payment preferences, and track their payout history without contacting your staff. Additionally, proactive alerts and notifications via email or SMS keep recipients informed about pending and completed payments, reducing ‘Where Is My Money’ (WIMM) inquiries by an estimated 30-50%.

Related Resources

Ready To Modernize Your Digital Disbursements?

See how Orbipay Payouts empowers you to replace expensive paper checks with fast, secure electronic payments while streamlining your operations and delighting your recipients.

Sources:

AFP recently found checks are the payment type most impacted by fraud. AFP also reported that the median cost of initiating and receiving an ACH payment for businesses is between 26 cents and 50 cents, while the median cost of issuing a check is between $2.01 and $4.

Checks continue to be the payment method most often subjected to fraud, with 63% of respondents (organizations) reporting that their organizations faced check fraud in 2024.

79% of consumers in January 2025 stating they would most prefer to receive disbursements immediately.

https://www.pymnts.com/study_posts/instant-uptake-the-urgent-need-for-spe