Orbipay Payments Hub for FedNow

Go Real-Time With FedNow®—Now

Orbipay Payments Hub for FedNow plugs into your current stack to light up 24/7 instant payments—Send and Receive—fast. Unify rails, streamline ops and reporting, and keep everyday money movement inside your brand—protecting deposits and primary relationships all on one hub.

Problem

A Growing Need for Change

Disconnected payment systems create inefficiencies, increase risk, and make it harder to support newer channels such as the FedNow® Service. Common pain points include:

Legacy, siloed platforms that slow real-time adoption and scale

Manual, multi-team workflows that raise costs and delay posting/reconciliation

Fragmented user experiences (extra logins, delayed funds) that push members to fintech wallets

24/7 fraud, limits, and compliance demands that strain infrastructure and staff

of FIs enable enterprise companies to send instant payments

of real-time payment implementations are expected within the next two years — banks that delay risk losing market share

Free instant payments nearly double the likelihood that customers will remain as clients

of FIs that enable instant payments, say they have at least a somewhat positive impact on customer retention

Key Capabilities

Make Instant Payments Simple

Orbipay Payments Hub for FedNow enables instant payments through a unified, ISO 20022-native platform built for real-time processing. It centralizes orchestration, routing, liquidity, compliance, and settlement across rails—integrating seamlessly with your existing systems to provide:

Unified Orchestration:

End-to-end processing of all payment rails on one platform.

Smart Routing & Rules:

Optimize by cost/speed and enforce limits, cutoffs, and compliance logic.

Liquidity & Settlement:

Monitor positions, manage prefunding, and streamline reconciliation.

Fraud & Compliance Controls:

Apply instant, consistent screening, velocity checks, and sanctions review across rails.

Open Integration:

Real-Time FX Services: Provides real-time FX rates for hundreds of currencies and countries, ensuring compliance with Reg E.

ISO 20022 Data Model:

ISO 20022-based messaging for interoperability today and future schemes tomorrow.

Did you know?

Key Benefits

The Business Case for Real-Time Payments With Alacriti

Cost Savings

Revenue Opportunities

Unified Payment Processing and Settlement

Future-Proof Your Payments Infrastructure

Agile Cloud-Based Platform for Innovation and Scale

Increased Accountholder Satisfaction

Case Studies

We Help Customers Achieve Superior Business Outcomes

Veridian Credit Union Among the First To Connect to the FedNow® Service

Customer

Veridian Credit Union

Industry

Credit Union

Frequently Asked Questions

What is FedNow?

The FedNow® Service represents the Federal Reserve’s entry into modernizing payments with a service that enables instant, 24/7 money transfers for financial institutions. It is the newest payment rail in the United States.

The FedNow Service aims to give businesses and people an effective way to pay and instantaneously access funds through their financial institutions. The financial institutions and their consumers benefit from a real-time payment option.

How does FedNow work?

Navigating the process is now more seamless than ever. Here is an overview of how it works.

The FedNow Service makes it possible to initiate payments seamlessly by transmitting payments messages through the end-user interface to financial institutions. The financial institution will then receive instructions to authorize the transaction, subsequently sending a payment message to the FedNow® Service. At this time, the FedNow Service will validate any payment messages and send them to the financial institution for either acceptance or rejection. Upon completion, the financial institution will send a response to the FedNow Service confirming the final decision.

In the event of rejection, the FedNow Service informs the payee. If accepted, the FedNow Service deducts funds from the payor’s account and credits them to the payee’s account.

Here’s a breakdown of this 10-step process that occurs within seconds:

- Step 1: This transaction will occur between the payee and the payee’s financial institution.

- Step 2: The payor initiates a payment by sending payment messages to the bank or credit union.

- Step 3: The bank or credit union will then receive instructions and proceed to authorize the transaction if sufficient funds are available.

- Step 4: The bank or credit union contacts and submits the payment message to the FedNow Service.

- Step 5: The service will validate the payment message and subsequently send it back to the bank or credit union, indicating either acceptance or rejection.

- Step 6: In the event of rejection by the bank or credit union, no further action will occur. However, upon acceptance, Fednow promptly deducts those funds and credits them to the payee’s account.

- Step 7: The service will either debit or credit the sender and receiver financial institutions’s authorized account. Steps up to this point will take up to 20 seconds to complete.

- Step 8: To notify both parties of the payment, the service will send an advisory to the receiver financial institution and an acknowledgment to the sender financial institution.

- Step 9: The receiver financial institution can choose to confirm the posting by sending a message to the sender financial institution.

- Step 10: Finally the Fednow Service notifies everyone of the successful transaction. In instances where the financial institution rejected the transaction in step 6, the FedNow Service notifies all parties of the rejection.

How can FedNow help banks and credit unions?

For Credit Unions: When choosing between credit unions and banks, the younger generation often leans towards banks due to perceived modernity. Zoomers form a relatively small portion of credit union (CU) members, which raises the question of why. This might be attributed to banks’ technological advancements and robust campus marketing. However, with connection to the FedNow Service available to all financial institutions, credit unions can now more closely align with the immediate gratification that Zoomers expect.

For Banks: The FedNow Service presents another opportunity for banks to improve their customer experience. As banks actively promote their instant payment services, the addition of the FedNow Service broadens their reach for financial institutions that participate in instant payments.

For All Financial Institutions: The FedNow Service will enhance liquidity management by introducing streamlined transfer capabilities, promoting efficiency for credit unions and banks. This directly benefits financial institutions and their accountholders, as the expedited process contributes to increased customer satisfaction. In addition, banks and credit unions that are struggling with processing and exceptions (associated with wires and ACH), may find relief in the fully automated FedNow Service. The result is better back-office efficiency.

How can the FedNow Service help bank customers and credit union members?

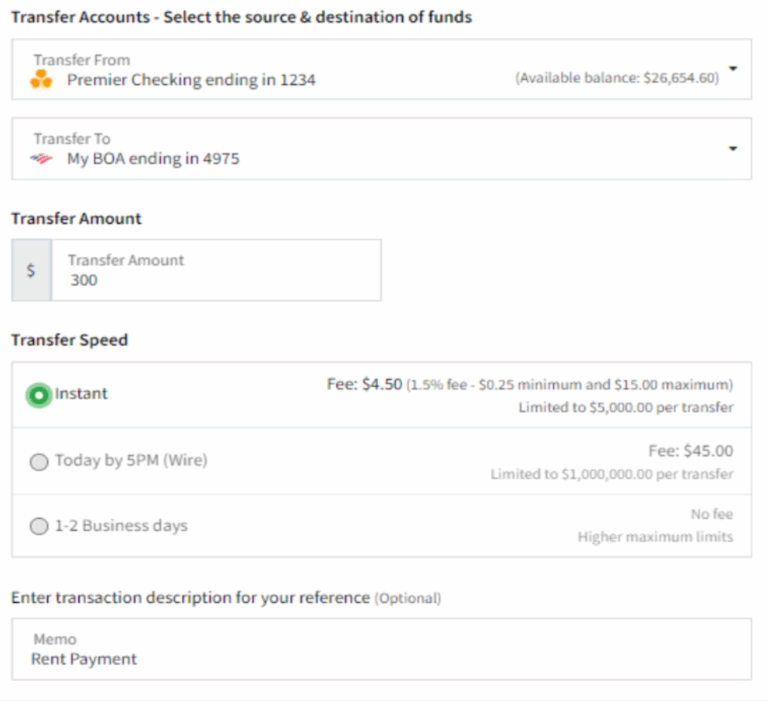

Improve Efficiency: The FedNow Service can improve efficiency for bank customers and credit union members. Customers and members demand speed and efficiency, especially in times of emergency. Customers can access funds immediately using the FedNow Service, resulting in faster access to funds. This is helpful for any accountholder, but is especially valuable for those who are not able to wait for conventional settlement timeframes.

Lowering Cost and Improving Management: Forward-thinking financial institutions equip their customers and members with personal finance tools to help manage their money. Offering instant payments helps accountholders better predict and manage their money, and avoid the frustration of unnecessary NSF fees. Not to mention for business owners, there can be faster settlements which can lead to minimizing administrative costs and enhancing the overall financial management.

Technological Advances: The addition of the FedNow Service will assist businesses in developing better and more pleasant ways to improve customer experience. Overall, the FedNow Service provides numerous opportunities for customers to have a better experience with their financial institutions. As technology is on the rise, providing customers with more convenient solutions than ever, so are the demands on banks and credit unions to enhance their customer experience with products that address their needs. For instance, a car loan disbursement over the weekend so a customer can drive out of the dealership with a new car on a Saturday.

For more common questions that financial institutions have about the FedNow Service, go to our FedNow Service Guide.

Let’s Talk About Your Payments Strategy

See how Orbipay Payments Hub for RTP enables you to access instant payment rails, streamline operations, and enhance your customer experience.