More Than Compliance: Real-Time Verification

Orbipay Bank Account Validation & Verification (BVV) Service helps financial institutions, billers, and businesses to confirm bank account details in real time—reducing risk, ensuring compliance, reducing returns, and improving payment success.

Challenges

When Legacy Processes Can’t Keep Up

Manual, delayed, or incomplete validation methods can’t keep pace with today’s real-time payment expectations. The result? Greater exposure to risk, rising return rates, and frustrated customers. Beyond meeting Nacha’s Web Debit Rule, BVV helps organizations address common challenges that impact performance and customer satisfaction, including:

High ACH return rates

that can trigger “high-risk” classifications with the network

Fraudulent or compromised accounts

that are being used for payments.

Payment delays

and cash-flow disruptions

Error-prone

manual account verification processes

Solution

Simplified Modern Account Validation and Verification

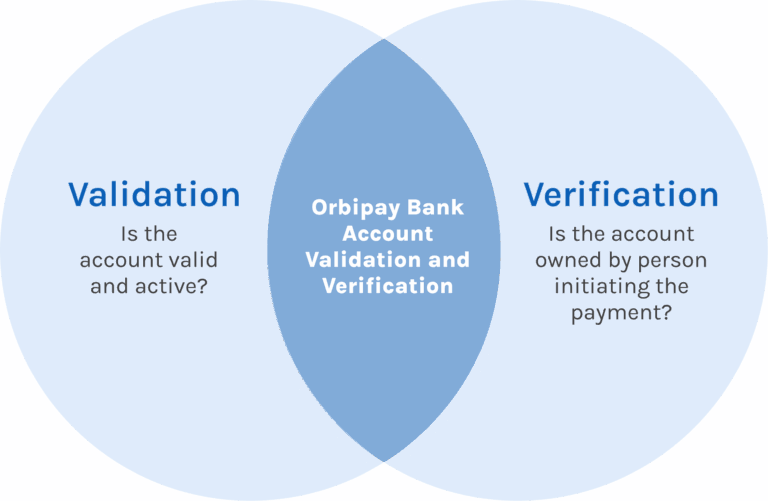

Orbipay BVV combines two complementary capabilities in one configurable solution:

- Bank Account Validation (BVA): Validates bank accounts to comply with Nacha’s Web Debit Rule and allows configurable risk tolerance for accounts with adverse history.

- Bank Account Verification (BVE): Verifies ownership of bank or credit union accounts as part of your overall fraud and risk management strategy.

Whether leveraged as a value-added service with any of Alacriti’s products or as a standalone service, Orbipay BVV strengthens every payment interaction—helping teams focus less on managing returns and more on moving money confidently.

Validation

Verification

Purpose

Confirms that a bank account is real, open, and able to transact.

Confirms that the person or business owns the account being used.

Used For

NACHA Web Debit compliance, new account setup, ACH debits

Fraud prevention, account funding, and high-value payments.

How It Works

Runs real-time checks against trusted databases to confirm account validity and transaction history.

Uses challenge deposits via RTP®, FedNow®, or Same Day ACH to verify ownership in real time.

Key Benefits

Reduces ACH returns from invalid or closed accounts. Improves compliance and payment success.

Prevents misdirected or fraudulent payments. Builds trust with consumers and businesses.

Why Alacriti?

Single Vendor Advantage

Validation, verification, and payments orchestration under one roof.

Fast Results

Validate and verify accounts in real time—no prenotes or microdeposits.

Reduced Risk

Prevent fraud, misrouted, and returned payments.

Easy Integration

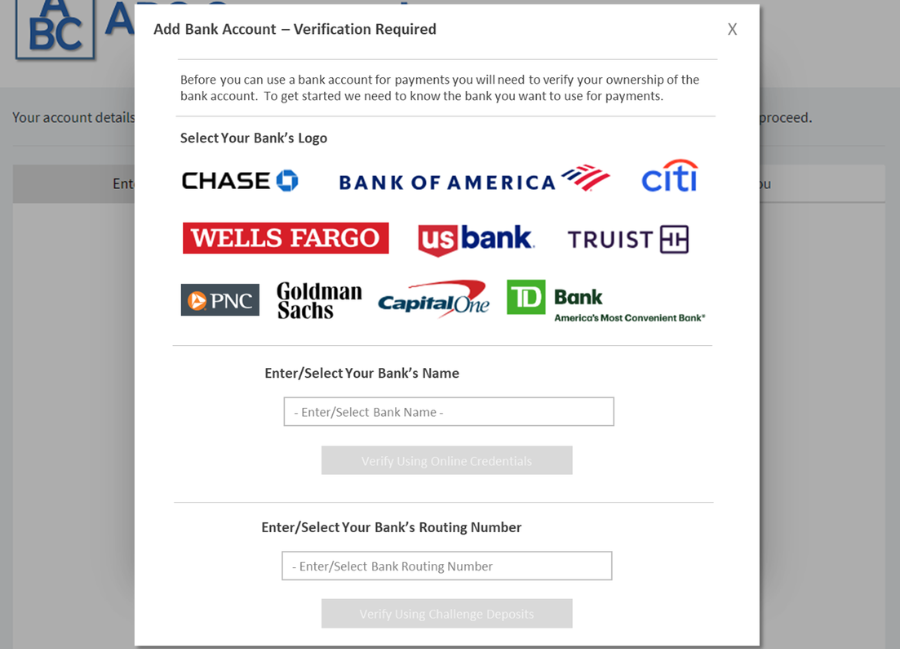

Connect via APIs or deploy through a hosted UI.

Back-Office Ready

Built-in integration simplifies support and operations.

Configurable Controls

Choose which checks to run and when within your Orbipay setup.

Value

Key Capabilities

Validation

- Nacha Compliance: Meet Web Debit Rule requirements automatically.

- Real-Time Checks: Validation completed instantly.

- Non-Intrusive: Uses only basic account data.

- Broad Coverage: ~95% of U.S. DDAs supported.

- Adverse History Alerts: Flag valid accounts with prior return activity.

Verification

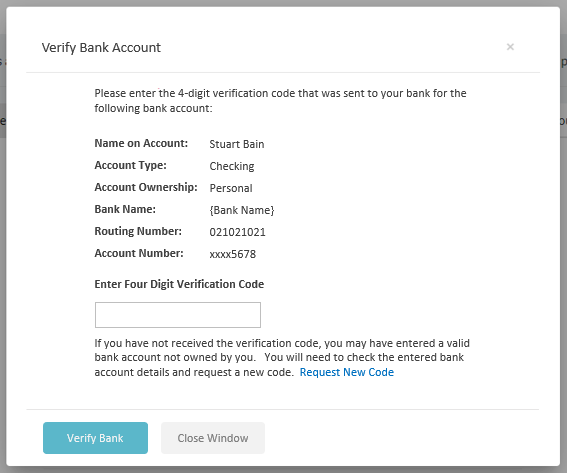

- Instant Challenge Deposits: ~70% of bank accounts via the RTP® network and the FedNow® Service.

- Same Day Challenge Deposits: via ACH for the remaining 30% of bank accounts.

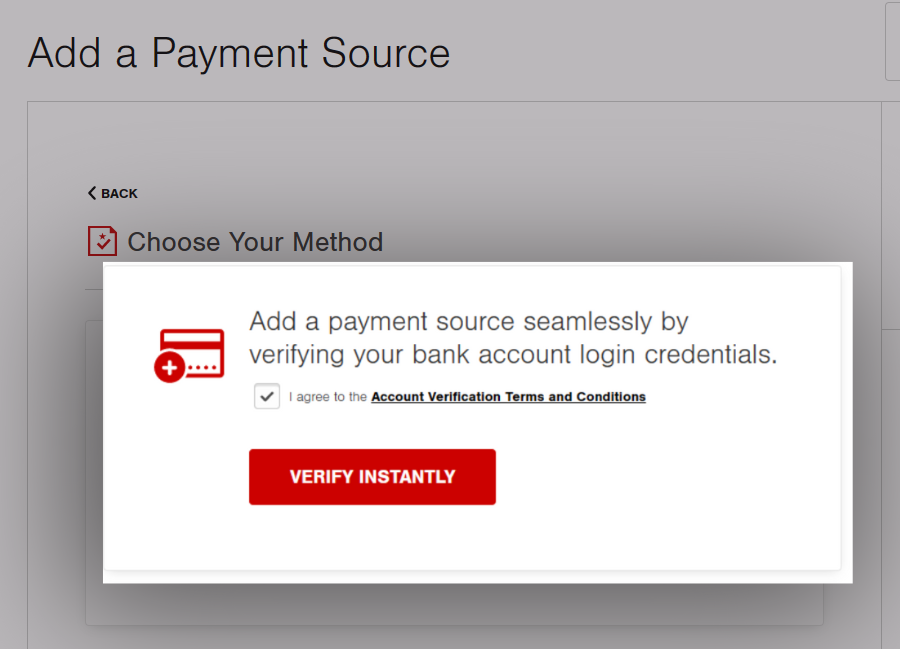

- Open Banking APIs: Credential-based verification with no screen scraping.

- Lower Return Rates: Reduce ACH debit returns by up to ~20%.

- Secure & Frictionless: Credentials entered directly with the financial institution.

Real-Time Validation and Verification—Your Way

Orbipay BVV can be configured to fit your organization’s needs and risk tolerance.

Frequently Asked Questions

What is bank account validation and verification?

Bank account validation confirms that an account is open and able to transact. Verification confirms that the person or business owns the account being used. Together, they help reduce ACH returns, prevent fraud, and ensure Nacha compliance.

Why is bank account validation required by NACHA?

Nachas WEB Debit Account Validation Rule, effective March 2021, requires organizations initiating ACH debits from accounts obtained online to validate those accounts using a commercially reasonable method. The rule was created to reduce unauthorized and invalid transactions that lead to ACH returns and fraud losses. Businesses can comply using methods such as prenotes, microdeposits, or real-time API-based validation services like Orbipay BVV, which perform real-time checks without adding friction.

What are the risks of not validating or verifying accounts?

Without proper validation and verification, organizations face higher return rates, fraud exposure, high-risk classifications, and potential compliance issues. Invalid or miskeyed accounts can delay payments and increase operational costs.

How is BVV different from prenotes or microdeposits?

Traditional methods like prenotes or microdeposits take one to two days and only confirm that an account exists. Our Bank Account Verification verifies accounts in real time with Instant Challenge Deposits for ~70% of bank accounts via RTP and FedNow, and Same Day Challenge Deposits via ACH for the remaining 30% of bank accounts.

Go beyond compliance and start verifying bank accounts now.

Discover how Orbipay Bank Account Validation & Verification (BVV) Service enables financial institutions, billers, and businesses to instantly confirm bank account details with confidence.