In today’s world, the way money moves is evolving at an unprecedented pace. Consumers and businesses alike expect speed, flexibility, and certainty in every transaction—and traditional rails alone can’t always deliver. Enter Stablecoins: a new form of digital currency designed to combine the efficiency of blockchain technology with the stability of the U.S. dollar. By offering 24/7 availability, programmability, and borderless transfer, stablecoins are quickly emerging as a practical payment rail with real implications for financial institutions.

Quick Links

What Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging to a reference asset—most often the U.S. dollar. This stability combines the benefits of digital currency—24/7 availability, programmability, and borderless transfer—with the low volatility needed for practical, everyday transactions.

How Do Stablecoins Work?

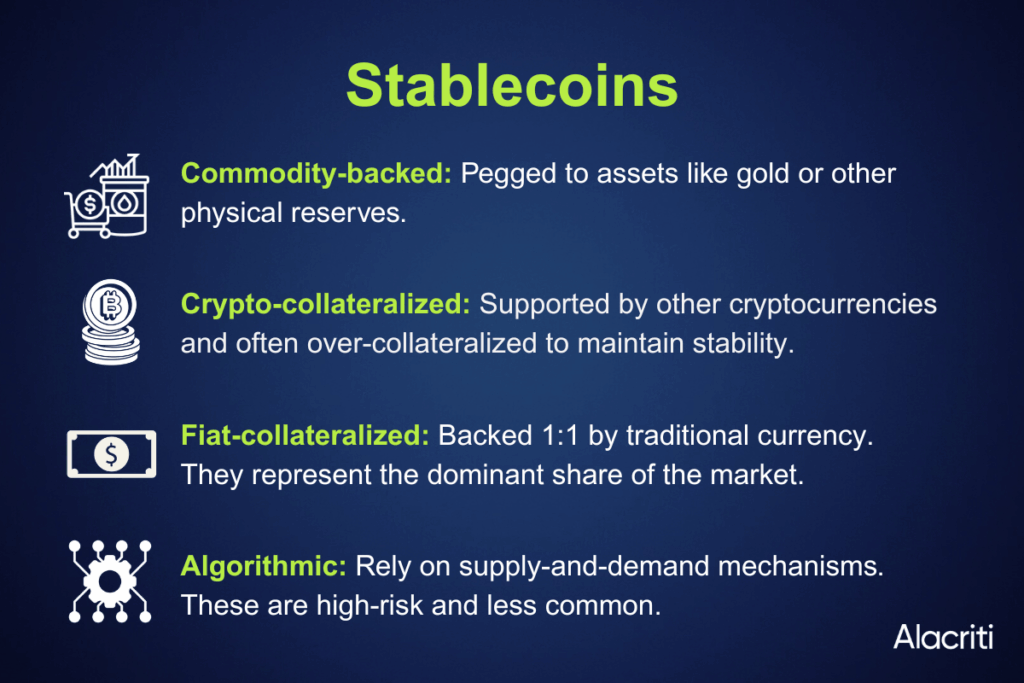

Stablecoins fall into four main categories: Commodity-backed, pegged to assets like gold or other physical reserves; Crypto-collateralized, supported by other cryptocurrencies and often over-collateralized for stability; Fiat-collateralized, backed 1:1 by traditional currency (e.g., USD) and representing the dominant share of the market; and Algorithmic, which rely on supply-and-demand mechanisms but are high-risk and less common.

What Is the State of the Market For Stablecoin?

The stablecoin market has expanded rapidly. In 2024 alone, the supply grew by more than 59%, reaching about 1% of the U.S. dollar supply. At the same time, annual stablecoin transfer volumes hit $27.6 trillion, surpassing Visa and Mastercard combined.

USD-backed stablecoins dominate—nearly:

of global stablecoin volume is tied to the U.S. dollar. Tether (USDT) and USD Coin (USDC) lead the market, while newer entrants like PayPal USD (PYUSD) underscore growing mainstream and fintech adoption.

Why Do Stablecoins Matter?

For banks and credit unions, stablecoins aren’t just another crypto trend—they represent a new, practical payment rail.

New Rails, New Revenue:

Stablecoins enable faster, lower-cost cross-border settlement and new fee income streams.

Complementary to the FedNow® Service and the RTP® network:

While FedNow and RTP provide instant domestic payments, stablecoins extend those benefits to cross-border transactions and 24/7 interbank settlement. It is yet to be shown if stablecoins will compete with those instant rails in the domestic US market.

Corporate Treasury Optimization:

FIs can offer treasury services like instant supplier payouts and 24/7 liquidity tools.

Customer Retention:

With nearly half of payment leaders exploring programmable money, stablecoins help FIs remain competitive and relevant.

Waiting for explicit demand is risky. “The reality is that if you’re waiting for your members to ask you, you’re probably too late. Because at the end of the day, they’re going to go to where those services are available, and they’re going to use those. And so if you’re not offering them, then you’re missing out,” Douglass added.

Members are already seeking out and using instant payments, whether through fintech apps or competing institutions. Credit unions that delay until requests become explicit will not only lose engagement but risk losing relevance. By offering instant payments now, credit unions can meet members where they already are—demanding speed, convenience, and reliability in every financial transaction.

Regulatory & Compliance

How will stablecoins be regulated, and what oversight applies to FIs that use them?

Stablecoin regulation in the U.S. continues to evolve, with oversight developing at both the federal and state levels, including guidance from the Treasury, SEC, and CFTC. These agencies are evaluating stablecoins as potential securities, commodities, or payment instruments based on their structure. In July 2025, the enactment of the GENIUS Act created a huge shift in establishing a regulatory environment for stablecoins. Stablecoin issuers are required to maintain one-on-one reserves of cash, backed by U.S. dollars or short-term U.S. treasury securities, as well as monthly third-party audits to ensure transparency.

Financial institutions that engage with stablecoins are under the Bank Secrecy Act (BSA), whether they are issuing, holding, transferring, or facilitating transactions. Financial institutions leveraging stablecoins may fall under the oversight of the Federal Reserve, OCC, and state banking regulators (especially around custody, liquidity, reserve requirements, and operational risk). Institutions also need to ensure their stablecoin activities meet payment network rules, consumer protection standards, and cybersecurity requirements to safeguard digital assets and customer data.

Do stablecoins fall under existing FDIC/NCUA, AML, KYC, and OFAC frameworks?

Yes. Financial institutions engaging with stablecoins must operate within existing regulatory frameworks:

FDIC/NCUA:

Stablecoins are not directly insured by the Federal Deposit Insurance Corporation (FDIC) nor the National Credit Union Administration (NCUA). To be subject to these regulatory frameworks, the stablecoin has to be issued by a financial institution that holds insured deposits—stablecoins may then be covered under the FDIC or NCUA.

AML/KYC:

Under the GENIUS Act, involvement with stablecoins must comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Due diligence, transaction monitoring, and reporting are essential for financial institutions to comply with the Bank Secrecy Act.

OFAC:

Transactions must be screened by financial institutions to ensure that no individuals or entities on the Office of Foreign Assets Control (OFAC) sanctions lists are involved. This is a critical compliance step to prevent illegal activity, uphold U.S. law, and protect both the institution and the financial system. Violating these rules can result in penalties.

How does the GENIUS Act propose to regulate stablecoins, and what impact could it have on financial institutions’ ability to issue or transact in stablecoins?

Insurance

Only entities that are designated as PPSIs are permitted to issue stablecoins, significantly reducing the pool of potential issuers.

Operational Compliance

In order to meet federal requirements, institutions must implement and uphold comprehensive compliance programs, including AML and KYC protocols.

Market Participation

By adhering to the Act’s regulatory standards, financial institutions can participate in the stablecoin market through issuance, custody, or transactions.

The GENIUS Act focuses on a secure environment for stablecoin operations, balancing innovation with consumer protection and financial stability.

What happens if the transferred stablecoin is issued by an EU source and is not backed by USD?

If the stablecoin is not USD-backed and is issued by an EU source, then its transfer and use within the European Union are governed by the Markets in Crypto-Assets (MiCA) regulation, and its redemption and stability are tied to those assets. Therefore, for a U.S. user receiving a Euro-sourced stabcoin, the value would fluctuate

In the U.S., treatment depends on where the activity occurs and who is involved, not only the coin’s country of issuance. A foreign-issued stablecoin can still trigger U.S. obligations (money-transmission/licensing, BSA/AML/KYC, and potentially securities/commodities considerations) when used by U.S. residents or handled by U.S. financial institutions. Practically, a U.S. user will often convert to USD to spend domestically, and any U.S. FI facilitating the transfer must apply AML/BSA controls even if the coin isn’t USD-backed.

MiCA, enforced since December 2024, classifies stablecoins in two categories, Asset-Reference Tokens (ARTs) and E-Money Tokens (EMTs).

What’s Next?

With potential U.S. legislation on the horizon, the adoption of stablecoin is expected to accelerate in the coming years. Financial institutions that integrate stablecoin capabilities today will be better positioned to capture new payment flows, retain customers, and future-proof their offerings.

Stablecoins are reshaping how money moves—both domestically and cross-border, as well as institution-to-institution. For financial institutions, they represent an opportunity to offer new services, generate revenue, and future-proof their payments strategy.

Currently, cross-border emerges as the solution that seems to have a solid business case, where it saves on exchange rates and increases visibility into the process; however, domestic use cases are still evolving.”

Take the next step beyond the basics. In this on-demand conference session, our Senior Director of Product, Data and Orchestration explores how stablecoins and other digital assets are influencing the movement of funds, highlights real banking use cases, and discusses what it takes to participate safely, stay compliant, and manage risk.

A practical look at what stablecoins mean for payments strategy and how institutions can prepare for what’s next.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform.