Editor’s Note: This article was originally published on CUInsight and is shared here for your convenience. You can also view the original publication on their website.

Person-to-person (P2P) payments began gaining traction in the late 1990s as consumers and businesses sought faster, more convenient ways to exchange money digitally. Early platforms made it possible to send and receive funds online without relying on paper checks or cash, laying the groundwork for secure digital transactions and setting new expectations for speed and ease of use in money movement

The rise of smartphones in the 2010s accelerated this shift dramatically. Mobile-native P2P solutions introduced user-friendly interfaces that allowed people to transfer money in real time, often with just a few taps. P2P payments have since become an everyday part of how consumers manage money, from splitting dinner bills to paying rent. A 2025 Chase survey revealed that 67% of consumers reported using P2P payments, up from just 40% in 2020. Globally, P2P also dominates mobile-first payments—55% of consumers used mobile devices for P2P by the end of 2024.

With so many third-party apps competing for engagement, financial institutions have a clear opportunity: bring these payments back to their own digital banking channels to drive stronger engagement and loyalty.

Why Banks and Credit Unions Should Care

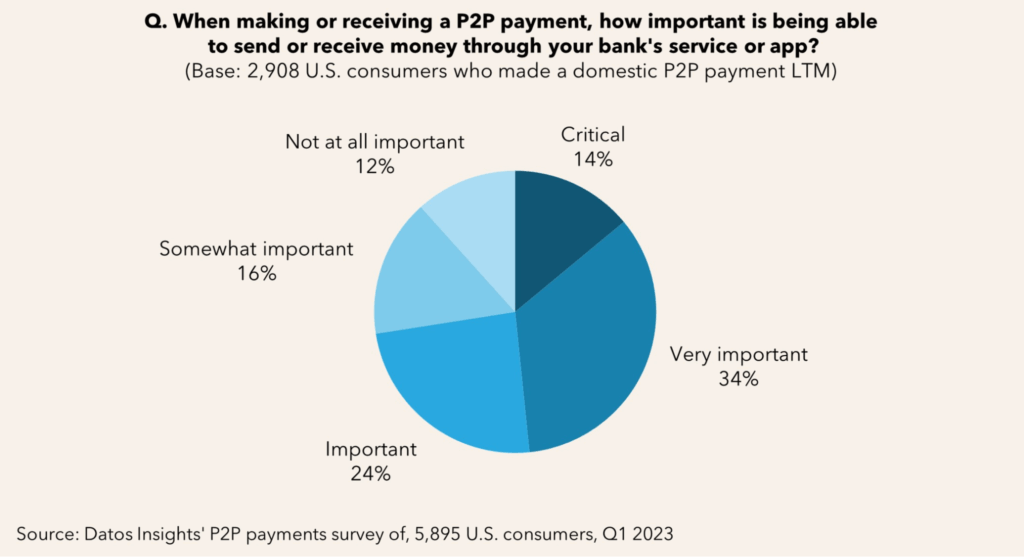

Consumers want P2P payments to stay within the banking ecosystem. Datos Insights’ 2023 survey found that nearly half of U.S. consumers (48%) consider it very important or critical to use their bank’s service or mobile app when sending or receiving P2P payments. Despite this preference, a large share of transactions still flows through non-bank providers, eroding engagement and limiting visibility into customers’ financial lives.

Small businesses are also fueling adoption. For example, in 2024, nearly one in four senders made a payment to a small business with the Zelle® app¹, and small businesses themselves sent or received more than 500 million transactions totaling $283 billion, a 32% increase from the prior year. This demonstrates that P2P is no longer just about person-to-person transfers—it’s becoming an important tool for commerce, payroll, and day-to-day cash flow management for businesses.

Engagement Through Embedded P2P

By offering P2P payments within your mobile or online banking app, financial institutions can:

- Increase digital engagement: P2P usage drives frequent logins; a third of consumers using P2P apps log in at least weekly

- Strengthen trust: Older generations, in particular, view banks as more trustworthy than nonbank providers when it comes to handling payments

- Create cross-sell opportunities: The more customers log in for everyday payments, the more visibility you can give them into your financial products and offers

- Protect cash flow: Keeping P2P activity within your channels reduces the risk of funds moving out to third-party wallets

P2P is no longer just a convenience; it’s a key driver of digital engagement. By meeting customers where they already want to transact—their bank or credit union app—financial institutions can strengthen relationships, capture more logins, and reinforce their role as the trusted hub for money movement.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with TCH’s RTP® network, the FedNow® Service, Zelle®, Fedwire, ACH, and Visa Direct, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. 1. Zelle® app was decommissioned in March 2025.