Fraud Prevention for Banks and Credit Unions

From increased cyberattacks to external fraud, financial institutions—not just banks and credit unions but also their customers and members—face significant risks. These risks can manifest in many ways, including financial loss, regulatory exposure, or reputational damage. As fraud becomes increasingly complex and digital channels continue to expand, implementing proactive strategies and safeguarding accounts and information is critical to maintaining strong relationships with customers and members.

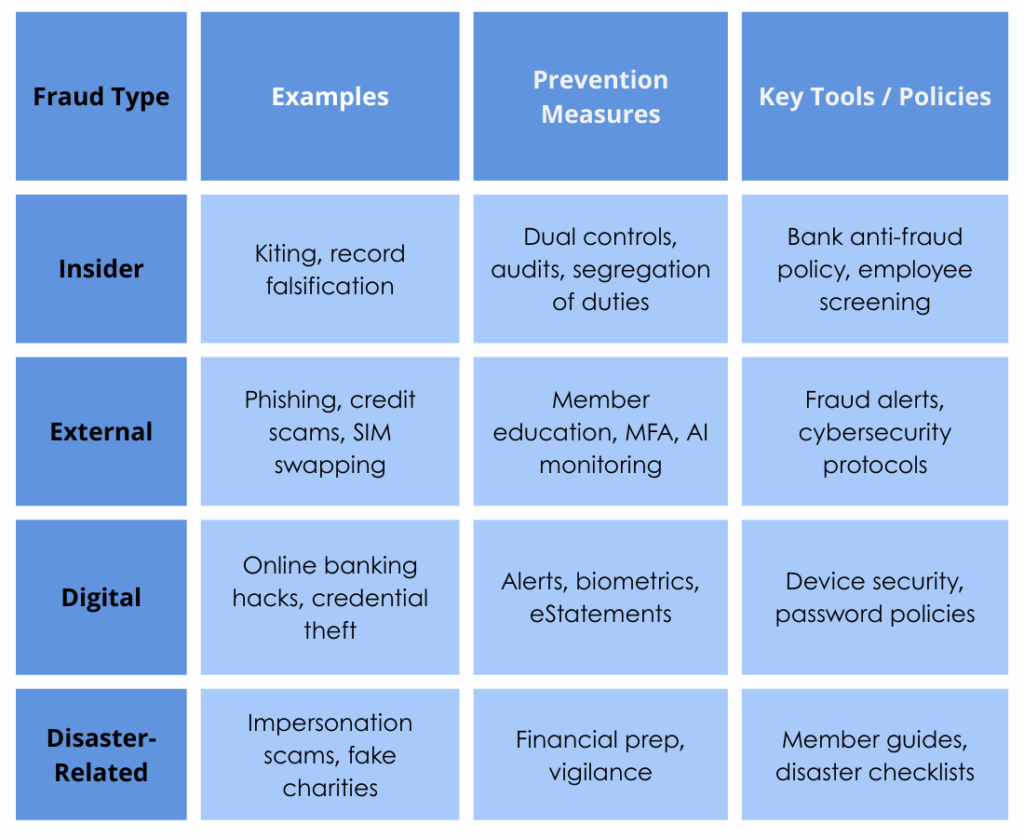

Banks and credit unions encounter fraud risks ranging from insider schemes, such as kiting, to external scams like phishing and SIM swapping. Effective fraud prevention combines strong internal controls, regular audits, and dual controls with member education, multi-factor authentication (MFA), and timely fraud alerts. A comprehensive bank anti-fraud policy and program not only help reduce fraud losses and protect personal information but also ensure a positive and secure member experience.

Insider Fraud

Even with strong controls in place, fraud can still occur. Detection strategies that financial institutions can implement include:

- Analyzing transaction data: Monitoring for patterns that deviate from normal behavior.

- Monitoring red flags: Watching for frequent transfers, insufficient funds across accounts, or unauthorized changes to member information.

- Employee communication: Encouraging employees to report suspicious behavior without fear of internal retaliation.

Getting into the habit of conducting consistent internal and external audits, performing regular account verifications, assessing computer access controls, and screening employees is crucial for implementing effective fraud prevention strategies. These measures form the backbone of a strong and efficient fraud prevention program.

Acting quickly is key in these situations. Below are some practices to keep in mind:

- Contact the fidelity bond company to begin the claims process.

- Follow regulatory and reporting requirements: adhering to AML/KYC, EFTA, and Regulation E guidelines.

- Conduct a thorough investigation: review system logs, transaction histories, and other relevant records.

External Fraud

Fraud can originate from various sources, including:

- Cybersecurity-related fraud: phishing, malware, credential theft, and account takeover.

- Consumer scams: fraudulent debt relief schemes and fake collection agencies.

- Authentication fraud: using another person’s phone number or credentials to bypass authentication and gain unauthorized access to accounts.

Acting quickly in these situations is just as critical as responding promptly to internal fraud. Employee education is essential, but member education is equally important. Regular training sessions on fraud prevention help keep both employees and members alert at all times.

Enhancing cybersecurity measures, such as firewalls, encryption, and device monitoring, is crucial. Strengthening account security through regular password updates, multi-factor authentication (MFA), and biometric authentication for online banking helps protect sensitive information.

With AI playing an increasingly prominent role, it’s important to ensure machine learning tools are effectively detecting suspicious behavior across payment channels, complementing the vigilance of both employees and members.

Reporting all documented steps to authorities, such as those listed below, ensures they are aware of the issue in a timely manner and can take the necessary actions.

- Fraud hotline: Direct channels for reporting suspected credit union fraud.

- Law enforcement reporting: May be required for certain types of fraud.

Fraudsters don’t just operate in everyday environments—they also take advantage of natural disasters to exploit vulnerable individuals during these sensitive times. Financial preparation, such as securing important documents and enrolling in online banking, is especially critical for institutions with in-person offices. Additionally, being vigilant for fake relief agencies and fraudulent charities is essential to protect both members and the institution.

Working closely with authorities, alongside your customers and members, is essential to prevent fraud at every stage of your business. Sensitive or vulnerable situations make it easier for fraudsters to exploit opportunities, but fraud can also occur unexpectedly at any time. The key is maintaining consistent momentum through educational programs and implementing robust measures to ensure fraud is prevented both internally and externally.

Alacriti’s fraud solution is a multi-layered collection of complementary tools and techniques purpose-built to detect and prevent fraud over instant payment rails. By integrating best-in-class capabilities across transaction, identity, and entity layers into a single platform, it empowers financial institutions to confidently send and receive on faster payment rails without having to curate a crowded marketplace and or manage multiple vendors. With flexible service tiers ranging from fully guided to customizable control, Alacriti’s solutions ensure institutions can detect anomalies in real-time and adapt quickly to evolving threats.