Last month, Alacriti attended the 18th annual Auto Finance Summit in Las Vegas, Nevada. Professionals from across the auto finance world convened at the beautiful Wynn Las Vegas for three days of engaging presentations and idea exchanges about all things auto finance. Here’s what we learned:

Auto loans are on the rise, which means delinquency is, too.

More people are financing new cars than ever before. Average monthly auto payments jumped to an all-time high of $523 in 2017, and total outstanding car loans hit a record $1.1 trillion. There were plenty of sessions at Auto Finance Summit dedicated to exploring this topic and how to help consumers manage their debt.

We had some great conversations with Auto Finance Summit attendees about how an electronic bill payment solution can help auto loan customers accelerate payments, increase customer satisfaction, and reduce the risk of bad debt. As more consumers take out loans to finance their car purchases, more auto lenders will need to provide an end-to-end experience that encourages customers to make payments in full and on-time.

Your customers want new ways to pay.

The technology habits of your customers are changing quickly, and they expect a bill payment experience that can keep up. As they move between laptops, smartphones, and smart speakers, today’s customers want seamless access to their billing accounts and convenient ways to pay from every device.

Many attendees shared their experiences with outdated technology and how it impacts customer experiences, and ultimately their bottom lines. Among the various auto leaders, lenders, and service providers at the event was a mutual understanding of the need for more innovation and smarter technology to help tackle the most prominent issues in auto finance today.

AI is steering the auto industry in a new direction.

There was some buzz around artificial intelligence at last year’s Auto Finance Summit, but it still seemed a bit far out. While it was an intriguing concept, its actual potential applications remained unclear. That changed in 2018 as artificial intelligence made its debut as a ready and viable solution on the exhibit hall floor.

This year, several early market players demonstrated practical ways auto finance companies can utilize artificial intelligence to automate various business operations, enhance the customer experience, and more. From data management to customer engagement, it was clear that AI is set to impact (and improve) nearly every facet of auto finance. With such a great showing this year, we’re expecting to see a larger focus on AI in coming years.

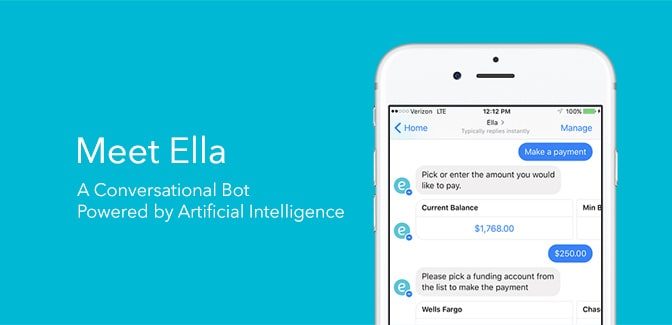

Over at the Alacriti booth, attendees enjoyed interacting with Ella, our AI-powered bot for bill payments and more. Ella utilizes a form of machine learning known as natural language processing (NLP) to converse with customers naturally, much like a live representative. Attendees were excited to see how Ella can help customers quickly retrieve bill details, make payments, and get answers to frequently asked questions through Facebook Messenger, Amazon Echo devices, and Google Home.

The Bottom Line: The auto industry has always been at the forefront of innovation, and auto finance companies are keenly aware of the need for digital transformation as technology continues to impact the market and consumer behavior. We’re excited to see how these trends evolve and shape the auto finance industry over the next year, and we look forward to returning to Auto Finance Summit in October 2019!