3 Reasons Why You Need to Offer Pay by Text—Now

Posted by Tiffany Taylor, Kristen Jason and Alison Arthur on 19 Oct 2022

A key element in accelerating receivables is to make it as easy and convenient as possible for customers, members, or policyholders to pay their bills. Electronic bill presentment and payment (EBPP) solutions like e-bills and online bill pay is a great start. However, with the prevalence of smartphones, it makes a lot of sense to engage with customers on handheld devices. SMS payments, or pay by text, is one of the easiest and safest ways to pay bills. The user doesn’t have to remember passwords or bank details, they need only text. Here are three reasons why you need to offer pay by text—now.

Text Messaging is Too Big to Ignore

Just how prevalent is text messaging? Five billion people globally have the capability to send and receive text messages. Consumers spend more time texting than any other activity on their phone (e.g., social media, games, shopping, viewing videos). Eighty-eight percent said texting was the number-one thing they use their phone for. Globally, smartphone usage is increasing. It’s expected that by 2025, it will increase to 77 percent of the global population. Add to that a very high rate of engagement for text messages—98 percent of text messages are opened and 45 percent of people reply to branded text blasts they receive—and it’s clear that text messaging is a channel with too much engagement to ignore.

Text messaging is a method of contact that is growing between businesses and consumers. Seventy-one percent of consumers say using text messaging to communicate with a business was effective. From appointment reminders and marketing promotions to bill-ready alerts and notifications, more and more companies are leveraging text messaging as a direct communication channel with their customers.

Simplifying Bill Payments with Pay by Text

Pay by Text helps businesses leverage the power of SMS text messaging to encourage on-time bill payments from their customers. Here are three key benefits.

Benefit 1: Convenience

Payment convenience means meeting your customer or member where they want to pay with how they want to pay. Research suggests that 91 percent of all U.S. mobile users keep their phones within arm’s reach at all times. With that level of engagement and the huge percentage of Americans owning phones that accept SMS text messages, text messaging might be one of the most convenient channels for customer communication. In fact, SMS has a much higher response rate than email or social media—36 percent compared to 3.4 percent for email and 2 percent for social media. Delivering this level of convenience to the bill payment process can encourage on-time, hassle-free transactions in the messaging apps that customers use most.

Benefit 2: Speed

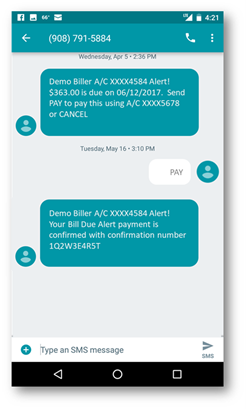

When a customer enrolls in Pay by Text, they can select the alerts and notifications they want to receive. Once enrolled, the system will check for a payment on the alert date, and if there is no payment, it will send a text to the customer. From there, the customer can simply reply with a text that says PAY to initiate a bill payment from the funding source they established in their account. A confirmation is texted back to the device, and the transaction is complete. Eliminating the need to open a browser or login to a user account means a faster bill payment experience for both businesses and consumers.

Benefit 3: Personalization

Customers sign up for Pay by Text and provide information including their mobile numbers, communication preferences, and payment funding methods to complete the enrollment process. In doing so, a highly personalized experience can be delivered. For example, customers can select how many days in advance they want to receive bill-ready alerts (within the biller’s parameters). Giving customers the ability to select when, where, and how these interactions take place can deliver an experience that’s custom-tailored to their needs and preferences.

Simplifying bill payments is all about delivering a user-friendly experience to the channels that customers use most. The ubiquity of mobile devices and extensive use of text messaging makes Pay by Text a natural way to accept bill payments from customers quickly and conveniently.

What about the “unbanked” or “underbanked”? Read: How Do the Underbanked Pay Their Bills?

Updated from a blog originally published January 12, 2021.

Alacriti’s Orbipay EBPP is a customizable electronic billing and payments solution for businesses and financial institutions of all sizes. Pay by Text is just one of several Orbipay EBPP features available to help you accelerate receivables. For more information, please contact us at info@alacriti.com.

Schedule A Personalized Demo

Schedule a Free Consultation